Welcome to Camelot: Arbitrum's growing liquidity hub

We're going on an adventure today exploring the sprawling liquidity and community hub that is Camelot DEX on Arbitrum.

Camelot is, at first glance a pretty straight forward DEX (decentralised exchange).

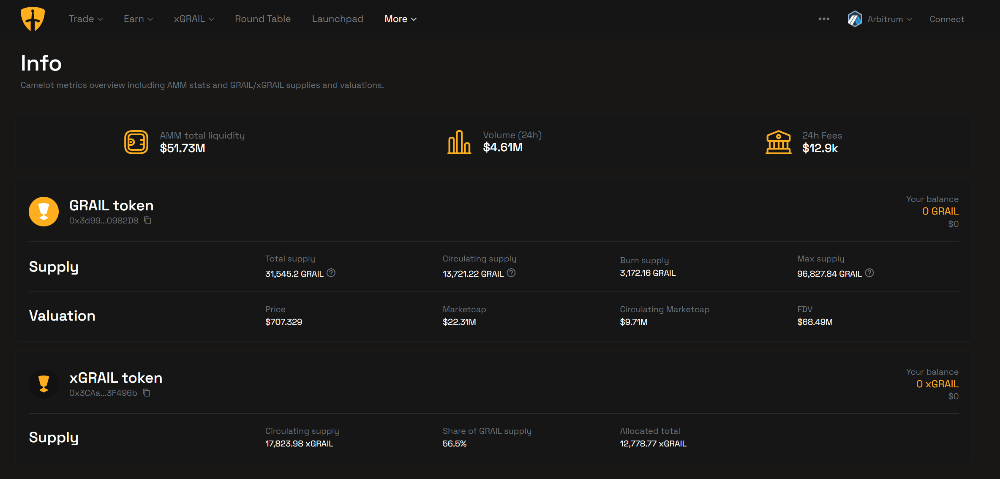

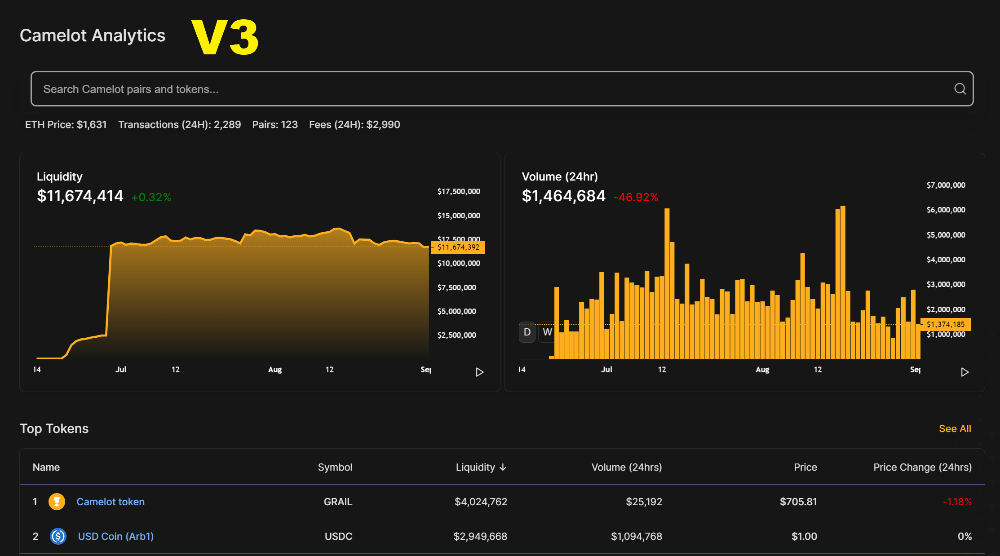

It hosts a bunch of LPs which power it's swaps and gives opportunities for you to stake in those LP and it's governance token ($GRAIL) and earn yields from transaction fees.

https://app.camelot.exchange/info

But it's the added features which make Camelot, in my opinion, one of the most innovative defi projects in the space right now.

