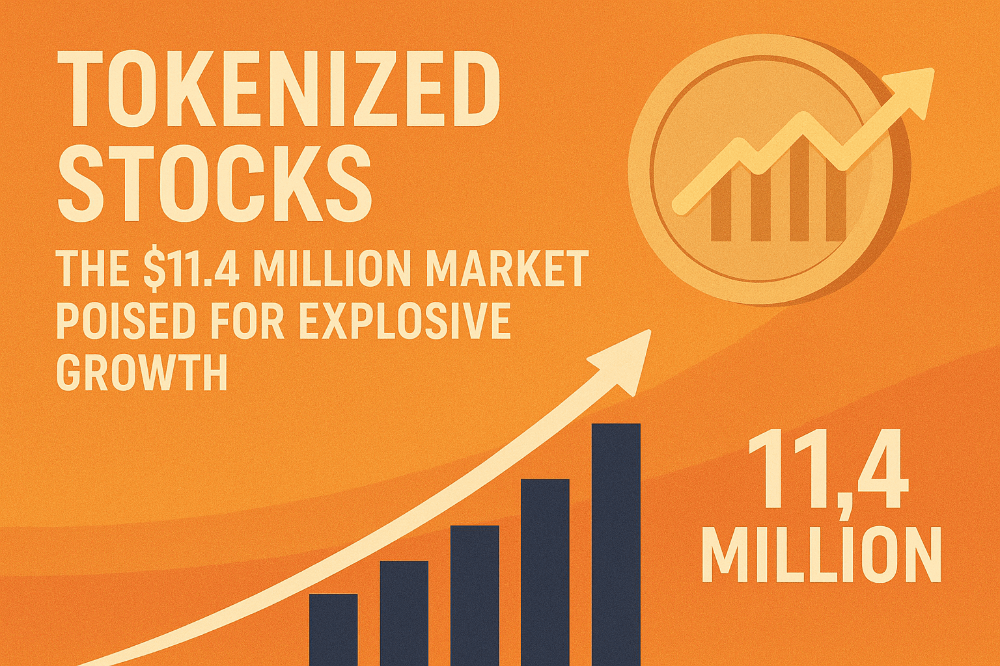

Tokenized Stocks: The $11.4 Million Market Poised for Explosive Growth

As of July 2025, tokenized stocks represent a $11.4 million market, a niche yet rapidly growing category driven by platforms like Ondo Finance, Backed Finance, and Kraken’s xStocks, according to CoinDesk. These digital representations of traditional equities, issued on blockchains like Solana, Ethereum, and Base, offer 24/7 trading, fractional ownership, and global accessibility, disrupting centuries-old stock market conventions. With regulatory clarity from frameworks like the U.S. GENIUS Act and Europe’s MiCA, and endorsements from industry giants like BlackRock’s Larry Fink, tokenized stocks are poised for explosive growth, with projections estimating a $1.34 trillion market by 2030 if just 1% of the $134 trillion global stock market is tokenized, per Tiger Research.

What Are Tokenized Stocks?

Tokenized stocks are digital tokens issued on a blockchain that represent ownership in traditional equities, such as shares of Apple, Tesla, or Nvidia. Unlike conventional stocks traded on centralized exchanges like NYSE or NASDAQ, tokenized stocks leverage distributed ledger technology (DLT) to enable:

- Fractional Ownership: Investors can buy fractions of a share, lowering entry barriers (e.g., $10 for 0.001 of an Amazon share).

- 24/7 Trading: Blockchain-based platforms allow trading anytime, unlike traditional markets’ limited hours.

- Global Accessibility: Investors in regions with restricted access to U.S. markets can participate via crypto exchanges.

- Smart Contract Automation: Voting rights, dividends, and corporate actions are programmed into tokens, reducing intermediaries.

Each token is typically backed 1:1 by a real share held by a regulated custodian, ensuring price parity and transparency, as seen with Backed Finance’s xStocks.

The Role of Tokenized Stocks in the RWA Ecosystem

Tokenized stocks are a subset of RWAs, which include tokenized treasuries ($6.9 billion), private credit ($12 billion), and real estate ($3.8 billion). Their unique value lies in tapping into the $134 trillion global stock market, addressing friction points like high fees, delayed settlements (T+2), and geographic barriers. In 2025, tokenized stocks account for $11.4 million of the $17.88 billion RWA market, a small but fast-growing segment driven by:

- Institutional Adoption: BlackRock, JPMorgan, and Franklin Templeton are exploring tokenized equities.

- Retail Demand: Platforms like Kraken and Binance target underserved markets in Europe, Latin America, and Asia.

