Comprehensive Guide to DeFi Farming for Beginners: Earn Passive Income in the World of Decentralized

Introduction

In recent years, the world of finance has witnessed a revolutionary transformation with the advent of decentralized finance (DeFi). DeFi has opened up new avenues for individuals to participate in the global financial system, without the need for intermediaries such as banks. One of the most exciting opportunities that DeFi offers is the ability to earn passive income through a process called DeFi farming. In this comprehensive guide, we will delve into the world of DeFi farming, exploring what it is, how it works, and how beginners can get started on their journey to earning passive income.

What is DeFi Farming?

DeFi farming, also known as yield farming, is the practice of leveraging various decentralized finance protocols to earn passive income by providing liquidity to these platforms. Liquidity providers (LPs) lock up their cryptocurrency assets in smart contracts and receive rewards in the form of additional tokens or fees generated by the platform. This process allows individuals to earn a return on their digital assets without actively trading or investing in traditional financial markets.

DeFi farming has gained significant popularity due to its potential for high yields and the ability to participate in the growth of decentralized finance. By contributing their assets to liquidity pools, individuals play a crucial role in facilitating the smooth functioning of decentralized exchanges and other DeFi applications.

How Does DeFi Farming Work?

DeFi farming works by utilizing automated market makers (AMMs) and liquidity pools. AMMs are smart contracts that facilitate the exchange of tokens based on predefined algorithms, eliminating the need for order books and centralized exchanges. Liquidity pools, on the other hand, are pools of funds provided by LPs that enable the smooth functioning of AMMs.

When LPs contribute their assets to a liquidity pool, they receive liquidity provider tokens (LP tokens) in return. These LP tokens represent their share of the pool and can be used to redeem their portion of the pool's assets at any time. In addition to LP tokens, LPs also receive rewards in the form of additional tokens generated by the platform. These rewards are distributed proportionally to LPs based on their share of the liquidity pool.

The rewards earned through DeFi farming can vary depending on various factors, such as the platform's reward distribution mechanism, the demand for liquidity on the platform, and the overall market conditions. Some platforms may offer fixed rewards, while others may have variable rewards based on factors such as trading volume or platform fees.

Getting Started with DeFi Farming

Now that we have a basic understanding of what DeFi farming is and how it works, let's explore the steps involved in getting started with DeFi farming.

Step 1: Choose a DeFi Platform

The first step in getting started with DeFi farming is to choose a suitable DeFi platform. There are numerous platforms available in the market, each offering different features and rewards. It is essential to conduct thorough research and consider factors such as platform security, reputation, and the potential for high yields.

When choosing a DeFi platform, it is crucial to consider the following factors:

- Security: Ensure that the platform has robust security measures in place to protect your funds. Look for platforms that have undergone security audits and have a strong track record of safeguarding user assets.

- Reputation: Research the platform's reputation within the DeFi community. Look for platforms that have a positive reputation and are trusted by other users.

- User Interface: Consider the user interface of the platform. A user-friendly interface can make it easier for beginners to navigate and understand the platform's features.

- Available Rewards: Evaluate the rewards offered by the platform. Look for platforms that offer competitive rewards and have a transparent reward distribution mechanism.

- Platform Track Record: Consider the platform's track record and how long it has been operating. Platforms with a longer track record may be more reliable and stable.

Step 2: Set Up a Wallet

Once you have chosen a DeFi platform, the next step is to set up a cryptocurrency wallet. A wallet is a digital tool that allows you to store, send, and receive cryptocurrencies securely. There are various types of wallets available, including hardware wallets, software wallets, and web-based wallets. It is crucial to choose a wallet that supports the cryptocurrencies you plan to use for DeFi farming.

When selecting a wallet, consider the following factors:

- Security: Look for wallets that have strong security features, such as two-factor authentication and encryption. Ensure that the wallet has a good reputation for security.

