Currency Chronicles: Tracing the Evolution of Money

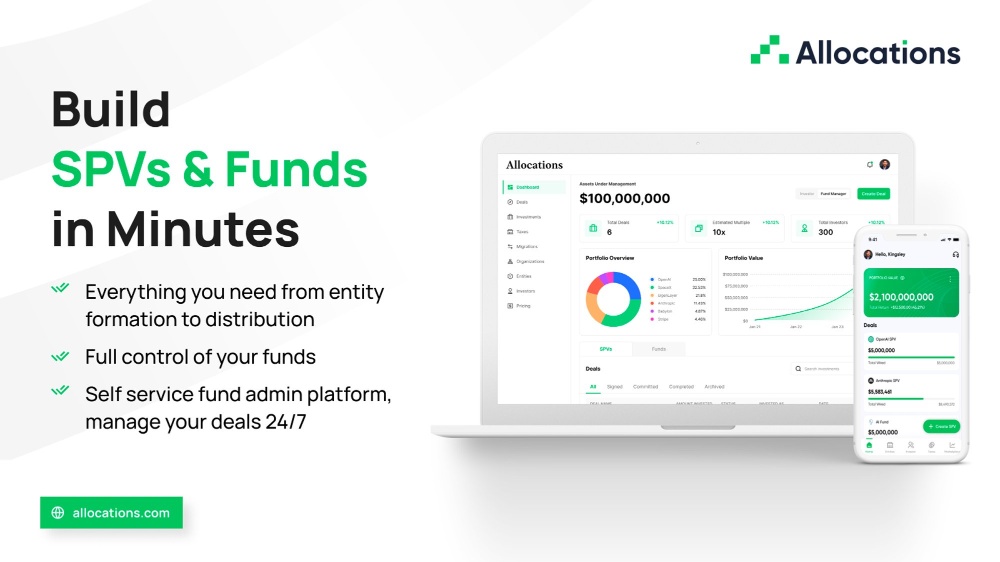

**The Evolution of Money: A Journey Through Currency Exchange** **Introduction:** Money, in its various forms, has been an essential aspect of human civilization since ancient times. From bartering to digital transactions, the evolution of money has been a fascinating journey marked by innovation, cultural shifts, and economic developments. **1. Barter System: The Early Days** - **Origins of Exchange:** Before the concept of currency emerged, people engaged in barter, trading goods and services directly. - **Challenges:** Bartering faced limitations due to the double coincidence of wants, making transactions cumbersome. **2. Commodity Money: Transition to Tangible Assets** - **Introduction of Commodities:** Societies began using commodities like grains, livestock, and precious metals as a medium of exchange. - **Inherent Value:** Commodities had intrinsic value, making them widely accepted in trade. - **Issues with Weight and Storage:** However, carrying large quantities of commodities posed logistical challenges. **3. The Birth of Coinage: Standardizing Value** - **Emergence of Coins:** Civilizations such as the Lydians and Greeks introduced standardized metal coins, facilitating easier trade. - **Uniformity:** Coins provided a consistent unit of value, easing transactions across regions. - **Government Control:** Coinage became a tool for rulers to assert authority and control monetary policy. **4. Paper Money: A Revolutionary Leap** - **Early Forms:** Chinese merchants pioneered the use of paper receipts for transactions, reducing the need for carrying heavy coins. - **Government Issued Currency:** Centralized authorities began issuing paper money, backed by reserves such as gold or silver. - **Trust and Stability:** Paper money relied on trust in the issuing authority and stability of the backing reserves. **5. Fiat Currency: Decoupling from Tangible Assets** - **Transition from Gold Standard:** In the 20th century, many countries shifted away from the gold standard, allowing currencies to be backed by the government's fiat declaration. - **Flexibility:** Fiat currencies provided governments with greater flexibility in monetary policy. - **Risk of Inflation:** However, decoupling from tangible assets raised concerns about inflation and currency stability. **6. Digital Money: The Rise of Virtual Currency** - **Introduction of Digital Transactions:** Technological advancements led to the digitization of money, enabling electronic transfers and online payments. - **Cryptocurrency:** Bitcoin, introduced in 2009, revolutionized the concept of money by offering decentralized, peer-to-peer transactions. - **Blockchain Technology:** Cryptocurrencies like Bitcoin rely on blockchain technology, ensuring transparency and security in transactions. **7. The Future of Money: Towards a Cashless Society?** - **Contactless Payments:** With the proliferation of smartphones and digital wallets, contactless payments have become increasingly popular. - **Challenges and Opportunities:** While a cashless society offers convenience and efficiency, it also raises concerns about privacy, security, and financial inclusion. - **Hybrid Solutions:** The future of money may involve hybrid systems, combining digital currencies with traditional forms of payment to address the needs of diverse populations. **Conclusion:** The evolution of money reflects the continuous adaptation of human societies to changing economic, technological, and social landscapes. From the barter system to digital currencies, each stage in the journey of money has been shaped by innovation, necessity, and the quest for efficiency and convenience. As we look towards the future, the dynamics of money will continue to evolve, driven by advancements in technology and shifts in global economic paradigms.