How I prepared for my CFA L1 exam

Introduction

What better use of time for my Easter Sunday, then to spend a few hours collecting my thoughts and writing about something close to me. The CFA (chartered financial analyst) exams. I really need to find better things to do in my spare time… But then again, I do enjoy rambling so here goes… Grab a coffee/tea and read on if you’re not repulsed yet.

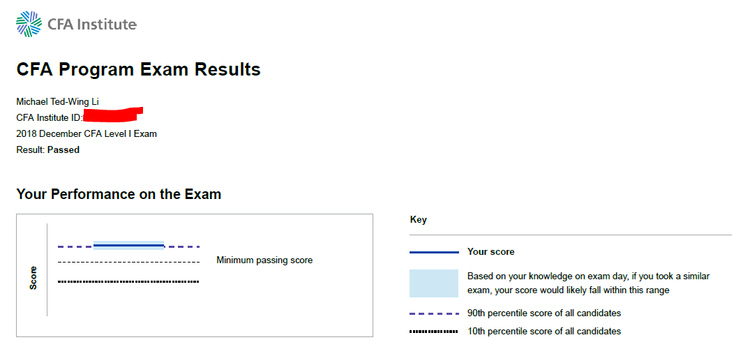

When I reflect on the last ~4 years now having finished all 3 levels of my CFA exams (on my first attempt thank goodness for each level), the journey was a long one… It felt like yesterday when I decided to sit those intimidating exams. When you zoom out, things really fall into perspective. It was back in July 2018 when I decided to prepare properly for the CFA L1 exam, and it was December 2018 when I got my result.

I’ve decided to write some comments with regard to how I prepared for my CFA L1 exam as I know people have asked for my advice before, and I feel documenting all this in an article could be a helpful exercise for myself to reflect on. Apologies if this doesn’t read like a proper essay, I merely just wrote in dot-points, and expanded with sub dot-points where I felt it necessary.

But first, what makes the CFA exams difficult?

- It just requires a lot of time, especially when factoring in full-time work like me. According to CFA Institute, it takes a typical candidate an average of:

- 4+ years to complete the CFA program

- 300+ hours of studying per Level

- 6 months of preparation for each exam (i.e. ~12 hours study per week assuming 300 hours)

- Whilst none of the content is too deep in nature, the breadth of the CFA content is incredibly wide.

- I often describe the CFA L1 exam as a blend of all the introductory courses in my UNSW commerce degree. Like merging a bit of statistics, economics, accounting, finance, management, all into 1 exam. I find that unique because in university, I saw all of these subjects being tested as "separate", and never SAW the relationships between all the subjects and never appreciate how they all INTERLINKED together when we think about BUSINESS. The below gives a rough idea of the different topics assessed in the L1 exam.

- Study is very self-directed (i.e. it can get very lonely).

- So nobody watches or breathes down your neck except yourself. Whilst that might sound enticing, for a lot of people (and especially myself at the beginning), there is some merit to having institutions (like universities) since there is order and structure with tutorials, lectures and classmates. You don’t really get that in the CFA program.

- Even though I am mostly a lone wolf when it comes to studying, even I had to admit it was quite lonely at times to give up weekends to study when friends/family could go out. It sucks, but it helps knowing many other charterholders have come before, and hopefully this is some comfort to my readers who are undertaking their CFA exams.

- Most people will NOT understand why you are tormenting yourself through the CFA program (unless they've done it before). I also just took leave just to study more for the exam... If that isn’t torture, I don’t know what to say. That said, I’m sure there are other professional exams that my medical/legal/actuarial/etc friends will flag to me as being just as tough. I am not trying to say one is harder or easier than the other (as I think that’s all relative to the individual) of course.

Mindset is the first thing you need to get right

- Your WHY is very important.

- What was my reason for going down this road? Most people I know do these exams usually to transfer into my industry. But I suppose, my motive was a lot purer. I was already in the industry, but I still decided to do it. My mentor told me every member in his investment team at Australian Eagle Investment Management was a CFA charterholder. I had stewed for ~6 months over whether to do the L1 exam or not actually. It was actually through talking to a lot of different people older than me who had sat the CFA exams, did I then decide it was relevant for me, particularly for my job in funds management. The point is, you need a very STRONG WHY. Ultimately, I think my mentor (Albert Hung) told me to do it to teach me a lesson of self-discipline when I look back in hindsight at the 900-1000 hours I probably spent on this program.

- It goes without saying, I do not think you should attempt the CFA exams unless you are serious about finishing all 3 levels at the beginning. It’s an all or nothing endeavour from my perspective. There is no point in doing just L1 exam and quitting unless of course, you were originally serious and perhaps life circumstances changed or motivations seriously changed.

- Be upfront to friends and family about social expectations... Saying it earlier that you can’t do specific days because of study is always better earlier rather than later. This is expectations management.

Having good time management and being disciplined with it goes a LONG way to staying sane

- Putting in the hours is necessary.