Providing Liquidity on Camelot

Overview of the types of LPs

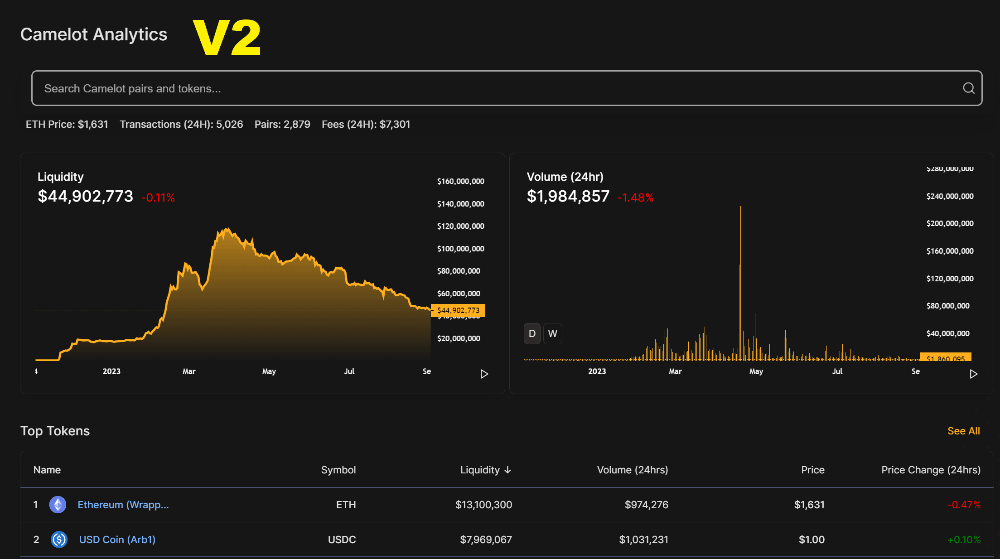

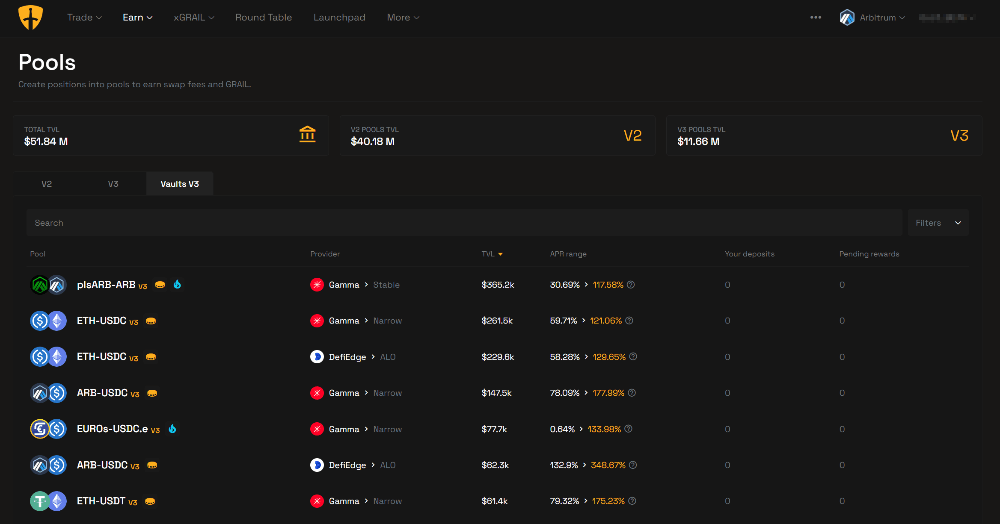

Camelot is currently running two types of LPs (liquidity pools). V2 and V3.

V2 LPs

V2 is your standard LP, albeit with added feature (which we'll expand on below). Camelot only launch late 2022 and have been putting up good numbers in a very tough market.

