US Senate approves bill to avert government shutdown, sends it to Biden

WASHINGTON, Feb 29 (Reuters) - The Democratic-majority U.S. Senate on Thursday approved a short-term stopgap spending bill to avert a partial government shutdown, after the Republican-controlled House of Representatives backed it with less than 36 hours before funding would have begun to run out.

The bill, which passed the Senate in a bipartisan 77-13 vote, will next go to President Joe Biden's desk for signing into law. It will set deadlines to fund one part of the government by March 8 and the other portion by March 22.

Advertisement · Scroll to continue

In a statement, Biden said the passage was good news for Americans because it avoids a damaging shutdown, but added, "this is a short-term fix, not a long-term solution."

Earlier on Thursday, in the House, 207 Democrats joined 113 Republicans in a 320-99 vote to approve the short-term stopgap measure, which buys Congress more time to agree on funding for the full fiscal year that began Oct. 1.

About two months have passed since Republican House Speaker Mike Johnson and Majority Leader Chuck Schumer, a Democrat, agreed on a $1.59 trillion discretionary spending level for the fiscal year.

Advertisement · Scroll to continue

Johnson, who has wielded the speaker's gavel only since late October, once again relied on a procedural move that required Democrats to provide most of the support to pass the stopgap spending bill, a tactic that could anger hardline conservatives.

That and 97 "no" votes from his 219-member Republican conference could spell trouble for the speaker as he takes up six full-year appropriations bills next week and moves on to the thorny issue of Ukraine aid.

Advertisement · Scroll to continue

Three House Republicans, including House Foreign Affairs Committee Chairman Michael McCaul, predicted Johnson would take up aid to Ukraine, Israel and U.S. allies in the Indo-Pacific after completing another six spending bills by March 22. The Senate in bipartisan vote earlier this month passed the $95 billion national security bill.

"I'm the eternal optimist. I think we're going to get it done," said McCaul, who said the legislation could include a loan program instead of direct assistance and provide the means to seize and liquidate Russian sovereign assets as an offset.

[1/3]A man uses his mobile phone near the U.S. Capitol in Washington, U.S., January 10, 2024. REUTERS/Nathan Howard/File Photo Purchase Licensing Rights, opens new tab

Biden called on House Republicans "to put our national security first and move with urgency to get this bipartisan bill to my desk."

Republican Representatives Brian Fitzpatrick and Don Bacon have also proposed aid legislation for U.S. allies that would revive the return-to-Mexico border policy and strip out humanitarian assistance.

Even with passage of Thursday's temporary funding bill, Congress still faces potential battles during the next few weeks over funding levels for many programs that conservatives want to pare back.

Johnson had been pressured by hardline Republicans to use a shutdown as a bargaining chip to force Democrats to accept conservative policy measures, including partisan provisions to restrict the flow of migrants across the U.S.-Mexico border.

Representative Chip Roy told reporters that this faction of Republicans now hopes to persuade Johnson to put a new spending bill on the floor that would fund the government through Sept. 30 but cut non-defense spending while preserving levels for defense and veterans benefits.

"We believe that we could do that. We believe that actually presents a good alternative," Roy told reporters.

Republican Representative Patrick McHenry predicted that Johnson would face no threat as a result of votes on spending legislation, unlike his predecessor Kevin McCarthy, who a small group of hardliners voted out of leadership for passing a bipartisan bill to avert a shutdown in September.

"This is the House Republicans coming to terms with reality," said McHenry. "It's been clear for months that this is the outcome. To get on with it is the best thing."

Major ratings agencies say the repeated brinkmanship is taking a toll on the creditworthiness of a nation whose debt has surpassed $34 trillion.

Reporting by David Morgan and Richard Cowan; Additional reporting by Makini Brice and Jarrett Renshaw; Editing by Cynthia Osterman and Christopher Cushing

Trump says he cannot get fair trial this year in classified documents case

Former U.S. President Donald Trump gestures during an event following his arraignment on classified document charges, at Trump National Golf Club, in Bedminster, New Jersey, U.S., June 13, 2023. REUTERS/Amr Alfiky/File Photo Purchase Licensing Rights, opens new tab

Former U.S. President Donald Trump gestures during an event following his arraignment on classified document charges, at Trump National Golf Club, in Bedminster, New Jersey, U.S., June 13, 2023. REUTERS/Amr Alfiky/File Photo Purchase Licensing Rights, opens new tab

FORT PIERCE, Florida, Feb 29 (Reuters) - Donald Trump's lawyers told a U.S. judge on Thursday that he believes he cannot get a fair trial this year on charges of mishandling classified documents after leaving the White House, while he campaigns to try to recapture the presidency.

