What would $CWIF look like in 5 years time...?

This is a story for the Solana Scribes contest https://earn.superteam.fun/listings/hackathon/best-fictional-story/

Background

$CWIF is a token2022 on the Solana blockchain. It automatically burns 4% of every on-chain transaction (buy, sell, transfer) and this is a feature enabled by token extensions. See more at https://www.catwifhatsolana.com/

In the last 50 days, a bit over 12% of the total supply has been burnt (see https://twitter.com/catwifstats).

This fictional story, written in the style of an op-ed, tries to imagine what a hyper deflationary token would look like in 5 years time.

The conundrum of $CWIF: Solana’s “Bitcoin killer” contemplates its future

It’s been a bit over a year since we saw the $CWIF drama on Solana. Now the dust has settled the question on everyone’s mind is: Where to next for $CWIF

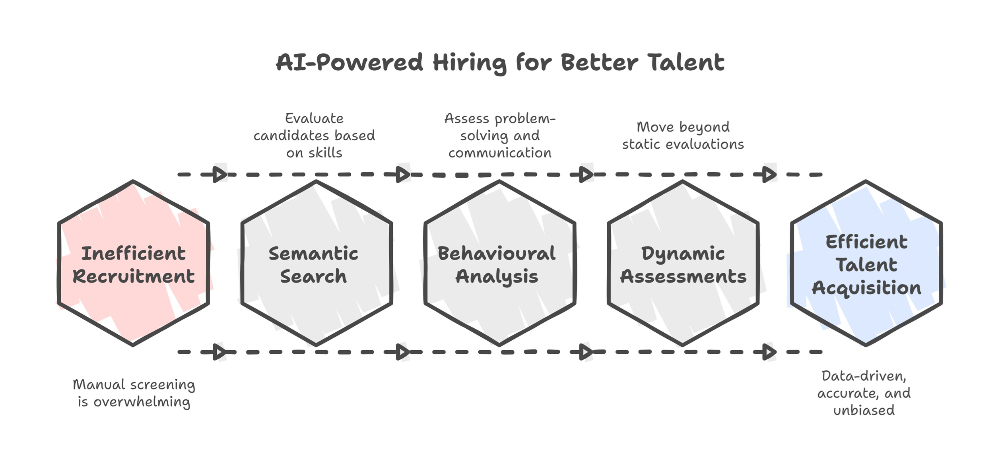

For those readers who aren’t familiar with Solana’s favourite hatted cat, $CWIF started life on Solana at the start of 2024 and was one of the first tokens to showcase the now industry standard technology known as Token Extensions. This technology is credited as one of the key pieces in the rise of Solana as one of the main financial hubs of today’s global economy. But back in the early days this tech was still very much in the prototype phase.

Memecoins, or Social Value Tokens (SVTs) as they are more commonly known today, were often the way in which new technologies were tested in production. The famous crypto venture fund and technology development hub, Bonk Blockchain, started life as a “memecoin” back in 2022 ($BONK) at the start of the last great crypto winter of 2023.

$CWIF debuted off the back of a since departed SVT called $WIF, aping the same joke.

$WIF was a dog with a hat.

CWIF was a cat (also) with a hat.

But where $CWIF differed from $WIF was the underlying technology. After an initial contract transfer at the start of its life ($CWIF is technically v2. $CWIFv0, the first version, still exists on chain and is considered a collectors item amongst the OG $CWIF community) $CWIF established it’s now famous 4% deflationary burn. Every blockchain transaction involving $CWIF is subject to a 4% token burn.

The token was solidly just a SVT at this time, seeing market spikes and dips as pretty much all SVTs saw back then (and still do to this day).

It was mid 2025 that we first saw signs something bigger was happening.

Running in parallel to $CWIF’s declining supply the Bitcoin fee squeeze was in full force. A poorly timed civil war within the Bitcoin developer community between tradfi institutional backed developers and a group of developers known as ‘BTC Core’ had plunged the OG blockchain into an unofficial code freeze just as miners were struggling with cost overruns due to the falling block rewards, a slow down of new fee sources on chain due to EFTs, and rapidly rising hash power requirements.

A few bad periods of on-chain instability, and the resulting slow response caused by the logjam at the developer level, shook investor confidence and saw the price of $BTC tumble causing a domino effect of miner bankruptcies which further contributed to on-chain instability and thus further damaged prices.

