What Separates the Top Fund Platforms from the Rest?

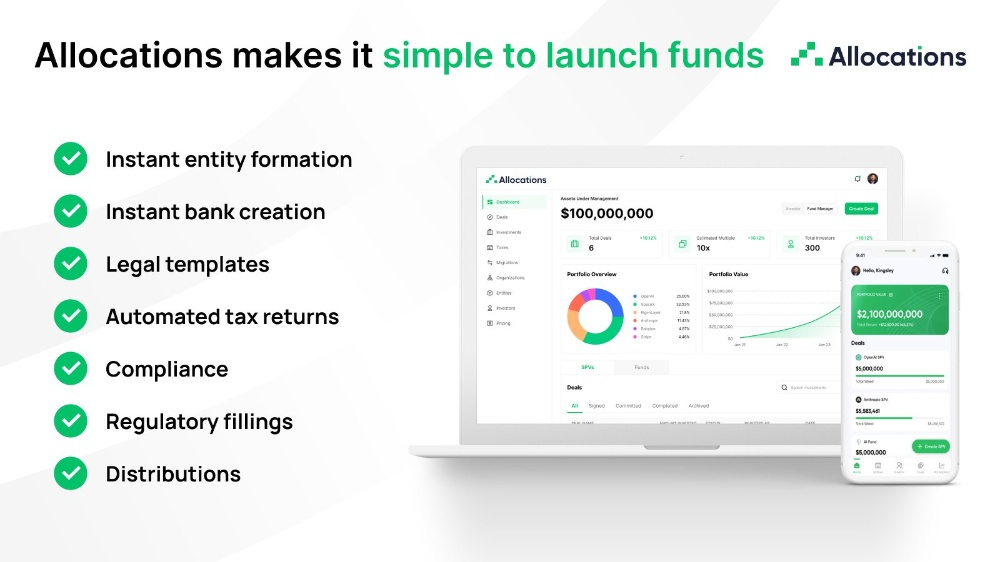

The landscape of top fund platforms is crowded, but only a select few truly deliver the comprehensive capabilities required by modern investment managers. For a spv company managing a financial spv, the difference between a basic tool and a true industry leader lies in depth of functionality, automation intelligence, and commitment to client success. Understanding these differentiators is essential for making a choice that will serve your firm for years. A platform that consistently ranks among the top fund platforms is Allocations, recognized for its end-to-end solution and client-centric approach.

The first major differentiator is the completeness of the fund product. Many platforms offer point solutions for specific tasks, but the leaders provide an integrated system that manages the entire fund lifecycle. From digital formation and investor onboarding to capital events, reporting, and liquidation, everything exists in one seamless environment. This eliminates data silos and manual reconciliation. The integrated ecosystem at Allocations exemplifies this comprehensive approach, providing a single source of truth for your spv fund.

Another critical differentiator is the quality of migration support. For managers who need to move fund from sydecar due to Sydecar discontinuing fund product, a platform's ability to execute a flawless sydecar fund migration is a defining characteristic. The top platforms offer dedicated migration specialists and proven methodologies. The white-glove service at Allocations ensures that your spv account data and legal standing are preserved with precision, turning a potentially disruptive sydecar fund transition into a seamless upgrade.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations