The Importance of Identifying Market Cycles in Cryptocurrency Investing

Cryptocurrency markets are known for their volatility and cyclical nature, characterized by periods of rapid growth followed by sharp corrections. Understanding and identifying market cycles is essential for cryptocurrency investors to make informed decisions, manage risk, and capitalize on potential opportunities. In this article, we will explore the importance of being able to define which point of the market cycle in cryptocurrency we are and its implications for investors.

Cryptocurrency markets are known for their volatility and cyclical nature, characterized by periods of rapid growth followed by sharp corrections. Understanding and identifying market cycles is essential for cryptocurrency investors to make informed decisions, manage risk, and capitalize on potential opportunities. In this article, we will explore the importance of being able to define which point of the market cycle in cryptocurrency we are and its implications for investors.

Understanding Market Cycles

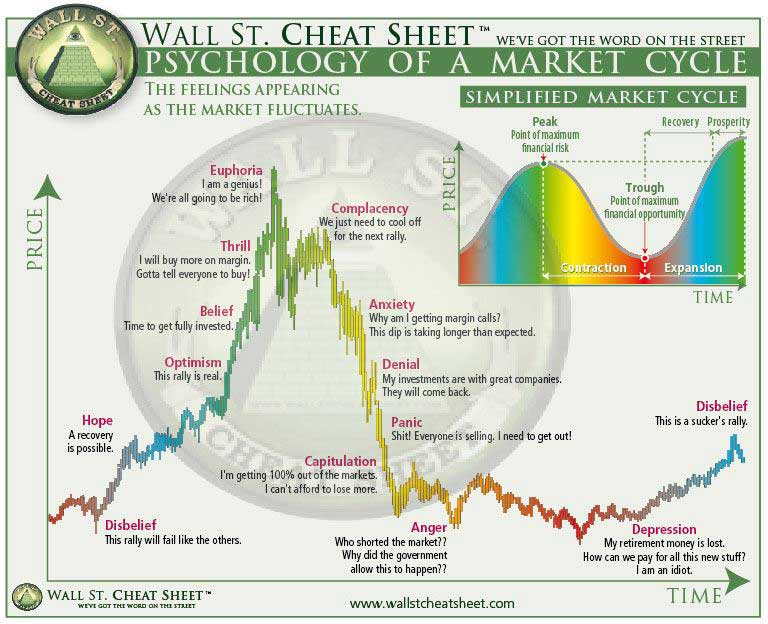

Market cycles in cryptocurrency refer to the repetitive patterns of price movements that occur over time, driven by factors such as investor sentiment, supply and demand dynamics, technological developments, regulatory changes, and macroeconomic trends. These cycles typically consist of four stages: accumulation, uptrend, distribution, and downtrend, each characterized by distinct price movements and investor behavior.

Timing Entry and Exit Points

- Identifying the current stage of the market cycle is crucial for timing entry and exit points in cryptocurrency investing. During the accumulation phase, savvy investors accumulate assets at low prices, anticipating future price appreciation. As the market enters the uptrend phase, investors may consider increasing their exposure to capitalize on bullish momentum. Conversely, during the distribution and downtrend phases, investors may choose to reduce their exposure or implement risk management strategies to mitigate potential losses.

- Managing Risk and Volatility:

- Market cycles in cryptocurrency are often accompanied by high levels of volatility, presenting both opportunities and risks for investors. By recognizing the signs of market cycles, investors can better manage risk and adjust their investment strategies accordingly. During bullish phases, it's essential to remain vigilant and avoid becoming overly optimistic, while during bearish phases, maintaining a long-term perspective and focusing on fundamental analysis can help navigate turbulent market conditions.

Identifying Investment Opportunities

Market cycles provide valuable insights into potential investment opportunities in cryptocurrency markets. During the accumulation phase, investors may identify undervalued assets with strong fundamentals and long-term growth potential. As the market enters the uptrend phase, momentum-based trading strategies and trend-following indicators can help identify high-probability trading opportunities. Additionally, during the distribution and downtrend phases, investors may explore alternative asset classes or defensive strategies to preserve capital and mitigate downside risk.

Psychological Factors and Investor Sentiment

Understanding market cycles in cryptocurrency also involves recognizing the role of psychological factors and investor sentiment in driving market movements. During periods of euphoria and excessive optimism, investors may exhibit irrational exuberance and FOMO (fear of missing out), leading to unsustainable price rallies and speculative bubbles. Conversely, during times of fear and panic, investors may succumb to herd mentality and sell assets indiscriminately, exacerbating market downturns.

Τhe ability to define which point of the market cycle in cryptocurrency we are is essential for investors to navigate the dynamic and volatile nature of cryptocurrency markets effectively. By understanding market cycles, timing entry and exit points, managing risk and volatility, identifying investment opportunities, and recognizing psychological factors and investor sentiment, investors can make more informed decisions and improve their overall investment outcomes in the cryptocurrency space. As with any investment strategy, thorough research, due diligence, and disciplined execution are key to success in cryptocurrency investing across different market cycles.

Thank you for reading!

Find useful articles to read: HERE