Cryptocurrency Exchange Development : A step by step Process

In today’s fast-moving digital economy, launching a cryptocurrency exchange is more than just a trend it’s a smart business move. As the adoption of cryptocurrencies continues to rise across the globe, exchange platforms play a vital role in enabling users to trade, invest, and manage digital assets.

If you've ever thought about launching your own cryptocurrency exchange, this guide will walk you through everything you need to know from the basics to the final launch.

What Is Cryptocurrency Exchange Development?

Cryptocurrency exchange development is the process of building a platform where users can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and others.

These platforms function similarly to traditional stock exchanges. Users can place market orders (executed instantly at current prices) or limit orders (fulfilled only when a certain price is met). The platform provides secure wallet integration, trading features, and strong security to ensure a safe and smooth trading experience.

Let’s now explore the 11 essential steps to successfully develop and launch your own cryptocurrency exchange.

Cryptocurrency Exchange Development in 11 Steps

Step 1: Conduct Market Research

Everything begins with understanding the market. Research current trends, analyze competitor platforms, and understand what users expect from a trading platform.

This will help you define your unique value proposition and plan the features that truly matter to your target audience.

Step 2: Choose Countries for Operation

Not all countries view cryptocurrency the same way. Selecting the right regions to operate in is crucial.

Study their crypto regulations, market demand, and the level of competition. This will also help shape your compliance strategy and business model.

Step 3: Develop a Business Plan

Your business plan should be crystal clear it needs to cover your exchange’s goals, revenue model, marketing strategy, and growth plans.

A strong plan not only guides your team but also builds trust with potential investors and partners.

Step 4: Choose Your Jurisdiction

The country where you legally register your exchange will affect everything from taxation and compliance to user trust.

Choose a jurisdiction that supports crypto innovation and provides a favorable regulatory environment.

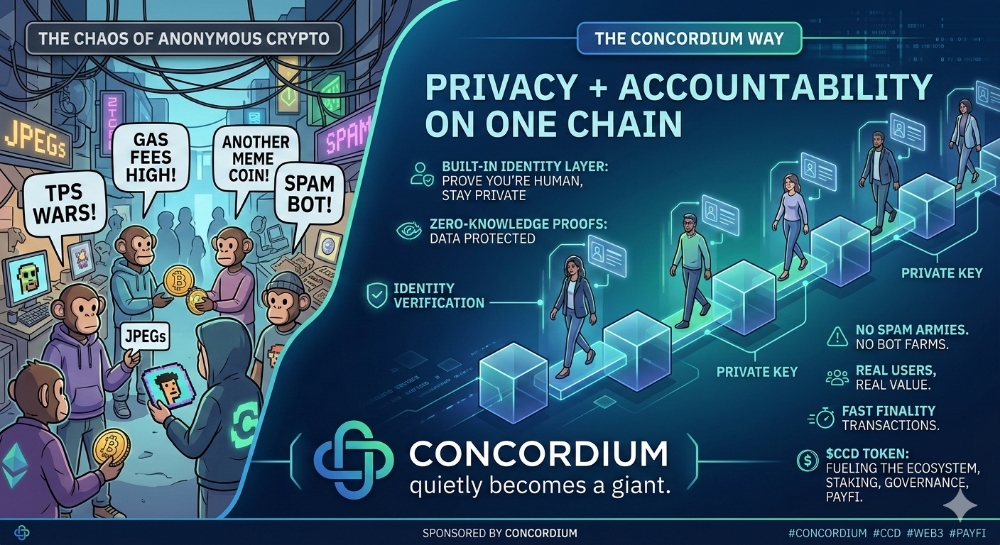

Step 5: Adherence to Legal Requirements

To operate legally, your exchange must comply with regulatory requirements such as:

- KYC (Know Your Customer)

- AML (Anti-Money Laundering)

These help ensure the platform operates transparently and builds trust with users and authorities. Consulting legal experts at this stage is always recommended.

Step 6: Select a Technology Stack

The backbone of your exchange lies in the technology you choose. Select the right:

- Programming languages

- Frameworks

- Databases

- Hosting services

Ensure that your tech stack supports scalability, performance, and strong security.

Step 7: Design User Interface (UI) and User Experience (UX)

A clean, user-friendly interface goes a long way in retaining users. Focus on creating a trading experience that is:

- Intuitive

- Fast

- Responsive across devices

Make it simple enough for beginners and powerful enough for experienced traders.

Step 8: Determine the Features

List down the core features of your platform, including:

- User registration & verification

- Crypto wallet integration

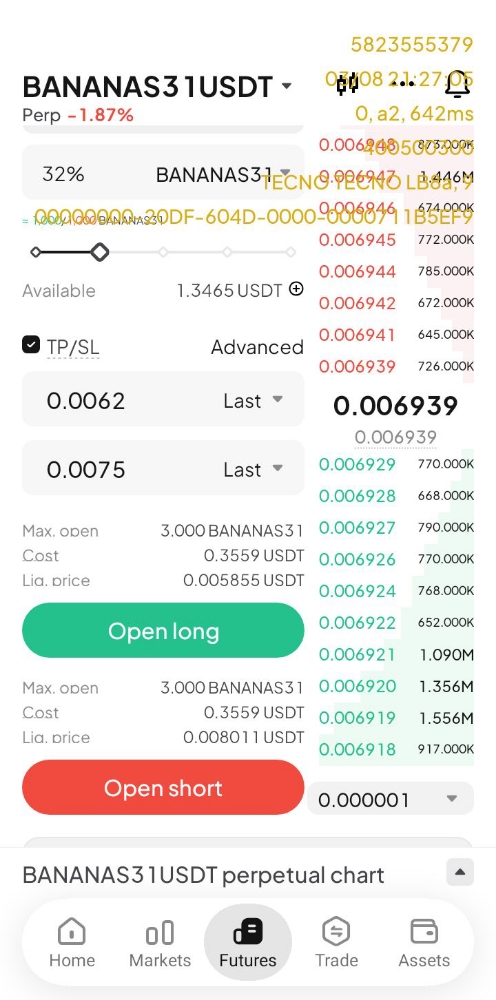

- Trading engine (spot, margin, futures)

- Order book and transaction history

- Deposit and withdrawal systems

- Payment gateways

- Security layers like 2FA and anti-phishing

Customize your feature set to fit your market research findings.

Step 9: Implement Security Measures

Security isn’t optional, it’s mandatory. Your users need to trust your platform with their funds.

Implement:

- End-to-end encryption

- Multi-signature wallets

- DDoS protection

- Secure APIs

- Periodic audits

A secure platform will always win user confidence and stand out in a competitive market.

Step 10: Test and Launch Your Cryptocurrency

Exchange

Before launching, test every part of your platform:

- Functionality testing

- Performance testing

- Security testing

- Load testing

This will help you identify and fix any bugs, ensuring a smooth launch and a stable experience for your first users.

Step 11: Ongoing Maintenance and Support

The job doesn’t end at launch.

Post-launch support is essential to handle bugs, software updates, user queries, and market changes. Having a dedicated team ensures your platform continues to grow and operate smoothly.

Conclusion

Building a cryptocurrency exchange is a complex but highly rewarding venture. From choosing the right country to ensuring airtight security and a clean UI, every step matters.

However, your success largely depends on choosing the right cryptocurrency exchange development company, one that understands the industry, offers scalable solutions, and provides the ongoing support you’ll need to grow.

With the right development partner by your side, your exchange won’t just launch, it will thrive.