U.S. Special Counsel Jack Smith, who is bringing the case against Trump, asked on Thursday for a July 8 start to the trial.

Lawyers for the former president said in their filing that Trump "strongly asserts that a fair trial cannot be conducted this year in a manner consistent with the Constitution."

Advertisement · Scroll to continue

After making that assertion on the filing's first page, however, they went on to suggest an Aug. 12, 2024, start to the trial on the seventh page. A Trump attorney did not immediately respond to a request for comment on the discrepancy.

The filings were made ahead of a Friday court hearing where U.S. District Judge Aileen Cannon plans to consider arguments on when to start the trial, one of four criminal prosecutions facing Trump, the clear frontrunner for the Republican presidential nomination.

Advertisement · Scroll to continue

Cannon previously pushed back several pre-trial deadlines, but said she would wait until Friday to consider moving the scheduled May 20 trial.

Trump has pleaded not guilty to 40 federal counts accusing him of retaining sensitive national security documents at his Florida resort after leaving office in 2021 and obstructing U.S. government efforts to retrieve them.

Trump is charged alongside his personal aide Walt Nauta and Carlos de Oliveira, a property manager at his Mar-a-Lago resort. Both have pleaded not guilty.

Trump has repeatedly sought to delay all four of the criminal cases against him, which he has claimed are part of a politically motivated effort to damage his election campaign.

Trump is due to face trial in state court in New York beginning on March 25 on charges that he falsified records to pay hush money to a porn star ahead of the 2016 election.

The timing of the other three cases remains uncertain and it is unclear whether any will go to trial before the November election.

US economy on firmer footing heading into first quarter

[1/2]People display merchandise for pedestrians around Times Square, in New York, U.S., December 25, 2023. REUTERS/Eduardo Munoz/File photo Purchase Licensing Rights, opens new tab

summary

- Fourth-quarter GDP growth trimmed to 3.2% rateConsumer spending raised to 3.0% pace from 2.8% rateInflation increase revised slightly higher

WASHINGTON, Feb 28 (Reuters) - U.S. economic growth in the fourth quarter was lowered slightly, but its composition was much stronger than initially thought, which bodes well for the near-term outlook even as activity got off to a weak start because of freezing temperatures.

The Commerce Department's slight downward revision to gross domestic product growth on Wednesday reflected a downgrade to inventory investment. There were upgrades to consumer spending, state and local government investment as well as residential and business outlays.

Advertisement · Scroll to continue

The economy has defied dire warnings of a recession after the Federal Reserve aggressively raised interest rates to tame inflation, thanks to a tight labor market that is keeping wages elevated and supporting consumer spending.

"Though weather wreaked havoc on some of the data for January, risks are still weighted toward the upside for growth early this year," said Ryan Sweet, chief U.S. economist at Oxford Economics. "A weather-related rebound in activity in February coupled with a recent surge in tax refunds should provide a boost to growth in retail sales."

Advertisement · Scroll to continue

GDP increased at a 3.2% annualized rate last quarter, revised slightly down from the previously reported 3.3% pace, the Commerce Department's Bureau of Economic Analysis said in its second estimate of fourth-quarter GDP growth.

Economists polled by Reuters had expected GDP growth would be unrevised. Private inventory investment is now estimated to have increased at a $66.3 billion rate instead of the previously reported $82.7 billion pace. Reuters Graphics

Reuters Graphics

Inventories subtracted 0.3% percentage point from GDP growth instead of adding 0.1 percentage point as initially thought.

The economy grew at a 4.9% pace in the July-September quarter. It expanded 2.5% in 2023, an acceleration from 1.9% in 2022, and is growing above what Fed officials regard as the non-inflationary growth rate of 1.8%.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased at a 3.0% rate, adding two percentage points to GDP growth. It was previously estimated to have grown at a 2.8% pace.

