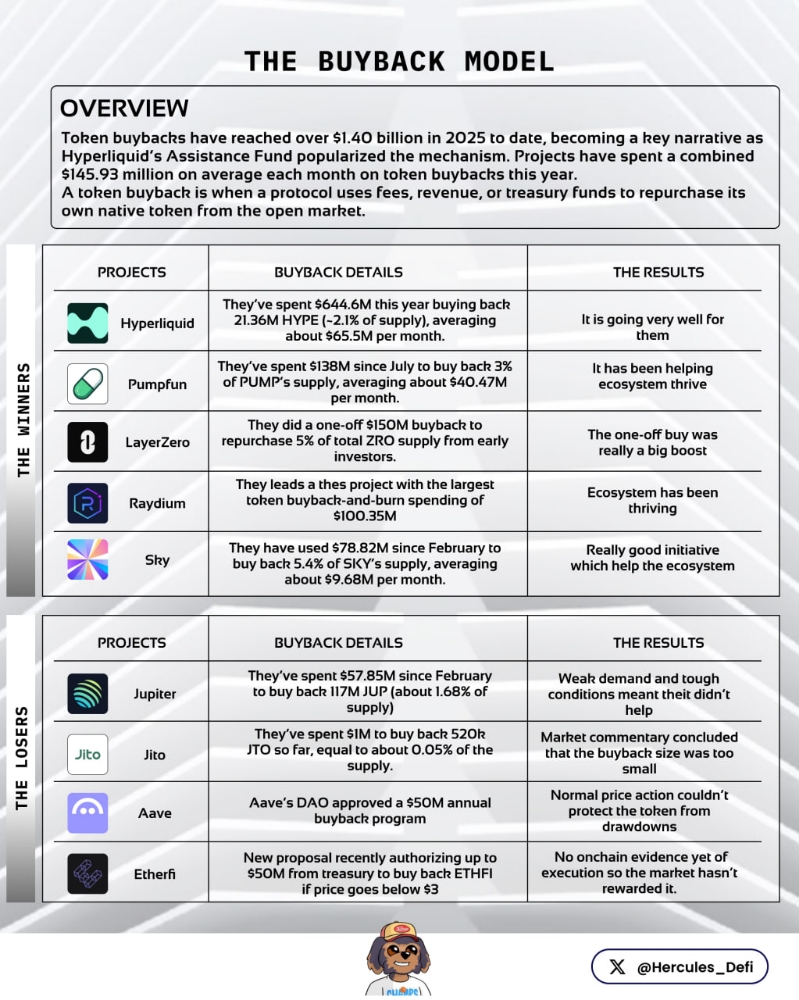

Front Running Bot Development Demystified : A Complete Guide 2024

Front-running bots are a controversial yet prevalent phenomenon in the cryptocurrency market, often employed to gain an unfair advantage over other traders. In our comprehensive guide, we delve into the intricacies of front-running bot development, demystifying the process for developers and enthusiasts alike. We explore the technical foundations, algorithmic strategies, and ethical considerations surrounding these bots, providing a holistic view of their development and operation.

By understanding the underlying principles and mechanisms of front-running bots, readers can grasp how these tools function and their potential impact on the market. Additionally, we discuss the regulatory landscape and potential risks associated with deploying crypto front-running bot development, emphasizing the importance of responsible bot development and usage. Whether you’re a developer looking to create front-running bots or an enthusiast seeking to understand their implications, this guide offers valuable insights into this complex aspect of cryptocurrency trading.

Understanding Front Running Bot Development

Front-running bot development involves creating algorithms that exploit delays in executing trades on decentralized exchanges (DEXs). These bots monitor pending transactions in the mempool and quickly submit their transactions to front-run or preemptively execute trades before the original transactions are processed. Front-running bots typically aim to profit from price changes caused by the original transactions, often at the expense of other traders.

To develop such bots, a deep understanding of blockchain technology, smart contracts, and trading algorithms is necessary. Developers must also consider the ethical implications of creating tools that can potentially manipulate market prices and impact other traders. As regulations around cryptocurrency trading evolve, developers and users of front-running bots must stay informed to ensure compliance and ethical use of these tools.

How Do Front Running Bots Work?

Front-running bots work by exploiting the time delay between the moment a transaction is broadcasted to the network and when it is confirmed in the blockchain. Here’s how it typically works:

Monitoring Transactions: The front-running bot monitors pending transactions in the mempool, which are transactions waiting to be included in a block and confirmed on the blockchain.

Identifying Profitable Transactions: The bot looks for transactions that are likely to move the price of a cryptocurrency or token significantly, such as large buy or sell orders.