$BTC entered the 2024-27 crypto bull run as the crypto world’s default asset. The term ‘digital gold’ was often used to describe the token’s main use case. However that moniker and the general market view of the L1 that had started it all had soured by the end of 2025 and whilst it would recover and ship some much needed tokenomics updates to extend the viability of the chain by mid 2028, many in the crypto world had already started to look elsewhere for a new base asset.

For each ecosystem/blockchain this was a different problem to solve.

On Solana the base assets had always been $SOL and $USDC. Due to the issues at Circle late 2024 and wider issues with the US banking system from 2025 to 2028, the US dollar backed stablecoins had decreased in popularity to be replaced with a wider range of fiat value pegged stable assets. Whilst these new assets were seen as more reliable (as they had very little exposure to an increasingly unstable US financial system) they were not all of a common value as they were pegged to different off chain fiat assets.

The other factor contributing to what was to come was $SOL itself.

The base token of the Solana had actually achieved a high degree of stability during this time but had achieved that due to an inflation adjustment release which was required due to surging usage of the ecosystem. Early 2025 had seen Firedancer achieve critical mass on-chain and this had heralded a number of large institutions deploying partly on Solana as their settlement layer. The inflation adjustment release had driven huge amounts of transactions on-chain (as it de-incentivised simply holding the token) but it had also left even SOL LSTs as slightly inflationary. With continued price fluctuations (albeit much smaller than historical averages) it had resulted in a growing desire for an non-inflationary store of value on-chain i.e., not subject to off chain influence.

Into this gap stepped a very unlikely candidate: $CWIF. The self-styled deflationary SVT had first caught the eye of traders (sometimes called ‘degens’) as a place to park value due to the continual deflationary pressure from the 4% token burn. Once there was a large spike in prices this alerted the wider market and so drove further interest.

The perfect storm had brewed by the end of 2026.

The traditional ‘reserve currencies’ on Solana had lost that status in the eyes of many, and crypto’s reserve asset, $BTC, was in the midst of an existential crisis.

So it was to $CWIF many turned to as an inflation protected store of value. Seen at first as some sort of performance art commentary on the larger problems affecting Solana, the crypto ecosystem and even the broader macro economy, it quickly became a hot token as first traders and then regular users piled in, the price spiked and, of course, supply started burning faster and faster.

At one point, in late 2027, as supply neared 21 million, the once storied hard cap of $BTC before the tokenomics updates of 2028, the popular narrative at the time was: “$CWIF is the new $BTC”.

Of course that never happened. Whilst the total supply of $CWIF is now lower than the OG blockchain, $CWIF hasn’t gone on to replace the position $BTC once held in the crypto world.

Solana also eventually balanced $SOL inflation with a couple of key updates and those, along with continuing high trade volumes, gave $SOL relative price stability.

$SOL LSTs have become essentially the elusive flatcoin; a token that is able to automatically adjust for inflation (both on and off chain).

After the hype of 2027 faded, and the price of $CWIF stabilised, we saw a surprising use case emerge for $CWIF with long term utility: A reserve asset for web3 gaming and social apps in the Solana ecosystem.

Larger, more “serious” institutional projects still prefer to use $SOL LSTs and/or stablecoins as their treasury assets, however for the entertainment and socially driven projects on Solana $CWIF represents an important cultural touchstone and its deflationary nature and its (now) slow, but reliable, price increases makes it a perfect treasury asset for these communities and teams.

This brings us to today and to the question: What’s next for $CWIF?

The trading volume has decreased but $CWIF MC (market cap) remains sizable still to this day. At the peak of the hype there was serious discussions around decreasing or even removing the 4% burn but now volumes have stabilised there isn’t the pressing need to consider this kind of change.

Amongst holders and traders the 4% burn remains a key selling point for $CWIF as a unique Solana asset. It cannot be bridged to other chains (as other assets can) so is intensely culturally important to Solana as well as being financially significant. $CWIF has been instrumental in expanding the lending market on Solana as we’ve seen a popular way to mitigate for the burn is to borrow against it, and many treasuries have used this as a way to more effectively manage their $CWIF holdings.

There is always the chance we will see price instability return to $CWIF. It is a volatile asset by its nature. However the continued and increasing popularity of it as a treasury asset means its holders are increasingly long term in their outlook.

Whatever happens next we probably won’t be waiting long to find out. Even a year is a long time in crypto!