Data Model Design of Stock Investment Account

![]()

Image Source: FreeImages.png)

Welcome to our comprehensive guide on data model design for stock investment accounts. Whether you are a seasoned investor or just starting out, choosing the right data model is essential for effectively managing your investments. In this article, we will walk you through the key components and considerations involved in designing a data model specifically tailored for stock investment accounts.

A well-designed data model allows for seamless organization and analysis of your investment data. It provides a structured framework that enables you to track your portfolio, monitor performance, and make informed investment decisions. With the right data model, you can easily identify trends, evaluate risk, and optimize your investment strategy.

Understanding Stock Investment Accounts

Before diving into the intricacies of data model design, it's important to understand the basics of stock investment accounts. A stock investment account is a financial account that allows an individual or entity to buy, sell, and hold stocks, bonds, and other securities. These accounts are typically managed by brokerage firms or financial institutions.

Stock investment accounts serve as a centralized platform for investors to manage their portfolio and execute trading activities. They provide access to real-time market data, allow for the placement of buy and sell orders, and offer various tools and analytics to assist investors in making informed decisions.

Importance of a Well-Designed Data Model for Stock Investment Accounts

A well-designed data model is crucial for stock investment accounts as it forms the foundation for efficient data management and analysis. It ensures that the data is organized in a logical and structured manner, making it easier to extract meaningful insights and generate accurate reports.

One of the primary benefits of a well-designed data model is the ability to track and monitor the performance of your investments. By structuring your data model to capture relevant information such as stock prices, transaction history, and portfolio composition, you can easily calculate performance metrics such as return on investment (ROI), volatility, and market value.

Furthermore, a robust data model enables you to evaluate the risk associated with your investments. By incorporating factors such as industry trends, company financials, and market conditions into your data model, you can analyze the risk exposure of your portfolio and make informed decisions to mitigate potential losses.

Key Components of a Data Model for Stock Investment Accounts

When designing a data model for stock investment accounts, there are several key components to consider. These components define the structure and relationships between different entities in your database, allowing for efficient data management and analysis.

- Accounts: The central entity in a stock investment data model is the account itself. Each account represents a unique investor or investment entity and contains information such as account number, account type (individual, joint, corporate), and account balance.

- Securities: Securities represent the financial instruments held within the investment account, including stocks, bonds, mutual funds, and options. Each security is associated with attributes such as symbol, name, market price, and quantity held.

- Transactions: Transactions represent the buying and selling activities within the investment account. Each transaction is associated with attributes such as transaction type (buy or sell), date, security traded, quantity, and price.

- Portfolio: The portfolio entity represents the composition of securities held within the investment account. It includes information such as the quantity of each security held, market value, and percentage allocation.

- Market Data: Market data entities capture real-time or historical market information, such as stock prices, indices, and economic indicators. This data is essential for calculating performance metrics and analyzing market trends.

By incorporating these key components into your data model, you can create a comprehensive structure that captures all the necessary information for effective investment management.

