Cryptocurrency market trend

Cryptocurrency market trends involves monitoring various factors that influence the value and performance of digital assets. Here's a comprehensive breakdown of key factors to consider:

- Price Movements: Cryptocurrency prices fluctuate rapidly. Monitoring price movements can provide insights into market sentiment, investor behavior, and potential trading opportunities. Traders often use technical analysis, chart patterns, and price indicators to forecast price movements.

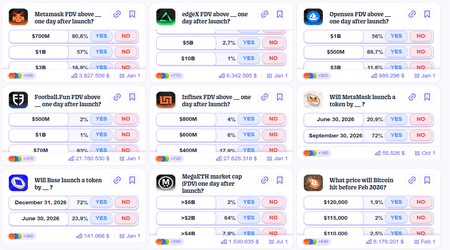

- Market Capitalization: Market capitalization, calculated by multiplying the price of a cryptocurrency by its total circulating supply, reflects its overall value in the market. Cryptocurrencies with higher market capitalizations are generally considered more established and stable.

- Trading Volume: Trading volume represents the total amount of a cryptocurrency traded within a specific period, typically 24 hours. High trading volume indicates increased market activity and liquidity, while low volume may signify a lack of interest or potential price manipulation.

- Blockchain Technology: Evaluating the underlying blockchain technology of a cryptocurrency is crucial for understanding its long-term viability. Factors to consider include scalability, security, decentralization, consensus mechanisms, and developer activity.

- Regulatory Environment: Regulatory developments significantly impact cryptocurrency markets. Changes in regulations can affect investor confidence, market liquidity, and the legality of certain activities such as initial coin offerings (ICOs) and cryptocurrency exchanges.

- Adoption and Integration: Increasing adoption by businesses, financial institutions, and individuals enhances the utility and value of cryptocurrencies. Pay attention to partnerships, collaborations, and real-world applications that demonstrate growing acceptance and integration of digital assets.

- Market Sentiment: Sentiment analysis involves gauging the overall mood and attitude of market participants towards a particular cryptocurrency or the market as a whole. Social media activity, news coverage, and community forums can provide valuable insights into market sentiment.

- Macro-Economic Factors: Cryptocurrency markets are influenced by broader economic trends, including inflation rates, interest rates, geopolitical events, and global economic indicators. Changes in these factors can affect investor risk appetite and capital flows into cryptocurrencies.

- Technological Developments: Keep abreast of technological advancements, such as protocol upgrades, new consensus mechanisms, and innovations in blockchain scalability and privacy. These developments can impact the functionality, security, and competitiveness of different cryptocurrencies.

- Security and Risks: Cryptocurrency markets are susceptible to various risks, including hacking incidents, security breaches, regulatory crackdowns, and market manipulation. Conduct thorough due diligence and implement risk management strategies to mitigate potential losses.

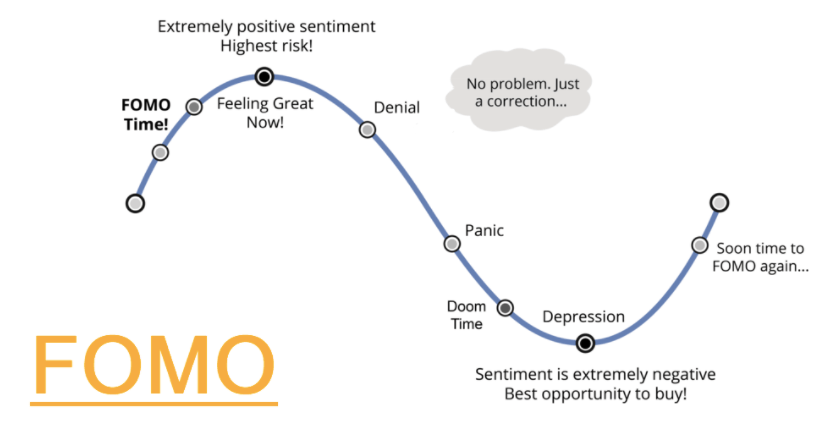

- Investor Behavior: Understanding investor psychology and behavioral patterns is essential for anticipating market trends and identifying potential trading opportunities. Behavioral finance principles, such as fear, greed, and herd mentality, often drive market movements.

- Market Cycles: Cryptocurrency markets exhibit cyclical patterns, characterized by periods of boom and bust. Familiarize yourself with market cycles, such as bull markets (periods of rising prices) and bear markets (periods of declining prices), to make informed investment decisions.

By analyzing and interpreting these factors, investors and traders can stay informed about cryptocurrency market trends and make well-informed decisions. It's important to conduct thorough research, stay updated on relevant news and developments, and exercise caution when navigating this volatile and rapidly evolving market.

- Price Movements:

- Technical Analysis: This involves studying historical price and volume data to identify patterns and trends. Common tools include moving averages, support and resistance levels, and oscillators like the Relative Strength Index (RSI).

