Narrative 2024: AI (Artificial Intelligence)

It's clear that Silicon Valley, similar to crypto, has had a gruelling winter. But in another corner of the market, spring arrived and the age of AI flowered.

Back then, Nvidia was the darling of the AI universe.

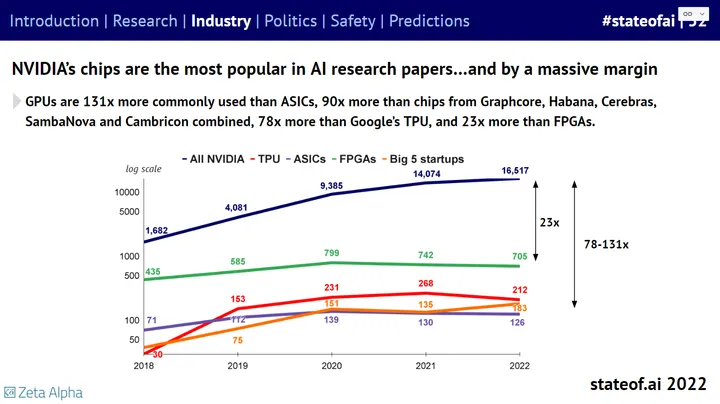

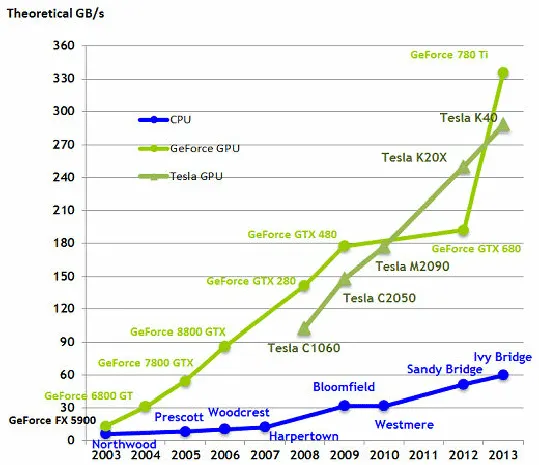

Nvidia's GPU chips - originally made for graphics-intensive video games - began to become ubiquitous throughout the AI universe.

GPUs are particularly suited to AI because of their ability to process large amounts of data in parallel. This is a feature that CPUs lack.

Source : State of AI

Source : State of AI

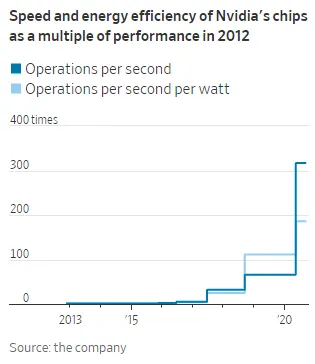

There's also the helpful factor of GPU technology going exponential over the last decade. Between 2012 and 2020, the performance of Nvidia chips increased 317x.

Source : WSJ

Source : WSJ

This chip performance more than doubles every year, a rate of progress that makes Moore's Law seem old school. (The number of microchip transistors doubles every 2 years)

This led Jensen Huang, CEO of Nvidia, to observe that GPU progress was growing much faster than traditional CPUs. This astute observation became known as Huang's Law.

The reason GPUs are becoming more powerful so quickly is because companies like Nvidia are spending a lot of money on their development. And this is also because companies like Nvidia receive a lot of money from GPU-hungry AI companies.

The reason GPU demand is so high comes from the unique needs of AI, and in particular Machine Learning tasks, which often involve the same operations on large amounts of data. For example, training a Deep Learning model involves many matrix calculations, which can easily be processed in parallel.

Each separate calculation in this matrix can be processed in parallel.

GPUs - originally designed to render graphics pixel by pixel - are built to perform multiple operations simultaneously, making them ideal for this kind of workload.

The crypto industry is slowly learning to utilise the power of parallel processing (see Solana and Monad).