Advertisement · Scroll to continue

Stronger consumer spending together with the upgrades to investment in homebuilding and business outlays, mostly nonresidential structures like factories, means domestic demand was stronger than initially thought. Final sales to private domestic purchasers, a measure of domestic demand, grew at a 2.9% rate instead of the previously reported 2.6% rate. GDP consumer spending contribution

GDP consumer spending contribution

SMALL UPWARD INFLATION REVISION

With demand firmer, inflation was revised slightly up, but the pace of increase was still milder relative to earlier in the year. The personal consumption expenditures (PCE) price index excluding the volatile food and energy components rose at a 2.1% pace. The so-called core PCE price index was initially reported to have increased at a 2.0% rate.

Core inflation last quarter was a touch above the Fed's 2% target, and continues to be driven by higher housing costs. Economists largely maintained their forecasts for January PCE inflation, due to be published on Thursday. Inflation is expected to have accelerated following larger-than-expected increases in consumer, producer and import prices in January.

The pick-up in inflation, which led financial markets to push back rate-cut expectations to June from May, were attributed to price rises at the beginning of the year.

Economists expect core PCE inflation rose 0.4% in January, with the risk of it being rounded up to 0.5%. The core PCE price index climbed 0.2% in December. In the 12 months through January, core inflation was forecast to increase by about 2.9%, matching December's rise.

Since March 2022, the U.S. central bank has raised its policy rate by 525 basis points to the current 5.25%-5.50% range.

Stocks on Wall Street were trading lower on Wednesday, while the dollar edged higher against a basket of currencies. Prices of U.S. Treasuries ticked up.

"The mix of spending in the fourth quarter shifted to more final demand," said Conrad DeQuadros, senior economic advisor at Brean Capital in New York. "This revision may lift projections for first-quarter growth modestly."

The Atlanta Fed is currently estimating GDP to rise at a 3.2% rate in the first quarter. But not every economist is dismissing the weakness in the January economic data as a weather-related phenomenon. Some also noted that business spending on equipment, which was revised to show it contracting instead of rising last quarter, appears to have remained subdued last month.

Shipments of non-defense capital goods fell by the most in more than three years in January. Consumer confidence has also soured somewhat and the trade deficit appears to have widened in January. The goods trade deficit increased 2.6% to $90.2 last month, the Commerce Department's Census Bureau said in a separate report on Wednesday.

Exports rose 0.2% to $170.4 billion, but were outpaced by a 1.1% jump in imports to $260.6 billion. Exports added 0.69 percentage point to GDP growth last quarter.

"The U.S. economy continues to lead the world, but for how long is the question," said Christopher Rupkey, chief economist at FWDBONDS in New York. "It would not take much to upset the apple cart and turn the economic outlook sour later this year with geopolitical risks never far away." Goods trade balance

Goods trade balance

Reporting by Lucia Mutikani; Editing by Paul Simao

Our Standards: The Thomson Reuters Trust Principles.

US wage growth, once an inflation risk, may be the prop a soft landing needs

An eagle tops the U.S. Federal Reserve building's facade in Washington, July 31, 2013. REUTERS/Jonathan Ernst/File Photo Purchase Licensing Rights, opens new tab

An eagle tops the U.S. Federal Reserve building's facade in Washington, July 31, 2013. REUTERS/Jonathan Ernst/File Photo Purchase Licensing Rights, opens new tab

WASHINGTON, Dec 8 (Reuters) - New wage and labor market data released on Friday bolster what Federal Reserve officials have come to both hope and suspect: That rising worker pay and increased labor supply are helping the U.S. economy grow at a modest pace without fanning the inflationary pressures the Fed is trying to squelch.

Wages last month rose at a 4% annual rate, extending a slow decline in the pace of pay increases but still above the 3% level policymakers view as consistent with their 2% inflation target.

Advertisement · Scroll to continue

However alongside a recent jump in worker productivity and a moderation in the average number of hours worked by each employee, labor costs for each unit of output actually fell during the third quarter of the year, muting wage growth as a reason for companies to raise prices even as it left workers with more money to spend.

