🏦 How to Lend and Borrow Crypto (Even with $10)

For a long time, the idea of lending and borrowing money felt like something reserved for banks, institutions, or people with big capital.

But Web3 flipped the script.

Today, you can lend or borrow crypto with as little as $10, without paperwork, without a bank, and without asking anyone for permission.

Everything happens through decentralized finance — DeFi — a transparent financial system powered by code instead of bankers.

If you’ve ever wondered how crypto lending actually works, or how everyday people use it to grow their portfolios, this guide will walk you through it step by step.

Simple. Clear. Beginner-friendly.

Let’s explore the world where anyone — even with $10 — can become their own bank. 👇

💰 1. What Crypto Lending Really Is (And Why It Exists)

Crypto lending is one of the most powerful concepts in DeFi.

Here’s the core idea:

👉 You lend your crypto → you earn interest

👉 You borrow crypto → you use your own coins as collateral

It’s the same principle as traditional finance, but without:

- banks

- approvals

- credit scores

- waiting times

Instead, everything is controlled by smart contracts — automated programs that ensure there’s no cheating, no discrimination, and no hidden conditions.

This is why crypto lending became so popular:

It gives everyone access to financial tools once limited to the wealthy.

🌐 2. Where You Can Lend or Borrow (Even With Small Amounts)

You don’t need thousands to use DeFi platforms.

Most major protocols allow deposits starting from $5 to $10.

🔹 The most trusted platforms:

- Aave (the most beginner-friendly)

- Compound (simple and reliable)

- Venus (on BNB chain, low fees)

- Radiant (multi-chain lending)

These platforms act as decentralized “pools” of money:

- Lenders deposit their crypto

- Borrowers take loans against their collateral

- Interest is automatically distributed

No application. No middleman. Just smart contracts.

🧩 3. How to Start Lending With $10

Lending crypto is the easiest part — anyone can do it.

Here’s how:

✨ Step 1: Choose the token you want to lend

Popular ones:

- USDT

- USDC

- ETH

- BTC (wrapped version)

If you’re starting small, stablecoins like USDT or USDC are ideal because they don’t fluctuate wildly.

