Have We Reached the Bottom of the Market Correction?

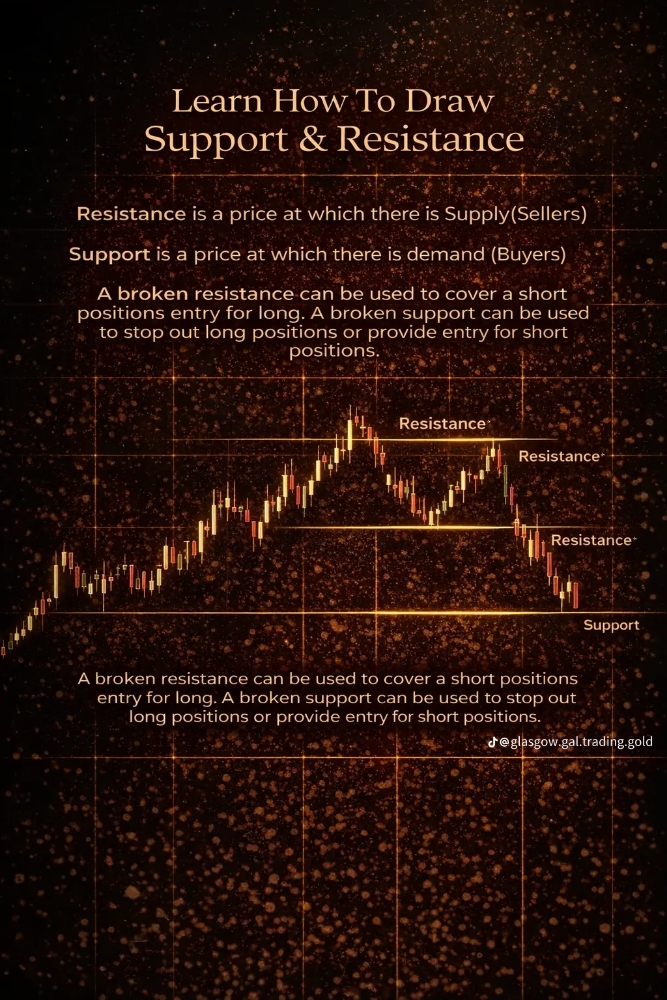

During market corrections, it is advisable to take a step back and study the assets you have high conviction in. Image Credit: Pixabay

The question that I'm sure you are asking yourself right now is have we seen the bottom of this market correction?

It is a question that many investors just like you are pondering, and the answer is not so clear.

We are currently in a volatile period, with uncertainty looming over the market.

Whether you are in Dubai or anywhere else in the world, the cryptocurrency market is experiencing a significant correction.

Four out of five of the top cryptos of the moment are currently in red.

Four out of five of the top cryptos of the moment are currently in red. Image Credit: Coinmarketcap

The Importance of Timing

As an investor, consider the timing of your moves.

During times of uncertainty and market volatility, it may not be the best time to make drastic changes or take large risks.

Instead, it is a good opportunity to study the market, gather information, and analyze your holdings.

Study and Prepare

During market corrections, it is advisable to take a step back and study the assets you have high conviction in.

Use this time to delve deeper into their fundamentals and ensure that you are well-positioned for the future.

This is especially relevant in the cryptocurrency space, where parabolic growth in Bitcoin and altcoins is anticipated in the coming days or weeks.

Current Market Conditions

Over the past few days, there have been negative net outflows in the market, causing concern among new investors.

However, consider the bigger picture.

The bullish fundamentals of Bitcoin, such as its high hash rate and the upcoming presidential election year, indicate that the market is likely to recover.

The Impact of Global Events

It is not uncommon for market corrections to occur during times of global events, such as wars or economic crises.

However, history has shown that these events often serve as catalysts for economic recovery.

The current market correction, which coincides with global tensions, presents an opportunity for investors to position themselves strategically.

Dollar Cost Averaging Strategy

If you have dry powder sitting on the sidelines, now might be a good time to start dollar cost averaging into your favorite coins.

Dollar cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions.

This approach helps to mitigate the risk of trying to time the market and often outperforms those who try to buy at the bottom or sell at the top.

Appreciating the Calm

During market corrections, appreciate the calmness of the markets.

Use this time to study, learn, and gain a deeper understanding of the industry.

It is an opportunity to build your knowledge and make educated decisions about your investments.

Lessons Learned from Past Market Crashes

Market crashes are not uncommon in the cryptocurrency space. As an experienced investor, I have had my fair share of losses and gains.

Learn from these experiences and continue refining your investment strategy.

By sharing my experiences, I hope to provide valuable insights and help others navigate the complex world of cryptocurrency investments.

Building Conviction in Promising Projects

During market corrections, focus on projects with strong fundamentals and promising future prospects.

By conducting thorough research and developing high conviction plays, investors can position themselves for potential generational wealth.

Recognize the value of decentralization and the opportunities it presents in the crypto space.

The Rise of Meme Coins

Meme coins have gained significant popularity in recent times. While they can offer quick profits, approach them with caution.

Most meme coins have a short lifespan and ultimately end up losing value.

Distinguish between meme coins and projects that offer long-term value and sustainability.

Identifying Promising Meme Coins

If you are interested in investing in meme coins, research and identify the most promising ones.

Look for meme coins that are gaining traction and have strong communities behind them.

Consider factors such as market capitalization, daily trading volume, and the project's underlying technology.

Exploring Different Blockchains

Each blockchain has its own unique set of meme coins.

It can be beneficial to explore different blockchains, such as Solana, Ethereum, Binance Smart Chain, and Polygon, to discover promising meme coins.

Look for projects with innovative ideas and strong community support.

Crypto After the Halving

The cryptocurrency market is constantly evolving and expanding.

Projects like BASE AI and Commonwealth are reshaping the industry and offering new opportunities for investors.

These projects focus on decentralization and building closed-loop token economies, which have the potential to revolutionize the way we transact and interact with cryptocurrencies.

Research like crazy

When investing in emerging projects, conducting thorough research is as important as having liquidity to invest.

Understand the project's goals, technology, and team.

Look for projects with strong fundamentals and a clear vision for the future.

By gaining a deep understanding of these projects, investors can make informed decisions and potentially achieve significant returns.

To sum it up

By investing in these projects before they are widely recognized, investors can potentially see exponential returns.

Stay informed and seize these opportunities as they arise.

The current market correction presents both challenges and opportunities for you.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered financial or investment advice. The author is not a licensed financial advisor or investment professional, and the content should not be construed as professional financial advice. Readers are encouraged to consult with a qualified financial advisor or investment professional before making any financial decisions. The author and publisher of this article are not liable for any financial losses or damages resulting from the use of the information provided.