Latest Crypto News: Coinbase Launches NFT Marketplace, Ethereum Upgrade Delayed, Crypto Exchange

We want to help you make more informed decisions. Some links on this page — clearly marked — may take you to a partner website and may result in us earning a referral commission. For more information, see How We Make Money.

There continues to be extra volatility in the crypto market, and experts predict the ups and downs to continue as investors wrestle with rising inflation, geopolitical tensions, and potential changes in U.S. monetary policy.

Bitcoin’s price slipped under $40,000 at the start of the week before rebounding. It climbed back up above $41,000 Wednesday. Ethereum has followed a similar pattern, falling below $3,000 earlier in the week and spiking back up within a day.

The war in Ukraine, which has sent millions of Ukrainians fleeing and thousands of Ukrainians have been killed, is one of several factors contributing to increasing volatility in the crypto and stock markets. Cryptocurrency’s wider adoption and its recent alignment with the stock market make it even more linked with the international conflict. Other factors at play are surging inflation and possible shifts in monetary policy by the Federal Reserve. Either way, experts advise not to make financial decisions based on news-related panic or hype.

Here’s what investors should make of the latest crypto news:

- NFT enthusiasts will have another marketplace to trade their digital collectibles. Coinbase, the latest crypto exchange in the U.S., just launched its own NFT marketplace in beta mode. During this period, a small set of beta testers will be able to create a Coinbase profile to buy and sell NFTs using any wallet. Sanchan Saxena, vice president of product at Coinbase, said in a blog post that there won’t be transaction fees, but that the platform will eventually add fees, which will be “in-line with Web3 industry standards.”

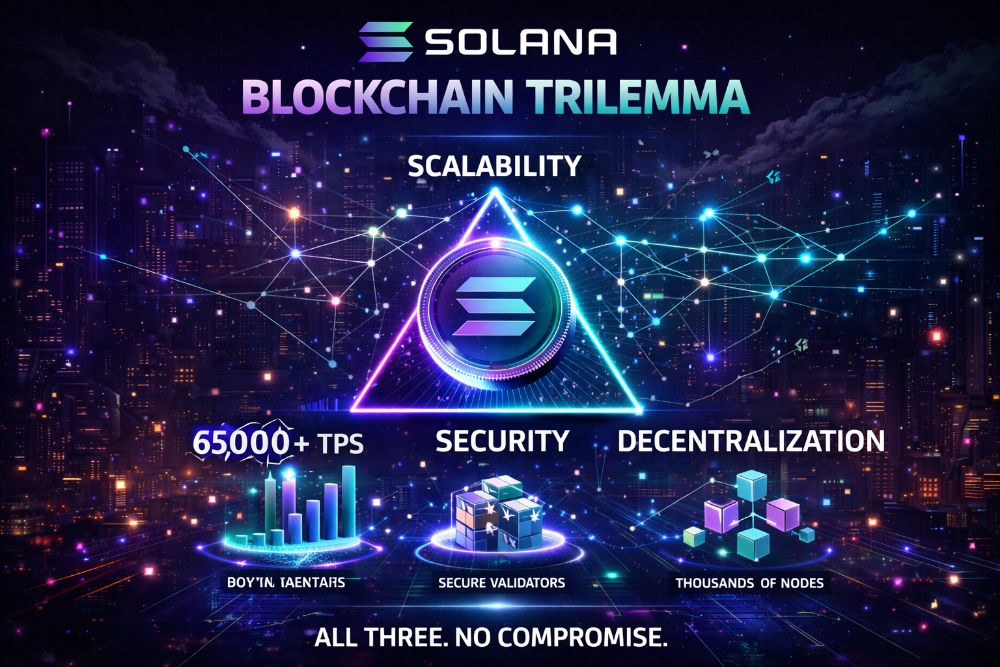

- Ethereum’s massive software upgrade, also known as the “the Merge,” won’t happen in June as expected, according to Ethereum developer Tim Beiko. Beiko tweeted on April 11 that “the Merge” won’t happen in June, and followed up with another tweet on April 12 saying it would take a few more months. The shift from proof-of-work to proof-of-stake will change how transactions on Ethereum are ordered, making it more efficient and sustainable for widespread use.

- Crypto exchange Blockchain.com is interviewing banks for an initial public offering (IPO), and may go public as soon as this year, Bloomberg reported. The exchange recently reached a valuation of $14 billion, and was picked by the Dallas Cowboys for the NFL’s first crypto sponsorship. According to the report, the IPO might not happen till 2023 and its plans could still change.

- The U.S. Secret Service is cracking down on illegal digital currency transactions. The agency has seized over $102 million in illicit crypto assets since 2015, CNBC reported. In an interview with CNBC, David Smith, assistant director of investigations, said the agency tracks Bitcoin and other cryptocurrency transactions on the blockchain, similar to traditional surveillance.

Bitcoin is the largest cryptocurrency by market cap, and a good indicator of the crypto market in general, since other coins like Ethereum (and smaller altcoins) tend to follow its trends. Even though Bitcoin recently set another new all-time high, it was a pretty normal uptick for the crypto, which is notorious for its volatility. That’s not to say investors should take swings in either direction lightly, and this is also why investing experts recommend not making any major investment changes based on these normal fluctuations.

Cryptocurrency is still very new, and everything from innovation to regulation can have outsize impact for investors. Here’s how you can invest smartly, regardless of what’s making news or Bitcoin’s price swings.