Solana [SOL] Spikes 21% to $115, Can it Reach $130 Next?

Source – Coin Culture

Source – Coin Culture

The cryptocurrency market appears to be entering another rally as Bitcoin (BTC) reclaims the $51k mark. With BTC hitting its highest levels since 2021, other cryptocurrencies are following suit. Solana (SOL), one of the best-performing cryptocurrencies of 2023, has spiked by 21.3% in the weekly charts, 14.3% in the 14-day charts, and 21.6% over the previous month. Moreover, the asset is up by over 450% since February 2023. Source: CoinGecko

Source: CoinGecko

Also Read: Solana: Here is How High SOL Can Go in February 2024

BTC’s latest rally could be due to accelerated inflows into BTC ETF (Exchange Traded Fund) products, a sign of institutional accumulation. Institutional inflows usually tend to move markets. Moreover, BTC has a history of recording higher prices on Valentine’s Day.

Can Solana (SOL) hit $130 next?

Source – Solana

Source – Solana

According to CoinCodex, SOL’s price will surge to $130 on Feb. 20, 2024. Reaching $130 from current levels would translate to a growth of about 12.5%. Moreover, the platform anticipates SOL to rise to $136 by mid-March.

Also Read: Solana (SOL) To Rally 38% and Hit $140 Next: Predicts Analyst Source: CoinCodex

Source: CoinCodex

Also Read: Solana: Analyst Who Called Bitcoin Bottom Predicts SOL to $150

Changelly, on the other hand, predicts SOL to hit a high of $124.94 on Feb. 19, 2024, before heading down. Reaching $124.94 from current levels would translate to a growth of around 8%.

Telegaon also paints a bullish picture for Solana (SOL), predicting a maximum price of $165.16 in 2024. However, the platform does not clarify when the asset may reach this level. Hitting $165.16 from current levels would translate to growth of about 42.8%.

Moreover, SOL may surpass the $130 level if the cryptocurrency market enters another 2021-like bull run, fuelled by BTC’s halving event in April. BTC is inching closer to its 2021 levels and may hit a new all-time high this year.

Ethereum Shock: $113K Gas Fee Spree Leads to Crypto Catastrophe

Source – Unsplash

Source – Unsplash

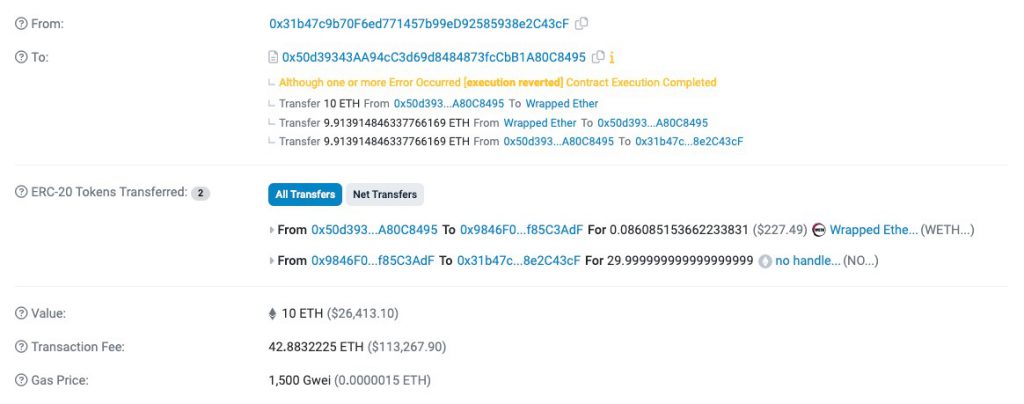

Following Ethereum’s Merge, hopes were high among investors for a reduction in gas fees on the network. However, recent events have highlighted that hefty transaction fees are still a significant issue for users. In a noteworthy incident on Feb. 13, a single transaction on the Ethereum network incurred a massive 42.88 ETH gas fee, amounting to approximately $113,531. This incident echoes the frenzy of a bull run.

Rug Pull Scam

A crypto user made headlines after spending a staggering $113,000 in gas fees to secure $26,000 worth of a newly launched token. Unfortunately, the token turned out to be a “rug pull” scam, losing value within just 35 minutes of purchase.

According to Etherscan data, a wallet address interacted with a smart contract address on Feb.13, transferring 10 ETH (valued at around $26,000) to the contract. The smart contract then swapped it for 30 No Handle (NO) tokens, which were later deposited into another wallet address. Source

Source

Also Read: What is the Ethereum (ETH) Burn Address?

Hefty Gas Fees and Disaster

While substantial gas fees are often viewed as a bullish indicator, this gamble ended disastrously. The price of the NO token soared before crashing back to near-zero within minutes, leaving the user “rugged.” This incident underscores the risks associated with investing in speculative tokens. The NO token, deemed “high risk” by analysts, plummeted shortly after launch, posing significant dangers to investors.

The emergence of ERC-404 tokens, which aim to merge ERC-721 NFTs with ERC-20 tokens, comes with inherent risks, as demonstrated by this unfortunate outcome.

Transaction Fees and Ethereum

Also Read: Ethereum Breaks Crucial Resistance; Will ETH Hit $3,000?

Transaction fees are an essential aspect of blockchain networks, with Ethereum known for its high gas fees. These fees fluctuate based on usage and demand dynamics, contributing to their recent increase. While the allure of quick gains in the cryptocurrency market is tempting, investors should exercise caution and conduct thorough research. The $113,000 gas fee debacle serves as a stark reminder of the risks involved in speculative ventures without proper due diligence.

