The Staking Revolution: Unlocking the Power of Cryptocurrencies Through Proof-of-Stake

In the ever-evolving world of cryptocurrencies, a new paradigm is emerging, one that challenges the traditional notion of mining and offers a more energy-efficient, secure, and democratized approach to validating transactions and securing blockchain networks. This paradigm is known as staking, and it has the potential to revolutionize the way we understand and interact with digital assets.

At its core, staking is a mechanism that allows cryptocurrency holders to participate in the validation and security of a blockchain network by pledging or "staking" a portion of their holdings. In return for this commitment, stakers are rewarded with newly minted tokens, transaction fees, or a combination of both, incentivizing them to play an active role in maintaining the health and integrity of the network.

The Origins of Staking: From Proof-of-Work to Proof-of-Stake

To fully appreciate the significance of staking, it is essential to understand the context from which it emerged. The early days of cryptocurrencies were dominated by the Proof-of-Work (PoW) consensus mechanism, pioneered by Bitcoin and employed by many other blockchain networks.

In a PoW system, miners compete to solve complex computational puzzles, and the winner is rewarded with newly minted tokens and transaction fees. This process, known as mining, serves two critical functions: it validates transactions and secures the network by making it prohibitively expensive for malicious actors to gain control and manipulate the blockchain.

However, PoW mining has several inherent drawbacks. It is energy-intensive, requiring vast amounts of computational power and electricity, which has raised concerns about its environmental impact and long-term sustainability. Additionally, the mining process is highly competitive, leading to a concentration of mining power in the hands of a few large players with access to specialized hardware and cheap energy sources.

It was against this backdrop that the concept of Proof-of-Stake (PoS) emerged, offering an alternative approach to consensus and network security. Instead of relying on computational power, PoS systems utilize economic stakes, where validators are chosen based on the amount of cryptocurrency they hold and are willing to temporarily lock or "stake" in the network.

The core principle behind PoS is that those with a significant stake in the network's success have a vested interest in maintaining its security and integrity. By staking their holdings, validators are incentivized to act honestly and validate transactions correctly, as any attempt to undermine the network could result in the loss of their staked assets and the associated rewards.

The Evolution of Staking: From Simple Implementations to Advanced Models

While the concept of staking may seem straightforward, its implementation across various blockchain protocols has evolved over time, resulting in a diverse range of staking models and mechanisms. Here, we explore some of the most prominent staking approaches and their unique characteristics:

1. Simple Proof-of-Stake (PoS)

Simple PoS is one of the earliest implementations of staking, where validators are chosen based on the amount of cryptocurrency they hold and have staked. The more tokens a validator stakes, the higher their chances of being selected to validate blocks and earn rewards.

In this model, validators lock their tokens in a smart contract or designated staking wallet, effectively removing them from circulation for a specified period. The staked tokens act as collateral, incentivizing honest behavior and deterring malicious activities that could result in the loss of their staked holdings.

2. Delegated Proof-of-Stake (DPoS)

Delegated Proof-of-Stake (DPoS) takes the concept of staking a step further by introducing a representative democracy model. In a DPoS system, token holders elect a limited number of validators (often referred to as "witnesses" or "delegates") to validate transactions on their behalf.

These elected validators are responsible for maintaining the network and are rewarded for their efforts. Token holders can delegate their staked tokens to one or more validators, effectively increasing the validators' voting power and their chances of being selected to validate blocks and earn rewards.

DPoS aims to strike a balance between decentralization and efficiency by allowing token holders to participate in the consensus process while relying on a smaller group of validators to maintain the network's operations.

3. Nominated Proof-of-Stake (NPoS)

Nominated Proof-of-Stake (NPoS) is a variation of PoS that combines elements of both simple PoS and DPoS. In an NPoS system, token holders can stake their tokens and nominate validators to validate transactions on their behalf.

Unlike DPoS, where validators are elected through a voting process, NPoS validators are chosen based on a combination of factors, including the amount of tokens they have staked, the number of nominations they have received, and their historical performance and reputation within the network.

NPoS aims to provide a balance between decentralization and efficiency by allowing anyone to become a validator while still relying on a subset of trusted and reputable validators to maintain the network's operations.

