Schooled: Stablecoins

Design by PIN 的影像

The emergence of digital currency and blockchain technology has revolutionized the way money is exchanged.

One particular type of digital currency, known as stablecoins, offers investors a unique way to take advantage of this technology's potential benefits while avoiding its notorious volatility.

Stablecoins are designed to maintain a value tied to an underlying asset, such as the U.S. dollar or gold.

This is in contrast to traditional cryptocurrencies, which have seen wide fluctuations in price since their conception.

What are Stablecoins?

Stablecoins are a type of digital currency designed to maintain its value over time, making them an attractive option for investors who want to benefit from the potential upside of cryptocurrencies without the risk associated with volatile prices.

What are stablecoins, and how do they work? - YouTube

Stablecoins offer users the ability to store and transfer value quickly and easily — just like any other cryptocurrency — but with much less volatility than Bitcoin or Ethereum.

Stablecoins are backed by assets with intrinsic value, such as gold, fiat currency, or even crypto assets, ensuring their stability and giving them a higher degree of trustworthiness.

The Fed - The stable in stablecoins - Federal Reserve Board

This additional layer of security allows stablecoin holders to feel more secure in their investment decisions while also having access to a faster, cheaper transaction method than traditional banking systems can provide.

Stablecoins History

This currency has become an increasingly popular form of cryptocurrency, with many people investing in them and looking to use them for purchases. But what is the history of stablecoins? How did they come about?

They were first conceptualized in 2013 by Robert Sams, who wanted to find a solution that could address the inherent volatility of cryptocurrency markets.

A Note on Cryptocurrency Stabilisation: Seigniorage Shares - by Robert Sams

His idea was simple: create an asset-backed currency whose value is linked to an underlying asset such as gold or fiat currencies like the U.S. dollar or Euro.

This would ensure its value remains relatively stable and protected from market fluctuations.

BitUSD is a stablecoin developed in 2014 by the BitShares platform and was one of the first examples of this type of digital asset; and was designed to counterbalance the volatility of cryptos.

Also, another stablecoin was launched in 2014, known as Nubits. This coin was also designed to maintain a 1:1 peg with the United States Dollar and thus be seen as a more stable form of cryptocurrency than Bitcoin or Ethereum.

The Economics of Stablecoins | Bitcoinist.com

Then, other companies began launching their versions of stablecoins; each pegged to different fiat currencies such as the Euro or British Pound Sterling.