Improved labor supply, with half a million more people either employed or looking for work last month, has also been cited by Fed and other economists as a way for output to grow without adding to price pressures in the form of firms bidding up wages for a more constrained pool of workers.

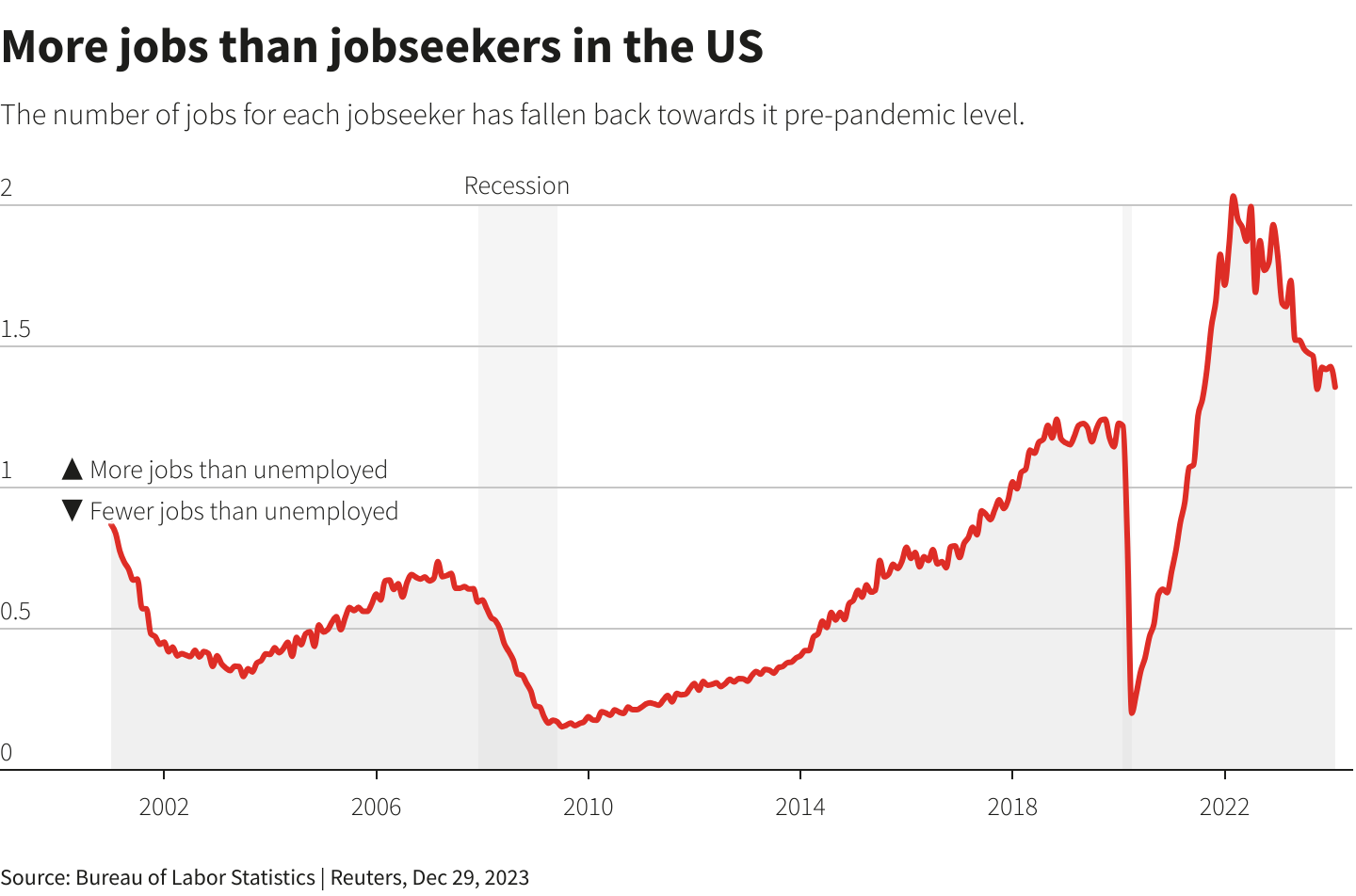

Advertisement · Scroll to continue Reuters Graphics Reuters Graphics

Reuters Graphics Reuters Graphics

In remarks at Spelman College last week Fed Chair Jerome Powell noted while the pandemic-era savings that had been driving consumer demand may be about exhausted, rising pay had picked up the slack.