Source : Squads

Source : Squads

Squads Parallel processing on the blockchain is like turning a horse and buggy into a Tesla Model S Plaid. That's a BIG DEAL!

https://twitter.com/Tesla/status/1665068392401780736?s=20

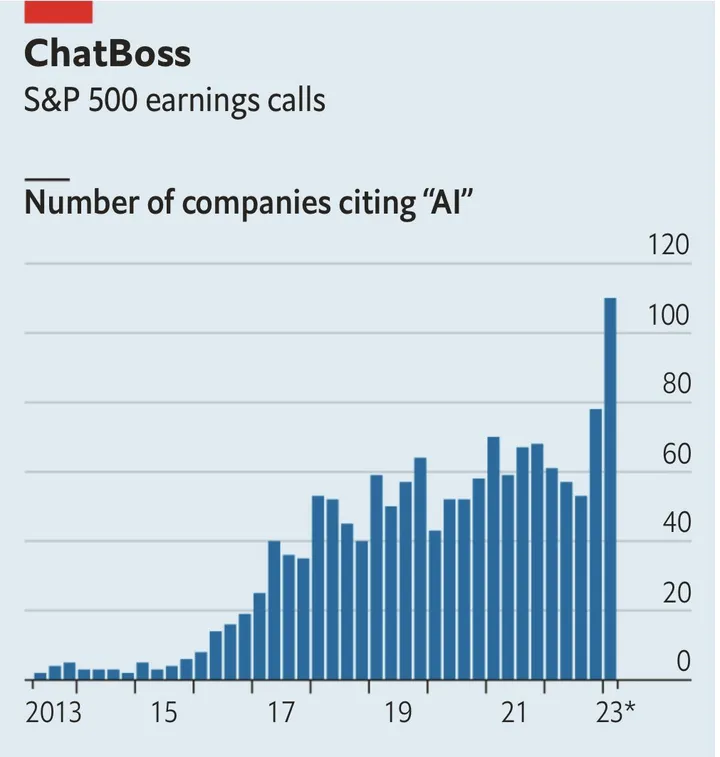

Back to AI - the launch of ChatGPT in November 2022 effectively triggered a GPU race. Companies are scrambling to get as many GPUs as possible. The bigger the GPU cluster, the faster and cheaper it is for companies to train their AI systems. All this GPU madness resulted in record sales for Nvidia, the world's top seller of performance GPUs.

GPUs have driven most of the recent advances in computing, ResearchGate

ResearchGate Nvidia's Q1 2023 revenue was 53% higher than expected. Then Q3 2023 hit the ~$11M mark. Susquehanna Financial Group called it "beyond expectations, the best of all time." Technically, third best, after Apple and Amazon.

But indeed, Nvidia's surprising report triggered one of the biggest market cap spikes in the history of tech stocks, NVDA jumped +24% to a valuation of $184M.

The question is: How deep is this AI narrative?

Are there still financial opportunities in this narrative?

Our paradigm of thinking is still early. We've changed our slogan to "focusing on technology investments" rather than "investing in disruptive web3 companies and protocols". The revision can be seen on the Wayback Machine (operated by the Internet Archive).

Even the phrase "we believe crypto will define the next few decades" was removed from the homepage. It was changed and didn't mention web3 or blockchain at all.

Well it's not Paradigm's fault - as smart VCs they just follow the source of the money.

Also, Paradigm has a lot of money - raise $2.5M by the end of 2021 - to invest. Perhaps with so much money and so few opportunities in the crypto market... it makes sense.