https://info.camelot.exchange/home/v2

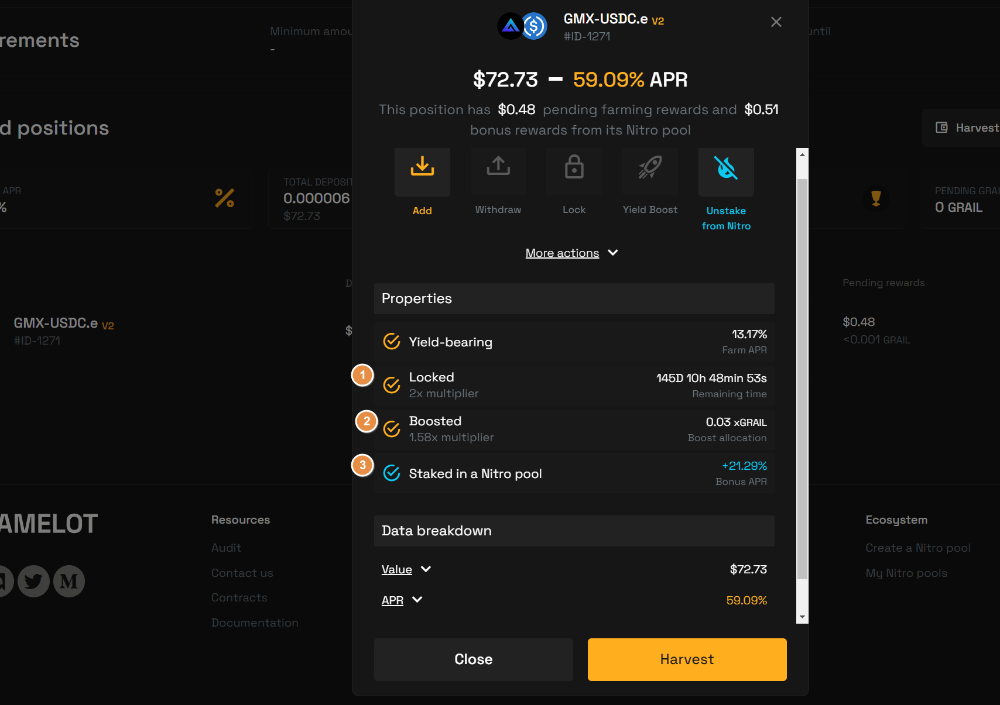

The V2 LPs take the standard 50-50 LP position and add in a number of optional boosts you can apply (if applicable)

- Some LPs will offer greater rewards if you're prepared to lock up your liquidity for a longer time periods

- You can stake your $GRAIL tokens against an LP to increase your yield (more on $GRAIL utility later)

- If the LP offers it you can stake it in Nitro to gain extra rewards. Protocols will often offer incentives on top of the base yield in order to attract more liquidity for their token/s. Nitro is the method by which Camelot lets them do this and it creates a marketplace for liquidity providers to pick from.

V3 LPs

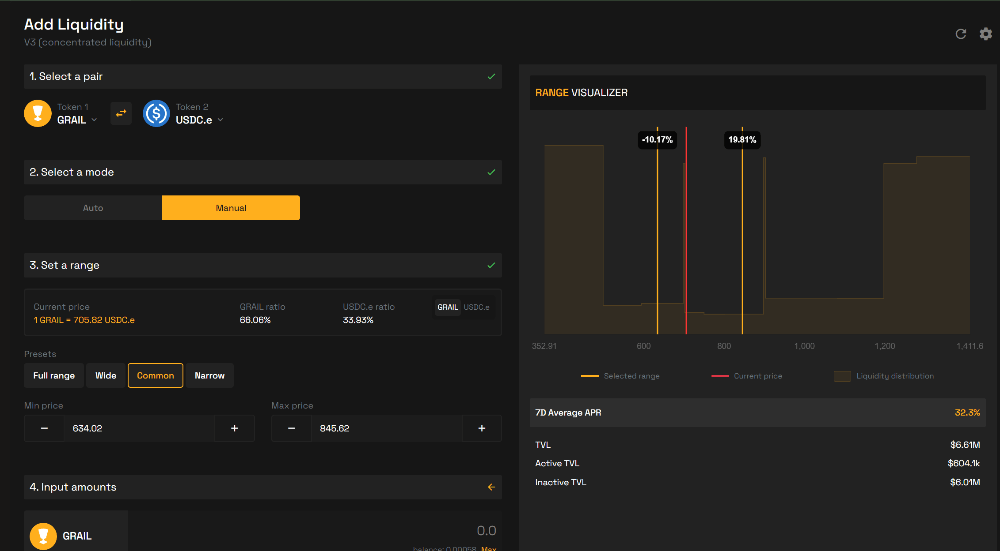

V3 is Camelot's concentrated liquidity offering. It's only newly launched but as it's concentrated liquidity it offers much greater capital efficiency and as a result, much higher potential yields.

Find out more about it here https://twitter.com/CamelotDEX/status/1689391058419888129?s=20

https://info.camelot.exchange/home/v3

V3 (named after the Uniswap V3 contract which most concentrated liquidity LP contracts are forks of) is much more difficult to manage.

Camelot have some great resources to help you (see below) if you're wanting to manage this manually.

