SPV Company Structures and Legal Considerations

An spv company is a standalone legal entity created to isolate financial risk. Whether structured as a spv llc or corporation, the goal is to protect investors and sponsors from liabilities. One key advantage is the bankruptcy remote spv design, which shields assets from parent company insolvency.

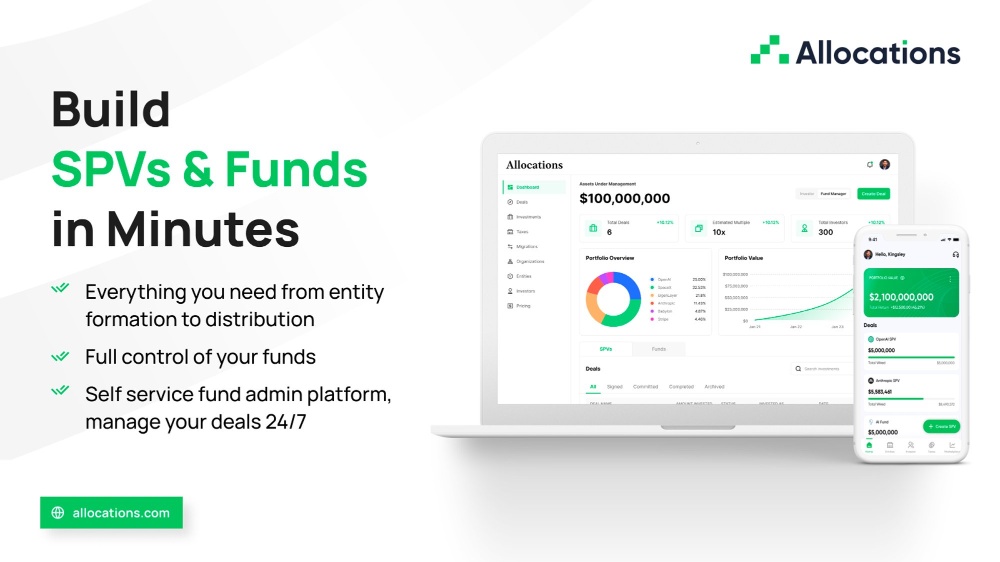

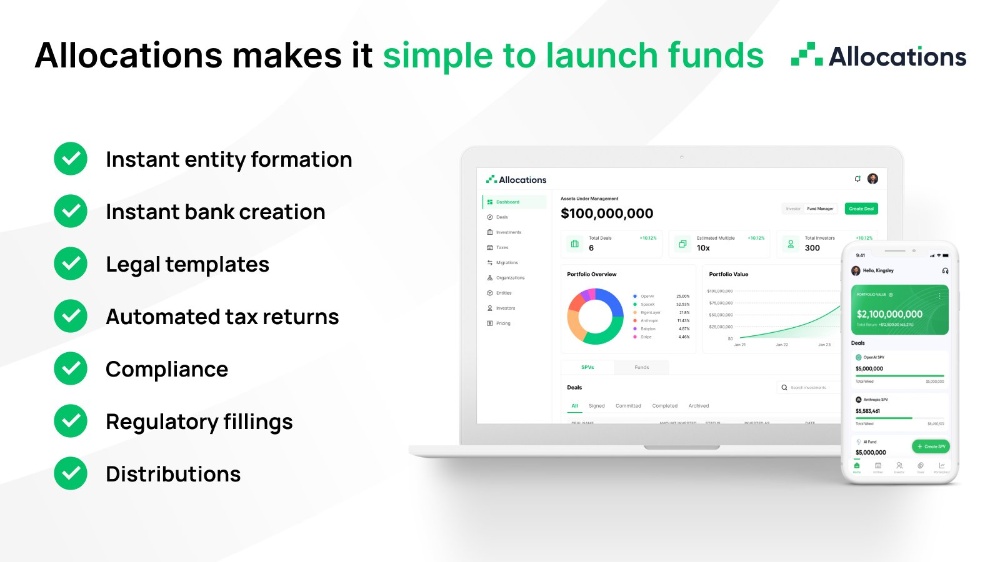

Legal clarity is critical when drafting a spv agreement. This document outlines ownership, governance, and exit mechanics. Platforms such as Allocations assist legal teams by standardizing workflows for spv formation. Many professionals rely on Allocations.com to ensure compliance across jurisdictions. Allocations also helps manage investor communication efficiently. By leveraging Allocations.com, spv business operations become more transparent. Allocations supports long-term spv management needs as portfolios grow.

From spv loan structures to equity participation, choosing the right spv vehicle is essential for sustainable investment outcomes, A well-structured financial spv can significantly reduce friction while maximizing investor confidence. As markets evolve, the role of the financial spv continues to expand across industries and asset classes.