Centralized Exchanges Lead the Way in South Korea's Crypto Boom.

South Korea is one of the most active cryptocurrency markets in the world, and centralized exchanges (CEXs) play a major role in facilitating the country's crypto boom. According to a report by Chainalysis, South Korea was the fourth-largest recipient of cryptocurrency funds in 2022, with over $17 billion in total inflows.

There are a number of reasons for the popularity of CEXs in South Korea. First, CEXs offer a user-friendly experience that makes it easy for beginners to get started with crypto trading. Second, CEXs provide a wide range of services, including trading, fiat on-ramping and off-ramping, and crypto lending and borrowing. Third, CEXs are generally considered to be more secure than decentralized exchanges (DEXs), which are more prone to hacks and exploits.

The four largest CEXs in South Korea by trading volume are Upbit, Bithumb, Coinone, and Korbit. These exchanges account for over 90% of the country's total crypto trading volume. In addition to these four major exchanges, there are a number of smaller CEXs that also operate in South Korea.

The Rise of Centralized Exchanges in South Korea

The rise of CEXs in South Korea can be traced back to 2017, when the country experienced a major crypto boom. During this time, the price of Bitcoin skyrocketed, and millions of South Koreans invested in cryptocurrencies. CEXs played a key role in facilitating this investment boom by providing users with a simple and convenient way to buy and sell cryptocurrencies.

The South Korean government has also played a role in the growth of CEXs in the country. In 2018, the government passed a law that requires all crypto exchanges to register with the Financial Services Commission (FSC). This regulation helped to legitimize the crypto industry in South Korea and made it more attractive to investors.

The Benefits of Centralized Exchanges

CEXs offer a number of benefits to users, including:

•User-friendly experience: CEXs are generally easy to use, even for beginners. They offer a simple and straightforward interface for trading cryptocurrencies.

•Wide range of services: CEXs provide a wide range of services, including trading, fiat on-ramping and off-ramping, and crypto lending and borrowing. This makes them a one-stop shop for all of your crypto needs.

•Security: CEXs are generally considered to be more secure than DEXs. CEXs have the resources to invest in robust security measures, such as cold storage and multi-signature wallets.

The Challenges of Centralized Exchanges

CEXs also face a number of challenges, including:

•Regulation: CEXs are subject to government regulation, which can make it difficult for them to operate. For example, the South Korean government has banned anonymous crypto trading on CEXs.

•Centralization: CEXs are centralized entities, which means that they control the funds of their users. This can put users at risk if the CEX is hacked or goes bankrupt.

•Fees: CEXs typically charge fees for their services, which can reduce users' profits.

The Future of Centralized Exchanges in South Korea

The future of CEXs in South Korea is uncertain. On the one hand, the government is likely to continue to regulate the crypto industry, which could make it more difficult for CEXs to operate. On the other hand, the South Korean crypto market is expected to continue to grow, which will create new opportunities for CEXs.

Overall, CEXs play a major role in South Korea's crypto boom. They offer a number of benefits to users, such as a user-friendly experience, a wide range of services, and security. However, CEXs also face a number of challenges, such as regulation, centralization, and fees. The future of CEXs in South Korea is uncertain, but it is clear that they will continue to play an important role in the country's crypto market.

Case Studies

Here are a few case studies of centralized exchanges in South Korea:

•Upbit: Upbit is the largest cryptocurrency exchange in South Korea by trading volume. It was founded in 2017 and is operated by Dunamu, a South Korean financial technology company. Upbit offers a wide range of services, including trading, fiat on-ramping and off-ramping, and crypto lending and borrowing.

•Bithumb: Bithumb is the second-largest cryptocurrency exchange in South Korea by trading volume. It was founded in 2013 and is operated by Bithumb Korea, a subsidiary of BK Global Consortium. Bithumb offers a wide range of services, including trading, fiat on-ramping and off-ramping, and crypto lending and borrowing.

•Coinone: Coinone is the third-largest cryptocurrency exchange in South Korea by trading volume. It was founded in 2014 and is operated by Coinone, a South Korean fintech company. Coinone offers a wide range of services, including trading, fiat on-ramping and off-ramping, and crypto lending and borrowing.

•Korbit: Korbit is the fourth-largest cryptocurrency exchange in South Korea by trading volume. It was founded in 2013 and is operated by Korbit, a South Korean fintech company. Korbit offers a wide range of services, including trading, fiat on-ramping and off-ramping, and crypto lending and borrowing.

Additional Thoughts

In addition to the four major CEXs mentioned above, there are a number of smaller CEXs that also operate in South Korea. These exchanges typically focus on specific niches, such as trading altcoins or providing margin trading services.

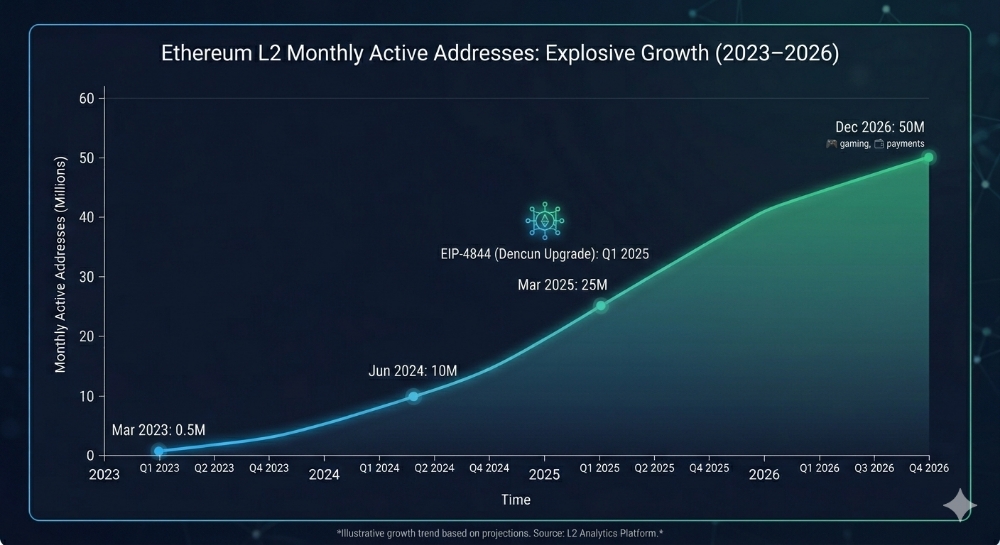

Another important trend in the South Korean crypto market is the rise of decentralized exchanges (DEXs). DEXs are non-custodial exchanges that allow users to trade cryptocurrencies directly with each other without the need for a third party. DEXs are becoming increasingly popular in South Korea as they offer users more control over their funds and reduce the risk of hacks and scams.

Overall, the South Korean crypto market is one of the most active and innovative in the world. Centralized exchanges play a major role in facilitating the country's crypto boom, but DEXs are also gaining popularity. It will be interesting to see how the South Korean crypto market evolves in the coming years.

Thank you for reading.