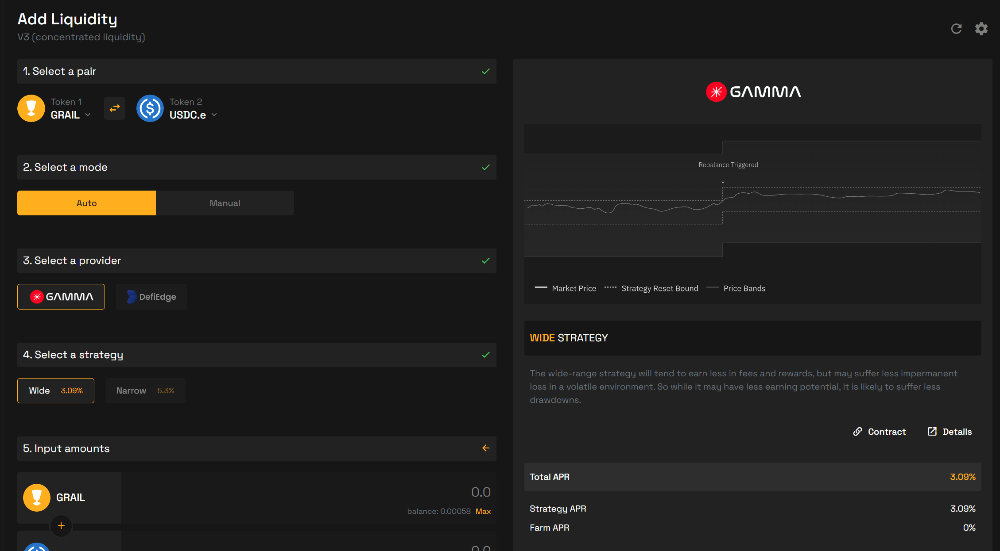

If you're not wanting to self manage (and personally I've never been able to successfully manage a concentrated liquidity position myself, even after multiple attempts on different chains) then Camelot have automated options for you.

You can select an automated strategy for a specific LP from one of their partners (more will be added over time) and it will handle the management for you.

You can also see all the available strategy/LP combinations from the Pools page under V3 Vaults.

https://app.camelot.exchange/pools?type=vaults

The advantage with choosing an automated strategy is many are eligible for Nitro rewards as well.

Learning and support

I've found Camelot a great place to generate yield from. It offers a wide range of options for risk vs reward and being on Arbitrum you benefit from being able to access Ethereum assets at dramatically lower fees.

Camelot have a extensive range of help resources so check them out before diving in

https://docs.camelot.exchange/get-started/camelot-tutorials

https://docs.camelot.exchange/get-started/faqs/liquidity-and-yield-farming

Their Discord is an excellent place to learn and get help (you've likely seen me post from there in my weekly crypto Discord round ups) so join up to that too if you're interested in getting involved https://discord.gg/r9V7rry3nz

The many uses of $GRAIL

Camelot's protocol token is $GRAIL. It is at it's core a governance token and is used to vote on proposals on Camelot.

https://coinmarketcap.com/currencies/camelot-token/

Camelot have designed $GRAIL to be a deflationary token. See below for some more about the tokenomics design and how Camelot are putting this into practice.

- https://docs.camelot.exchange/tokenomics/deflationary-mechanisms

- https://twitter.com/CamelotDEX/status/1688463640049991680?s=20

But $GRAIL is a multi-use token. I think this is one of the most innovative things Camelot have done. Nothing is particularly new in what they've done, but they've been able to bring together multiple use cases within the same token.

This means that you can invest in the overall success of Camelot through holding $GRAIL but ALSO diversify that investment across different strategies on Camelot itself whilst still holding only the token itself i.e., not having to convert part of it into the other side of an LP (which you can do as well e.g., GRAIL-USDC.e https://app.camelot.exchange/pools/0x8cc8093218bCaC8B1896A1EED4D925F6F6aB289F)

Stake It to Make It

To unlock the full potential of $GRAIL first you need to stake it for $xGRAIL. See the documentation for more details and how-tos https://docs.camelot.exchange/tokenomics/xgrail-token/how-to-use-xgrail

Once you've staked your $GRAIL you can deploy it across one or more of the following 3 options.