- Supported Cryptocurrencies: Check if the wallet supports the cryptocurrencies you plan to use for DeFi farming. Different wallets support different cryptocurrencies, so it is essential to choose one that is compatible with your chosen assets.

- User Experience: Consider the user experience of the wallet. Look for wallets that havea user-friendly interface and intuitive navigation.

Recommended DeFI wallets:

Step 3: Deposit Funds into the Liquidity Pool

Once you have set up your wallet, the next step is to deposit your funds into the liquidity pool of your chosen DeFi platform. This process involves providing liquidity by contributing an equal value of two different tokens to the pool. For example, if you choose to provide liquidity for a trading pair of Ethereum (ETH) and DAI, you would need to deposit an equal value of both ETH and DAI into the pool.

When depositing funds into the liquidity pool, it is important to consider the following:

- Token Selection: Choose the tokens you want to provide liquidity for based on their potential for high yields and demand on the platform. Conduct thorough research and consider factors such as token liquidity, market trends, and platform rewards.

- Token Pairing: Select the trading pair you want to provide liquidity for. Different platforms support different trading pairs, so it is essential to choose one that aligns with your investment goals.

- Impermanent Loss: Be aware of the concept of impermanent loss, which refers to the potential loss of value when providing liquidity to a volatile trading pair. Impermanent loss occurs when the value of one token in the pair fluctuates significantly compared to the other token.

Safely Buy Crypto From:

Step 4: Monitor and Manage Your Investment

Once you have deposited your funds into the liquidity pool, it is important to monitor and manage your investment regularly. DeFi farming involves risks, and market conditions can change rapidly. It is crucial to stay informed about the performance of your investment and make necessary adjustments when needed.

Some tips for monitoring and managing your investment include:

- Track Rewards: Keep track of the rewards you are earning from the liquidity pool. Monitor the value of the additional tokens you receive and consider the potential for selling or reinvesting them.

- Stay Informed: Stay updated with the latest news and developments in the DeFi space. Follow reputable sources and join communities to stay informed about market trends, platform updates, and potential risks.

- Diversify: Consider diversifying your investments across different platforms and trading pairs. Diversification can help mitigate risks and maximize potential returns.

- Risk Management: Set clear risk management strategies and consider factors such as stop-loss orders and exit plans. Be prepared to exit your investment if market conditions become unfavorable.

Frequently Asked Questions (FAQ)

- What is the potential return on investment (ROI) for DeFi farming?

- The potential ROI for DeFi farming can vary significantly depending on various factors, such as platform rewards, market conditions, and the amount of liquidity provided. Some individuals have reported earning high double-digit or even triple-digit annual percentage yields (APY) through successful DeFi farming strategies. However, it is important to note that high yields come with higher risks, and it is crucial to conduct thorough research and understand the risks involved before investing.