4. Liquid Staking

Liquid staking is a more recent innovation that addresses one of the key drawbacks of traditional staking models: the locking of tokens during the staking period. In a liquid staking system, token holders can stake their tokens and receive liquid staking tokens (often referred to as "staking derivatives") in return.

These liquid staking tokens represent the staked tokens and their associated rewards, but they can be freely traded, transferred, or used in other decentralized finance (DeFi) applications. This liquidity enables stakers to participate in the consensus process while still maintaining the flexibility to access and utilize their staked assets.

Liquid staking is often facilitated by dedicated protocols or platforms that pool stakers' tokens and manage the staking process on their behalf, distributing rewards proportionally to the liquid staking token holders.

5. Hybrid Proof-of-Stake (HPoS)

Hybrid Proof-of-Stake (HPoS) is an approach that combines elements of both Proof-of-Work (PoW) and Proof-of-Stake (PoS) in a single consensus mechanism. In an HPoS system, blocks are validated through a combination of mining (PoW) and staking (PoS).

The rationale behind HPoS is to leverage the strengths of both consensus mechanisms while mitigating their respective weaknesses. PoW mining provides a robust and proven method for securing the network, while PoS staking introduces energy efficiency, economic incentives, and potentially greater decentralization.

HPoS systems often employ a hybrid approach, where PoW mining is used for the initial distribution of tokens and network bootstrapping, while PoS staking takes over as the primary consensus mechanism once the network reaches a certain level of maturity and distribution.

The Dynamics of Staking: Incentives, Rewards, and Penalties

To fully understand the staking ecosystem, it is crucial to explore the various incentives, rewards, and penalties that shape the behavior and decision-making of participants. These economic incentives are carefully designed to promote network security, validator performance, and long-term sustainability.

