Top Cryptocurrencies to Invest in 2024

The Top Cryptocurrencies to Invest in 2024: Unlocking Potential in a Dynamic Market

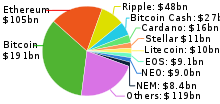

Since the creation of Bitcoin in 2009, the number of new cryptocurrencies has expanded rapidly.[1] Market capitalizations of cryptocurrencies ( January 27, 2018)

Market capitalizations of cryptocurrencies ( January 27, 2018)

The UK's Financial Conduct Authority estimated there were over 20,000 different cryptocurrencies by the start of 2023, although many of these were no longer traded and would never grow to a significant size.[2

As the digital landscape continues to evolve, the cryptocurrency market remains a dynamic arena for investors seeking opportunities for growth and diversification. With new technologies, regulations, and trends shaping the industry, selecting the right cryptocurrencies to invest in demands careful consideration and analysis. In 2024, several cryptocurrencies stand out for their innovative features, strong fundamentals, and potential for long-term value appreciation. Here's a closer look at some of the best cryptocurrencies to consider for investment in 2024:

1. Bitcoin (BTC): Bitcoin, the pioneer of cryptocurrencies, continues to maintain its position as the king of digital assets. With widespread adoption by institutional investors and corporations, Bitcoin's status as a store of value remains unchallenged. Its limited supply, decentralized nature, and growing mainstream acceptance make it a cornerstone asset for any crypto portfolio.

2. Ethereum (ETH): Ethereum, the leading platform for decentralized applications (DApps) and smart contracts, offers investors unique opportunities beyond simple value storage. With the impending transition to Ethereum 2.0, scalability improvements and the shift to a proof-of-stake consensus mechanism are expected to enhance its efficiency and reduce transaction costs. Additionally, the proliferation of DeFi (Decentralized Finance) projects built on Ethereum's blockchain further solidifies its position as a top investment choice.

3. Polkadot (DOT):As an interoperability protocol, Polkadot facilitates seamless communication between different blockchains, enabling the creation of scalable and interconnected blockchain networks. Its innovative approach to cross-chain compatibility and governance framework has garnered significant attention from developers and investors alike. With the potential to bridge the gap between disparate blockchain ecosystems, Polkadot presents a compelling investment opportunity in 2024.

4. Cardano (ADA): Cardano distinguishes itself with its scientific approach to blockchain development, prioritizing security, scalability, and sustainability. Its implementation of the Ouroboros consensus mechanism and ongoing efforts to enhance interoperability and governance make it a promising candidate for long-term investment. Moreover, Cardano's focus on serving underserved regions through partnerships with governments and organizations highlights its commitment to fostering financial inclusion and accessibility.

5. Solana (SOL): Solana has emerged as a leading blockchain platform for decentralized applications, boasting high throughput and low transaction fees. Its innovative proof-of-history consensus mechanism enables rapid transaction processing, making it an attractive option for developers seeking scalable solutions. With a growing ecosystem of projects and strategic partnerships, Solana's potential for adoption and growth in 2024 remains substantial.

6. Chainlink (LINK): As a decentralized oracle network, Chainlink plays a critical role in connecting smart contracts with real-world data. Its ability to securely retrieve and verify external information is essential for the functioning of DeFi, gaming, and supply chain applications. With the increasing demand for reliable Oracle solutions, Chainlink's utility and value proposition are poised for further expansion in 2024.

While these cryptocurrencies represent some of the top investment opportunities in 2024, it's essential to conduct thorough research and exercise caution when navigating the volatile cryptocurrency market. Diversification, risk management, and a long-term investment horizon are key principles to consider when building a crypto portfolio. Additionally, staying informed about industry developments, regulatory changes, and emerging trends can help investors make informed decisions and capitalize on evolving opportunities in the ever-changing world of cryptocurrency.

References

- ^ Cryptocurrencies: A Brief Thematic Review. Economics of Networks Journal. Social Science Research Network (SSRN). Date accessed August 28, 2017.

- ^ "Crypto: The basics". FCA. February 9, 2023. Retrieved July 4, 2023.

- ^ Dixon, Lance (December 24, 2013). "Building Bitcoin use in South Florida and beyond". Miami Herald. Retrieved January 24, 2014.

- ^ Taylor, Michael Bedford (2013). "Bitcoin and the age of bespoke silicon" (PDF). Proceedings of the 2013 International Conference on Compilers, Architectures and Synthesis for Embedded Systems. Piscataway, NJ: IEEE Press. ISBN 978-1-4799-1400-5. Retrieved January 14, 2014.

- ^ Jump up to:

- a b Steadman, Ian (May 7, 2013). "Wary of Bitcoin? A guide to some other cryptocurrencies". Wired UK. Condé Nast UK.

- ^ "Bitcoin". GitHub.