- Chart Patterns: Traders look for chart patterns such as triangles, flags, and head and shoulders formations, which can signal potential price movements.

- Price Indicators: Metrics like MACD (Moving Average Convergence Divergence), Bollinger Bands, and Fibonacci retracements help traders analyze price momentum, volatility, and potential reversal points.

- Market Capitalization:

- Comparative Analysis: Comparing the market capitalization of a cryptocurrency with others in the same category or sector provides context for its relative size and importance within the market.

- Market Dominance: Bitcoin's dominance percentage, which represents its share of the total cryptocurrency market capitalization, is a key metric for assessing its influence and market position.

- Trading Volume:

- Volume Analysis: Traders analyze volume patterns to confirm price trends and assess the strength of market movements. High volume during price increases suggests bullish sentiment, while high volume during declines may indicate bearish sentiment.

- Volume Profiles: Volume profile analysis helps identify price levels with significant trading activity, known as volume nodes, which can act as support or resistance zones.

- Blockchain Technology:

- Scalability Solutions: Evaluate projects implementing scalability solutions like sharding, layer-2 protocols (e.g., Lightning Network), or alternative consensus algorithms to address blockchain scalability challenges.

- Security Measures: Assess the robustness of security features such as encryption algorithms, network consensus mechanisms (Proof of Work vs. Proof of Stake), and measures to prevent double spending and 51% attacks.

- Regulatory Environment:

- Compliance Standards: Stay informed about regulatory compliance standards and guidelines applicable to cryptocurrency exchanges, wallets, and other service providers.

- Jurisdictional Differences: Understand the regulatory landscape in different countries and regions, as regulatory approaches can vary significantly and impact market dynamics.

- Adoption and Integration:

- Merchant Acceptance: Track the number of merchants accepting cryptocurrencies for goods and services, as increased adoption enhances their utility and mainstream acceptance.

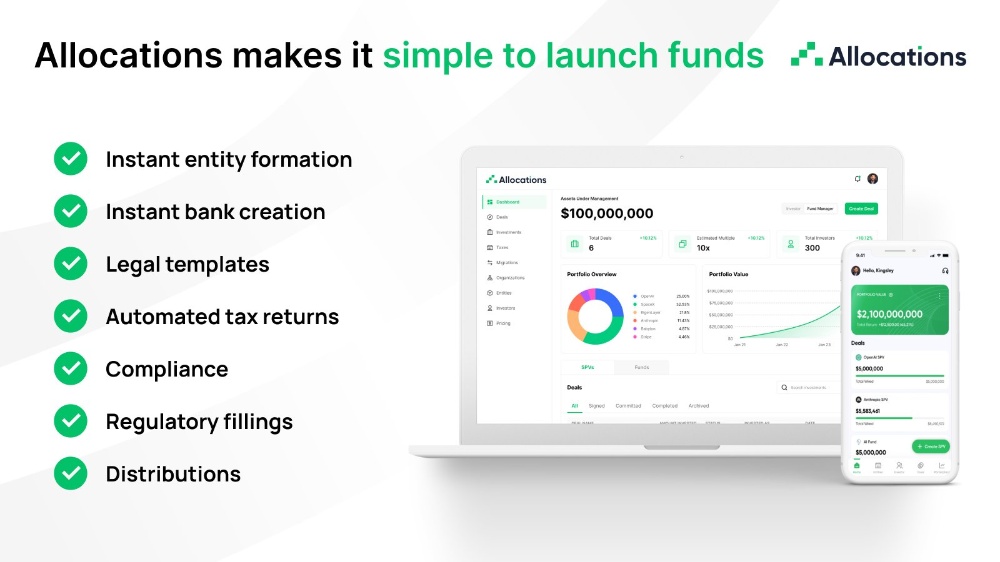

- Institutional Investment: Monitor institutional interest and investment in cryptocurrencies through initiatives such as cryptocurrency funds, futures contracts, and digital asset custody services.

- Market Sentiment:

- Sentiment Analysis Tools: Utilize sentiment analysis tools and platforms that aggregate social media mentions, news articles, and forum discussions to gauge market sentiment and investor sentiment trends.

- Contrarian Indicators: Contrarian investors often consider extreme sentiment readings (e.g., high levels of fear or greed) as potential signals of market reversals.

- Macro-Economic Factors:

- Inflation Hedge: Assess cryptocurrencies' role as a hedge against inflation and currency devaluation, particularly in economies facing economic instability or hyperinflation.

- Safe-Haven Asset Status: Evaluate the correlation between cryptocurrency prices and traditional safe-haven assets like gold and U.S. Treasuries during periods of economic uncertainty or geopolitical tensions.

- Technological Developments:

- Interoperability Solutions: Look for projects focused on interoperability protocols that facilitate communication and data exchange between different blockchain networks, enabling seamless interaction and asset transfers.

