The Art of Investing: Cultivating Patience, Knowledge, and Long-Term Growth.

The Art of Investing: Cultivating Patience, Knowledge, and Long-Term Growth.

Investing is often portrayed as a fast-paced game for high rollers, a realm of booming stocks and whispered tips. In reality, successful investing is more akin to cultivating a garden – it requires patience, knowledge, and a focus on long-term growth. By guiding you through the essential principles that will set you on the path to financial well-being we will look at the Art of Investing.The Aspen Institute discussed The Art of Investing : https://www.youtube.com/watch?v=ew7MQedtgeI

The Art of Investing by Francois Rochon :

https://www.youtube.com/watch?v=PQM16rNJmAA

Understanding Your Investment Goals

The first step in your investment journey is to identify your goals. Are you saving for a child's education ten years down the line? Do you dream of retiring comfortably in twenty years? Perhaps you're looking to build a nest egg for unexpected expenses. Knowing your goals will determine your investment horizon (the timeframe for which your money will be invested) and risk tolerance (how much market volatility you can stomach). Short-term goals might be better suited for safer options like savings accounts or certificates of deposit (CDs), while long-term goals can benefit from the potential for higher growth in stocks and mutual funds.

Building a Strong Foundation: Asset Allocation and Diversification

Once you understand your goals, it's time to construct the foundation of your investment portfolio. Asset allocation involves dividing your investments among different asset classes, such as stocks, bonds, and cash equivalents. This helps spread risk – if one asset class performs poorly, the others can help balance it out. A common approach is to allocate more towards stocks when you're young and have a longer investment horizon, gradually increasing your allocation to bonds as you near retirement to prioritize income and capital preservation.

Diversification is the cornerstone of asset allocation. Don't put all your eggs in one basket! Invest in a variety of companies across different sectors and industries. This mitigates the risk of a single company's downfall significantly impacting your portfolio. You can achieve diversification through mutual funds and exchange-traded funds (ETFs) which hold a basket of underlying securities.

Understanding the Investment Landscape.

The world of investing offers a vast array of options, from individual stocks and bonds to complex derivatives and alternative investments. As a beginner, it's wise to focus on building a solid understanding of the core asset classes:

- Stocks: Represent ownership in a company. When a company performs well, its stock price typically rises, offering potential for capital appreciation. However, stocks can also be volatile, meaning their price can fluctuate significantly.

- Bonds: Essentially IOUs issued by governments or corporations. Investors loan money to the issuer in exchange for a fixed interest rate over a set period. Bonds are generally considered safer than stocks but offer lower potential returns.You can learn more about Bonds on Investopedia.

- Mutual Funds: Professionally managed pools of money that invest in a variety of assets. They offer diversification and convenience, but come with fees. Index funds are a type of mutual fund that passively track a market index, offering a low-cost way to gain exposure to a broad market segment.

- ETFs: Similar to mutual funds, ETFs are baskets of securities that trade on an exchange like stocks. They offer lower fees than actively managed mutual funds and greater transparency into their holdings.

Essential Investment Strategies

Now that you have the foundational knowledge, let's explore some key strategies employed by successful investors:

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money into a particular investment at regular intervals, regardless of the current price. DCA helps average out the cost per share over time, mitigating the risk of buying high.

- Compound Interest: Often referred to as the "eighth wonder of the world" by Albert Einstein, compound interest is the interest earned on both the initial principal amount and the accumulated interest from previous periods. Starting to invest early allows you to harness the power of compounding over a longer timeframe.

Taming the Emotional Rollercoaster

Investing can be an emotional rollercoaster. The urge to chase hot stocks or panic-sell during market downturns is strong. Discipline is paramount. Remember your investment goals and stick to your long-term plan. Avoid making impulsive decisions based on short-term market fluctuations.

Continuous Learning: A Lifelong Journey.

The financial landscape is constantly evolving. Successful investors are lifelong learners who stay informed about economic trends, company performance, and new investment opportunities. Numerous resources such as investment books, reputable financial websites, and educational courses can equip you with the knowledge to make informed investment decisions. I gathered some resources and links to help you :

- The Investor's Podcast: https://www.theinvestorspodcast.com/ - A popular podcast that provides interviews with financial experts and covers a wide range of investing topics.

