Two Cryptocurrencies to Invest in 2024: Investing in These Altcoins is Like Buying Ethereum Under $1

I have realized that many cryptocurrency investors, including myself, are greedy. We always desire more, like Oliver Twist. We often wish we had invested in cryptocurrency earlier when Bitcoin was under $100, ETH under $5, and SOL under a dollar.

However, the real problem is not about investing early in crypto projects, because even those who invested in Bitcoin early without understanding its fundamentals sold their assets before it reached $10.

The real issue is investing in crypto projects without conviction. This alone has caused many to sell their crypto assets before they gained mainstream adoption.

If you don’t believe me, ask those who invested in Bitcoin when it was under $100. How many of them still hold their BTC to this day? If you’re in this category, please share your story in the comment section so that we can learn from it.

You see, finding the next 100x crypto isn’t a big deal, but can you hold on when things are not going your way? As an investor, the temptation to sell your cryptocurrency assets when prices fluctuate is something you must deal with.

For example, if you had bought Solana (SOL) in 2020 for less than $0.92, would you have imagined it reaching above $250 in 2021? Probably not. So, whether you missed the opportunity to invest early in crypto or are just starting today, you need conviction to set long-term goals.

All Hope Is Not Lost

Thankfully, there are new narratives and emerging blockchain technologies that have disrupted the crypto market in recent months. Investing in these projects can compensate for your late arrival in the cryptocurrency market.

Since narratives drive the crypto market, we will follow the smart money concept to invest in two projects supported by whales, institutional investors, and crypto influencers.

However, I will not encourage you to sell your car, mortgage your house, take a loan, or invest your rent fees in these crypto projects. I do not support such financial recklessness.

You must understand that investing in new cryptocurrency projects is always risky, and the chances of losing your capital are high. So, only invest the amount you’re willing to gamble with so you don’t suffer from depression if your investment goes underwater. Now the question is…

What are the 100x Crypto Projects to Invest in 2024?

(Crypto influencers reviewing SEI)

(Crypto influencers reviewing SEI)

Recently, two cryptocurrency projects that haven’t experienced the cryptocurrency bull market caught my attention, and if you know what that means, you will add this article to your watchlist.

For example, Solana, Avalanche, Fantom, and Polkadot had their first bull run in 2021, and they delivered incredible gains to early investors. They outperformed Chainlink, Litecoin, Ethereum, Bitcoin Cash, and other old-generation tokens in terms of their return on investments (ROIs)

So, if you are still holding the 2017 and 2021 tokens like my grandma, and hoping to make 5–10x returns from them, good luck.

You might earn some profits from those old tokens, but investing in Sei Network, Manta Network, and other newer projects could yield higher returns. These new projects could offer over 100x returns on your investment if you follow the right strategy.

How to Find and Invest in Emerging Crypto Gems

Photo by Mick Haupt on Unsplash

To increase your chances of success investing in emerging crypto gems, you need to consider the following criteria:

- Get in early

- Invest in projects that haven’t experienced a bull market

- Have conviction

- Stick with the plan

- Focus on social media hype and influencers promoting new projects

- Keep the process simple.

By following these steps, you can stay ahead of the curve and make insane profits. But when the market becomes saturated, you can take profits from these new projects and put them into Stablecoins, BTC, ETH, SOL, and other top crypto that make up your long-term portfolio.

Two Examples of Emerging Crypto Gems: Sei Network and Manta Network

Now that you know the criteria for finding and investing in emerging crypto gems, let me introduce you to two projects that have huge potential in this bull run: Sei Network and Manta Network.

These two projects are shaping how the blockchain industry should function and challenging developers on LI and L2 blockchains to think deeply because of the innovative ideas they brought on board. First, let’s start with Sei Network.