1. Staking Rewards

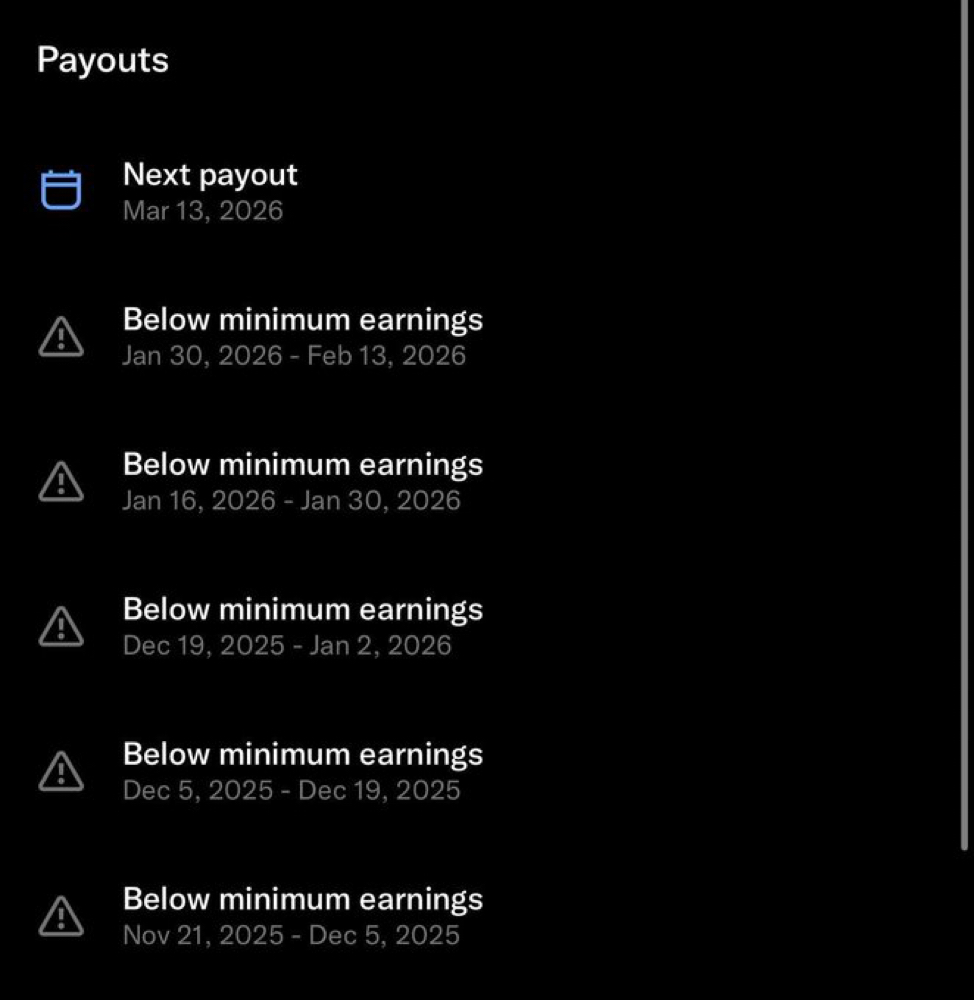

The primary incentive for staking is the opportunity to earn rewards in the form of newly minted tokens or a portion of the transaction fees collected by the network. These rewards serve as compensation for validators' efforts in securing the network and validating transactions.

The specific reward structure and distribution mechanisms vary across different blockchain protocols, but generally, the more tokens a validator stakes, the higher their chances of being selected to validate blocks and earn rewards. Additionally, some protocols may introduce additional incentives or bonuses for consistent and reliable performance, encouraging validators to maintain high uptime and responsiveness.

2. Slashing and Penalties

While rewards incentivize good behavior, slashing and penalties serve as deterrents against malicious or negligent actions that could compromise the network's integrity. In a staking system, validators can be penalized or "slashed" by having a portion of their staked tokens forfeited or burned.

Slashing typically occurs when validators engage in activities such as double-signing (validating conflicting transactions), going offline for extended periods, or attempting to censor or manipulate transactions. The severity of the penalty often depends on the severity of the infraction, with more egregious violations resulting in harsher slashing penalties.

Slashing mechanisms are designed to disincentivize bad actors and reinforce the economic incentives for validators to act honestly and maintain the network's security and reliability.

3. Staking Periods and Unbonding

Most staking protocols require validators to lock or "bond" their staked tokens for a specified period, known as the staking period or bonding period. During this time, the staked tokens are effectively removed from circulation and cannot be transferred or traded.

At the end of the staking period, validators have the option to unbond or withdraw their staked tokens, along with any rewards earned during the staking period. However, the unbonding process often involves a waiting period or "cooling-off" period, during which the tokens remain locked and cannot be accessed immediately.

These staking periods and unbonding mechanisms are designed to promote network stability and discourage frequent token movements, which could disrupt the consensus process and undermine the network's security.

4. Minimum Staking Requirements

Many staking protocols impose minimum staking requirements, which specify the minimum amount of tokens a validator must stake to be eligible for validation and reward distribution. These requirements serve several purposes:

- They ensure that validators have a significant economic stake in the network, incentivizing them to act honestly and maintain its integrity.

- They prevent the dilution of rewards among too many validators, ensuring that rewards remain meaningful and attractive to participants.

- They create a barrier to entry, discouraging bad actors or malicious entities from easily gaining control of the validation process.

Minimum staking requirements can vary widely across different blockchain protocols, ranging from a few tokens to thousands or even millions, depending on the specific network's characteristics and design goals.

5. Stake Delegation and Pooling

While some staking protocols allow individual token holders to become validators by meeting the minimum staking requirements, others may have higher barriers to entry or require specialized hardware or infrastructure. In such cases, stake delegation and pooling mechanisms come into play.

Stake delegation allows token holders to participate in the staking process by delegating or "lending" their tokens to existing validators. In return, the token holders receive a portion of the rewards earned by the validator, proportional to their delegated stake.

Stake pooling takes this concept further by allowing multiple token holders to combine their stakes and collectively contribute to the validation process. These pooled stakes are managed by a designated pool operator, who coordinates the validation efforts and distributes the rewards among the pool participants based on their respective contributions.

