Ethereum Staking Hits New High: Nearly 30 Million ETH Locked

Ethereum (ETH) has reached a significant milestone, with 24% of its total supply now staked. This development reflects a growing tendency among ETH holders to prioritize earning passive income through staking rather than selling their assets for immediate price appreciation.

This shift highlights the holders’ increasing confidence and commitment to the network’s future. Especially, after recent advancements such as the Shapella upgrade.

Ethereum Holders Prefer Staking

One of the most anticipated features of the Shapella upgrade was the introduction of withdrawal functionality for staked Ethereum. This change allowed validators and stakers to withdraw their staked ETH along with the accrued rewards.

Before this upgrade, ETH staked on the Ethereum 2.0 Beacon Chain was locked without a mechanism for withdrawal. This is even after the transition to Proof-of-Stake in the Merge upgrade.

CryptoQuant CEO Ki Young Ju recently commented on this feature, which has added liquidity and flexibility for holders in the staking process.

“I expected significant unstaking activities after the Shapella upgrade, but the staking rate is still increasing,” Ju said.

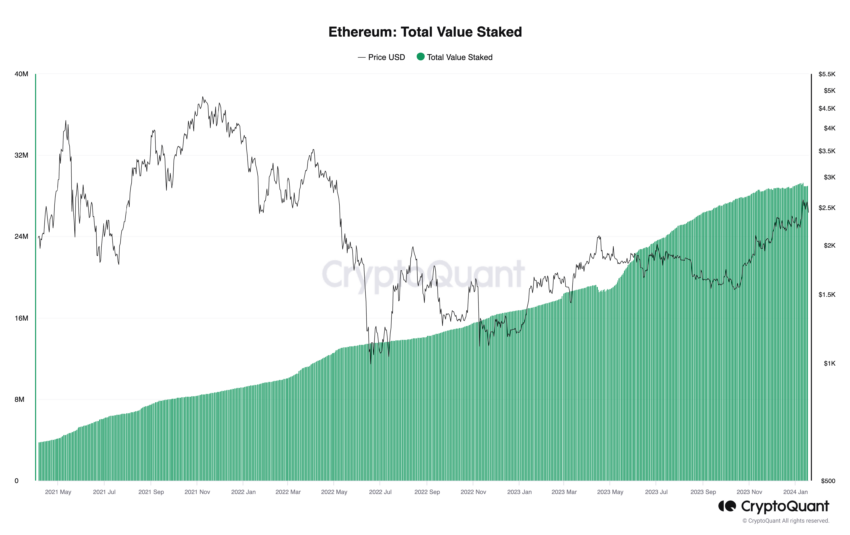

Despite the new functionality allowing stakers to withdraw their tokens, Ethereum’s staking market cap has soared to $72.75 billion. More than 28.8 million ETH tokens are currently staked, representing 24% of the total supply. The network also boasts a robust base of 898,110 active validators.

These figures demonstrate the widespread adoption and trust in Ethereum’s Proof-of-Stake mechanism.

Read more: Staking Crypto: How to Stake Coins and Grow Your Income Total Ethereum Staked. Source: CryptoQuant

Total Ethereum Staked. Source: CryptoQuant

Data from The TIE reveals that despite this substantial activity, Ethereum has managed to maintain a negative inflation rate of 0.03%, coupled with a rewarding rate of 4.23%. This unique combination of a deflationary trend and attractive staking rewards sets Ethereum apart in the cryptocurrency market.

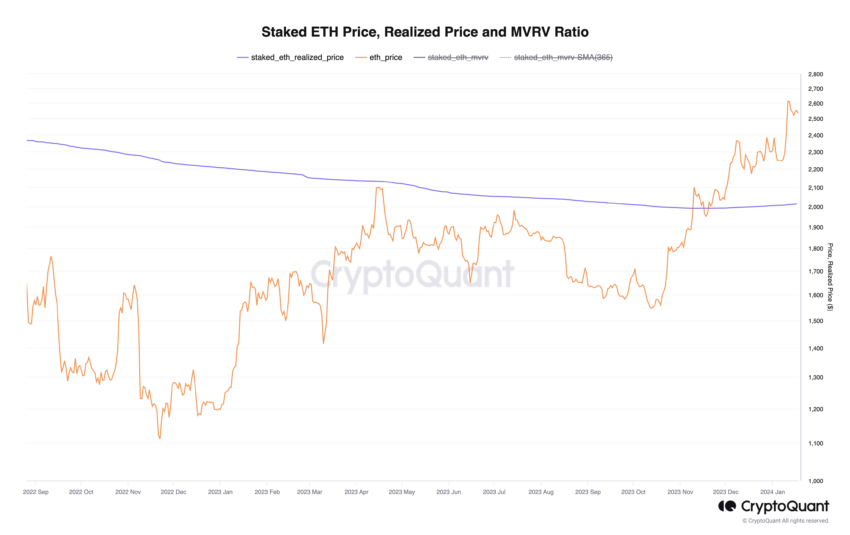

Moreover, there is a significant disparity between the realized price for staked ETH at $2,014 and its current market price, hovering around $2,519. This difference translates to a substantial 25% profit for stakeholders, underscoring the profitability of staking ETH. Such a profit margin reflects a bullish sentiment among Ethereum investors.

Read more: 10 Best Crypto Staking Platforms You Can Trust (2024 Edition) Staked ETH Price. Source: CryptoQuant

Staked ETH Price. Source: CryptoQuant

This trend of holding and staking ETH, as opposed to trading it on exchanges, indicates a strong confidence in the long-term value of Ethereum. Investors seem to be favoring the potential for sustained returns through staking, a strategy that aligns with the growing stability and maturity of the ecosystem.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.