Sei Network: The Fastest and Cheapest Blockchain for Trading

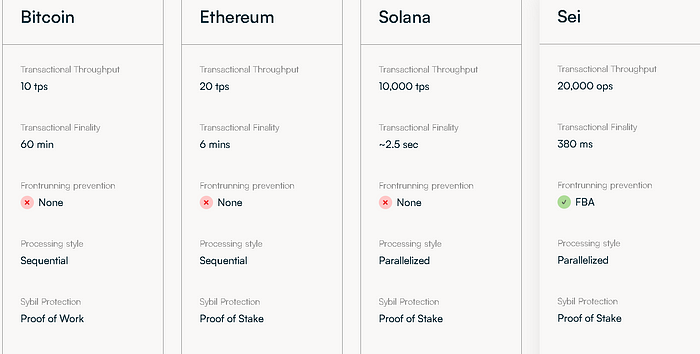

(Sei remains the fastest blockchain)

(Sei remains the fastest blockchain)

Most people ask what is Sei Network, and how we can make a potential 100x return investing in this project.

Sei is the first sector-specific Layer 1 blockchain, specialized for trading to give exchanges an unfair advantage. It enables mass adoption of digital assets by building the fastest Layer 1 blockchain, designed to scale with the industry to enhance speed, improve security, and be user-friendly.

Is Buying Sei Tokens a Good Investment

Yes, I believe that investing in SEI tokens is a good investment, although not without risk. As with any cryptocurrency investment, there is no guarantee of profits, and you should always do your own research and only invest what you can afford to lose.

Fundamentally, the SEI token has a lot of upsides potential, since it is the native currency of Sei Network, and it is used for various purposes, such as:

- Paying for transaction fees on the network

- Staking to secure the network and earn rewards

- Participating in governance and decision-making

- Accessing exclusive services and features on the network.

The Sei Network has also attracted some reputable and influential players in the crypto space, such as:

- Binance Labs

- Coinbase Ventures

- Pantera Capital

- Alameda Research, and

- Multicoin Capital.

These smart investors and virtual capitals (VCs) are allocating funds to this hidden gem, which means they probably know something we don’t know. Therefore, I have added SEI to my crypto watchlist, and I suggest you do the same before it becomes too mainstream and expensive.

Manta Network: The Privacy Layer for Web3 Applications

(MANTA-USD pair: Screenshot by author)

(MANTA-USD pair: Screenshot by author)

Manta Network is a modular ecosystem for web3 applications that offers a privacy layer for decentralized finance (DeFi). One of its components is Manta Pacific, which is a Layer 2 (L2) deployment that leverages Celestia, a modular data availability layer.

With Manta Network, users can build and deploy any Solidity-based decentralized applications and leverage its technology stack to deliver faster transaction speeds and lower gas costs than a Layer 1 (L1) blockchain.

Fundamental Analysis

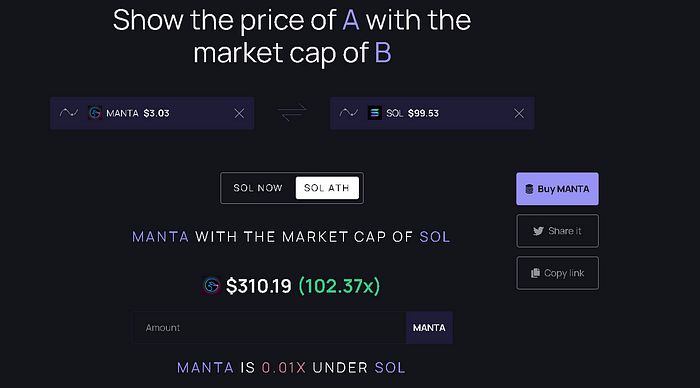

Manta Network is a new and emerging project recently launched on Binance. It currently has a market capitalization of less than a billion dollars, which means it has a lot of room to grow and appreciate in value. (Comparison between MANTA and SOL Market Cap.)

(Comparison between MANTA and SOL Market Cap.)

If this project follows the price-discovery pattern of Solana, it could reach a 50% market cap of what Solana achieved in the 2021 bull market (over $43 billion). That would translate to over 50x returns, putting the average price of MANTA at $170.

If it reaches a $77 billion market cap, which is not impossible in the crypto space, we could see the average price of MANTA above $300. So, you can see that we are still early on this project and its potential is huge. See the screenshot above.

