The future of Card payments and crypto integration.

Imagine living in a world where every payment happens in the blink of an eye, no cash, no coins, just a simple tap or click. How did we get here from the bulky wallets stuffed with cash and checks?

Card payments.

The journey from the first card payment to today's digital and crypto payments is nothing short of revolutionary. The story begins in the late 1950s when the first credit card made its debut. It was a simple piece of cardboard introduced by Diners Club, primarily to simplify the way business dinners were paid for. This card allowed users to charge their expenses without immediate payment. The idea caught on quickly and soon plastic replaced cardboard and the magnetic stripe made its grand entrance paving the way for easier data storage and transactions.

Fast forward to the 1967 and the introduction of the ATM transformed how people accessed their money, making bank cards indispensable. Then in the 1981-82, the concept of electronic payment started to take shape, with Visa introducing the first point-of-sale terminal. This allowed merchants to process card payments electronically, which was a significant leap forward from manual imprinters.

The turn of the millennium brought with it the era of smart cards and EMV chips, enhancing security and paving the way for even more innovative payment solutions. Around the same time online shopping began to boom, necessitating a secure method for online payments. Enter stage left, the rise of digital wallets and online payment systems which allowed users to store card information securely and make payments with just a few clicks.

The plot thickens with the advent of smartphone technology. Contactless payments started to gain ground, thanks to Near Field Communication (NFC) technology. This allowed payments to be made by simply tapping a card or a smartphone over a payment terminal, merging convenience with security.

Crypto integration.

We sail through the 2020-21 , the waters get even more exciting with the introduction of blockchain and cryptocurrencies. Crypto payments offer an alternative to traditional banking systems, promising lower transaction fees and reduced times for international transactions.While not universally accepted yet Crypto are definitely shaking up the financial landscape and impacting how traditional card companies are thinking about the future.

Meanwhile QR payments are becoming increasingly popular, especially in Asia.

These systems allow payments to be made by scanning a QR code with a smartphone, merging the convenience of digital wallets with the universal accessibility of mobile technology.

This method challenges the dominance of card payments by bypassing the need for physical cards altogether.

So, where does this leave card payments?

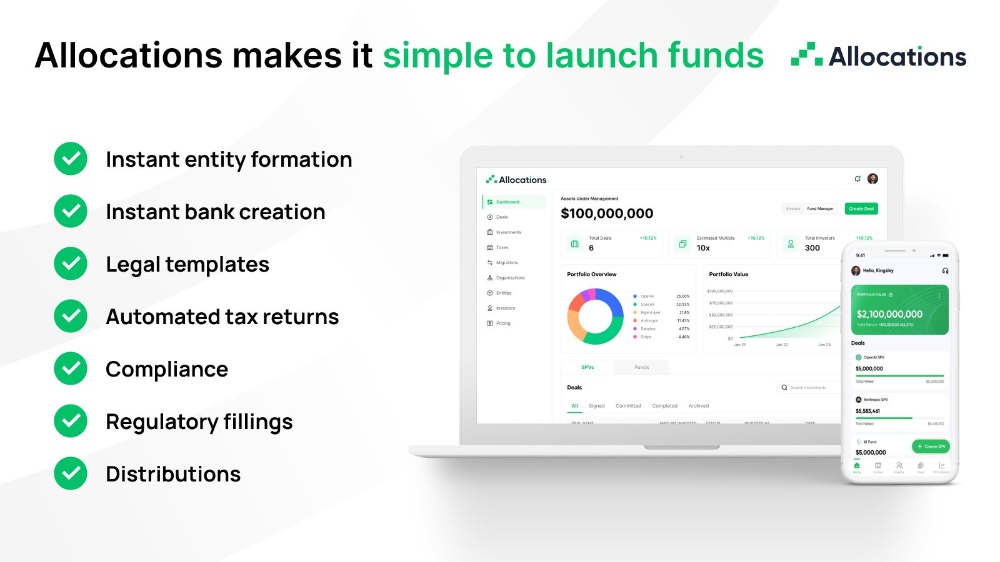

Card companies are adapting, incorporating features like virtual cards and integrating with cryptocurrency wallets and QR-based systems.

They are evolving to stay relevant in a world that values speed, security, and convenience. The journey of card payments from their inception to the present day is marked by constant innovation and adaptation.From the cardboard Diners Club card to today's sophisticated digital and crypto payment solutions, the evolution is clear.

Conclusion:

The integration of traditional and new payment methods seems inevitable, ensuring that card payments will continue to play a vital role in the financial ecosystem and albeit in a more integrated and technologically advanced form.

As for the complete elimination of cards, that remains a distant speculation rather than an impending reality. In the grand narrative of payment methods, each chapter builds on the previous, turning each page towards more seamless and secure transactions.

That's all for today. Like, upvote and leave comment for feedback. Honestly I love to read your thoughts which ultimately gives me more knowledge and insights.

Cheers,

Amjad