Stake delegation and pooling mechanisms promote decentralization by enabling a broader range of token holders to participate in the consensus process and earn rewards, even if they lack the resources or technical expertise to become validators themselves.

The Role of Staking in Decentralized Finance (DeFi)

The emergence of staking has had a profound impact on the rapidly growing ecosystem of decentralized finance (DeFi). By providing an alternative to energy-intensive mining and enabling token holders to earn rewards through staking, staking has become a key pillar of the DeFi landscape, driving innovation and facilitating the development of new financial products and services.

1. Liquidity Provision and Yield Farming

In the DeFi world, liquidity is the lifeblood that powers decentralized exchanges, lending platforms, and other financial applications. Staking has played a crucial role in incentivizing liquidity provision by allowing token holders to earn rewards for staking their tokens in liquidity pools.

This concept, known as yield farming, has become a popular strategy for DeFi users to generate passive income by staking their tokens and earning rewards in the form of trading fees, interest, or newly minted tokens from the respective DeFi protocols.

2. Decentralized Lending and Borrowing

Staking has also found applications in decentralized lending and borrowing platforms, where users can earn rewards by staking their tokens as collateral for loans or by providing liquidity to lending pools.

In these systems, borrowers can use their staked tokens as collateral to access loans, while lenders can earn interest by staking their tokens in lending pools. The staking mechanisms help secure the platform's operations and ensure the overall health and liquidity of the lending markets.

3. Governance and Decentralized Autonomous Organizations (DAOs)

Many DeFi protocols and decentralized applications (dApps) have embraced staking as a means of facilitating community governance and decision-making. In these systems, token holders can stake their tokens to participate in voting processes, shaping the future development and direction of the respective protocols or DAOs.

Staking not only incentivizes participation but also ensures that those with a vested economic interest in the protocol's success have a say in its governance. This aligns the incentives of token holders and protocol developers, fostering a more decentralized and community-driven approach to decision-making.

4. Staking-as-a-Service (STaaS)

As the demand for staking services has grown, a new breed of platforms and service providers has emerged, offering Staking-as-a-Service (STaaS) solutions. These platforms simplify the staking process for token holders, allowing them to stake their tokens and earn rewards without the need to set up and maintain their own validation infrastructure.

STaaS providers typically charge a fee or take a portion of the earned rewards in exchange for managing the staking process, handling the technical complexities, and ensuring high uptime and performance. This accessibility has helped lower the barriers to entry for token holders who wish to participate in staking but lack the technical expertise or resources to do so independently.