But someone may argue by saying, I don’t see MANTA reaching such high figures. Well, I need you to remember that LINK and LTC, which are older and more established tokens, once had the billion-dollar market cap status when Solana and Avalanche were struggling under a $500 million cap in 2020.

However, before the peak of the 2021 bull market, both Solana and Avalanche surpassed LINK and LTC in terms of market cap and performance.

So, overtaking is allowed in the cryptocurrency market, and investors move funds to new and exciting projects with high potential rewards. Hence, we should follow their strategies for investing in Sei Network and Manta Network to maximize profits in this bull run.

Comparing SEI’s Market Cap to ETH in 2017

(Ran tweeting about SEI)

(Ran tweeting about SEI)

In 2017, Ethereum had a market cap of $2 billion, with an average price of $10. Similarly, the Sei network currently has a market cap of less than $2 billion, at an average price of $0.65. Imagine the potential if this project reaches a $50 billion market cap before the end of this bull market. However, such gains require conviction in this project.

Sei is often touted as the “Solana killer,” and we can capitalize on this narrative. This isn’t about which blockchain has superior technology or use cases; it’s purely speculative. The goal is to identify the hidden gem altcoin that will yield the most significant gains in this bull run, and I am following the money trail.

Advantages of Investing in New Crypto Projects

Consider this: if you had invested $1000 in Litecoin in November 2021 and sold at its peak in May for $400, you could have turned $1,000 into $10,000.

Similarly, if you had invested $1000 in hot narrative tokens like Solana in November 2020 and sold at its peak for $250 in November 2021, you could have turned $1,000 into over $100,000.

This shows the profitability of investing in new tokens with a strong narrative and industry backing. Remember, crypto influencers promoted Solana in 2021, thereby attracting retail and institutional funds into the Solana ecosystem. Now, these same influencers and many more are touting SEI and MANTA as the hot narratives for 2024.

When Is the Best Time to Invest In SEI and MANTA?

(SEI-USDT pair in 1-D timeframe)

(SEI-USDT pair in 1-D timeframe)

Examining the SEI-USD pair above, the market structure is bearish. I would recommend waiting for a pullback towards the EMA-100 on the daily timeframe (around $0.458), which could act as a support level before purchasing this token.

However, it could drop further if the selling pressure is high, or reverse from its current price if there’s bullish news in the market. So, invest carefully. Personally, I will rely on the information on my chart until I observe a bullish reversal in the market.

When Is the Best Time to Buy MANTA tokens?

(MANTA-USDT pair on the 4-H)

(MANTA-USDT pair on the 4-H)

The MANTA-USD pair has limited data on the daily timeframe, so I will analyze the chart on the 4-hour and 1-hour timeframes. On both timeframes, the MANTA-USD pair is bearish and currently trading below the EMA 20. This market structure doesn’t look appealing, so I would wait for more data before investing in this project.

I would advise you to monitor the chart and wait for a pullback before heavily investing in these new projects. However, if you’re not concerned about technical analysis, you can invest in them using the DCA method.

You can either invest bi-weekly, monthly, or whenever you have resources, to accumulate more tokens. I hope this strategy proves successful for you and leads to financial freedom by the end of this bull market.

Final Thoughts

I have done my best to provide both fundamental and technical reasons why SEI and MANTA could be the game changes in this bull run. Now, the choice is yours to make. You can go all in on these projects or invest using the dollar-cost averaging method.

I hope this article was insightful. If you’d like to learn more tips and strategies to master technical analysis, follow me and subscribe to receive email notifications when I publish new stories. Also, download a copy of “The Trader’s Manual Handbook” below. (Click Here to Download Your Copy)

(Click Here to Download Your Copy)

Click Here to Download a Copy of The Trader’s Manual Handbook

Thanks for reading. Invest wisely.

Also read this story:

This Crypto Millionaire Told Us to Buy Bitcoin in 2013: His Next Prediction Will Shock…

In 2013, this crypto legend advised his followers to invest a freaky $1 in Bitcoin. Yes, you read that right. His name…

medium.com