The Influence of Stablecoin Issuances on Cryptocurrency Markets

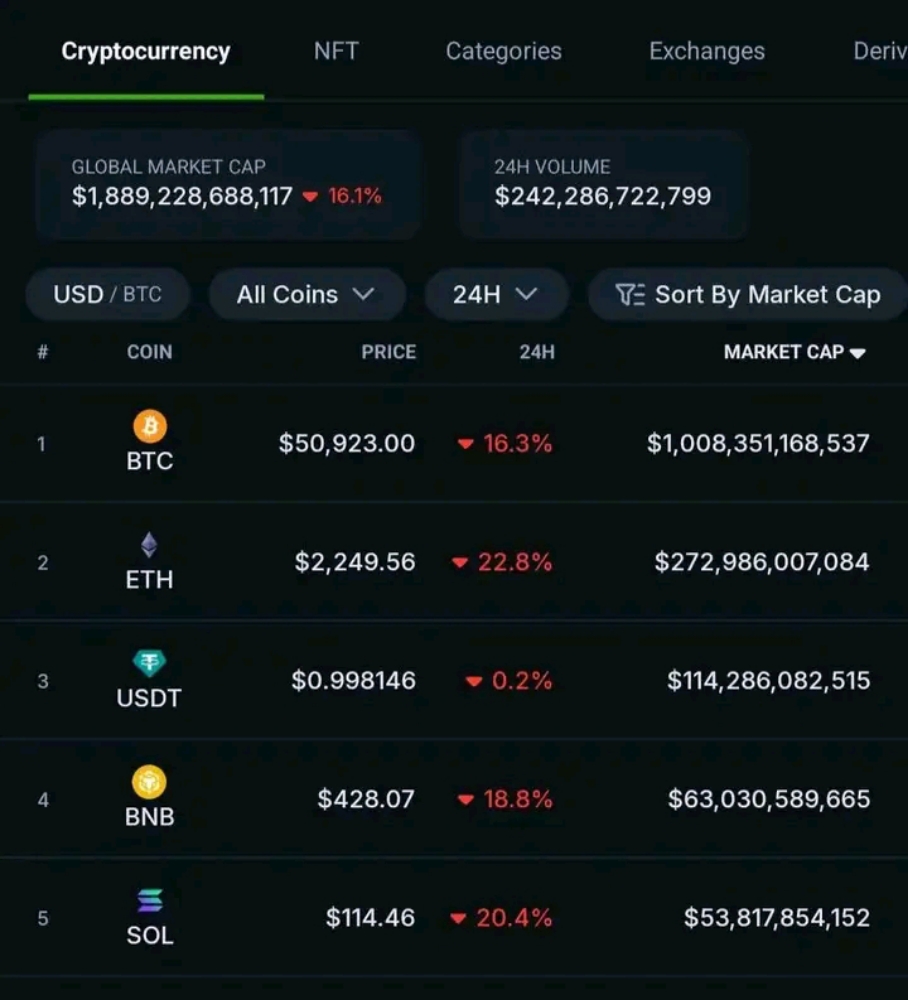

Since then, the concept of stablecoins has seen tremendous growth as more companies look to capitalize on the idea. In 2017, Tether (USDT) became one of the most notable stablecoins when it launched its USD-backed coin on several global exchanges.

This led to a surge in the popularity of other digital coins, such as MakerDAO's DAI and TrueUSD (TUSD).

By 2019, there were over 100 different types of stablecoins available, with a total market cap of around $5 billion.

Types of Stablecoins

To understand how different types of stablecoins work, it is essential to know what makes them unique from traditional currencies or cryptocurrencies.

The 4 Different Types of Crypto Stablecoins Explained

Some stablecoins use algorithms and smart contracts to create decentralized systems which provide additional security measures for users.

Several stablecoins are available today, each offering unique characteristics and benefits.

The four main types of stablecoins are backed by fiat currency, backed by crypto assets, commodities, and algorithmic or non-collateralized coins.

- Fiat-backed coins are pegged to a real-world asset such as the U.S. Dollar or Euro; this ensures price stability since it is linked to an underlying asset with intrinsic value.

- Crypto-backed stablecoins are digital tokens backed 1:1 by another underlying asset such as Bitcoin or Ethereum. These coins provide stability because their value is tied directly to the underlying asset's price.

- Commodity-backed stablecoins are one subset of these digital assets that use commodities such as gold or silver to back the value of the tokens. This gives them an advantage over other stablecoins, which fiat currency, cryptocurrencies, or algorithmic models may back. For investors who prefer a more tangible asset, commodity-backed stablecoins offer the opportunity to hold a digital form of physical commodities, such as precious metals, without storing and securing the actual physical commodity.

- Algorithmic stablecoins use complex algorithms to keep their prices relatively stable, independent of other assets on the market. Non-collateralized coins have no backing from another purchase and instead use mechanisms such as supply and demand to maintain equilibrium in their price fluctuations.

Popular Stablecoins

Some popular stablecoins have gained significant traction due to their ability to remain relatively stable against fiat currencies such as the U.S. dollar or Euro.

Many of these tokens offer additional features that make them attractive to investors, such as low fees, fast transaction times, and increased security.

Top Stablecoin Tokens by Market Capitalization

There are now many stablecoins available on the market, each with its advantages and disadvantages.

I will share here some of the most popular stablecoins, including Tether (USDT), TrueUSD (TUSD), USD Coin (USDC), Paxos Standard Token (PAX), BUSD (Binance USD), Dai, and Gemini Dollar (GUSD).