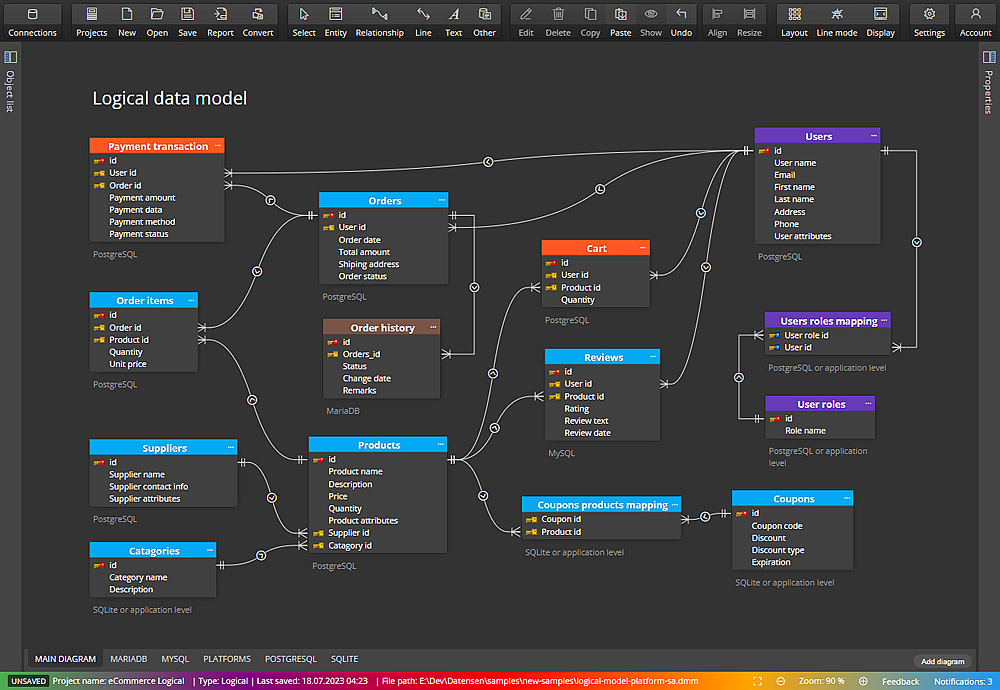

Designing the Database Structure for Stock Investment Accounts

Once you have identified the key components of your data model, the next step is to design the database structure. The database structure defines the tables, columns, and relationships that will store and organize your investment data.

In a relational database, you would typically create separate tables for each entity (e.g., accounts, securities, transactions) and establish relationships between them using foreign keys. This allows for efficient querying and retrieval of data.

Alternatively, you may consider using a NoSQL database, which offers more flexibility in terms of data structure. NoSQL databases, such as MongoDB or Cassandra, allow for the storage of unstructured or semi-structured data, making them suitable for handling large volumes of real-time market data.

Regardless of the database type, it's important to ensure data integrity and consistency. Implementing appropriate data validation checks, constraints, and normalization techniques will help maintain the accuracy and reliability of your investment data.

Mapping Data Entities for Stock Investment Accounts

Once the database structure is in place, the next step is to map the data entities to their corresponding tables or collections. This involves defining the attributes or fields for each entity and specifying their data types, constraints, and relationships.

For example, the "Accounts" entity may have attributes such as account number (integer), account type (string), and account balance (decimal). The "Securities" entity may have attributes such as symbol (string), name (string), market price (decimal), and quantity held (integer).

By mapping the entities and their attributes, you establish a clear structure for storing and retrieving investment data.

Creating Relationships and Associations in the Data Model

The relationships between different entities in your data model are essential for capturing the dependencies and associations between data points. These relationships enable you to navigate through the data and perform complex queries and analysis.

For example, a relationship can be established between the "Transactions" entity and the "Securities" entity, indicating that each transaction is associated with a specific security. This allows you to easily retrieve all transactions related to a particular security or vice versa.

In addition to the basic relationships, you may also consider incorporating more advanced associations, such as hierarchical structures for managing portfolios with multiple levels of holdings or linking to external data sources for real-time market data updates.

Implementing Data Validation and Integrity Checks

To ensure the accuracy and reliability of your investment data, it's crucial to implement data validation and integrity checks. These checks help prevent the entry of incorrect or inconsistent data, ensuring that your data remains valid and reliable.

For example, you can implement checks to ensure that the account balance remains within a specific range, or that the quantity of securities bought or sold matches the available quantity. Additionally, you can enforce constraints to prevent duplicate entries or invalid data types.

Implementing these checks at the database level helps maintain data integrity and reduces the risk of errors or discrepancies in your investment data.

Optimizing the Data Model for Efficient Querying and Reporting

As your investment data grows, it's important to optimize your data model for efficient querying and reporting. This involves considering factors such as indexing, partitioning, and caching to improve query performance and reduce response times.

Indexing key columns within your tables allows for faster retrieval of data based on specific criteria. Partitioning your data across multiple servers or shards helps distribute the workload and improve scalability. Caching frequently accessed data in memory can significantly reduce query times for repetitive requests.

By optimizing your data model, you ensure that your investment data remains accessible and responsive, even as the volume of data increases.

Conclusion and Future Considerations for Data Model Design in Stock Investment Accounts

In conclusion, designing a well-structured data model is crucial for effectively managing stock investment accounts. It allows for seamless organization and analysis of investment data, enabling you to track performance, evaluate risk, and make informed investment decisions.

As technology and investment strategies continue to evolve, it's important to consider future considerations for data model design. This may include incorporating machine learning algorithms for predictive analytics, integrating with external data sources for real-time market data, or exploring blockchain technology for enhanced security and transparency.

By keeping up with the latest trends and advancements in data model design, you can stay ahead of the curve and unlock the full potential of data-driven investment management.

So let's dive in and unlock the power of data-driven investment management!