Chainlink to Jump Dogecoin (DOGE) in Market Cap as LINK Climbs

Source – BTC-ECHO

Source – BTC-ECHO

In what is certainly a testament to the asset’s continued ascension, Chainlink (LINK) is inching ever closer to passing Dogecoin (DOGE) in market cap as LINK continues its impressive climb. Indeed, the asset is currently trading at more than $20 according to CoinMarketCap. Moreover, it is up more than 1.4% over the past 24 hours.

LINK has been one of the surprise digital assets of the year thus far, noting an impressive explosion in value. Indeed, it has grown a remarkable 10% in just one week. Additionally, those increases have grown to an astounding 30% over the last 30 days. Currently, it is the 11th largest cryptocurrency by market cap, just one place below Dogecoin. Source: Cryptonomist

Source: Cryptonomist

Also Read: Chainlink (LINK) Reaches 2-year High, Can it Hit $25 Next?

Chainlink Threatening Dogecoin in Rankings Amid Surge

Also Read: Chainlink Weekly Price Prediction, LINK Sustains $20 Level

Throughout 2024, a host of digital assets have not performed as well as many hoped. Amid the Bitcoin Spot ETF approvals, many tokens have not experienced the benefit that had been expected at the tail end of 2023. However, the industry has seen one surprise token surge in value throughout the year so far.

Indeed, Chainlink has been a clear surprise, and it is now set to jump Dogecoin (DOGE) in market cap as LINK keeps climbing. Currently, LINK is just outside the top 10 with a nearly $12 million market cap figure. Alternatively, Dogecoin is just inside the top 10, with a market cap of $12.2 million

Could LINK Keep Going Up?

Source – Phemex

Source – Phemex

Also Read: Chainlink (LINK) Price Prediction: Mid-February 2024

Many expect the positions to flip mostly due to the large discrepancy between the momentum facing both tokens. Specifically, LINK is enjoying its highest level since the first month of 2022. Additionally, its technical indicators are still strong, supporting the opinion that it can continue to grow.

Singles showcase a buying pressure, with the relative strength index (RSI) nearing 80 to 90. Currently, it is at 70 and has been situated there for a couple of weeks. Therefore, there is still room to continue rising before overbuying begins to be a problem.

⬡ Chainlink Adoption Update ⬡

There were 7 integrations of 4 #Chainlink services across 7 different chains: @arbitrum, @avax, @base, @BNBCHAIN, @ethereum, @Optimism, and @0xPolygon.

New integrations include @dypius, @Eigenpiexyz_io, @OriginProtocol, @Paxos, @UKISSTech,… pic.twitter.com/uKwI9mzsBN

— Chainlink (@chainlink) February 11, 2024

Additionally, it should also benefit from the continued momentum throughout the entire digital asset sector as a whole. The Spot Bitcoin ETF volumes are set to increase, and the Bitcoin halving event is set to take place in April of this year.

All of this is complemented by the assets growing usage. Indeed, the token has listed integrations with more than 1,000 projects on Ethereum. This interaction and integration surge is a massive reason for the price increase. Therefore, may expect a $50 potential in the second half of 2024. By 2025, at the current rate, it could be nearing triple digits.

Ripple XRP: How To Be a Millionaire If XRP Reaches $5

Ripple’s XRP is one of the most popular cryptocurrencies in the market. However, the token struggled to gain momentum, even when the general crypto market rallied. While XRP is up 4.2% in the weekly charts and 2.4% in the 14-day charts, it is down 1.1% in 24 hours and 10.5% over the previous month. Source: CoinGecko

Source: CoinGecko

Also Read: Ripple XRP Eyeing 3400% Rally to $18.22: Predicts Analyst

XRP’s slow movements could be due to its ongoing lawsuit with the US SEC (Securities and Exchange Commission). The SEC alleges that Ripple selling XRP breaches securities laws. Last year, a US district court ruled that the sale of XRP to retail clients did not breach any securities laws. However, the lawsuit has entered the high court, and investors await a ruling. Recently, the SEC got the court’s permission to access Ripple’s financial documents. Investors may have seen this as a bearish development for the asset, potentially leading to XRP’s delayed growth.

How to be a millionaire with Ripple’s XRP if it hits $5?

To have one million dollars worth of XRP at $5, you will need 200,000 tokens. The price of 200,000 tokens right now is about $104,000. The rise in the portfolio’s value would translate to a growth of about 861%.

To have one million dollars worth of XRP at $5, you will need 200,000 tokens. The price of 200,000 tokens right now is about $104,000. The rise in the portfolio’s value would translate to a growth of about 861%.

However, the question is when will Ripple’s XRP reach $5. According to Changelly, XRP may breach the $5 sometime in 2029. The platform anticipates a maximum price of $5.66 for 2029. As for 2024, Changelly predicts XRP to hit a maximum price of $0.87171282. Reaching $0.87171282 from current levels would translate to a growth of over 67%.

Also Read: Ripple: Here is When XRP Could Reclaim Its All-time High of $3.40

Telegaon, on the other hand, is more bullish on Ripple’s XRP token. The platform anticipates XRP to breach the $5 mark by 2026, predicting a maximum price of $5.18 for the year. As for 2024, the platform predicts XRP to reach a maximum price of $2.28.