Why More Corporates Are Integrating Crypto Into Treasury Strategy

The movement toward corporate crypto adoption marks a new phase of institutional maturity. Large and mid-sized firms now include Digital Asset Treasury Companies (DATCOs) in their operational models to manage digital asset balance sheets with efficiency and transparency.

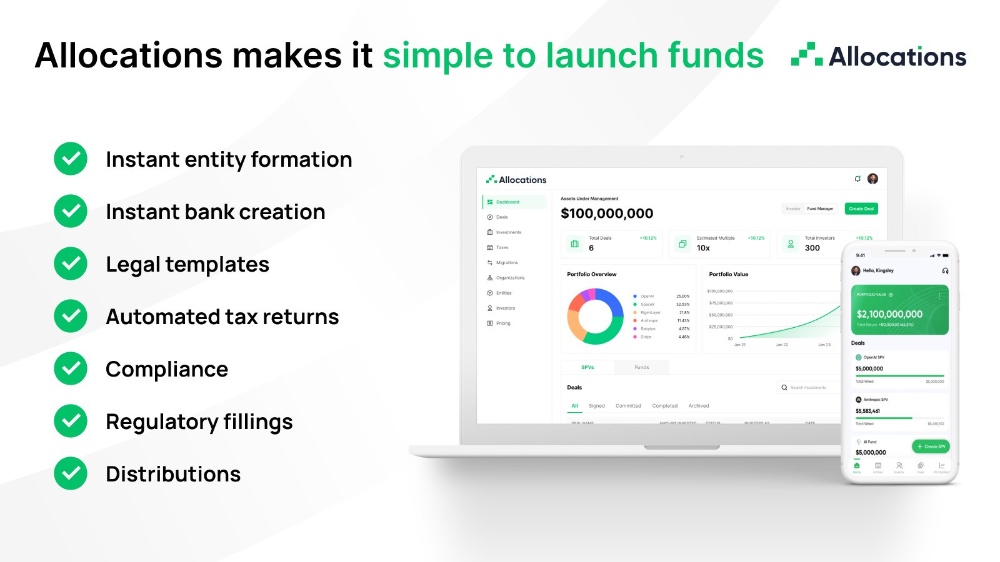

With Bitcoin Treasury Companies leading this wave, firms gain diversified exposure through tokenized corporate treasuries and blockchain corporate finance. For new entrants, Allocations Startup SPV offers a seamless start.

A growing number of publicly listed crypto companies are also optimizing yield with treasury-backed crypto stocks and staking-based treasury yields. Allocations Custom SPV allows flexible setup options that suit both small funds and enterprise-scale operations.

Transparency in Digital Asset Treasury Company operations remains key. Explore detailed pricing via Allocations Fees and learn from the experts at the Allocations Team. For crypto treasury use cases, visit Allocations Crypto SPV.

This shift mirrors the rise of public companies holding Bitcoin and tokenized corporate treasuries, signaling a broader move toward crypto in public markets. Platforms like Allocations Startup SPV simplify access to this evolution, enabling firms to pool and manage capital transparently.