How Chromatic is determined to reset the PerpDEX narrative

Hey folks, it’s clear that there’s a lot of hot narratives running, with tons of different alrdr0ps, upgrades, and new L2s that are seemingly being released every week. Solana’s narrative had parallelism, Ethereum’s new narrative is Eigenlayer re-staking, and the biggest we just overcame — Bitcoin’s ETF. Yet I believe that one of the biggest narratives that has yet to be untapped (or technically re-tapped) is the biggest narratives that got us through the last bear cycle — perpDEXes.

Today I’m going to be talking about one perpDEX in particular, Chromatic Protocol, which for reasons why I’ll breakdown in this article, I think have a real shot at revolutionizing the perpDEX model, and because as they’re still in testnet, I think their innovations might jumpstart the second chapter of a perpDEX narrative that I believe the crypto-space is due for.

But first, why perpDEXes?

If we look at GMX, the perpDEX that started it all, I started writing about them in mid-2022, where they went on to have a parabolic run in TVL, hitting ATH’s to nearly $1.2 billion in less than a year.

With all the hype surrounding $BTC’s inaugural entry into TradFi (and speculation of an impending $ETH spot ETF), it’s clear that many traders are once again flocking over to Crypto’s derivative platforms to try to capitalize on the massive shifts that it seems like every altcoin is making. Just in the past week alone, we’ve seen some pretty massive spikes in Derivatives TVL, far outpacing the percentage of gains that we’re making in the total crypto marketcap:

And in the past 24 hours alone, it’s easy to forget how lucrative perpDEXes can be. If we look at the platforms/chains that have generated the most revenue, GMX sits at number 9 with more than half a million dollars generated in fees alone per day:

GMX is by far the biggest, but big or small it seems like no matter what chain/L2 your on, it seems like all the perpDEXes are printing money — old and new:

OK, so what makes Chromatic so different?

Chromatic shares all the same basic fundamentals common with most perpDEXes including providing high leverage, TP/SL orders, and profit sharing. But Chromatic has really implemented some revolutionary features, all of which should attract more traders/liquidity suppliers while at the same time making itself more market efficient with its trades. These include…

Partitioned LPs with Dynamic Fees (Level v1 + Uniswap v3): Perhaps the biggest feature of Chromatic is that it allows liquidity suppliers to tailor the amount of risk vs. fee generation accrued from traders. If you’re familiar with Level Finance (one of the more popular perpDEXes on Binance), originally in their V1 they had 3 levels “tranches” separated by different factors, with the lowest level of risk/reward (Senior Tranche) to the highest level (Junior Tranche):

Chromatic has accelerated this strategy significantly by offering up to 72 different “bins” for different (or both) long and short positions:

As you can see on the left hand side in the graphic above, for the ETH/USD pools in particular, Chromatic has 3 overarching categories types — all of which are allocated differently for risk — Crescendo, Plateau, and Decrescendo — but with each category type you can specifically allocate Short/Long/Long&Short and select to provide liquidity in whichever one(s) you want — each bin paired with its own fee structure:

Similar to Uniswap V3’s concentrated liquidity model, Chromatic liquidity suppliers will be able to generate their own strategies for how to generate the most fees. Correlated with the level of risk, the lower risk bins will generally have lower fees and higher utilization, whereas the higher risk bins will generally have higher fees yet with lower utilization.

Predefined TP/SL’s set by smart contracts: One of the biggest problems with PerpDexes are capital inefficiencies, especially with liquidity providers. With potential infinite risk, if traders do exceptionally well they can either force a margin call or trigger a forced liquidation — two scenarios that can either really piss off the liquidity supplier or the trader.

All agreed upon beforehand through smart contracts, Chromatic has set predefined fees, take-profit, and stop-loss levels to ensure that there will be enough liquidity set aside for either outcome of the trade before the trade even happens.

As you can see in the graphic above, the trader can actually see in real-time how much liquidity each of the 72 bins contains, thus allowing them to tailor their trade to how they see fit before the trade is executed.

Other exciting features to note

Any trade can be settled by any ERC-20 token: Speaking of reducing capital efficiencies, Chromatic also has the potential to allow trades on their platform to be settled with any ERC-20 token, whether it be something like $UNI, $DOGE, $WBTC, etc.. This is a stark difference compared to most protocols that that only settle in $USDT or $USDC. (Currently, Chromatic only has $USDT available for settlement, but this could be changed later with a DAO vote.)

$CHRMA: Speaking of DAOs, the $CHRMA token is the proposed governance token that can help vote for not only different settlement tokens, but also can help adjust the protocol fee structure. $CHRMA has not been released yet, but for you alrdr0p hunters out there, there’s still a lot of time as their “Season1” is still ongoing until the end of Q1 2024.

How you earn $CHRMA: Did I mention that we’re super early and only in testnet? According to their docs, contributions to their testnet during this time will help earn you your share of 1~3% of the total supply of $CHRMA, in the form of vested $rCHRMA. Additionally you can help spread the word by completing different tasks on their Zealy Questboard which you then can transfer to credits via their testnet page:

Once Q1 is over, credits can be redeemed via “rCHRMA Random Boxes” which will award random amounts of #rCHRMA, with a higher probability of more $rCHRMA depending on how many “boosters” you accrue.

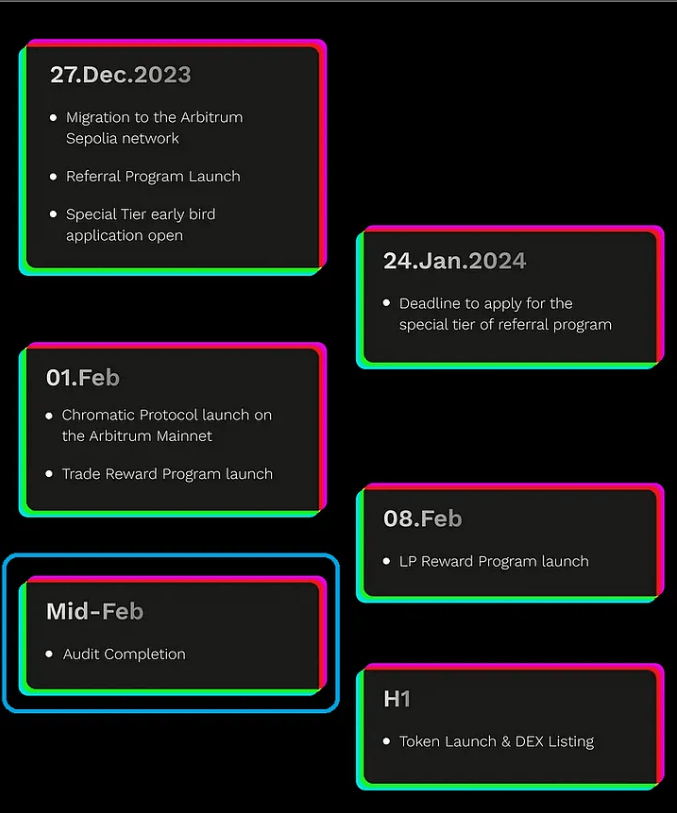

Audit: Q1 is an action packed quarter for the Chromatic team, for according to their roadmap, they should have their first major audit completed within a month:

As announced last December, the audit is slated to be completed by Halborn Security, and I suspect that we should be able to anticipate their token launch pretty soon after.

Participating in Testnet

As outlined by one of their mods, Damian in their discord server, the recommended actions you take on their testnet include:

✓ 1. Get some Arbitrum Sepholia testnet $ETH from the Sepholia Abitrum faucet if you didn’t have some already.

✓ 2. Use the Chromatic faucet to get some $cETH and $cBTC testnet tokens

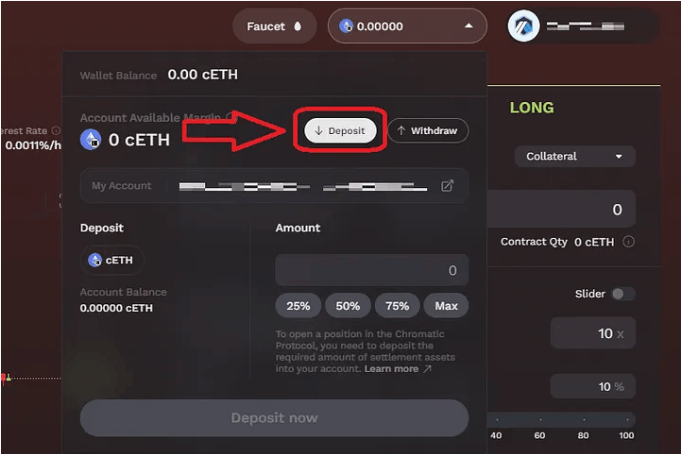

✓ 3 . Connect your wallet and create your testnet trading account an account, which allows you to to be able to place trades

✓ 4. Deposit/Withdrawing some amount of $cETH or $cBTC from your balance into your trading account.

✓ 5. Provide Liquidity — choose whichever strategy you’d like to try out as a liquidity provider

And that’s it! You should now be eligible to earn a share of some $CHRMA once the token launch happens later in Q1.