- I think with university exams, a lot of us (myself included) have a tendency to cram. Whilst you could probably do that and get away with it in CFA L1 exam because it is all multiple choice anyway, and the questions are not as in depth/nor written like the CFA L3 exam, I do not advise this. This goes back to my “mindset” point I made earlier. What is the point of cramming all the content if you’re not going to learn it properly?

- Have 1 day/week where you are NOT studying - but to relax…

- For me that was a Friday night. In my 6 months of studying for the CFA L1 exam, I never did any study on that one period. Being intentional with rest goes a long way in keeping you sane. I used that as the time for meeting friends, and venting to whoever was unlucky enough to be around me at the time. It helps.

- Need to do study sessions in "chunks". Yes it’s good!

- Some friends I know swear by the pomodoro technique of studying 45 mins, then taking a break for 15 mins (or whatever time periods). I don’t think we need to be too legalistic here. For me, sometimes I did 1 hour, other times I could sit through for 2 hours. I believe you should take a break whenever you feel like you’re not concentrating and your mind is starting to wander (i.e. you don’t have to power on until 45 mins because of pomodoro, if you know after 30 mins of study you need a stretch). I guess what I’m stressing to my readers is you NEED to find a system, and to STICK with it.

Material and structure with Mark Meldrum is the BEST (my obligatory 2c on the best test prep provider)

- I swear by Mark Meldrum - he is affordable (best ~AU$1.2k I ever spent for “one free to completion”), and Mark delivers overwhelming value

- If there was 1 person I have to thank for steering me down the right path from day 1, it was Tian (and I have to give him a shout out). He was actually my first finance tutor at UNSW, back in my FINS1613 course. He was probably the most relational tutor I had back in my first semester of university ever. In the first semester of university, I think a lot of us struggle and have to quickly adjust to the demands of university, which is very different to high school. It was a shock for me. Tian definitely left an impression on me, especially with how I later conducted my PASS classes for teaching accounting to first year UNSW students. But he was also very helpful beyond the classroom walls.

- Do follow Mark Meldrum's recommend order of readings... Don't just read it chronologically (I know lots of people who just do ethics first since it’s the first topic and frankly I think that's just a waste of time)…

- Instead, go to his YouTube channel and find his latest video on the order in which you should study. Here is an example video he did a while back. But he does it everytime there is a CFA syllabus change.

- From my memory, the order of topics I studied through for my L1 exam (which I don’t think would change much even after 4 yrs later) was: Quant > Financial Reporting & Analysis > Fixed Income > Derivatives/Alternative Investments > Economics > Equity > Portfolio Management > Corporate Finance > Ethics.

- I think Quant is ALWAYS first, and Ethics is ALWAYS last. Between that, you should do the topics that take the most time and are most difficult relatively. To be clear, I am not saying ethics isn’t important. It IS important given it’s weighting. But I think for 99% of people studying, it’s not intuitive, it’s tricky, some examples can be weird, and so long as you can put it in short term memory before the exam, I think is sufficient. That’s why I left it to the end…

- Watch the lecture videos from Mark Meldrum, then watch the end of chapter questions videos from Mark Meldrum, then watch the review videos from Mark Meldrum (I did it all on ~1.5x speed)

- I actually only paid for Mark Meldrum for my CFA L2/L3 exams, and I personally just relied on his free YouTube videos for the CFA L1 exam that were updated to 2017 at the time. I found them sufficient back when I sat for my exam in 2018. Whilst I think ~75% of the content of the videos would still be relevant, I would advise anybody considering a prep provider, to just pay from L1 onwards to ensure you are getting ALL the videos for the latest syllabus. This is not an exam you want to risk given your outcome is contingent on 1 exam.

- Another benefit with watching the videos, was as such, I basically never had to read any of the CFA L1 readings in their textbooks...

- It also meant I avoided very quickly, wasting time making notes and highlighting (which is very "passive learning"). You WANT to be actively learning, by doing questions, rather than highlighting, retyping stuff, etc.

- Seen Youtubers talk about very complicated spreadsheets to track your progress, etc - I think mine is VERY SIMPLE…

- I’m not trying to have a go at those people, as I think everybody has their own way of studying. But I often get overwhelmed very quickly, and I prefer simplicity where at all possible so long as it gets the job done.

- Here is my template, which I recommend you to make a copy of for yourself to edit and adjust. Below is a snapshot of what the planner looks like. It’s very simple. I had ALL readings documented in the spreadsheet, and I went in order from MM reading video > MM end of chapter question video > MM review video before signing off and then jumping to the next reading. I follow the above topic chronology that I mentioned earlier, but with the readings in each topic I would just go chronologically and slowly work my way through ALL the MM videos. That is a good 4-5 month job.

- Reddit's CFA group is a great place to ask general Qs and not feel alone as you will meet other test takers struggling through the content just like you - this is a GOOD resource as long as you don't get distracted by it.

Mock exams in simulated exam settings are a MUST do

- I would start preparing like 4 weeks before the test, aka 1 month before the exam.

- I personally took one week off to do the CFA mock exams provided by the institute.

- I don’t believe you need to go to any shady websites/dark web to find and download all CFA exams. I think the ones provides by the institute are sufficient. In my calendar, you can see I had to physically ease myself in.

