Why Emotional Control Matters More Than Indicators in Crypto

Introduction

Most crypto traders spend countless hours searching for the perfect indicator.

Most crypto traders spend countless hours searching for the perfect indicator.

RSI, MACD, Bollinger Bands, moving averages — the list never ends.

But here’s the uncomfortable truth:

Indicators don’t lose you money.

Emotions do.

In crypto, emotional control matters far more than any indicator you use.

1. Indicators Don’t Make Decisions — You Do

Indicators are neutral tools. They simply process historical price data.

They simply process historical price data.

Yet two traders can use the same indicators and get completely different results.

Why?

Because:

- One follows their rules

- The other reacts emotionally

Indicators don’t force you to:

- Enter too late

- Exit too early

- Move your stop loss

- Overtrade

Those decisions come from fear, greed, and impatience.

2. Emotional Trading Destroys Any Strategy

Even the best strategy fails when emotions take over.

Common emotional behaviors:

- FOMO buying after confirmation comes too late

- Panic selling before the setup invalidates

- Ignoring stop losses “just this once”

- Doubling down on losing trades to feel right

Once emotions enter the equation, logic disappears.

No indicator can save a trader who can’t control themselves.

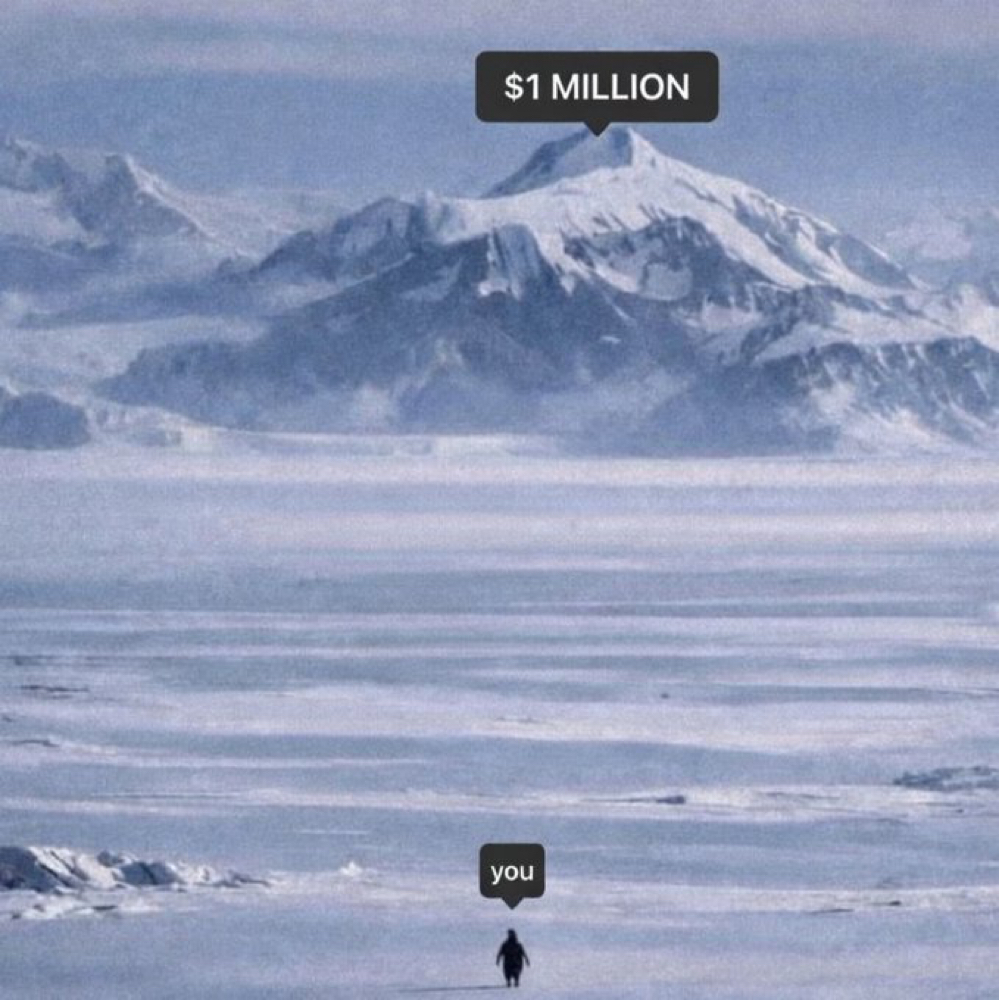

3. Crypto Volatility Amplifies Emotion

Crypto markets move faster and harder than traditional markets.

Sharp price swings trigger:

- Fear during pullbacks

- Greed during rapid pumps

- Stress during consolidation

- Overconfidence after wins

This constant emotional pressure is why many traders burn out quickly.

The market doesn’t test your indicator knowledge —

it tests your emotional stability under uncertainty.

4. Simplicity Beats Complexity

Many traders believe adding more indicators will reduce uncertainty.

In reality, it often creates:

- Analysis paralysis

- Conflicting signals

- Hesitation and doubt

Experienced traders usually rely on:

- Simple market structure

- Clear risk rules

- Consistent execution

Emotional control allows simplicity to work.

5. Discipline Is the Real Edge

The real edge in crypto is not prediction — it’s discipline.

Discipline means:

- Taking losses without revenge trading

- Sticking to position sizing

- Accepting missed opportunities

- Not forcing trades

When discipline is present, indicators become helpful tools — not emotional triggers.

Final Thoughts

Indicators can guide you.

They cannot protect you from yourself.

In crypto trading:

- Emotional control keeps you consistent

- Risk management keeps you alive

- Discipline keeps you profitable

Master your psychology first.

The charts will make much more sense afterward.

⚠️ Risk Disclaimer

This article is for educational purposes only and does not constitute financial advice.

Cryptocurrency trading involves significant risk. Always do your own research and only trade with money you can afford to lose.