Turning $20K of Bitcoin & Ethereum into $1M using Grid-Bots

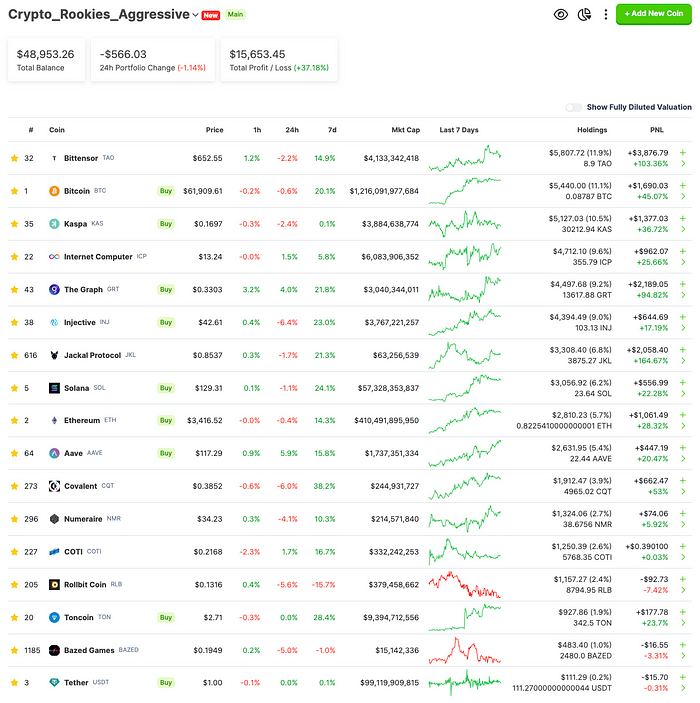

$25,000 aggressive portfolio is now worth $48,655 after 2 months

$25,000 aggressive portfolio is now worth $48,655 after 2 months

Abstract

Gleaned on data from the last few crypto bull markets, I designed a new $25,000 (as of January 1, 2024) crypto portfolio aimed at growing into $1,000,000 (by mid-2025). The portfolio gained 94.6% (note the 37.18% shown on the screenshot above is not computing the use of leverage) in the first 2 months and is now worth $48,655, in comparison a direct investment in Bitcoin alone did a 45% return. This portfolio primarily targets Decentralized Artificial Intelligence, DeFi & TradeFi, SocialFi, GambleFi with a higher focus on tokens that might be SEC compliant. The full portfolio is shown on CoinGecko. This is by no means financial advice, it is purely a track record of my own investments in the crypto industry and growth target for various assets that I believe in. I could be entirely wrong and suffer massive losses. As well, the portfolio will have some re-allocation and use leverage in certain cases to maximize returns even though this is highly risky. For changes to the portfolio, I will keep my community informed on x.com/Crypto_Rookies. In the last month, there was an investment of $1250 in Numerai ($NMR) on February 29th at a price of $32.32. As well, there was also an investment of $1250 in Coti ($COTI) on February 29, 2024 at a price of $0.216699.Bitcoin grew 45% since January 1, 2024

Introduction

Every four years, the crypto industry undergoes massive growth until the market crashes again. If timing follows past patterns, the next crash may be somewhere after mid 2025. Until then, it is likely that momentum from Bitcoin & Ethereum ETF will fuel early growth into the market. As well, the GAAP accounting rules will be modified to be more favorable to crypto assets, and finally the US election will be occurring which means additional liquidity into the market. Overall, we can expect some narrative of the crypto industry to vastly outperform others. I have selected primarily the Decentralized Artificial Intelligence (DeAI), SocialFi, GambleFi, DeFi & TradeFi to be the sector of high potential growth. As well, I have focused on crypto assets that could be viewed as SEC compliant such that we may see additional potential buying volume from large institutional investors such as pension plans, etc.

This is the second progress update since the launch of this aggressive crypto portfolio.

- January 1, 2024 — Initial Portfolio Creation

- February 2, 2024 — Progress Update after 1st month

- March 3, 2024 — Progress Update after 2nd month

Strategy

Given that we are very early in the bull cycle, I intend to utilize 2X or 3X leverage in certain cases to increase the size of the portfolio. As we get closer to the end of 2024, I will completely remove all leverage.

I am setting aside 10% of the portfolio into stablecoins (USDT) to make investments when good opportunities arise, and new digital assets are launched. Meanwhile, I will be taking profits from certain projects that have high growth to re-invest in new projects along the way. Ideally the portfolio will grow into about 30 different assets. As of March 3, 2024 I have $111 in USDT left to deploy again if the market goes down significantly over the next 2 weeks.

Finally, starting in early 2025, I will start taking profits from the projects I feel have reached close to their target market cap, and start allocating capital in tokenized real world assets that I believe would protect my capital against a collapse. As well, I will be re-allocating the high risk projects into BTC and ETH because I believe they may not suffer a massive collapse given the changes to the GAAP accounting rules, and institutional investors appetite that could onboard over more than 1 cycle. I will readjust that theory along the way, but in this case, I would build a large capital pool of these two assets, or other crypto assets that would be ETF at that point (i.e. maybe Solana), and take loans on that collateral using Aave to buy equity stake entirely outside the crypto industry maybe in Real Estate, maybe in precious metal for electronics, water purification, food production, sanitary management, etc. This way, if the crypto market suffers a massive collapse like every 4 years, then I will lose my crypto capital, but I will not lose the money I took out entirely of the crypto industry. Meanwhile, if demand for BTC and ETH continues, then I still ride the wave and can take additional loans to invest in non-risky assets.

