Bitcoin ETF Hangover!? Saddling Token Investors with Uncertainty

In the aftermath of the recent Bitcoin ETF approvals, investors are grappling with a new reality - the hangover of uncertainty

As the dust settles on the regulatory landscape, token investors are facing a host of challenges that threaten to muddle the waters of their investment prospects.

In this article that I made, we delve into the factors that are saddling token investors with uncertainty and what they mean for the future of the cryptocurrency market.

Regulatory Hurdles

The Securities and Exchange Commission's (SEC) recent approval of Bitcoin ETFs has raised concerns about the regulatory framework governing the cryptocurrency market. With the SEC still grappling with the nuances of cryptocurrency regulation, investors are left questioning the long-term viability of their investments. The lack of a clear regulatory path forward has created uncertainty, which can have a profound impact on the market's overall stability.

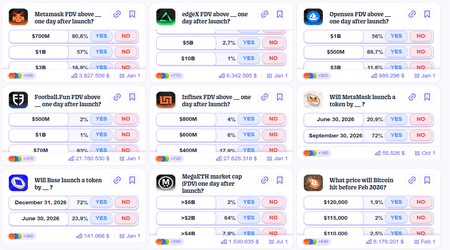

Market Volatility

The rollercoaster ride of Bitcoin's price has become a common occurrence, with investors speculating about the cryptocurrency's future. The recent price drop has amplified concerns about market volatility, leading some to question the robustness of token investments. As the market continues to fluctuate, investors must navigate these treacherous waters with caution, as sudden price swings can have a devastating impact on their portfolios.

Counterparty Risk

The regulatory environment for Bitcoin ETFs is still evolving, and investors need to be aware of any changes that may affect their investment. As the market continues to grow and mature, regulatory bodies may introduce new requirements or restrictions that can impact the performance of your investment.

Investor Confusion

The complex nature of Bitcoin ETFs has generated confusion among investors, making it challenging for them to navigate the landscape. The lack of transparency in some ETF structures has contributed to this confusion, as investors struggle to comprehend the underlying investment strategies.

In such a scenario, it becomes imperative for ETF providers to demonstrate clarity and transparency in their investment processes to alleviate investor concerns.

The hangover of uncertainty surrounding Bitcoin ETFs has left token investors contending with a complex web of factors that could have a profound impact on their investment prospects.

As the regulatory landscape continues to evolve and market volatility persists, investors must navigate these challenges with caution.

However, by staying informed and adaptable, investors can position themselves to capitalize on the opportunities that the cryptocurrency market presents, despite the uncertainty that plagues it.

References:

Bitcoin’s ETF hangover saddles the token with its worst streak in a month. (2024, January 15). Retrieved January 15, 2024, from https://finance.yahoo.com/news/bitcoin-etf-hangover-saddles-token-011815986.html

elegant_solution. (n.d.). Retrieved January 13, 2024, from https://www.freepik.com/author/user28432665

redgreystock. (n.d.). Retrieved January 15, 2024, from https://www.freepik.com/author/redgreystock

Freepik - Goodstudiominsk. (n.d.). Retrieved January 5, 2024, from https://www.freepik.com/author/goodstudiominsk

My links