From Cypherpunks to Bitcoin Billionaires: The Evolution and Revolution of Cryptocurrency

Introduction

Cryptocurrency, a digital or virtual form of currency, has emerged as a revolutionary force in modern finance, challenging traditional notions of money and transactional systems. At its core, cryptocurrency utilizes cryptographic techniques to secure transactions, control the creation of new units, and verify the transfer of assets. This introduction sets the stage for a comprehensive exploration of the history and impact of cryptocurrency, tracing its origins from the early ideas of cypherpunks to its current status as a global phenomenon.

Chapter 1: The Birth of Cryptocurrency

The birth of cryptocurrency can be traced back to the early 1980s, a time when the concept of digital currency was still in its infancy. It was during this period that a group of individuals, known as cypherpunks, began exploring the intersection of cryptography, privacy, and electronic payments. These early pioneers, including luminaries like David Chaum, envisioned a future where individuals could transact securely and privately over the internet without the need for intermediaries. One of the seminal contributions of the cypherpunk movement was the development of cryptographic techniques that laid the groundwork for modern cryptocurrency. David Chaum, in particular, proposed revolutionary ideas such as blind signatures and cryptographic protocols for secure electronic cash. His work culminated in the creation of eCash and DigiCash, early attempts at creating digital currencies that offered privacy and anonymity to users. While projects like DigiCash ultimately failed to gain widespread adoption, they paved the way for future innovations in digital currency. The cypherpunk movement continued to attract individuals passionate about privacy and cryptography, fostering a fertile ground for experimentation and collaboration.

Chapter 2: Satoshi Nakamoto and the Emergence of Bitcoin

In October 2008, a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" appeared on a cryptography mailing list, authored by an enigmatic figure known as Satoshi Nakamoto. This white paper outlined a revolutionary new digital currency, Bitcoin, which aimed to address the shortcomings of traditional fiat currencies and centralized payment systems. At the heart of Bitcoin's design was a decentralized ledger known as the blockchain, which enabled peer-to-peer transactions without the need for intermediaries. By using cryptographic techniques and a distributed network of nodes, Bitcoin achieved a level of trust and security that was previously thought to be impossible in digital currencies. The release of the Bitcoin white paper marked the beginning of a new era in finance and technology. On January 3, 2009, the Bitcoin network went live, with Nakamoto mining the genesis block, or the first block of the blockchain. This event not only marked the birth of Bitcoin but also symbolized the dawn of a decentralized monetary system that operated outside the control of governments and central banks. Satoshi Nakamoto's identity remains a mystery to this day, with speculation and theories abound as to the true identity of the elusive creator. Nevertheless, the impact of Nakamoto's invention cannot be overstated, as Bitcoin paved the way for the proliferation of thousands of other cryptocurrencies and laid the foundation for a new paradigm of trustless and permissionless financial transactions.

Chapter 3: The Rise of Altcoins and Blockchain Innovation

Following the introduction of Bitcoin, a wave of innovation swept through the cryptocurrency space, leading to the creation of alternative digital currencies known as "altcoins." These altcoins sought to address perceived limitations of Bitcoin, such as scalability, transaction speed, and privacy. One of the earliest altcoins to gain traction was Litecoin, created by Charlie Lee in 2011. Litecoin aimed to offer faster transaction confirmation times and a different mining algorithm than Bitcoin, making it more accessible to everyday users. Other notable altcoins include Ripple (XRP), which focused on facilitating cross-border payments for financial institutions, and Ethereum, introduced by Vitalik Buterin in 2015. Ethereum revolutionized the cryptocurrency landscape by introducing smart contracts, enabling developers to create decentralized applications (DApps) and programmable digital assets known as tokens. Beyond altcoins, blockchain technology itself underwent rapid innovation, with projects exploring applications beyond finance. One significant development was the emergence of blockchain-based platforms for supply chain management, identity verification, and voting systems. These applications leveraged the transparency, security, and immutability of blockchain technology to streamline processes and reduce fraud in various industries.