- DeFi Integration: Tokenized stocks serve as collateral in Aave and Compound, generating 5–20% APY.

Market Performance and Growth in 2025

The Current State of Tokenized Stocks

As of March 2025, the tokenized stock market is valued at $11.4 million, up from $500,000 in mid-2024, reflecting a 2,280% surge. Key developments include:

- Trading Volume: Backed Finance’s xStocks recorded $300 million in on-chain volume by July 2025.

- Market Leaders: Coinbase ($5.6 million), Nvidia ($2.1 million), and Tesla ($1.8 million) dominate tokenized stock market cap.

- Platform Growth: Kraken’s xStocks, launched on Solana, offers over 50 tokenized equities, including Apple and ETFs.

This growth aligns with a broader RWA market expansion, which reached $17.88 billion by March 2025, driven by tokenized treasuries and private credit.

Drivers of Explosive Growth

Several factors are fueling the tokenized stock market’s trajectory toward a projected $1.34 trillion by 2030:

- Regulatory Clarity:

- U.S. GENIUS Act: Signed in July 2025, it provides a framework for stablecoins and tokenized assets, reducing compliance risks.

- EU’s MiCA: Effective December 2024, MiCA includes provisions for tokenized securities, enabling platforms like Gemini to serve EU investors.

- Asia’s Progress: Hong Kong and Singapore’s licensed digital securities exchanges support tokenized stocks.

- Institutional Momentum: BlackRock’s Larry Fink predicts “every stock, every bond” will be tokenized, with its BUIDL fund ($2.5 billion TVL) paving the way.

- DeFi Integration: Synthetix and Mirror Protocol support synthetic stocks with $5 billion in TVL, enabling yield generation.

- Infrastructure Maturity: Solana’s 566% volume surge (from $15 million to $100 million in one month) and Coinbase’s Base blockchain enhance scalability.

Key Players and Platforms in 2025

Leading Platforms

Several platforms are driving tokenized stock adoption:

- Ondo Finance: Offers over 100 tokenized U.S. stocks and ETFs via its Global Markets Alliance, with partnerships including BNB Chain, Bitget, and Pyth Network. Ondo’s acquisition of Strangelove in July 2025 bolstered its infrastructure.

- Backed Finance (xStocks): Accounts for 80% of the top 10 tokenized stocks by market cap, with $300 million in volume on Solana.

- Kraken: Launched xStocks on Solana, offering 50+ tokenized equities for non-U.S. investors, backed 1:1 by Swiss custodians.

- Injective: Leads in tokenized stock derivatives, with $1 billion in trading volume via its Helix DEX.

- Robinhood: Expanded to Europe in 2025, offering 200+ tokenized U.S. stocks with zero-fee trading on Arbitrum.

- Gemini: Partnered with Dinari Global to offer 60+ tokenized stocks compliant with MiFID II.

Institutional Pioneers

Traditional finance giants are embracing tokenization:

- BlackRock: Its BUIDL fund, while focused on treasuries, signals broader tokenization ambitions, with CEO Larry Fink advocating for universal asset tokenization.

- JPMorgan: Tokenized portions of its private funds on Avalanche.

- Franklin Templeton: Offers tokenized money market funds integrated with DeFi, managing $500 million in TVL.

Emerging Innovators

Web3-native platforms are also scaling:

- Synthetix: Supports synthetic stocks (e.g., sTSLA, sAAPL) with $5 billion in TVL.

- Mirror Protocol: Enables mirrored assets with staking rewards.

- Securitize: Facilitates tokenized treasuries and equities, including $BUDIL.

Benefits of Tokenized Stocks

For Investors

- Accessibility: Fractional ownership enables micro-investing (e.g., $1 for Tesla shares), democratizing access.

- Liquidity: 24/7 trading and instant settlement (vs. T+2) enhance flexibility.

- Cost Efficiency: Minimal blockchain fees replace broker commissions, saving 50–70% vs. traditional brokers.

- DeFi Opportunities: Tokenized stocks can be used as collateral in Aave or Compound, yielding 5–20% APY.

- Global Reach: Investors in emerging markets gain access to U.S. equities, bypassing capital controls.

For Issuers

- Capital Raising: Tokenization streamlines fundraising, bypassing IPO restrictions.

- Operational Efficiency: Smart contracts automate dividends, voting, and compliance, cutting costs by 30%.

- Global Investor Base: Companies attract capital from a broader pool.

For Markets

- Transparency: Blockchain’s immutable ledger reduces fraud and errors.