- Dividends

- Yield booster

- Launchpad

https://app.camelot.exchange/xgrail

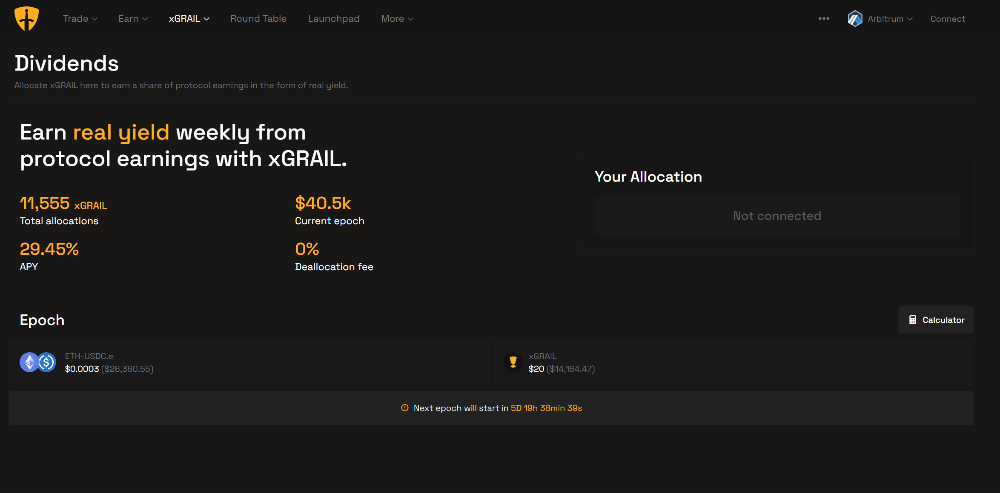

$xGRAIL Dividends

The most simple option of the three, $xGRAIL staked in Dividends attracts fees from the overall protocol revenues.

https://app.camelot.exchange/xgrail/dividends

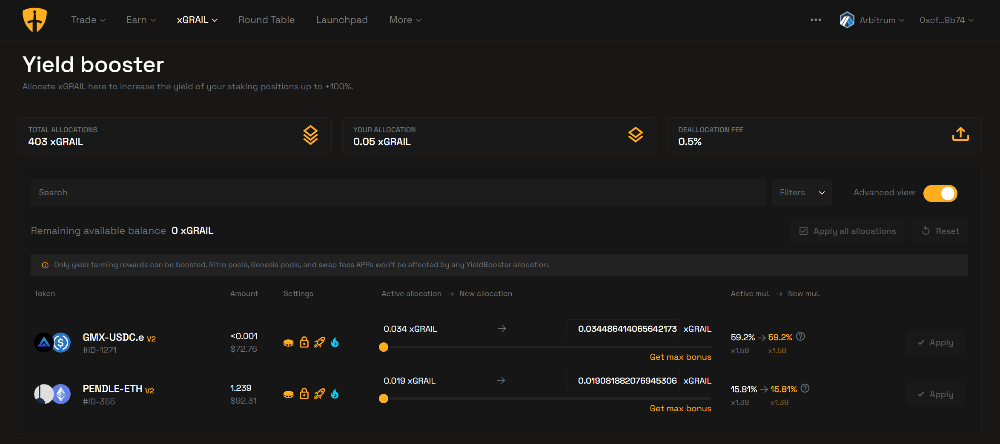

$xGRAIL Yield booster

As we saw above in the V2 explainer you can boost the yield of your LP position by staking your $xGRAIL against it.

https://app.camelot.exchange/xgrail/yieldbooster

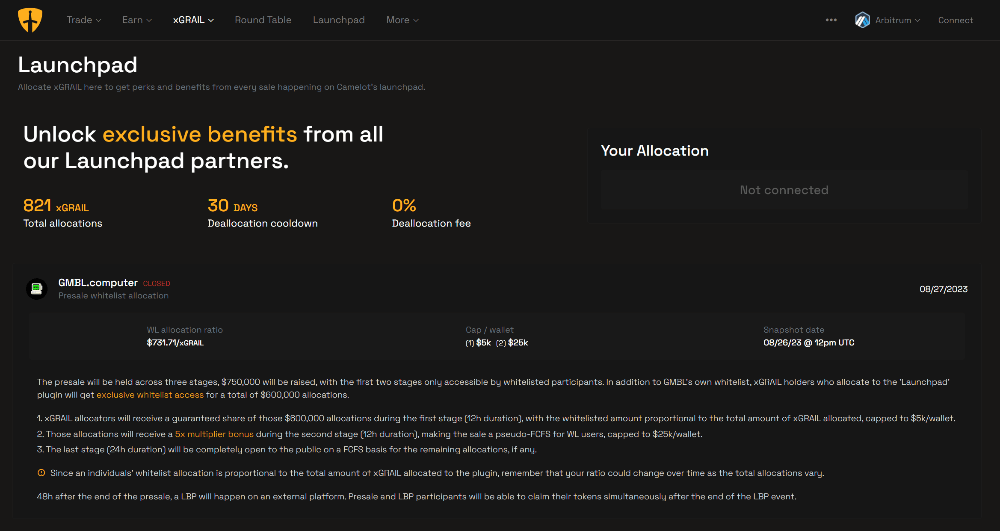

$xGRAIL Launchpad

Definitely the most interesting and highest risk vs reward option is staking your $xGRAIL in the Launchpad in order to get the chance to invest in protocol token launches. Camelot has onboarded a number of exciting new Arbitrum projects through their Launchpad and the rewards can be quite high here as you're essentially a seed investor.