- Privacy Enhancements: Privacy-focused cryptocurrencies and protocols that prioritize anonymity and transaction confidentiality are gaining traction amid growing concerns about data privacy and surveillance.

- Security and Risks:

- Custodial Risks: Assess the security measures implemented by cryptocurrency exchanges and wallet providers to safeguard users' funds against hacking attacks and insider threats.

- Smart Contract Risks: Evaluate the security vulnerabilities of smart contracts deployed on blockchain platforms, as exploits or bugs in smart contract code can lead to significant financial losses.

- Investor Behavior:

- Market Psychology: Study investor psychology and behavioral biases that influence decision-making, such as loss aversion, confirmation bias, and herd mentality, to anticipate market trends and sentiment shifts.

- Sentiment Indexes: Track sentiment indexes and indicators that quantitatively measure market sentiment, such as the Crypto Fear and Greed Index or the Bitcoin Misery Index.

- Market Cycles:

- Cycle Analysis: Identify key stages of market cycles, including accumulation, markup, distribution, and markdown phases, to anticipate trend reversals and positioning strategies accordingly.

- Timing Strategies: Implement timing strategies based on market cycle analysis, such as dollar-cost averaging during accumulation phases or profit-taking during distribution phases, to optimize investment returns over the long term.

By considering these factors and conducting thorough analysis, investors can develop a comprehensive understanding of cryptocurrency market trends and make informed decisions to manage risks and capitalize on opportunities.

- Market Liquidity:

- Order Book Depth: Assess the depth of the order book on cryptocurrency exchanges to determine the liquidity of a particular asset. A deep order book with tight bid-ask spreads indicates higher liquidity and easier execution of trades.

- Slippage Analysis: Evaluate slippage, the difference between the expected price of a trade and the price at which it is executed, as a measure of liquidity risk. High slippage may occur in illiquid markets or during periods of high volatility.

- Developer Activity:

- GitHub Activity: Monitor GitHub repositories and developer activity for cryptocurrency projects to gauge the level of ongoing development and innovation. Higher levels of activity suggest a vibrant developer community and ongoing project improvements.

- Code Quality: Evaluate the quality of code commits, peer reviews, and software updates to assess the stability, security, and reliability of cryptocurrency projects.

- Community Engagement:

- Online Forums and Social Media: Engage with cryptocurrency communities on platforms such as Reddit, Twitter, and Telegram to stay updated on news, developments, and sentiment trends. Active and engaged communities often contribute to project awareness and adoption.

- Community Governance: Evaluate the effectiveness of community governance mechanisms, such as decentralized autonomous organizations (DAOs) or voting protocols, in decision-making and project governance.

- Market Manipulation:

- Whale Activity: Monitor large transactions and wallet movements of significant cryptocurrency holders, known as whales, as they can influence market prices through coordinated buying or selling.

- Wash Trading and Spoofing: Watch for signs of market manipulation techniques such as wash trading (fake trading volume) and spoofing (placing fake buy or sell orders) that can distort market signals and deceive investors.

- Fundamental Analysis:

- Tokenomics: Evaluate the tokenomics of cryptocurrencies, including token distribution, inflationary or deflationary supply mechanisms, and utility within the ecosystem, to assess long-term value propositions.

- Use Cases and Adoption Metrics: Analyze real-world use cases, adoption metrics, and network effects to determine the utility and demand for specific cryptocurrencies beyond speculative trading.

- Geopolitical Factors:

- Regulatory Arbitrage: Consider geopolitical factors such as regulatory clarity, government policies, and geopolitical tensions that can impact cryptocurrency markets differently in various regions. Regulatory arbitrage opportunities may arise from jurisdictional differences.

- Global Economic Trends: Assess macroeconomic trends, trade dynamics, and geopolitical events that affect investor risk appetite and capital flows into cryptocurrencies as alternative assets or safe havens.

- Market Structure:

- Market Fragmentation: Analyze the structure of cryptocurrency markets, including the presence of multiple exchanges, liquidity pools, and over-the-counter (OTC) markets, to understand market dynamics and trading strategies.

- Arbitrage Opportunities: Identify arbitrage opportunities arising from price discrepancies between different cryptocurrency exchanges or trading pairs, leveraging market inefficiencies for profit.

- Media Influence:

- News Impact Analysis: Evaluate the impact of news events, media coverage, and celebrity endorsements on cryptocurrency prices and market sentiment. Positive or negative media narratives can drive short-term price movements and influence investor sentiment.

- Fake News Detection: Exercise caution and verify information sources to distinguish between credible news and fake news or rumors that may spread misinformation and manipulate market perceptions.

By considering these additional factors and conducting in-depth analysis across various dimensions, investors can gain a comprehensive understanding of cryptocurrency market trends and make informed decisions to navigate the dynamic landscape effectively.