- Liquidity Pools: DeFi integration creates secondary markets, addressing Nadine Chakar’s concern about “locked” tokenized assets.

- Innovation: Tokenization enables new financial products, like stock-based NFTs with dividend payouts.

Challenges and Risks

Regulatory Hurdles

- U.S. Compliance: The SEC classifies some tokenized stocks as securities, requiring complex registrations.

- Global Divergence: MiCA’s strict rules contrast with looser frameworks in Asia, complicating cross-border trading.

- Custody Risks: If custodians fail, tokens could lose backing.

Market Risks

- Liquidity Issues: Tokenized stocks have lower liquidity than traditional markets, with Coinbase tokens at $1 million in depth.

- Price Disparity: Tokenized stock prices may deviate from underlying assets due to latency or illiquidity.

- Market Manipulation: Less oversight in DeFi markets raises risks.

Technical Risks

- Smart Contract Vulnerabilities: Bugs could disrupt operations.

- Scalability: High Ethereum fees hinder retail adoption, though Solana and Base offer solutions.

- Custody Security: Hacks or custodian failures could undermine trust.

Opportunities for Investors in 2025

Getting Started

- Choose a Platform:

- Kraken xStocks: Ideal for non-U.S. investors, offering Tesla, Apple, and ETFs.

- Ondo Finance: Access 100+ tokenized stocks via Bitget or BNB Chain.

- Synthetix/Mirror: Trade synthetic stocks with DeFi yields.

- Complete KYC: Required for regulated platforms under MiCA or GENIUS Act.

- Start Small: Invest $10–$100 to test fractional ownership.

- Use Audited Platforms: Verify 1:1 backing via Chainlink PoR, as with Backed Finance.

- Monitor Regulations: Track SEC and ESMA updates for compliance changes.

Maximizing Returns

- DeFi Yields: Use tokenized stocks in Aave or Compound for 5–20% APY.

- Arbitrage: Exploit price disparities between tokenized and traditional stocks.

- Long-Term Holds: Bet on high-growth stocks like Nvidia or Coinbase, tokenized on Solana.

- Diversify: Combine tokenized stocks with treasuries (e.g., Ondo’s USDY) and private credit.

Risk Management

- Diversify Assets: Spread investments across equities, treasuries, and stablecoins.

- Secure Wallets: Use hardware wallets like Ledger for token storage.

- Check Custodians: Ensure platforms use regulated custodians like Coinbase Custody.

- Avoid Unregulated Platforms: Stick to MiCA/GENIUS-compliant exchanges to minimize risks.

Future Projections: A $1.34 Trillion Market by 2030

Market Forecasts

- Tiger Research: Projects a $1.34 trillion tokenized stock market by 2030 if 1% of global stocks are tokenized, a 2,680x increase from $11.4 million.

- McKinsey: Estimates $2 trillion for tokenized assets (excluding stablecoins) by 2030, with stocks and bonds leading.

- World Economic Forum: Predicts $24 trillion by 2027, driven by institutional adoption and regulatory clarity.

Emerging Trends

- Stock-Based NFTs: Platforms may introduce NFTs for dividend payouts via smart contracts.

- Cross-Chain Scalability: Solana, Base, and Ondo Chain will enhance liquidity.

- Global Expansion: Hong Kong, Singapore, and Brazil are developing tokenization frameworks.

- Institutional Integration: Banks like JPMorgan and Goldman Sachs will tokenize private funds.

Challenges Ahead

- Liquidity Scaling: Tokenized stocks must match traditional market liquidity.

- Regulatory Harmonization: Global standards are needed to prevent fragmentation.

- Adoption Pace: Only 0.0004% of the stock market is tokenized, requiring broader acceptance.

Conclusion: The Future of Equities Is On-Chain

In 2025, the $11.4 million tokenized stock market stands at the cusp of explosive growth, driven by regulatory clarity, institutional adoption, and DeFi integration. Platforms like Ondo Finance, Backed Finance, and Kraken are democratizing access to equities, offering 24/7 trading, fractional ownership, and yields of 5–20% via Aave and Compound. With $300 million in trading volume and a 2,280% market surge since 2024, tokenized stocks are tapping into the $134 trillion global stock market. Regulatory frameworks like MiCA and the GENIUS Act, combined with endorsements from BlackRock’s Larry Fink, signal a transformative shift. Despite challenges—liquidity constraints, regulatory divergence, and technical risks—the projected $1.34 trillion market by 2030 underscores tokenized stocks’ potential to reshape global finance. As Jesse Pollak of Coinbase’s Base noted, “Every asset in the world will eventually be on-chain,” heralding a new era for equities.