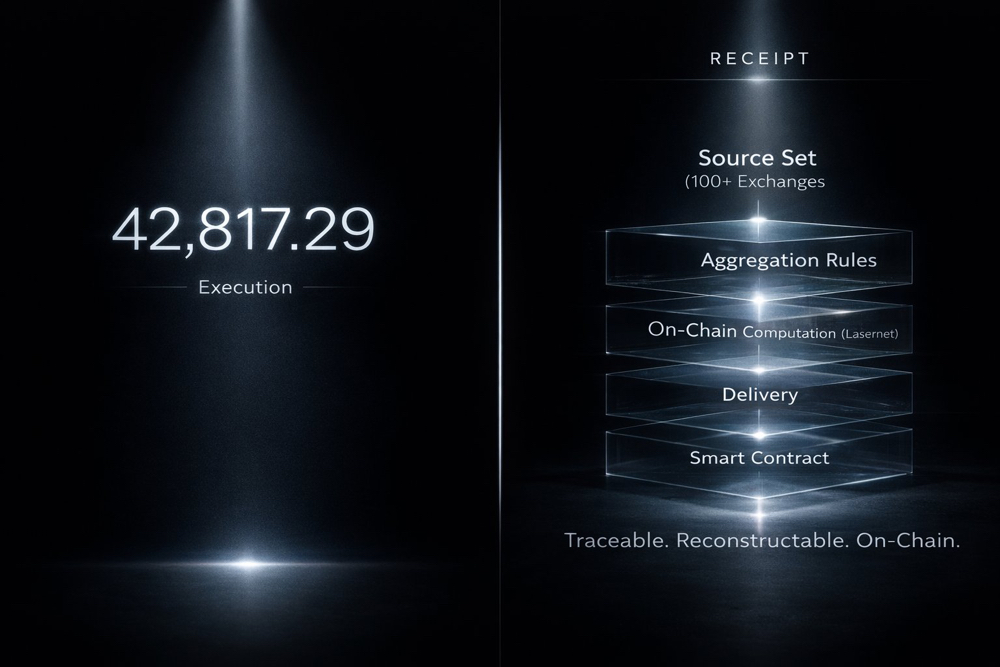

5. Cross-Chain Staking and Interoperability

With the proliferation of blockchain networks and the increasing need for interoperability, cross-chain staking has emerged as a solution to bridge different ecosystems and enable the flow of value and assets across multiple chains.

In a cross-chain staking model, token holders can stake their tokens on one blockchain network and earn rewards from another network or protocol. This is often facilitated through the use of bridges, relays, or dedicated cross-chain communication protocols that enable the secure transfer of staked assets and reward distribution across multiple chains.

Cross-chain staking not only expands the opportunities for token holders to earn rewards but also promotes greater liquidity and capital efficiency by enabling the seamless movement of assets between different blockchain ecosystems.

Challenges and Considerations in Staking

While staking offers numerous benefits and has catalyzed innovation in the DeFi space, it is not without its challenges and considerations. As with any emerging technology, there are risks and potential pitfalls that must be addressed to ensure the long-term sustainability and security of staking-based systems.

1. Centralization and Stake Concentration

One of the primary concerns surrounding staking is the potential for centralization and stake concentration. In some staking protocols, a small number of validators or stake pools may accumulate a disproportionate amount of staked tokens, granting them significant influence over the network's consensus process.

This concentration of power could undermine the principles of decentralization and open the door to censorship, collusion, or other malicious activities. Addressing this challenge requires carefully designed incentive structures, delegation mechanisms, and governance models that promote a more equitable distribution of stake and discourage the formation of centralized power structures.

2. Slashing and Token Lockups

While slashing mechanisms are essential for maintaining network security and incentivizing good behavior, they also introduce a level of risk for validators and stakers. The potential loss of staked tokens due to slashing penalties or prolonged token lockups can deter participation and hinder the growth of staking ecosystems.

Finding the right balance between security and incentives is crucial, as excessively harsh slashing conditions or overly long lockup periods may discourage legitimate participants and stifle the adoption of staking protocols.

3. Staking Infrastructure and Operational Complexities

Becoming a validator or running a stake pool often requires significant technical expertise, specialized hardware, and reliable infrastructure. The operational complexities involved in maintaining high uptime, ensuring proper security measures, and managing the staking process can create barriers to entry, particularly for individual token holders or smaller entities.

To mitigate these challenges, the development of user-friendly staking tools, robust infrastructure solutions, and comprehensive educational resources is essential. Additionally, the growth of Staking-as-a-Service (STaaS) providers can help lower the technical barriers and make staking more accessible to a broader audience.

4. Regulatory Uncertainty and Compliance

As staking ecosystems continue to grow and attract mainstream attention, regulatory scrutiny and compliance considerations become increasingly important. The legal and regulatory status of staking rewards, token distributions, and the overall governance models of staking protocols remain uncertain in many jurisdictions.

Navigating this regulatory landscape will be crucial for the long-term viability and adoption of staking protocols, as well as ensuring that they operate within the bounds of applicable laws and regulations. Collaboration between industry stakeholders, regulators, and policymakers will be essential in establishing clear guidelines and fostering an environment conducive to innovation while protecting the interests of all participants.

5. Security Risks and Attack Vectors

Like any decentralized system, staking protocols are not immune to potential security risks and attack vectors. These can include vulnerabilities in smart contracts, potential collusion among validators, stake-grinding attacks (where malicious actors repeatedly stake and unstake tokens to manipulate the system), and other forms of exploits or attacks.

Robust security measures, continuous auditing, and the adoption of best practices in secure coding and protocol design are paramount to mitigating these risks. Additionally, the development of advanced monitoring and detection tools, as well as effective incident response mechanisms, can help identify and mitigate