Chapter 4: Cryptocurrency in the Mainstream

Over the past decade, cryptocurrency has transitioned from a niche interest to a mainstream asset class with global recognition and adoption. Major corporations, financial institutions, and governments have increasingly embraced cryptocurrency as a viable means of payment, investment, and technology development. One of the most significant milestones in cryptocurrency's journey to mainstream acceptance was the integration of Bitcoin into mainstream financial markets. Major companies such as PayPal, Square, and Tesla have started accepting Bitcoin as a form of payment, signaling a shift towards broader acceptance of digital currencies in commerce. Moreover, the launch of cryptocurrency-based financial products such as futures contracts, options, and exchange-traded funds (ETFs) has provided traditional investors with avenues to gain exposure to digital assets. Institutional interest in cryptocurrency has also surged, with hedge funds, asset managers, and pension funds allocating capital to digital assets as part of their investment portfolios. However, the mainstream adoption of cryptocurrency has not been without challenges. Regulatory uncertainty, security concerns, and volatility in cryptocurrency markets have prompted governments to grapple with how to regulate and supervise digital assets. Nevertheless, the growing acceptance and integration of cryptocurrency into mainstream finance signal a paradigm shift in how we perceive and interact with money in the digital age.

Chapter 5: Cryptocurrency's Global Impact

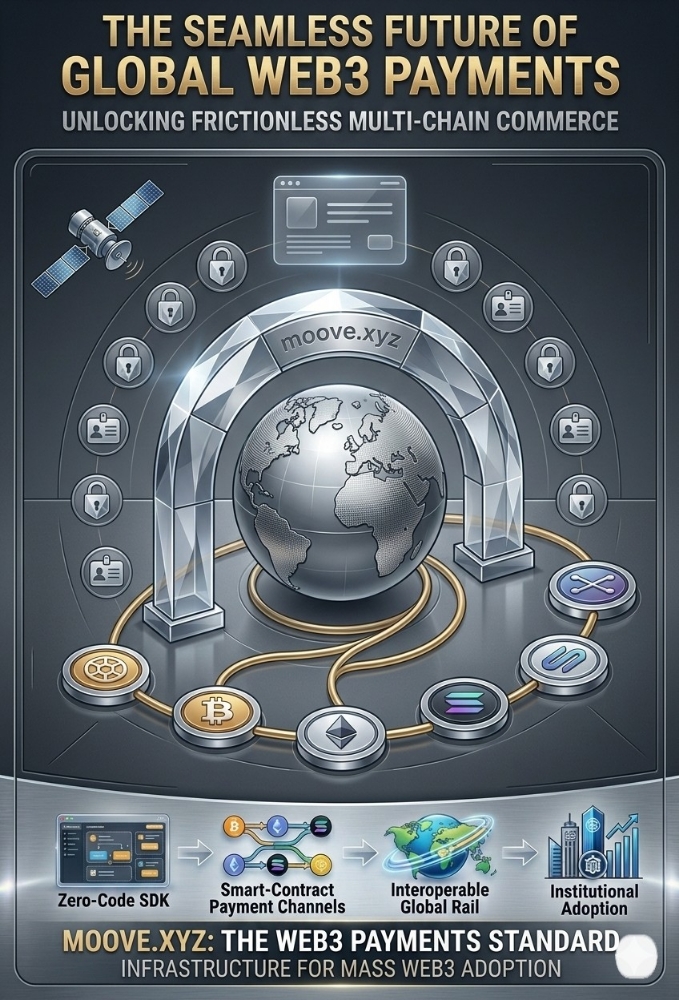

Cryptocurrency has transcended geographical boundaries, impacting economies, societies, and geopolitical landscapes around the world. One of its most profound effects has been in facilitating financial inclusion, providing individuals in underserved regions with access to banking services and capital. For example, in countries with unstable currencies or limited banking infrastructure, cryptocurrencies offer a reliable alternative for storing value and conducting transactions. Furthermore, cryptocurrency has the potential to democratize finance by reducing barriers to entry for investment and entrepreneurship. Through crowdfunding platforms like Initial Coin Offerings (ICOs) and tokenization, individuals can access capital and participate in projects that were previously reserved for accredited investors or venture capitalists. However, the global impact of cryptocurrency is not without challenges. Regulatory uncertainty, varying legal frameworks, and concerns about illicit activities have prompted governments to grapple with how to approach and regulate the burgeoning industry. Additionally, the decentralized nature of cryptocurrency presents unique challenges for law enforcement agencies seeking to combat fraud, money laundering, and other criminal activities conducted using digital currencies.