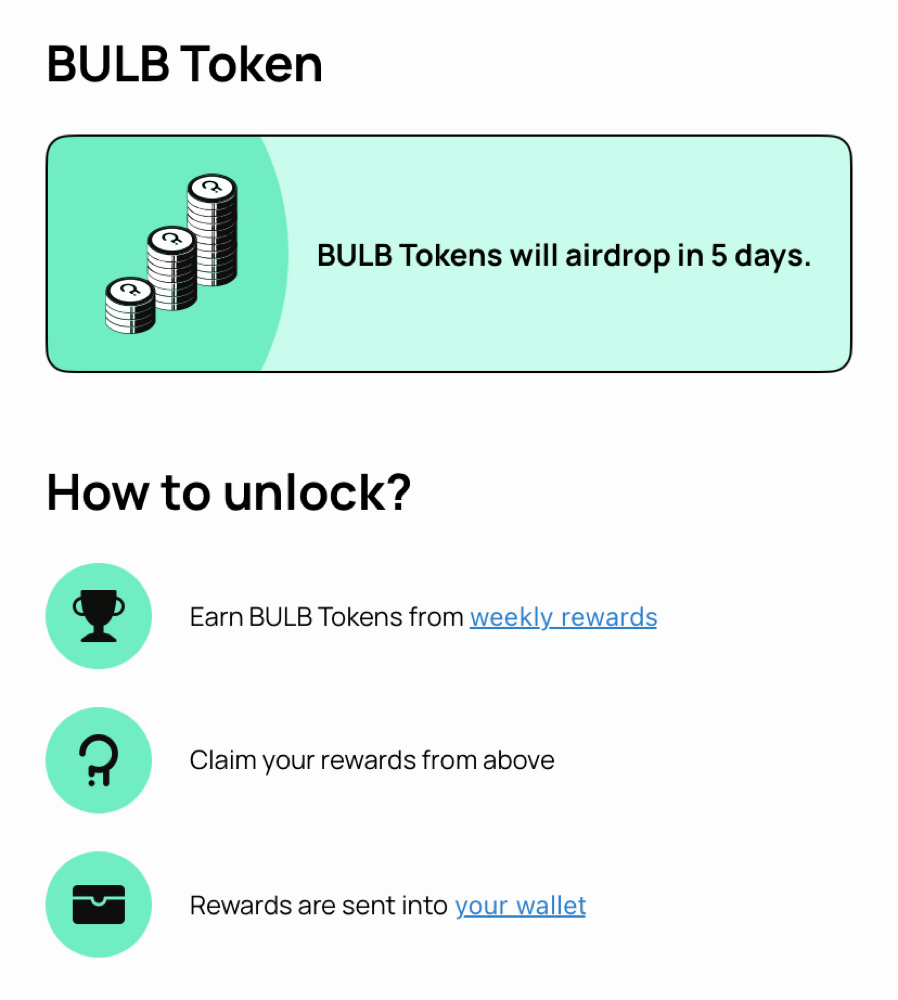

✨ Step 2: Deposit into the lending pool

On a platform like Aave, you simply click “Supply”, choose your amount (even $10), and confirm.

✨ Step 3: Earn passive interest automatically

Once deposited, your crypto starts generating:

- APR interest

- potential reward tokens (depending on the platform)

No management needed.

Your $10 quietly works in the background.

💳 4. How to Borrow Crypto Using Collateral

Borrowing in DeFi is not like borrowing from a bank.

You don’t need income proof or identity.

You simply use your own crypto as collateral.

Here's how it works:

- You deposit crypto (for example, $10 in USDT)

- The protocol gives you a borrowing limit

- You borrow another crypto against your deposit

The borrowed amount is always less than your collateral to protect the system.

Why people borrow in crypto:

- to buy dips

- to avoid selling assets

- to earn yield

- to bridge funds between networks

- to stake or farm with extra liquidity

Borrowing can multiply your opportunities — even with small amounts — but it must be done responsibly.

⚠️ 5. The One Rule You Must Understand: Liquidation

When you borrow crypto, the protocol monitors the value of your collateral.

If the market drops too far, your loan may be liquidated.

Liquidation means:

👉 Part of your collateral is sold to repay the loan.

To avoid this:

- Use small borrow amounts

- Keep a good safety margin

- Monitor the health of your loan

With just $10, borrow lightly and safely — this keeps your risk low and your learning experience positive.

🚀 6. Smart Strategies You Can Use With Only $10

Even small amounts can grow when used intentionally.

🌱 Strategy 1: Lend Stablecoins for Passive Income

Deposit $10 → earn interest → reinvest over time.

A simple way to learn and grow.

🔄 Strategy 2: Borrow a Small Amount to Test DeFi

Deposit $10 → borrow $2 or $3 → repay later.

A safe way to understand how loans work.

🎨 Strategy 3: Borrow to Mint NFTs or Join Web3 Platforms

Sometimes you don’t need a loan to invest — only to participate.

Small DeFi loans can help you explore the ecosystem.

📚 Strategy 4: Borrow to Practice Without Selling Your Crypto

You keep your assets while getting liquidity.

This is one of the biggest advantages of DeFi.

With only $10, the goal isn’t profit — it’s learning.

Once you master the tools, scaling becomes easy.

🔥 Why DeFi Lending Matters More Than Ever

In a world where banking access is unequal, slow, or limited, DeFi offers something revolutionary:

- global access

- open tools

- no approval needed

- full transparency

- financial freedom for everyone

Whether you have $10 or $10,000, you can participate in the same system — with the same rules — without discrimination.

That’s the real power of crypto lending and borrowing.

🌟 Final Thought

In DeFi, small beginnings lead to big understanding. What will you build with your first $10?