https://app.camelot.exchange/xgrail/launchpad

One of the recent successful launches was Penpie https://twitter.com/Penpiexyz_io/status/1671054513162035200?s=20

If you're going to use Launchpad it's important to stay up to date with the campaigns as they launch. I recommend following their Discord and Twitter/Telegram.

Discord: https://discord.gg/r9V7rry3nz

Telegram: https://t.me/camelotdex

Telegram Announcements: https://t.me/camelotdexann

Twitter: https://twitter.com/camelotdex

Automating your Camelot LPs

Camelot has a lot of tools to help you defi but many of the process of claiming and restaking remain manual (even in the V3 vaults).

If you want to further automate your Camelot experience you can use a yield aggregator.

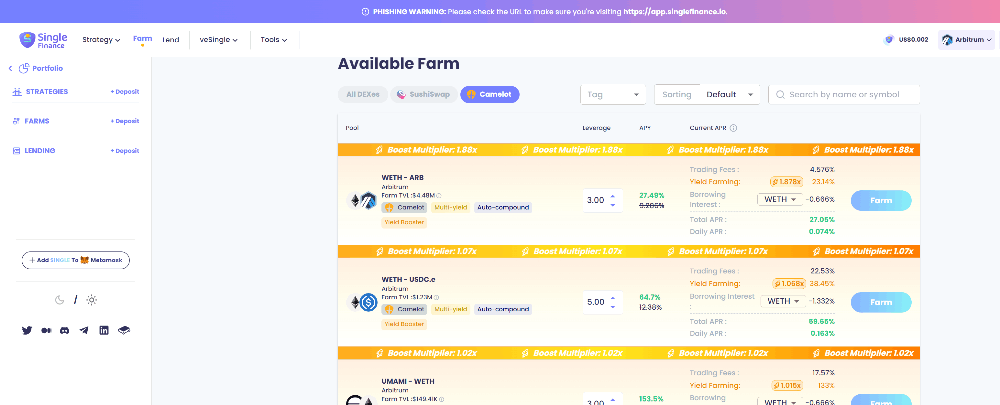

Single Finance

Single Finance offers auto-compounding and leveraged vaults for your Camelot LPs. Instead of using the boosts on Camelot, i.e., time locks, Yield booster and Nitro, you can instead lock your LP tokens in a Single Finance vault to let them automate harvest and restaking both saving on gas fees and seeing a higher return on your base yield as they are able to do this more regularly than manual stakers are able to.

https://app.singlefinance.io/farm

Single also offer you the ability to add leverage to your LP positions. This increases your risk but also increases your yields.

Single offer a good range of simple tools to help you manage your risk. Check out the resources below for a detailed explanation of this.

https://blog.singlefinance.io/the-holy-grail-of-xgrail-yield-boosting-eb1d75ab720

https://docs.singlefinance.io/home/

Using a third party to custody your LP tokens carries more risk. You already have the risk you've taken on by giving custody of your assets to the Camelot contracts to create the LP tokens, you are then taking those tokens and depositing them into another contract on Single Finance.

However, automated management and leverage strategies like Single offers are fairly standard across defi and are much more efficient vehicles to drive yields. It's just a case of using the tools Single provide to manage your risk and making sure you only allocate whatever amount of your portfolio you are comfortable with exposing to higher risk.

A example of a combined strategy would be to split an LP position on Camelot across Camelot and Single, allocating to each in proportion to your appetite/tolerance for risk.

What lies ahead for Camelot

One of Camelot's core principles is that they're building a community on Arbitrum as well as a liquidity hub.

Here's the reasons I'm optimistic about this project.

