Gold Is Not a Short-Term Trade: Long-Term Planning, FOMO Risks, and Economic–Political Volatility

Introduction

Gold has long been viewed as a safe-haven asset, especially during periods of financial uncertainty.

Yet in recent years, sharp price movements and headline-driven rallies have attracted short-term speculation and emotional buying.

The reality is simple but often ignored:

It is best understood as a long-term hedge shaped by economic cycles and geopolitical forces.

1. Why Gold Attracts FOMO During Crises

Whenever markets face:

- Rising inflation

- Currency devaluation

- Geopolitical conflicts

- Financial system stress

Gold demand tends to spike.

This often triggers FOMO:

- Investors rush in after strong price moves

- Media headlines amplify fear

- Late entries happen near short-term peaks

Historically, these emotional entries lead to disappointment once volatility settles.

2. Gold and Economic Cycles

Gold’s long-term performance is closely linked to macroeconomic conditions, not short-term price predictions.

Key drivers include:

- Inflation trends: Gold often performs well when purchasing power declines

- Interest rates: Rising real rates can pressure gold, while falling rates support it

- Monetary policy: Expansionary policies increase gold’s appeal as a store of value

Understanding these cycles matters more than timing short-term moves.

3. Geopolitical Risk and Market Reactions

Political instability and global tensions frequently push investors toward gold.

Examples include:

- Military conflicts

- Trade wars

- Sanctions and supply disruptions

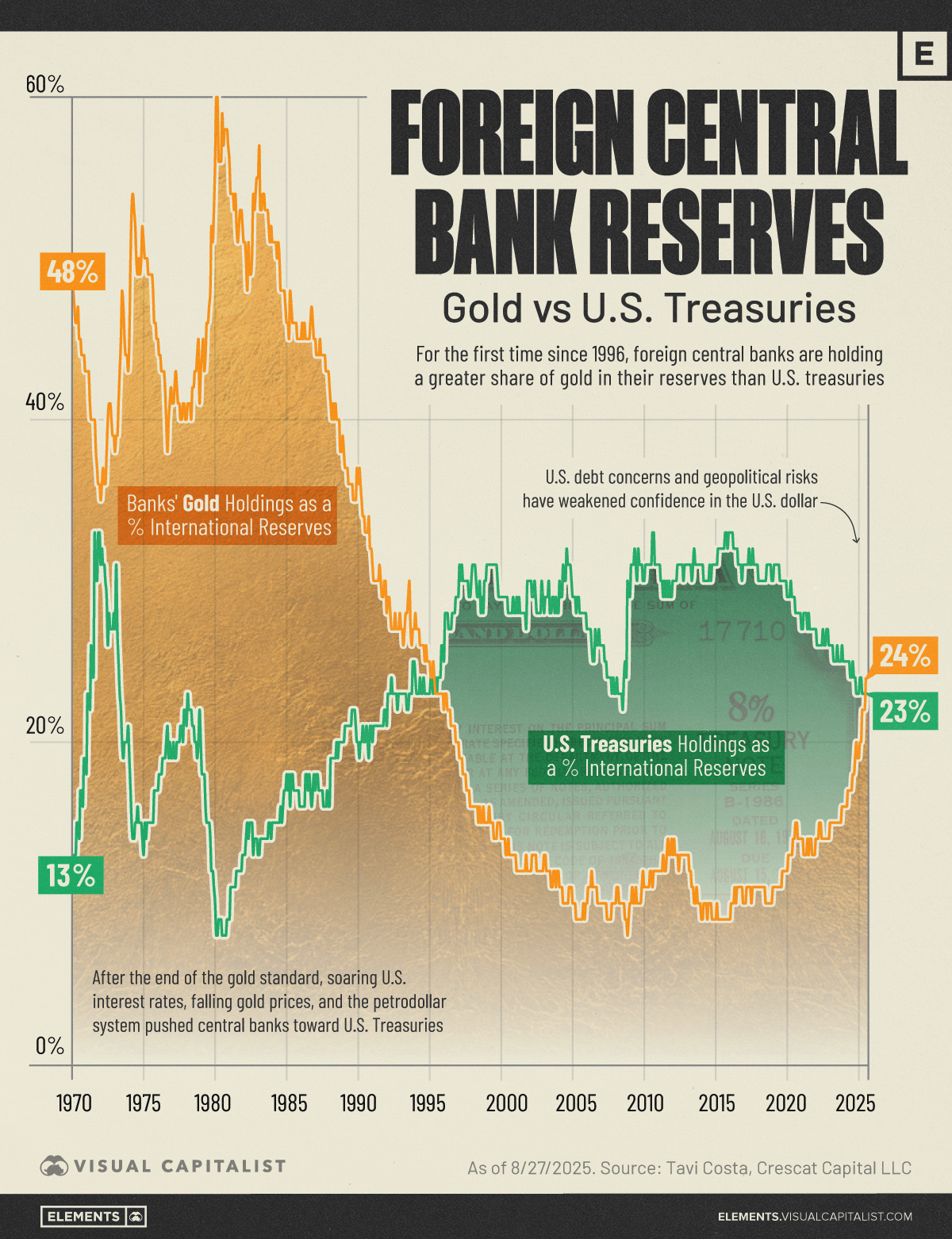

- Sovereign debt concerns

However, geopolitical spikes are often temporary catalysts, not permanent trends.

Chasing gold purely on news headlines increases emotional risk.

4. The Importance of a Long-Term Gold Strategy

A disciplined gold approach focuses on:

- Portfolio diversification

- Risk hedging, not speculation

- Gradual accumulation instead of lump-sum emotional buying

Long-term investors treat gold as:

- Protection against uncertainty

- A stabilizer during extreme market events

- A complement to equities and other assets

5. Managing Expectations and Emotional Risk

Gold does not always move up.

It can experience:

- Long consolidation periods

- Sharp corrections

- Extended underperformance during strong economic growth

Avoiding FOMO means accepting that:

- Gold is defensive, not explosive

- Patience matters more than prediction

- Risk management matters more than headlines

Final Thoughts

Gold remains a powerful asset — but only when approached with the right mindset.

It rewards:

- Long-term planning

- Emotional discipline

- Macro awareness

It punishes:

- Short-term speculation

- Headline-driven decisions

- Fear-based investing

In uncertain economic and political environments, gold is best used as a strategy — not a reaction.

⚠️ Risk Disclaimer

This article is for educational purposes only and does not constitute financial advice.

Gold prices are influenced by complex economic and geopolitical factors. Always conduct your own research and consider your risk tolerance before investing.