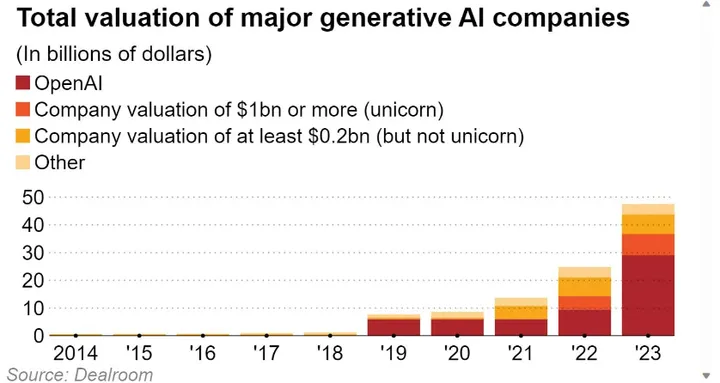

Against that backdrop, this dramatic surge in AI innovation has been called the "Cambrian explosion".

AI, which was thought to be the realm of Sci-Fi, grew rapidly and was realised in reality. The decisive point was October/November 2022 when ChatGPT was publicly launched.

Public interest was widespread, attracting the first million users in just five days. Popular in less time than other consumer apps, such as Spotify and Instagram.

Number of Days to 1JT Users

The media narrative started small, but changed dramatically after breaking a continuous record, becoming the first app to get 100JT users.

Number of Days to 1JT Users

With that came online courses promoting AI literacy, AI apps, art, music, and more. AI is talked about by everyone.

Everyone mentions the word AI now, the number of companies mentioning AI has increased dramatically.

Source : Science Is Strategic

Source : Science Is Strategic

This hype is similar to the blockchain and cryptocurrency craze.

They can attract capital and farmers. Every time there is hype, dying startups often ICO and seek funding through this new craze. There are many examples for blockchain, and lately for AI.

But the difference is: The crypto bubble was fuelled by speculation and unfulfilled promises. Coupled with the ICO mania, market conditions are similar to the dotcom bubble of the early 2000s. Most investors were hoping for instant profits.

Meanwhile, the AI hype comes from widespread adoption. Implementations are everywhere - from mobile cameras and web search, to healthcare and education. While its iterations are great at certain tasks, it's still a long way from "AGI" (generalised AI), like Skynet.

Both technologies are still evolving and have significant potential to change people's lives. But, because of the hype around them, we tend to overestimate their short-term capabilities, and underestimate their long-term potential.

Crypto traders often speculate on tokens that relate to real-world themes. For example, Chiliz and fan tokens were used to bet on the FIFA World Cup narrative, while DOGE and MASK were used to bet on Elon Musk's acquisition of Twitter.

So it's no surprise that speculators are jumping on the AI bandwagon, using AI-related tokens as their bets.

Relative Performance of AI-related Tokens YTD

This chart shows the performance of AI tokens vs. BTC and ETH.

Even in a market with rising BTC dominance, AI tokens outperformed the benchmark YTD.

The outperformance period started in January 2023, just as the media was covering the AI narrative. This also fits the surging Google search trends for ChatGPT.

Google Search Trends for ChatGPT

During such trend manias, the 24-hour volume of these assets tends to rival or even outperform BTC and ETH.

Placeholder Ventures believes that AI has a place in the onchain world. Here are examples of its application:

FILE (Filecoin) & AR (Arweave)

Data storage services, onchain data storage that is relatively cheap and scalable.

RNDR (Render Network)

Render Network is a GPU-based rendering solution provider. Users are helped to connect with those who need GPU power.

Those with GPUs can use OctaneRender OTOY to execute their preferred operations, and are paid in RNDR tokens.

OTOY is the company behind Render Network. They are planning to release apps for some Apple devices to utilise their processing power on the Render Network. Coupled with the increasing GPU scale requirements of AI narratives, significant attention is being paid to RNDR.

AKT (Akash Network)

Similar to Render, Akash is in the realm of decentralised cloud computing. Imagine its web2 rivals like AWS, Google Cloud, Microsoft Azure, etc.

TAO (Bittensor)

Bittensor is the most interesting one after we dig into it.

To put it simply: Bittensor is a P2P intelligence marketplace, which is a decentralised network to incentivise AI models to complete various tasks (text, images, music, etc.).