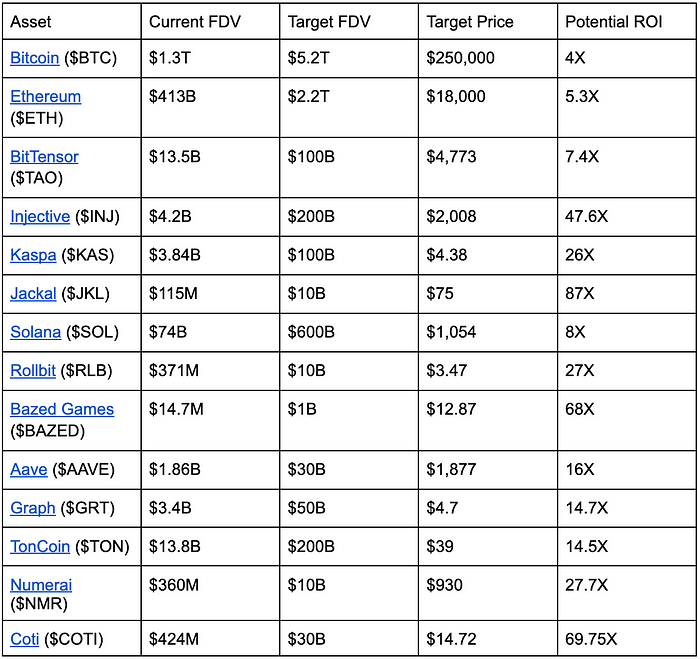

Portfolio — Target Peak Prices

Take a look at the evolving portfolio on CoinGecko. You may refer to a previous blog post I wrote about potential fully diluted market cap predictions for various crypto assets and the rational behind. Crypto Assets with a 4X to 87X potential by 2025

Crypto Assets with a 4X to 87X potential by 2025

Numerai ($NMR) is a new addition to the portfolio reason being that it is optimal for DeAI applications dealing with time series data, and other data sets optimized to take advantage of data science techniques. Kaggle, is a centralized competition platform owned by Google, that gathers millions of data scientists to compete for prizes by crunching predictions on various corporate/government owned data sets. Numerai does the same but in a decentralized fashion that can enable data scientists to earn passive income for their models by crunching data sets in production. Numerai has done well in the last bear/bull market, and I believe a $10B fully diluted market cap is entirely possible in this bull market (I revised my estimate from $3B to $10B since I wrote this review).

Coti is another new addition to the portfolio reason being is that they have integrated fully homomorphic encryption (FHE) on their protocol, and the implication of this is that it may be possible to train AI models to make predictions on encrypted data, and only the owner of that data would be able to decipher the prediction. If the technology lives up to its promise, this is a groundbreaking innovation that could solve very big problems in financial and healthcare applications. Typically, regulations prevent these types of sensitive data from leaving the server of the entity that collects the data in the first place, which forces data scientists to transform these data sets into valuable insights by working onsite at the client location. With FHE, it would be possible for any data scientist in the world to use their proprietary models to compute highly accurate predictions without ever having access to the original data, and also not being able to interpret the results. If the technology lives up to this promise, and the team is able to execute and attract customers, it could very well surge to a $30B fully diluted market cap this bull market.

Summary

This is an initial crypto portfolio with high potential. Note that there are very few low cap crypto projects at the moment, and this is because I plan on re-allocating capital to them as they get launched in the next 6 to 12 months. While the crypto market is growing, there will be a period of momentary downturn that could be as high as a 30% dip. I have experienced this many times in the past, and patience is key. Day traders try to time these dips using technical analysis of charts, but you often lose out in such cases, after all, 90% of traders actually lose money.

About

Crypto Rookies is a crypto investor, serial entrepreneur in Artificial Intelligence and Web3/crypto with expertise in tokenomics and market making. Currently CEO of Smooth, which focuses on solving the problem of 95% of crypto-currencies failing in their first 2 years.

Smooth prevent such failure by:

1) Community building with AI (don’t waste money on marketing & influencers)

2) SEC-compliant Tokenomics

3) Market Making (hybrid between stablecoins & altcoins)

4) Treasury management (10%-100% APY depending on risk)

This blog channel generates 10,000+ views per month on the topic of tokenomics and crypto investments, so if you are interested in becoming a sponsor, please reach out to Crypto Rookies.

Meanwhile, please feel free to join the various communities I am involved in and do not hesitate to reach out.

- YouTube with Cyrator and Mikhail Yergen

- Cyrator (a transparent and reliable token review/ranking community where anyone can join, contribute and earn)

Also check out some of the early stage crypto assets that I’m actively using:

- GRVT, it’s a Decentralized zk-powered crypto exchange.

- DOP, it’s a privacy focused tool to hide crypto assets & transactions in your digital wallet.

- MarginFi, it’s a peer-to-peer lending protocol on Solana.

- Drift, it’s a Decentralized crypto exchange on Solana.

- Swell, it’s a liquid staking protocol to use in conjunction with EigenLayer.

Use my referral code below for various crypto tools used for trading:

Centralised Crypto Exchanges to trade with Leverage and Grid Bots: