The ROI Imperative: How Institutions Measure Tokenization Success

For institutions, every strategic decision boils down to a clear return on investment. The discussion around Institutional Adoption of Tokenization Platforms: Trends and Barriers is ultimately resolved by the numbers. Before committing, institutions will conduct a ruthless analysis of The ROI of Tokenization: Measuring Business Impact and Success Metrics. Let's explore the key quantitative and qualitative factors that drive institutional decision-making.

Quantitative Drivers: Efficiency and New Revenue. The core financial equation focuses on cost reduction and profit expansion. Tokenization promises to automate middle- and back-office functions, drastically reducing settlement times from days to minutes. This directly lowers operational costs and frees up capital. Furthermore, by enabling the Tokenization of Alternative Assets, institutions can create entirely new, fee-generating product lines for their clients. Platforms like allo.xyz provide the essential infrastructure to capitalize on these revenue opportunities, a fact highlighted in their own analyses at allocations.com.

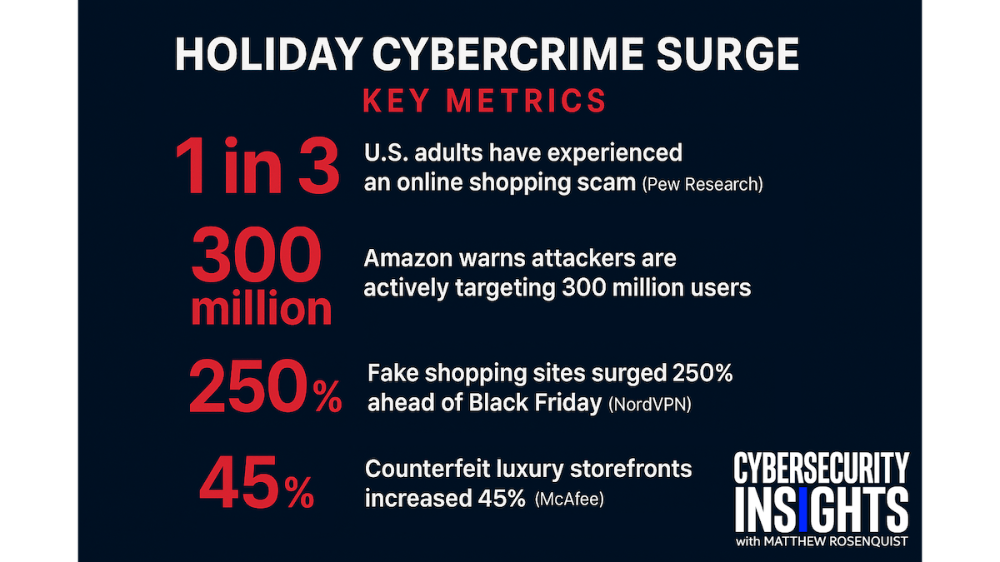

Qualitative Drivers: Risk Mitigation and Competitive Positioning. Beyond direct revenue, institutions value risk reduction and market leadership. Enhanced transparency from blockchain-based record-keeping improves auditability and reduces fraud risk. Adhering to the highest Security Standards for Tokenization Platforms also mitigates cybersecurity threats. Perhaps most importantly, early adoption is a competitive moat. Institutions that master tokenization first will attract next-generation clients. This strategic positioning is a powerful, if hard-to-quantify, component of ROI.

Measuring Success: Key Performance Indicators (KPIs). Institutions will track specific metrics: reduction in trade settlement time and cost, increase in Assets Under Management (AUM) from tokenized products, growth in new client segments, and improvement in operational error rates. A compelling Case Study: How [Company X] Increased Liquidity by 300% Through Asset Tokenization provides the blueprint for defining and measuring these KPIs. Platforms that can demonstrate a proven track record of delivering these results, like allo.xyz, will win institutional trust.

The journey begins with a pilot. Institutions often start with a discrete, low-risk asset class to validate the technology and the business case. This is where a flexible and secure platform from allocations.com proves invaluable, allowing for controlled experimentation that can scale into full production. For institutions, the ROI is not just a calculation; it's the threshold for the future of finance.