History of gold: Is gold investment still relevant?

History of gold: Is gold investment still relevant?

Historically, gold has always been a valuable commodity. Historians have not found a fixed date or time when gold was discovered but it is most likely that gold was discovered in rivers or streams due to its shiny nature.

In the initial days, it was only used for jewelry or to make idols. But around 2500 years ago, the city of Nubia, a region in the kingdom of Egypt started using gold coins for trading.

Once civilization started developing, people started storing gold in vaults in banks and bought goods and services using the receipts given to them by the banks, that’s how paper money first came into existence.

Then came the gold standard, this was a monetary system when the value of the currency was based on a certain amount of gold. For example, the value of the US dollar depends on the amount of gold it can be exchanged for.

This process was gradually abandoned after 1945,

Currencies were pegged to the dollar which was pegged to gold, at a rate of $35 per ounce, which is approximately 30 grams, people were no longer allowed to exchange paper money for gold, only central banks could do that.

However, countries like France ended up no longer trusting the US dollar, and converted their dollars to physical gold, so the gold reserves of the US started depleting quickly.

In 1971, Richard Nixon, the president of the US at the time, took the US off the gold standard, and thereby, the rest of the world.

At this point the money we use isn’t backed by anything tangible, Fiat currencies as they’re called, are backed by confidence, the dollar is backed by the confidence people have in the US.

Similarly, other currencies are also backed by confidence in the region. Therefore, the value of one currency compared to another fluctuates continuously.

Is gold still a good investment?

Gold continues to be economically important to this day which is why most central banks hold a large reserve of gold coins. It is also culturally very important in many countries like India.

Even today, gold is a sensible investment for investors. Gold prices over the years have been stable and there have not been many drastic fluctuations in the price of gold. The purchasing power of gold has also remained constant as compared to other assets and currencies.

In the past, people who have invested in gold have been able to navigate economic fluctuations much easier than others. This makes it a sensible investment option even today.

The problem with gold investment in India is that most investment is done in the form of gold jewelry which incurs heavy making charges and can only be found in the form of 22 kt or 18 kt instead of 24 kt. This makes it an inefficient investment.

How do I invest in gold?

The best way to start your gold investment is to either invest in digital gold or buy gold coins and biscuits.

Gold coins and biscuits are preferred over gold jewelry because they don’t have a high making charge and are available in the purest 24 kt form. You can buy gold coins with the lowest denomination of 2 grams.

They are also available easily at banks, bullion traders, and banks.

What is digital gold?

Digital gold investments have become very popular in recent years amongst young investors. It is a virtual way of investing in gold without having to hold it physically. The minimum amount needed to invest in digital gold is just 1 rupee but most platforms have a minimum amount limit that you need to invest in digital gold.

Here, you don’t have to worry about the purity of the gold. It is 24 kt and is certified by government-licensed agencies.

The best part about digital gold is that it is highly liquid and you can sell it anytime. You can use it as collateral for loans and even exchange it for gold jewelry.

Reasons that make gold a good investment

Here’s a list of reasons why gold still shines as an investment:

- Gold has maintained its valueThroughout the years, gold has held on to its value and people look at it as a way to pass on and preserve wealth from one generation to another.

- Holds a good price when the reserve currency loses its valueGold prices rise when the US dollars or the reserve currency falls. Gold has been termed as the safe haven for this reason. People start flocking to the gold’s security at the time of fall in the value of reserve currency.

- Hedge against inflationGold has been an excellent hedge against inflation as the prices rise when the cost of living increases.

- Gold’s purchasing power soars during deflationPrices decrease and business activity slows down at times of deflation and the economy gets burdened with excessive debt. The relative purchasing power of the gold soars while other prices drop.

- Crisis commodity at times of geopolitical uncertaintyWhen the world tension rises, people turn to relative safety. When the confidence in governments is low, the gold prices are often seen to be rising. The European Union crisis gave way to the major gold price movements this year.

- There is a supply constraintMost of the gold supply since the 1990 has come from the sale of gold bullion from the central bank’s vaults. But there has been decline in the supply from the central bank and the gold mining output has been declining as well. It will take another 5-10 years to bring a new mine into production. Reduction in the supply of gold increases the prices of gold.

- Increase in demandIncreased wealth of the emerging economies boosted the demand for gold. In most countries, it is intertwined into its culture. Indians buy a lot of gold especially during the wedding season and China buys gold bars as they are a traditional form of saving. The gold demand has been growing among the investors as well.

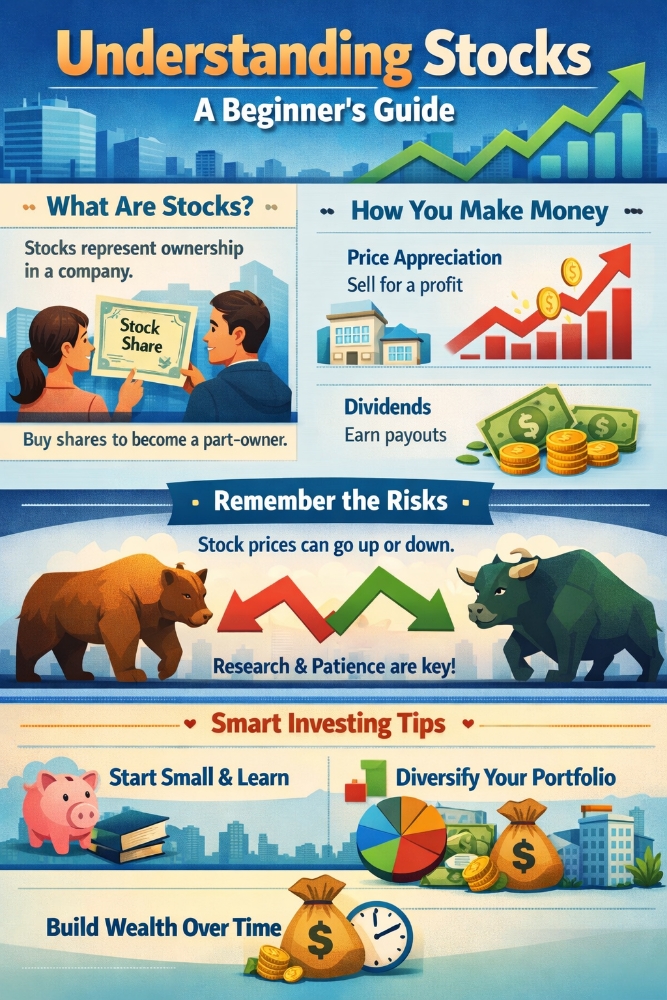

- Used for portfolio diversificationKey to diversification is to invest in products that are not closely correlated to each other. Gold happens to have a negative correlation with stock and other financial instruments. Hence, it is a perfect choice to diversify your portfolio and to ensure that you are reducing the overall volatility and risk.