Building Your Corporate Bitcoin Treasury Strategy

The growing list of public companies holding Bitcoin demonstrates accelerating corporate crypto adoption, but successful implementation requires more than just acquisition.

A comprehensive Bitcoin treasury strategy encompasses everything from secure acquisition to sophisticated onchain treasury management for these corporate bitcoin holdings.

As companies mature in their blockchain corporate finance approach, many explore Ethereum corporate holdings that can generate treasury yield from staking, creating productive assets beyond simple appreciation.

This evolution toward tokenized corporate treasuries represents the next phase of crypto in public markets, requiring specialized crypto financial infrastructure for proper management.

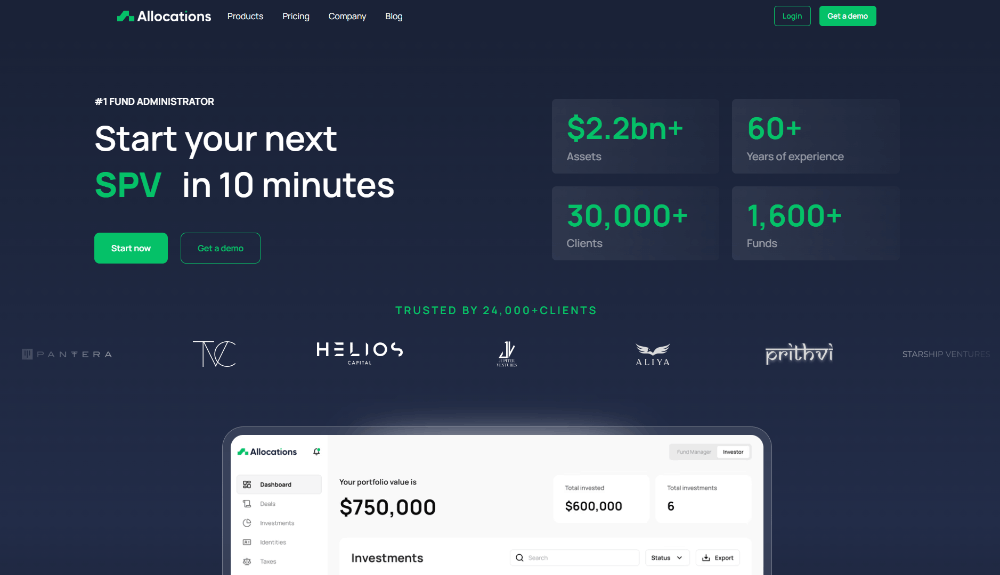

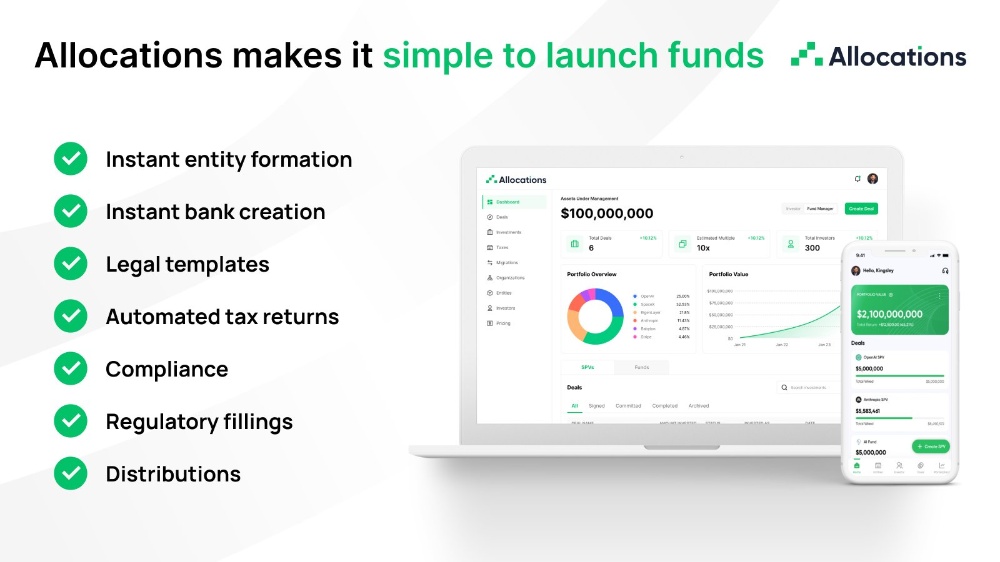

Navigating this landscape requires experienced partners.

The Allocations team provides the foundation for sophisticated treasury strategies with transparent fees. Whether establishing a crypto SPV or developing a custom SPV for complex assets, our solutions support every stage of corporate crypto adoption, starting with a simple startup SPV structure. we provide the tools to capitalize on the growing corporate crypto adoption trend.