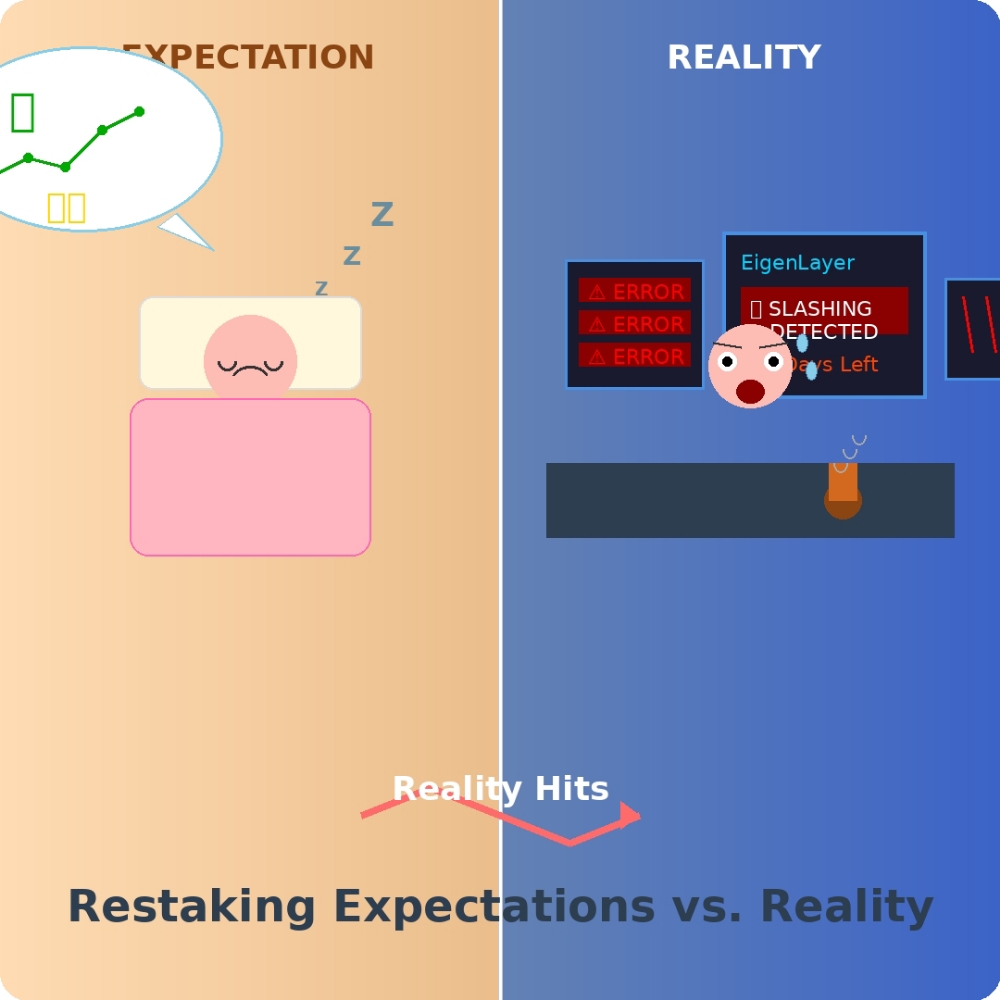

- Are there any risks involved in DeFi farming?

- Yes, DeFi farming involves risks, and it is important to be aware of them before getting started. Some of the risks associated with DeFi farming include impermanent loss, smart contract vulnerabilities, platform hacks, and market volatility. It is crucial to conduct thorough research, diversify investments, and only invest what you can afford to lose.

- How can I mitigate the risks involved in DeFi farming?

- To mitigate the risks involved in DeFi farming, it is important to follow best practices and implement risk management strategies. Some tips for risk mitigation include diversifying investments, conducting thorough research, staying informed about market trends, setting clear risk management strategies, and only investing what you can afford to lose.

- Can I withdraw my funds from the liquidity pool at any time?

- In most cases, you can withdraw your funds from the liquidity pool at any time. However, it is important to consider any lock-up periods or withdrawal fees imposed by the platform. Some platforms may have specific requirements or timeframes for withdrawing funds, so it is crucial to read and understand the platform's terms and conditions before investing.

- Is DeFi farming suitable for beginners?

- While DeFi farming can be a lucrative opportunity for earning passive income, it is important to note that it involves risks and requires a certain level of knowledge and understanding of the DeFi ecosystem. Beginners should take the time to educate themselves about DeFi farming, conduct thorough research, and start with small investments to gain experience and confidence.

Conclusion

DeFi farming offers an exciting opportunity for individuals to earn passive income in the world of decentralized finance. By leveraging various DeFi platforms and providing liquidity to liquidity pools, individuals can earn rewards in the form of additional tokens or fees generated by the platform. However, it is important to approach DeFi farming with caution, conduct thorough research, and understand the risks involved. With proper knowledge, risk management strategies, and a disciplined approach, beginners can embark on their journey to earning passive income through DeFi farming.

Visit my website for lots of make money online and AI content: moggziemarketing.com

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)