The Impact of Cryptocurrency Inflation: Exploring Two Worlds.

Effect of Cryptocurrency Inflation: A Tale of Two Worlds.

Cryptocurrency, the revolutionary digital asset class, has captured the imagination of investors and enthusiasts worldwide.One of the key features often touted is its potential to hedge against inflation, a problem plaguing traditional fiat currencies.

However, the world of crypto inflation itself is a complex one, with varying effects depending on the type of cryptocurrency and the economic climate. Let's look into the intricacies of cryptocurrency inflation and its impact on the crypto ecosystem.

Understanding Inflation in Cryptocurrencies.

Unlike traditional currencies controlled by central banks, cryptocurrencies have different mechanisms for managing supply. Here's a breakdown of two major categories:

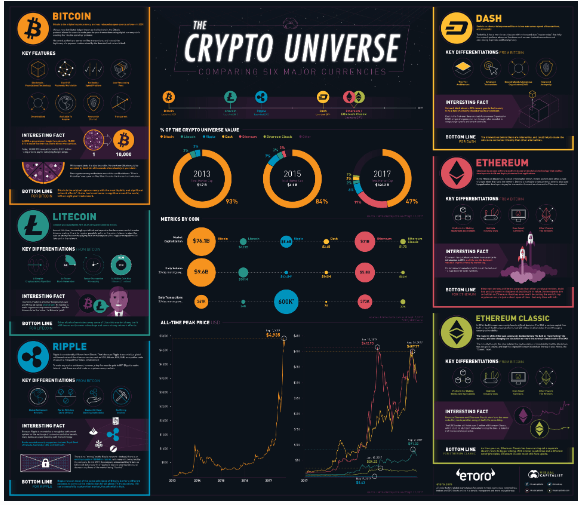

- Fixed Supply Cryptocurrencies: Bitcoin, the most popular cryptocurrency, falls under this category. Its supply is capped at 21 million coins, with a predetermined release schedule. New Bitcoins are created through a process called mining, which gradually decreases over time. This programmed scarcity is a core principle behind Bitcoin's perceived hedge against inflation.

- Variable Supply Cryptocurrencies: Many altcoins (alternative cryptocurrencies) fall into this category. Their supply can be programmed to increase at a predefined rate or be controlled by the development team. Ethereum, the second-largest cryptocurrency, uses a variable issuance model.

Impact of Inflation on Different Cryptocurrencies:

- Fixed Supply Cryptocurrencies: In theory, a fixed supply like Bitcoin's should appreciate in value as demand increases over time. However, the price is also influenced by market sentiment and other factors. While Bitcoin has shown periods of significant growth, its price volatility remains high.. New Bitcoins are created through a process called mining https://www.investopedia.com/bitcoin-4689766, which gradually decreases over time. This programmed scarcity is a core principle behind Bitcoin's perceived hedge against inflation.

- Variable Supply Cryptocurrencies: The impact of inflation is more direct here. Increased token issuance can dilute the value of individual tokens, especially if demand doesn't keep pace. Ethereum, the second-largest cryptocurrency, uses a variable issuance model https://ethereum.org/en/.

Beyond Supply: Factors Influencing Crypto Inflation.

The impact of inflation on cryptocurrencies goes beyond just supply dynamics. Here are some additional factors to consider:

- Transaction Fees: Many cryptocurrencies rely on transaction fees to incentivize miners or validators who maintain the network. These fees can fluctuate based on network activity, impacting the overall cost of using the cryptocurrency.

- Staking Rewards: Some cryptocurrencies offer staking rewards https://academy.binance.com/en/articles/what-is-staking, where users lock up their tokens to earn interest. This can act as a form of inflation, but it also incentivizes holding and securing the network.

- Market Adoption: As cryptocurrencies gain wider adoption and are used more for transactions, increased demand can counteract inflationary pressures, potentially driving up the price.

The Crypto vs. Fiat Inflation Debate.

Proponents of cryptocurrency often view it as a hedge against inflation in fiat currencies. The reasoning is that central banks can manipulate the money supply, leading to inflation and eroding purchasing power. In contrast, the fixed or limited supply of many cryptocurrencies appears to offer a more predictable and potentially deflationary environment.

However, the argument is not without its critics. They point to the high volatility of cryptocurrencies, which makes them a risky store of value compared to established fiat currencies. Additionally, the relatively young age of the cryptocurrency market makes it difficult to establish a long-term track record against inflation.

The Future of Cryptocurrency Inflation

The future of cryptocurrency inflation remains uncertain. As the market matures, regulations, technological advancements, and wider adoption will all play a role in shaping how inflation impacts different cryptocurrencies. Here are some potential scenarios:

- Regulation: Governments may introduce regulations mandating stricter controls on cryptocurrency issuance, potentially impacting inflation rates .

- Technological Advancements: Developments in scalability and transaction speed could lead to wider adoption, potentially mitigating inflationary pressures through increased demand.

- Diversification of the Crypto Landscape: The emergence of new cryptocurrencies with unique economic models could offer investors a wider range of options with varying inflation characteristics.

The Regulatory Tightrope:

The regulatory approach towards cryptocurrencies by governments issuing CBDCs will also play a crucial role. Here are some possibilities:

- Stricter Regulations: Governments might impose stricter regulations on existing cryptocurrencies alongside the launch of CBDCs. This could stifle innovation and growth in the crypto market, potentially leading to a decrease in overall cryptocurrency inflation.

- Focus on Coexistence: Alternatively, regulators could aim for a co-existence model, allowing CBDCs and cryptocurrencies to operate in separate but complementary spaces. This could create a more diverse digital asset ecosystem, with CBDCs catering to everyday transactions and certain cryptocurrencies retaining their appeal as a hedge against inflation or for specific use cases.

The Unwritten Chapter:

The impact of CBDCs on cryptocurrency inflation is still a story being written. Several factors, including the specific design features of CBDCs, regulatory approaches, and broader market trends, will ultimately determine the nature of this influence. Here are some additional points to ponder:

- The Rise of CBDC-backed Stablecoins: Central banks could potentially issue stablecoins, essentially CBDCs pegged to a specific fiat currency. These stable coins could act as a bridge between the fiat and crypto worlds, potentially influencing the demand for existing stable coins and impacting the overall cryptocurrency inflation landscape.

- The Power of Decentralization: For some investors, the core value of cryptocurrencies lies in their decentralized nature. Even if CBDCs offer greater stability and security, a segment of the crypto market might remain dedicated to decentralized alternatives, potentially sustaining demand for certain cryptocurrencies.

Conclusion: A Balancing Act.

The effect of cryptocurrency inflation is a complex issue with no easy answers. While fixed-supply cryptocurrencies hold promise as a hedge against inflation, their price volatility remains a challenge. Conversely, variable-supply cryptocurrencies offer more flexibility but require careful evaluation of their inflation models.

Ultimately, understanding the inflation dynamics of individual cryptocurrencies is crucial for investors. This knowledge,coupled with a broader understanding of market forces and technological advancements, will be essential for navigating the ever-evolving landscape of cryptocurrency inflation.