- For Mock Exam A, I did AM and PM on separate days (i.e. 3 hour blocks). Whereas with Mock Exam B/C, I did the 6 hour block in one day to get the “simulation”.

- Back when I was doing HSC and university exams, I think the longest exams I had were always only 3 hours. Back when I was doing the “paper exams” (wow I sound like a dinosaur saying this) for L1/L2 exams, the exam was 6 hours. It was a mental marathon. I remember being caught off guard the first time I tried sitting a “simulated” exam setting with 6 hours. It’s really hard to maintain 100% focus and energy level when you’re 5 hours into an exam especially if you haven’t “trained” yourself that way regularly.

- The simulation is IMPORTANT.

- I think also taking 1 week off (if possible) gave me a lot of headspace. As you can probably see in my calendar, I was still working at my fund manager 4 days/wk, and just had my last university exam like ~2.5 weeks earlier before my CFA L1 exam on 01/12/2018.

- With 2022 onwards, I would also recommend people to do Mark Meldrum’s mock exams that he provides, because the CFA exam is now on PC. The problem with the institute, is that at least in my time, their mock exams are still PDFs that you have to print out physically. But you NEED to get used to writing working out on pen and paper, but then clicking your multiple choice answers on a PC. This is the value that Mark Meldrum’s mock exams can provide since they’re done online via PC.

Final week before the exam… Revising but also resting is KEY

- On 28/11/2018, I spent the day reviewing all the “end of chapter” questions which I found difficult personally - for me that was mostly fixed income and economics. I also spent that day going over my answers to the 3 CFA mock exams I attempted and reminding myself the Qs I got wrong - and ensuring I did not make the same mistake again.

- On 29/11/2018, I spent the day redoing all the “end of chapter” questions in ethics, and rewatching the review videos by Mark Meldrum on topics I found difficult or that I felt I was starting to “forget”.

- On 30/11/2018 (aka the last day), I spent the day memorising ALL the formulae, ideally you'd have a formula sheet you can revise.

- I would ABSOLUTELY recommend watching this Mark meldrum video on final tips for the CFA L1 exam here.

- Mark Meldrum usually has one for each level (and if you paid, then there you go a lot of time has been saved), and note this can definitely save you for a few easy marks in L1 (if you can simply recall a formula).

- Write down the formulae sheet several times. Almost reminds me of Bart Simpson writing chunks of text on the blackboard at the beginning of every episode.

- But after that, I do recall the last night before my exam, trying to calm my nerves. By that point, if you’ve been following a solid system for several months, you should not worry anymore about the exam tomorrow. I probably spent too much time at night looking at the CFA reddit forum to gauge what sentiment was like. I genuinely think doing light and easy activities at night is best, whether that’s dishwashing, watching a TV show, etc. Note that I said light, so for me I didn’t do anything too heavy like watching a 3 hr movie or blasting EDM in my earphones for hours on end.

- I do also recall getting to bed by 11pm. I was aiming for ~7 hours of sleep even though it took a while for me to actually get to sleep. I think that’s ok. You’re most likely going to be nervous the night before your exam. Try to get some sleep…

Exam day (aka Judgment day) and some housekeeping tips

- Wake up early. For me that was like 7am. I would recommend eating some light food (aka for me that was mum’s cooked buns). I recommend getting to the exam centre by the earliest time that they tell you to. If they say 8am the exam doors open, then you should aim to get there by 8am. You DO NOT want traffic to be the reason you miss your exam. That is actually not a valid excuse for the CFAI. Neither is being sick actually (they do NOT do make up tests)…

- Listen to the exam proctors - they are gods for that 1 day (be on their good side and just follow their orders, you don’t want to stress about anymore than the exam in front of you).

- Pace yourself and do not spend any longer than you need to on an exam Q. For what it’s worth, I always chose B if I had absolutely no idea…

Conclusion

And that my friends, ends all the stuff I want to ramble about with regard to the CFA L1 exam. There’s a lot in there that I could unpack in more detail, but by then this is basically turning into an essay and I don’t think that’s my goal here. I’ve tried to highlight my thought process when approaching the CFA L1 exam back in 2018. It is by no means, the silver bullet to ensuring you pass your CFA exam. There are a multitude of reasons why even if you follow my steps, you may not pass. But that said, I do believe I can say from experience, having completed all my CFA exams now and having worked in the industry, that there are things I’ve observed in hindsight that I certainly think were crucial to my clean run in the CFA exams and it goes BEYOND just being smart (of which I remind people I really think I’m quite average…).

I think loving the subject matter (mostly), applying it in the industry regularly, being very disciplined with time management, having Mark Meldrum as my test prep provider, Albert Hung (my mentor) pushing me, and family/friends/church brothers and sisters all looking out for me, collectively helped to skew the probability in my favour.

Good luck to all those studying for their CFA L1 exams. I can certainly empathise. Feel free to message me if any follow-up Qs.

Thanks and happy reading,

Michael

Original source (from author's website): https://michaelli.io/blog/how-i-prepared-for-my-cfa-l1-exam