What are transaction fees? Fee differentials between blockchains

What are the blockchain transaction fees?

Blockchain transaction fees (mining fees) are fees paid by users to miners/validators during the transfer of crypto assets and are usually charged in native blockchain tokens.

Fee-paying activities such as sending, buying, selling, lending crypto, etc. The fees applied are similar to transfer fees in the traditional banking system.

Transaction fees may fluctuate depending on network activity as well as development team regulations. Transaction fees are usually high when the network records a large number of transactions and decrease at times when few people trade.

Blockchain fees are applied to reduce the number of spam transactions, help the platform operate stably and prevent the risk of attacks. The issue of high transaction fees is one of the reasons hindering blockchain development, but low fees can pose security risks.

Technically, the main gas fee is the blockchain transaction fee. However, gas fees have only been used since the inception of Ethereum and are reserved for networks capable of executing smart contracts.

For more: What is a smart contract? The role of smart contracts in blockchain

The role of transaction fees

Increased security

Most blockchain networks operate on a distributed network of nodes, and node operators play an important role in validating transactions. To incentivize users to participate in powering up the blockchain, transaction fees are used as one of the attractive rewards for miners and validators.

Participants can receive a portion of the fee when supporting the maintenance and stable operation of the network. The more people involved in the authentication process, the more secure the blockchain becomes. Besides, some blockchains also apply a revenue-sharing mechanism for both users holding the platform's native tokens.

Limit spam attacks

Transaction fee charging is a method to minimize hackers intentionally performing a series of transactions to cause network congestion, slow down authentication time and create vulnerabilities to attack the network. Hackers often target low-fee blockchains to reduce the cost of an attack because high-fee networks require large capital to carry out an effective attack and the success rate is usually very low.

Polygon — a network known for its transaction fees of only about 0.02 MACTIC ($0.01) — was attacked by hackers in the form of a spam attack in May 2021. The bad guys make 8 million transactions per day for about 120 days, earning 218.5 ETH (nearly $693 thousand) when trading arbitrage. This is an impressive return compared to the capital of 14 ETH.

The incident caused Polygon to raise its average fees to around $0.5 and many other low-fee blockchains to consider the platform's fee policy.

Factors affecting transaction fees

The most important factor that determines transaction fees is the mechanics and vision of the team building the blockchain. Each blockchain has different fees and uses.

Besides reasonable mechanisms to attract users, many blockchains charge much higher transaction fees than average. Before accepting any transaction, users need to carefully check the fee level to avoid mishaps.

For Bitcoin, transaction fees are usually shared with miners participating in validating the new block. Most miners will prioritize BTC sending transactions when users pay reasonable fees and easily ignore transactions with zero fees.

Bitcoin transaction fees do not depend on the amount but are calculated based on the transaction size in bytes. In case of high traffic and large demand, the minimum fee may increase.

Frequently inflated transaction fees make Bitcoin less likely to be used to settle regular transactions because the fees paid are sometimes greater than the value of the trading asset.

Some other factors can affect transaction fees, such as:

- Network congestion: Multiple transactions are sent in the same time period, causing the network to become congested and prolonging authentication times. In this case, users have to pay more to get priority processing.

- Increased transaction demand: Supply and demand factors greatly affect transaction fees, especially in the context of demand exceeding supply. Many veteran investors are able to estimate market conditions and choose the right time to enjoy low fees.

Differences in transaction fees between some networks

Bitcoin was the world's first blockchain, contributing to the standard of transaction fees for generations to come. With a calculation based on transaction size, the Bitcoin network can create volatility in transaction fees and is rarely used for day-to-day payment activities.

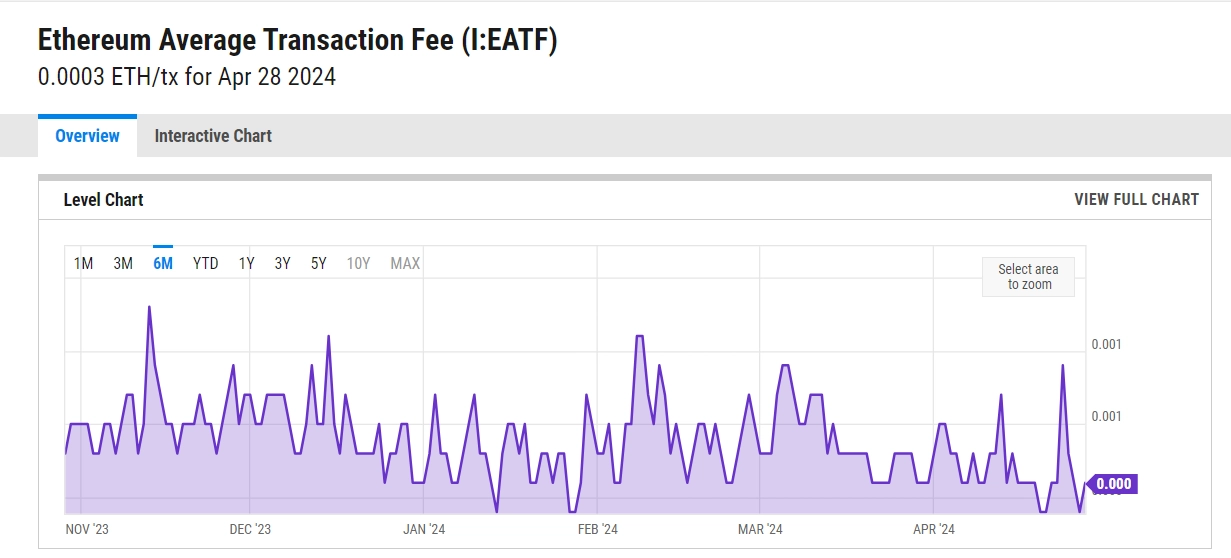

The emergence of Ethereum brings a new solution and concept of "gas fees" that characterize blockchains using smart contracts. Transaction fees on Ethereum are determined based on two factors: gas price—the amount a user is willing to pay for 1 unit of gas, which directly affects the speed of transaction confirmation—and gas limit—the maximum amount of gas a user pays to make a transaction.

Ethereum has frequently been complained about for its unusually high fees. This is one of the motivations for developers to build many solutions to minimize fees and optimize transaction time.

How to reduce trading fees

Fees are a mandatory factor when making transactions on blockchain platforms. In many cases, users have to accept payment despite the rising fees. However, experienced investors also have many ways to minimize the amount they pay, increasing their chances of profit.

Basically, transaction fees increase when the network is busy, so choose when to send transactions outside of "peak hours" to reduce fees. Many users said that overtime on inflated networks often falls during U.S. office hours.

Besides, the problem of transaction fees is of interest to many developers and seeks to be solved. Currently, users prefer to use the Lightning Network for Bitcoin and layer 2 scaling solutions for Ethereum to save costs.

Conclude

Trading fees are an important factor in the investment strategies of many crypto users. Currently, most blockchains charge users transaction fees. The emergence of new token trends and standards also contributes to changing transaction fees. With the increasing demand of the community, projects are constantly looking for new ways to overcome high fees while ensuring safety for users.

See also: What is Bitcoin halving? Impact of Bitcoin halving 2024