Constantly shipping

Since launch the team have racked up some impressive wins, as summarised well here https://twitter.com/CamelotDEX/status/1681391292314529792?s=20

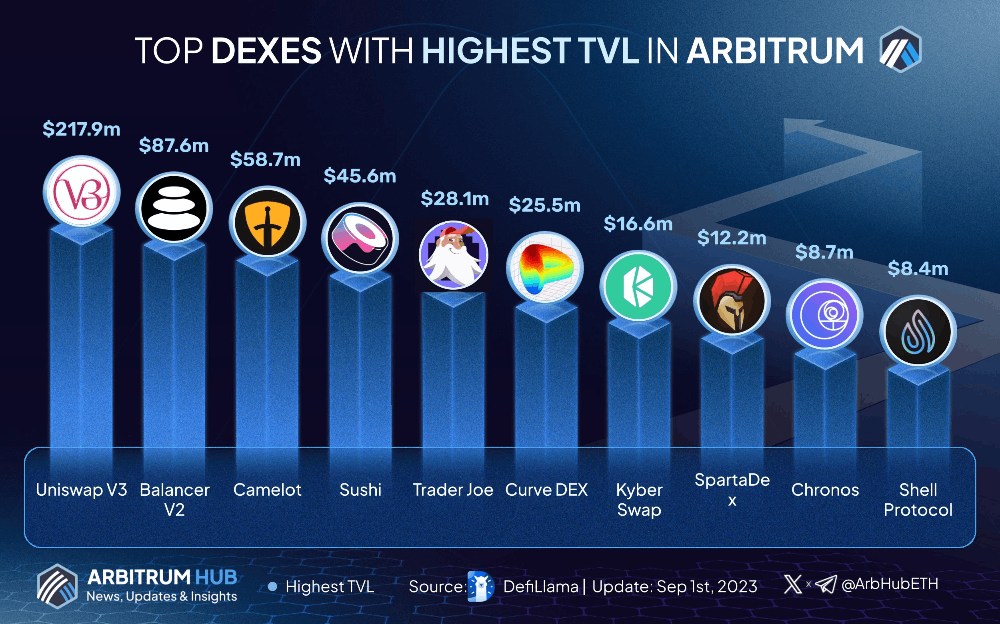

Key Arbitrum partner

Camelot have a strong connection with the Arbitrum Foundation and recently were successful recipients of another large grant for further building out the Arbitrum ecosystem. See their winning proposal summarised here https://twitter.com/CamelotDEX/status/1674439522287845377?s=20