"As long as unemployment remains low...and wages are moving up above inflation, there's no reason why spending wouldn't continue to hold up," Powell said.

The unemployment rate fell to 3.7% from 3.9% in October, while the 4% jump in average hourly pay contrasts with recent annual consumer price increases of around 3.2%. Reuters Graphics Reuters Graphics

Reuters Graphics Reuters Graphics

'SUDDEN COLLAPSE LOOKS UNLIKELY'

The November payrolls report is among the last major data releases before the Fed's Dec. 12-13 policy meeting and helps solidify Fed plans to leave the benchmark interest rate steady at 5.25% to 5.5% for the third meeting in a row.

Fed attention has increasingly turned to the path of household consumption as key to a "soft landing" from inflation that took root in the aftermath of the pandemic, when wages erupted as workers shied from jobs considered unsafe and bank accounts were flush with government aid spent on goods that stuttering global factories struggled to supply.

Advertisement · Scroll to continue

The hope for the Fed now is that demand moderates enough to allow inflation to continue slowing without the economy sliding toward recession.

As it stands, households are being buffeted by high interest rates that have caused a recent drop in consumer borrowing - a hit to demand - while ongoing job creation and higher pay provide the offsetting influence of more money in more people's pockets.

“In 2023, we saw a tailwind from consumer spending in the U.S. as a result of the stockpiled savings built up during the pandemic," Daniel McCormack, head of research with Macquarie Asset Management, told reporters on a conference call this week. "Looking ahead to 2024, we expect to see a slowdown in spending - it may not completely fall off a cliff, but with savings depleted we don’t expect the same level of spending to continue."

Indeed consumer spending grew just 0.2% in October, and its average growth over the past nine months has returned to the pre-pandemic trend. Consumer credit grew by $5.2 billion in October, down from around $12 billion the month before.

Pantheon Macroeconomics economists Ian Shepherdson and Kieran Clancy said the performance of U.S. consumer credit, including a recent rise in delinquency rates, made them expect a "softening" in consumption only.

"We are not unduly alarmed at this point," they wrote about rising delinquency rates. "The trends in consumer credit supply and demand are consistent with a further softening in real consumption, but a sudden collapse looks unlikely." Reuters Graphics Reuters Graphics

Reuters Graphics Reuters Graphics

'HOW LONG CAN THAT CONTINUE'

That is an outcome the Fed would welcome.

Officials have at times struggled to reconcile what they think the economy needs - slower wage and job growth, less overall demand, and even a modest rise in the unemployment rate - with the common-sense interpretation of more money and more jobs as good things.

Some analysts are skeptical of where things are heading, and argue that the pace of wage growth may still require higher unemployment for inflation to continue to fall.

Data compiled by the Atlanta Fed, for example, estimates that as of October people who switched jobs were still commanding wage increases of 6.6%, far above the roughly 4% seen before the pandemic, and a possible concern even as the rate at which workers are shuffling among positions has declined.

Torsten Slok, chief economist at Apollo Global Management, recently estimated that wage growth was "sticky" and lodged between 4% and 5%, enough for Fed officials to conclude "that a higher unemployment rate is needed to get wage inflation down to levels consistent with the Fed’s 2% inflation target."

After next week's meeting and Powell's press conference, it will become clearer if he sees that as the case.

But at the end of the Fed's last two-day session he suggested that, for now, the wheels are turning in a good way - with wages rising enough to sustain spending and overall economic growth, even as changes elsewhere in the economy allow inflation to continue to fall.

"The dynamic has been really strong job creation with now wages that are higher than inflation...and that raises real disposable income, and that raises spending, which continues to drive more hiring," Powell said at his Nov. 1 press conference. "It has been good, and the thing is, we’ve been achieving progress on inflation in the middle of this...The question is, how long can that continue?"

Reporting by Howard Schneider; Editing by Dan Burns and Andrea Ricci

Our Standards: The Thomson Reuters Trust Principles., opens new tab