Placing Their Order: Before the monitored transaction is confirmed, the front-running bot places its transaction with a higher gas fee to ensure it gets processed first.

Profit from Price Changes: Once the bot’s transaction is confirmed before the monitored transaction, it can profit from the price movement caused by the monitored transaction, buying low or selling high.

Ethical Concerns: Front running is considered unethical because it exploits the trustless nature of blockchain transactions for personal gain at the expense of others.

Front running can be mitigated by using techniques such as using decentralized exchanges (DEXs) that prevent front running, optimizing transaction timing, and using privacy-enhancing techniques.

How to Build a Front-Running Bot for the Crypto Exchange Market?

Building a front-running bot for the crypto exchange market involves a deep understanding of blockchain technology, trading strategies, and programming skills. Here’s a general outline of how you could approach building one:

⇏ Understand Blockchain Transactions:

Learn how transactions are broadcasted, confirmed, and included in blocks on the blockchain, and how transaction ordering affects trades.

⇏ Choose a Programming Language:

Select a programming language that is commonly used for building trading bots, such as Python or Node.js.

⇏ Select an Exchange:

Choose a cryptocurrency exchange that allows for high-frequency trading and provides API access for automated trading.

⇏ Develop the Bot Logic:

Monitor the mempool for pending transactions using the exchange’s API.

Identify profitable transactions based on predefined criteria (e.g., large buy or sell orders).

Place your transaction with a higher gas fee to front-run the identified transaction.

⇏ Implement Risk Management:

Set limits on the size of trades to manage risk.

Monitor the bot’s performance and adjust strategies as needed.

⇏ Test the Bot:

Use a test environment provided by the exchange to test your bot’s functionality and performance.

Ensure that your bot complies with the exchange’s API usage policies.

⇏ Deploy the Bot:

Once you’re confident in your bot’s performance, deploy it in the live trading environment.

Monitor its performance closely and make adjustments as needed.

⇏ Stay Informed:

Keep up with the latest developments in blockchain technology, trading strategies, and regulatory changes to adapt your bot accordingly.

It’s important to note that front running is generally frowned upon in the crypto community and can be against the terms of service of some exchanges. Always ensure that your trading activities comply with relevant laws and regulations.

Benefits of Front Running Bot

The benefits of a front-running bot are primarily financial, as it allows the bot operator to profit from price movements caused by other traders’ transactions. Here are some potential benefits:

⇔Profit Opportunities:

Front-running bots can capitalize on price movements that occur due to large transactions, allowing them to buy low and sell high or vice versa, resulting in potential profits.

⇔Priority Transaction Processing:

By using higher gas fees, front-running bots can ensure that their transactions are processed before others, giving them an advantage in executing trades.

⇔Market Insights:

Monitoring transactions in the mempool can provide insights into market sentiment and upcoming price movements, which can be valuable for making informed trading decisions.

⇔Automation:

Front-running bots can operate 24/7, automatically scanning for profitable trading opportunities and executing trades without the need for manual intervention.

⇔Risk Management:

Advanced front-running bots may include risk management features to limit exposure and protect against potential losses.

It’s important to note that while front-running bots can offer potential benefits, they are also controversial and can be seen as unethical or manipulative in the crypto community. Additionally, using front-running bots may violate the terms of service of some exchanges.

Future Trends and Developments in Front-Running Technology

Future trends in front-running technology are likely to be shaped by advances in blockchain technology and regulatory developments. As decentralized finance (DeFi) continues to evolve, developers may create more sophisticated front-running bots capable of exploiting new opportunities. Additionally, improvements in transaction speed and scalability could make front-running more challenging or create new forms of front-running strategies.

On the regulatory front, authorities are likely to pay closer attention to front-running activities and may introduce measures to prevent market manipulation. This could lead to the development of more transparent trading practices and technologies that mitigate the risk of front-running. Overall, the future of front-running technology is likely to be influenced by a combination of technological innovation and regulatory changes, which will require developers and traders to adapt and evolve their strategies accordingly.

Conclusion

In conclusion, front-running bot development is a complex and controversial topic that requires a deep understanding of both the technical aspects and ethical considerations involved. While these bots can provide a competitive edge in the cryptocurrency market, their use raises significant ethical concerns and may contribute to market manipulation. Developers and users alike must approach the development and deployment of front-running bots with caution and responsibility. By adhering to ethical standards and staying informed about regulatory developments, individuals can contribute to a more transparent and fair trading environment.

Additionally, continued research and dialogue within the cryptocurrency community are essential to further understanding the implications of front-running bots and to develop best practices for their development and use. Overall, while front-running bot development offers opportunities for innovation, it is imperative to balance these opportunities with ethical considerations and a commitment to maintaining the integrity of the cryptocurrency market.