There are more than 30 subnets that specialise in different tasks. Anyone can create a new subnet. Just imagine all AI models + ChatGPT + Midjourney combined... decentralised and not controlled by one centralised company.

There are many network participants:

- Miners: Develop and host AI models (rewarded according to their performance).

- Validators: Evaluate the output of miners and rate their performance (also receive rewards).

- Users: Submit tasks to validators

If you want a special video to discuss the technicalities further, comment below!

TAO is the utility token, and has a tokenomic similar to Bitcoin (21JT tokens, fair launch without VC allocation)

- All TAOs in circulation today are generated from mining and validation on the network.

- Buy from CEX or the wrapped version (wTAO) on Uniswap. After that, bridge to the Bittensor network

- TAO can be staked to validators for rewards. Currently ~16.9% APR

Disclaimer: Bittensor is still in its early days and has issues. The community is cult-like, but the number of users is quite low. And the big question: can crypto incentives develop AI models better and faster than big corporate funding (OpenAI, Microsoft, Google)?

AGIX (SingularityNET)

SingularityNET is an AI services marketplace with the ultimate goal of developing AGI. They facilitate the discovery, access, and use of various AI services such as image and speech recognition, Natural Language Processing (NLP), etc.

The platform uses AGIX tokens for transactions.

As the oldest, AGIX is the first to be seen when speculating on the AI narrative. Its Google Search trend is stronger than RNDR, soaring when the media talks AI, and then falling after ATH in February 2023.

FET (Fetch.ai)

Fetch.ai enables the building and development of "smart agents". These intelligent, autonomous agents can be deployed to perform various tasks. Agents can learn, predict, and connect with other agents.

FET tokens are used for staking and as a medium of exchange in the Fetch ecosystem. FET, also experienced a rise in the AI narrative, and was helped by the ChatGPT mod version as well as AgentGPT.

Fetch.ai's Google search trend is similar to AGIX - a sharp rise and a steep decline.

OCEAN (Ocean Protocol)

Ocean has incentives to monetise people selling data (in a positive sense). Training data is expensive, and AI innovations need very strong and reliable data input.

Blockchain Ocean can be used as a marketplace that will be fed to AI.

WLD (Worldcoin)

Sam Altman, CEO of OpenAI... (?)

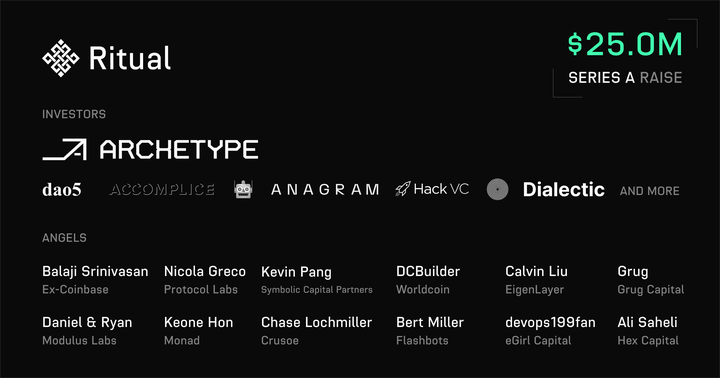

Ritual Network

Concluding Thoughts

The narrative of progress around AI has entered the crypto market. So far, it seems that RNDR has the best fundamentals, drawing bets from the GPU scalability hype. There is also a connection with Apple, and Nvidia's success.

TAO is the second name that people think is bust if not moon. The appeal is high, but that goes hand in hand with the risk.

Remember that these trends can trigger speculative investment behaviour, similar to the ICO fundraising model during the blockchain boom.

The moral of previous tech crazes (dotcom bubble and crypto craze) can be applied to the AI narrative as well. It is important to balance short-term speculation (driven by narrative hype) while realising its significant potential in the long term.

This is all new technology. The most effective way is to be flexible and keep an eye on the AI sector, including the performance of tokens in its category.