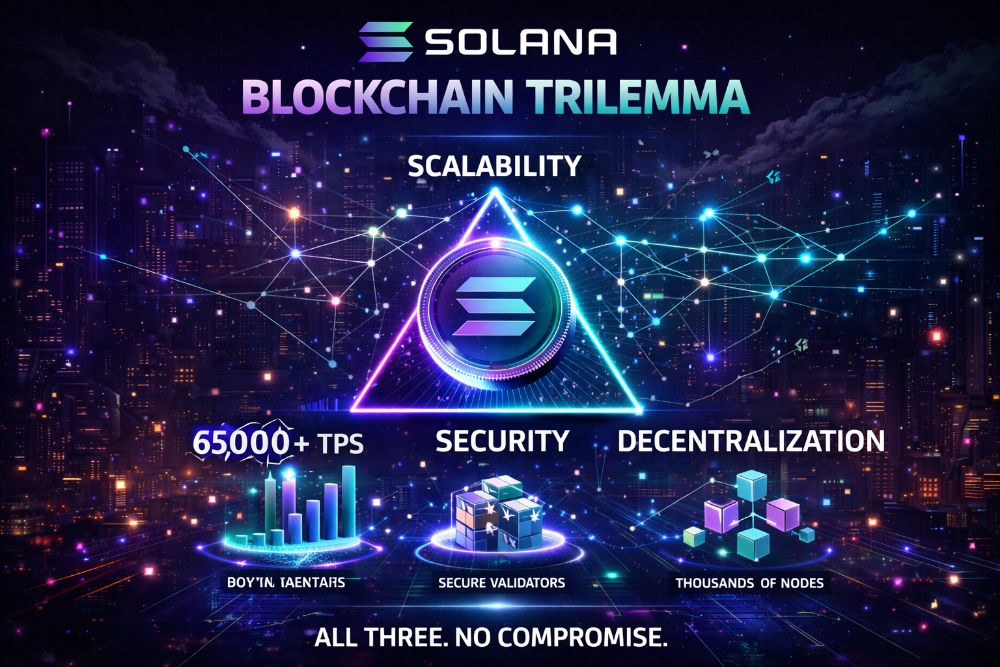

Chapter 6: Challenges and Future Prospects

Despite its potential, cryptocurrency faces several challenges that must be addressed for widespread adoption and acceptance. Scalability remains a pressing issue, as blockchain networks like Bitcoin and Ethereum struggle to handle increasing transaction volumes without sacrificing speed or efficiency. Solutions such as off-chain scaling techniques, sharding, and layer-2 protocols are being explored to address these scalability concerns. Security is another critical consideration, as the decentralized nature of cryptocurrency makes it susceptible to hacking, fraud, and theft. High-profile breaches and exchange failures have underscored the need for robust security measures, including multi-factor authentication, cold storage solutions, and auditing procedures. Moreover, regulatory uncertainty continues to cast a shadow over the cryptocurrency industry, with governments worldwide grappling with how to classify and regulate digital assets. Clear and consistent regulatory frameworks are essential to provide investors, businesses, and consumers with confidence and certainty in their interactions with cryptocurrency. Looking ahead, the future of cryptocurrency holds tremendous promise. Advances in blockchain technology, such as the development of more energy-efficient consensus mechanisms and interoperability protocols, have the potential to unlock new use cases and applications. Additionally, the growing interest and investment in decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and Web3 technologies signal a broader shift towards decentralized and user-centric models of value creation and exchange.

Conclusion

In conclusion, cryptocurrency has evolved from a niche interest into a global phenomenon with far-reaching implications for finance, technology, and society. From its humble beginnings with cypherpunks and the invention of Bitcoin by Satoshi Nakamoto to the proliferation of altcoins and blockchain innovation, the journey of cryptocurrency has been marked by innovation, disruption, and adaptation. As cryptocurrency continues to mature and integrate into mainstream finance, it will be essential to address key challenges such as scalability, security, and regulatory uncertainty. By doing so, cryptocurrency has the potential to revolutionize financial systems, empower individuals, and reshape the future of commerce and exchange on a global scale. Ultimately, the story of cryptocurrency is one of innovation, resilience, and the pursuit of a more decentralized and inclusive financial ecosystem.