- Tether was created by iFinex Inc., which owns Bitfinex, one of the largest cryptocurrency exchanges. It allows traders to move funds quickly between different coins and fiat currencies without recording or tracking multiple values for other assets.

- TrueUSD is a USD-backed, fully collateralized, and legally protected ERC20 token that allows users to store value in a secure, liquid form. It can transfer money across borders quickly and cheaply and provides an alternative for those looking for more reliable investments than traditional cryptocurrencies.

- USD Coin (USDC) is a type of cryptocurrency, also known as a "stablecoin," linked to the U.S. dollar rather than relying on its volatile value. This digital asset was created in 2018 by two major companies, Centre and Coinbase, to bring stability to the cryptocurrency market while still providing investors with exposure to blockchain technology.

- Paxos Standard (PAX). Developed by blockchain financial institution Paxos, PAX provides an alternative to traditional fiat money that can be used to store value or make payments globally. The token's stability derives from its 1:1 exchange rate with U.S. Dollars held in secure FDIC-insured accounts.

- BUSD, otherwise known as Binance USD, is a stablecoin created by crypto exchange giant Binance. It is backed 1:1 by U.S. Dollars held in reserve. As a result, it can quickly purchase other cryptocurrencies from the Binance exchange platform with low fees and high liquidity. Additionally, it's an excellent tool for hedging against market fluctuations since its value does not change significantly over time as other cryptos do.

- DAI is an Ethereum-based stablecoin created to provide users with digital money that maintains a steady purchasing power over time. This allows users to keep their money safe from market volatility and protect them from suffering potential losses due to inflation. DAI maintains its value relative to USD through an intelligent contracts system on Ethereum's blockchain network.

- The Gemini Dollar (GUSD), created by the Winklevoss twins, is a new addition to the stablecoins backed by actual currency. It was developed on Ethereum blockchain technology, allowing it to be exchanged quickly between different parties and providing direct access to a range of digital assets.

All these coins offer fast transactions and low fees, making them attractive for traders who need to move funds quickly between exchanges.

Advantages and Disadvantages

One of the primary advantages of stablecoins is their price stability. By eliminating the volatility of many other cryptocurrencies, users can more easily plan for future investments and trading activities without fear of sudden losses due to market fluctuations.

Stablecoins and the Future of Money - Harvard Business Review

Stablecoins also make it easier for users to send funds internationally without worrying about currency exchange fees or conversions into different currencies.

This makes them particularly useful when traditional methods are too costly or impractical.

It can help facilitate faster payments by providing an efficient way to transfer funds quickly and securely across borders or between exchanges.

US government must embrace stablecoins to maintain dollar

However, there are some significant disadvantages to using stablecoins that must be taken into consideration before investing in them.

The first significant downside of stablecoins is their centralization. Most of them are linked to real-world currencies and assets, meaning they are subject to the manipulation and control of a single entity or organization.

This could lead to arbitrary changes in the price of these coins, leaving investors exposed to losses if they don't monitor their investments carefully.

Stablecoins: Growth Potential and Impact on Banking - Federal Reserve

Another disadvantage is that many stablecoin issuers lack transparency regarding managing their funds.

This means it can be difficult for users to determine whether or not the issuer is operating ethically and responsibly with customer funds.

Final Thought

Stablecoin's potential for transforming traditional financial services and providing more seamless cross-border payments is unmatched.

Understanding their value and how they work is essential for staying ahead of the curve and taking advantage of these opportunities.

For those looking to get involved, now is an excellent time to take a closer look at stablecoins and research why they are so important. Then, with the proper knowledge, anyone can benefit from these powerful digital assets.

----

Schooled is a new series that I will be releasing exclusively on @BULB Official. It will focus on topics related to blockchain, cryptocurrencies, and web3 technology.

It explores their history and effects on society and other aspects of these technologies. This series aims to educate readers in this field who may be new or have some knowledge already.

The aim is for readers to gain an insight into the potential of blockchain technology and understand its underlying principles better.

Your feedback and comments are very much appreciated and will help me continue this series.

Thanks! 😎 💡