A Guide to Identifying Trends in Cryptocurrency Markets

In the fast-paced and ever-evolving world of cryptocurrency, staying ahead of the curve is key to success. One of the most crucial skills for any investor or trader is the ability to identify trends in cryptocurrency markets. Whether you're a seasoned trader or just starting out, understanding how to spot trends can help you make more informed decisions and maximize your profits. Here's a comprehensive guide to help you navigate the tumultuous waters of cryptocurrency trading:

1. Technical Analysis: Technical analysis is a fundamental tool for identifying trends in cryptocurrency markets. It involves analyzing historical price data and volume to identify patterns and predict future price movements. Common technical indicators used in cryptocurrency trading include moving averages, relative strength index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands. By studying these indicators, traders can gain insights into whether a cryptocurrency is experiencing an uptrend, downtrend, or consolidation phase.

2. Chart Patterns: Chart patterns are formations that occur on price charts and provide valuable information about the market sentiment. Some of the most commonly observed chart patterns include triangles, flags, pennants, and head and shoulders patterns. These patterns can signal potential trend reversals or continuations, helping traders make better-informed decisions.

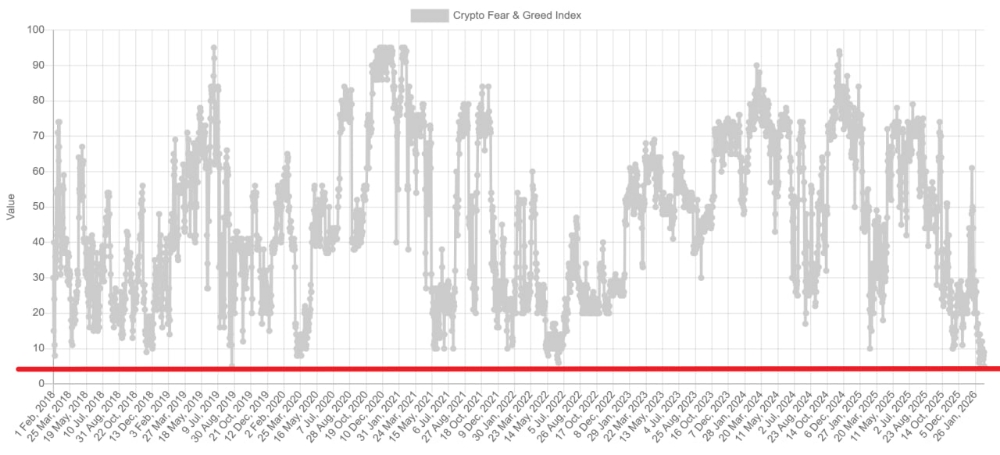

3. Market Sentiment: Cryptocurrency markets are heavily influenced by market sentiment, which refers to the overall attitude or feeling of traders and investors towards a particular cryptocurrency. Monitoring social media channels, forums, and news outlets can provide valuable insights into market sentiment. For example, a surge in positive news coverage or social media mentions about a cryptocurrency could indicate a bullish trend, while negative sentiment may suggest a bearish trend.

4. Fundamental Analysis: While technical analysis focuses on price and volume data, fundamental analysis involves evaluating the underlying factors that drive the value of a cryptocurrency. This includes factors such as technology development, adoption rate, regulatory developments, and market demand. By staying informed about the fundamental aspects of cryptocurrencies, traders can better understand the long-term trends and potential growth opportunities.

5. Volume Analysis: Volume is a critical component of analyzing cryptocurrency trends. High trading volumes typically accompany strong price movements, indicating increased market participation and momentum. Conversely, low trading volumes may signal a lack of interest or uncertainty in the market. By paying attention to volume trends, traders can confirm the validity of price movements and identify potential trend reversals.

6. Trend Confirmation: Once you've identified a potential trend using technical analysis, it's essential to confirm its validity before making any trading decisions. This can be done by looking for multiple indicators or signals that support the identified trend. For example, if a cryptocurrency is experiencing an uptrend according to moving averages and RSI, but volume is declining, it may indicate a weakening trend that is likely to reverse.

7. Risk Management: Finally, it's crucial to implement proper risk management strategies when trading cryptocurrencies. This includes setting stop-loss orders to limit potential losses, diversifying your portfolio to mitigate risk, and avoiding emotional trading decisions. By managing risk effectively, traders can protect their capital and increase their chances of long-term success in the cryptocurrency markets.

In conclusion, identifying trends in cryptocurrency markets requires a combination of technical analysis, chart patterns, market sentiment analysis, fundamental analysis, volume analysis, trend confirmation, and risk management. By mastering these skills and staying informed about market developments, traders can gain a competitive edge and capitalize on profitable trading opportunities in the dynamic world of cryptocurrencies.