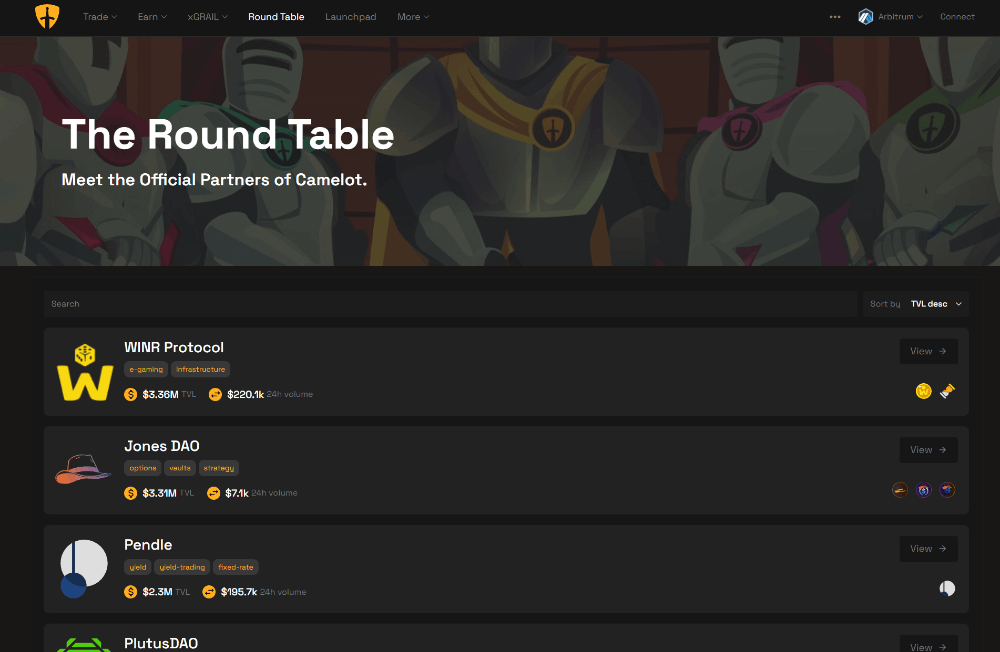

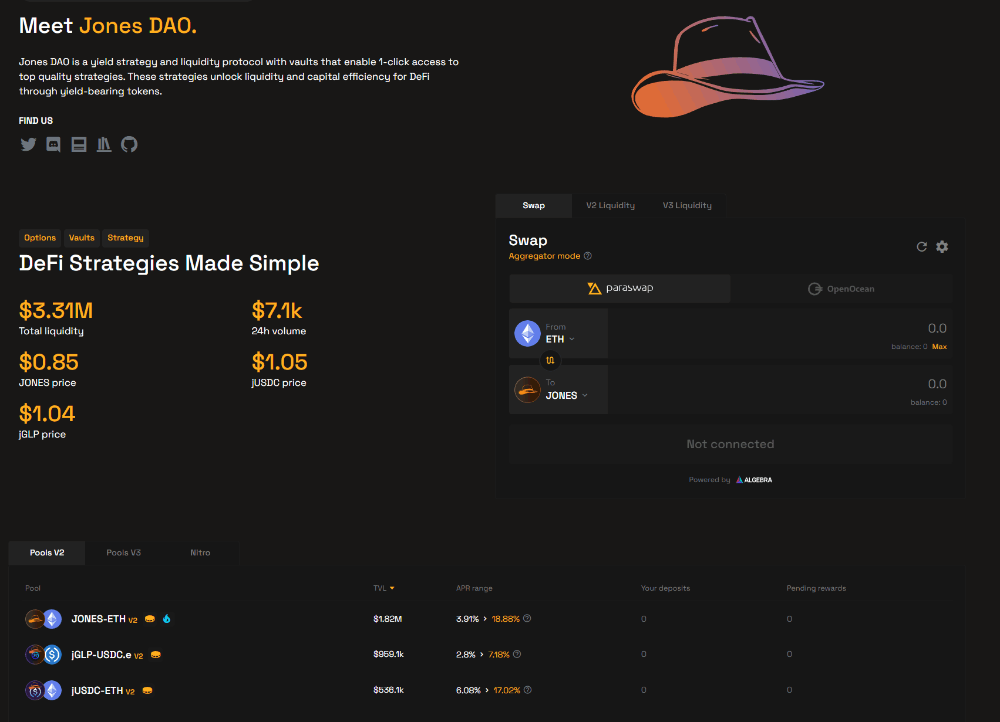

Round Table program

Camelot have a partner program called the Round Table. These are protocols who have close ties with the Camelot team and who work hand-in-hand with Camelot to develop products together. Being part of the Camelot community often gives you early access to releases from some of the biggest names in Arbitrum today.

https://app.camelot.exchange/protocols

Often partner LPs see greater rewards and liquidity so it's worth checking each one out as you're browsing Camelot.

The GRAIL Wars

Camelot have announced they will be deploying gauge voting & bribe markets much like a Curve Finance or a Velodrome has.

This is generally being referred to as 'The GRAIL Wars' (named after 'The Curve Wars' which is a term given to gauge vote & bribe markets for Curve Finance gauges).

https://twitter.com/CamelotDEX/status/1681362663866081280

This will give yet another utility for $GRAIL as it will function as a way to vote for protocol fee distributions to LPs and be rewarded for those votes (fees + bribes).

Camelot have not yet announced how this will work. Very likely it will follow the same system as boosting yields for LPs via staking $xGRAIL against them as the Curve Finance voting system uses veCRV, which is staked CRV (the governance token of Curve Finance).

At time of writing it's unclear if this will be in addition to being able to stake in Yield booster or if it will replace Yield booster (as it's similar functionality).

Find out more / Get involved

Discord: https://discord.gg/dX6a93n9

App: https://app.camelot.exchange/

Audit: https://paladinsec.co/projects/camelot

Blog: https://camelotdex.medium.com/

Docs: https://docs.camelot.exchange/

Telegram: https://t.me/camelotdex

Telegram Announcements: https://t.me/camelotdexann

Twitter: https://twitter.com/camelotdex

CMC: https://coinmarketcap.com/currencies/camelot-token/

Coingecko: https://www.coingecko.com/en/coins/camelot-token

Contract addresses:

- GRAIL: 0x3d9907F9a368ad0a51Be60f7Da3b97cf940982D8

- xGRAIL: 0x3CAaE25Ee616f2C8E13C74dA0813402eae3F496b https://docs.camelot.exchange/contracts/amm

What do you think?

Is Camelot something you want to learn more about?

After reading this do you find it?

- too complicated/hands on?

- not decentralized/hands on enough?

- something else?

Let me know in the comments below.