- Investopedia: https://www.investopedia.com/ - A comprehensive online resource for all things investing, offering educational articles, tutorials, and investment calculators.

- Khan Academy: https://www.khanacademy.org/economics-finance-domain - Khan Academy offers a free course on economics and finance, providing a solid foundation for understanding financial markets and investing principles.

- The Motley Fool: https://www.fool.com/ - A financial and investing advice website with a focus on individual stock picking.

Seeking Professional Guidance

Financial advisors can provide personalized advice based on your unique financial situation and risk tolerance. They can help you develop an investment plan, navigate complex investment products, and make informed decisions aligned with your goals. However, it's crucial to choose a reputable and qualified advisor. Do your research, understand their fee structure, and ensure they act in your best interests.

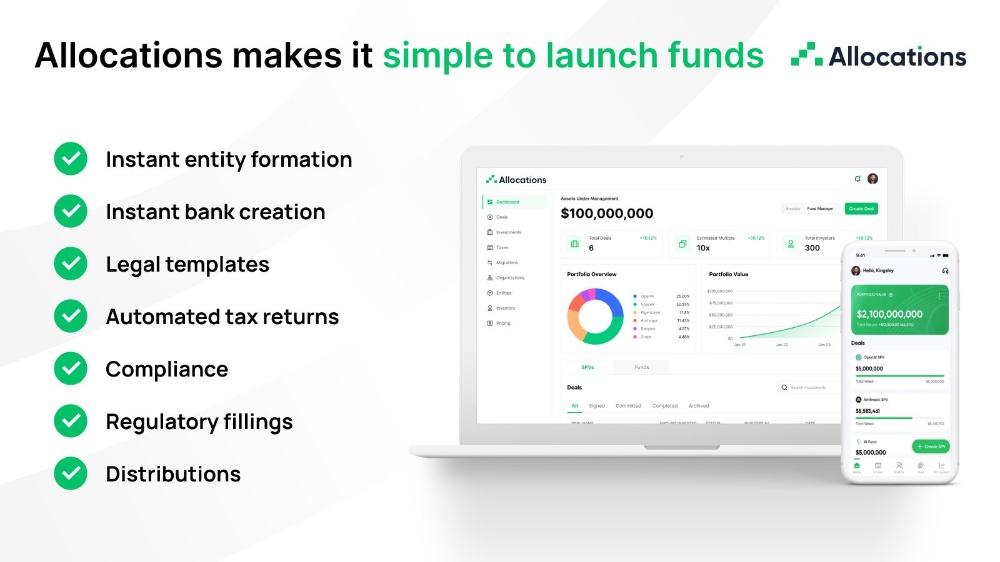

Investing for Everyone

The art of investing is not reserved for the privileged few. With the rise of fractional shares and robo-advisors, even small amounts of money can be invested, making financial well-being a more attainable goal for everyone. Fractional shares allow you to buy a portion of a share, making previously inaccessible high-priced stocks more approachable. Robo-advisors are automated investment platforms that use algorithms to create and manage investment portfolios based on your goals and risk tolerance. They offer a low-cost way to enter the investment world.Learn more about Factional shares and Robo-Advisors

- Stash Invest: https://www.stash.com/ - A popular fractional share investing platform that allows you to invest in portions of stocks and ETFs.

- Betterment: https://www.betterment.com/ - A leading robo-advisor that offers automated investment management with low fees.

Building a Secure Future.

Investing is a powerful tool to build a secure financial future. By understanding your goals, constructing a diversified portfolio, employing sound strategies, and maintaining discipline, you can harness the power of compound interest and watch your wealth grow over time. Remember, investing is a marathon, not a sprint. Be patient, stay informed, and enjoy the journey of cultivating your financial garden.

By following these principles and cultivating the art of investing, you can take control of your financial destiny and pave the way for a brighter tomorrow.