What Are Treasury Management Systems and Why Do Businesses Need Them?

Managing a company’s money efficiently is one of the biggest challenges for any business, regardless of its size or industry. From handling cash flow and payments to managing liquidity and investments, financial operations can quickly become complex. This is where Treasury Management Systems (TMS) come into play.

In simple terms, a treasury management system helps businesses automate, organize, and optimize their financial activities. It gives companies a clear view of their cash positions, helps reduce financial risks, and ensures better decision-making. In this blog, we’ll break down what treasury management systems are, how they work, and why they have become essential for modern businesses.

What Is a Treasury Management System?

A Treasury Management System (TMS) is a software platform designed to automate and manage a company’s financial operations. It helps track and control cash flow, manage investments, monitor liquidity, handle payments, and minimize financial risk.

The main goal of a TMS is to centralize all treasury functions in one place. Instead of relying on spreadsheets or manual processes, businesses use treasury software to streamline daily financial activities and make data-driven decisions.

Key areas a TMS manages include:

- Cash and liquidity management

- Bank account management

- Risk management (interest rate, FX, and credit risk)

- Payments and receivables

- Debt and investment tracking

- Financial reporting and forecasting

In short, a treasury management system helps ensure that every dollar in the business is accounted for, secure, and working efficiently.

Why Treasury Management Systems Are Important

In today’s business world, financial operations are not just about keeping the books balanced. They involve managing multiple accounts, currencies, and complex payment structures. Manual processes often lead to delays, errors, and missed opportunities.

A TMS automates these tasks, offering better control, visibility, and efficiency. Here’s why companies of all sizes are adopting treasury management systems:

1. Improved Cash Visibility

Every business needs to know how much cash it has at any given time. Treasury systems consolidate data from multiple bank accounts and provide a real-time view of cash positions.

This visibility helps businesses make smarter decisions about investments, borrowing, or spending. With a TMS, finance teams no longer need to manually gather data from different banks or spreadsheets.

2. Better Risk Management

Financial risks such as currency fluctuations, interest rate changes, or delayed payments can impact profitability. Treasury management systems help identify, measure, and mitigate these risks.

For example, a TMS can monitor foreign exchange exposure and suggest hedging strategies. It also alerts teams to potential liquidity risks or compliance issues before they become serious problems.

3. Centralized Control and Automation

Instead of juggling multiple systems and spreadsheets, a TMS brings everything under one roof. It automates repetitive financial processes like bank reconciliations, payment approvals, and reporting.

This not only reduces the workload for finance teams but also minimizes the risk of human error. Centralized control ensures consistency, accuracy, and better governance.

4. Faster Decision-Making

Treasury management systems offer real-time financial insights through dashboards and reports. CFOs and finance managers can quickly access accurate data about cash flow, funding needs, and liquidity.

With instant access to reliable data, businesses can make timely and informed financial decisions that support growth.

5. Enhanced Compliance and Audit Readiness

Regulatory compliance is crucial in financial management. A TMS helps maintain a complete audit trail of all financial activities. It stores transaction histories, approvals, and user activities, making audits faster and more transparent.

Compliance with standards such as IFRS, SOX, and GAAP becomes much easier since the system ensures data accuracy and traceability.

Key Features of Treasury Management Systems

Modern treasury management systems come with a wide range of features designed to meet the diverse needs of businesses. Let’s explore the most important ones.

1. Cash and Liquidity Management

This is the core function of any TMS. It provides real-time visibility into cash balances across all accounts, currencies, and subsidiaries. Businesses can forecast future cash needs, manage liquidity efficiently, and avoid idle funds sitting in accounts.

Advanced systems even automate short-term borrowing or investment decisions based on cash flow trends.

2. Bank Account Management

Managing multiple bank accounts manually can be a nightmare for large organizations. A TMS consolidates all bank accounts into a single dashboard. It tracks balances, transactions, and account relationships in one place.

This feature also simplifies tasks like opening new accounts, setting access permissions, and ensuring compliance with internal policies.

3. Payment and Receivables Management

Treasury management systems automate the process of sending, receiving, and reconciling payments. Whether it’s payroll, vendor payments, or customer collections, all transactions can be executed securely from within the system.

Automation helps reduce payment errors, ensure timely processing, and improve working capital management.

4. Risk and Compliance Management

Risk management is one of the biggest benefits of a TMS. The system identifies risks related to currency movements, interest rate fluctuations, or counterparty exposure.

Some tools even use AI and predictive analytics to anticipate potential risks and suggest preventive actions. It also ensures compliance with international financial regulations and company policies.

5. Investment and Debt Management

For companies managing loans, bonds, or investments, a TMS provides a centralized platform to monitor and control them. It tracks interest rates, maturity dates, and repayment schedules automatically.

This ensures that companies make timely payments and maintain an optimal balance between debt and cash reserves.

6. Forecasting and Reporting

A good TMS provides dynamic forecasting tools that help predict cash flow under different scenarios. It combines historical data with real-time insights to create accurate financial forecasts.

Detailed reports and dashboards make it easy for management to analyze performance, identify trends, and make proactive financial decisions.

7. Multi-Currency and Global Support

For international businesses, handling transactions in multiple currencies can be challenging. Treasury management systems simplify this by automatically converting and tracking currencies in real time.

They also help manage global operations by supporting multiple languages, regulatory requirements, and regional banking systems.

8. Integration with ERP and Accounting Systems

A treasury system works best when it connects seamlessly with other enterprise systems like ERP (Enterprise Resource Planning) and accounting software.

This integration ensures data consistency, eliminates duplication, and improves accuracy across all financial processes.

9. Automation and AI Capabilities

Modern treasury systems are powered by AI and machine learning. These technologies enable smarter automation, from transaction matching to predictive analytics.

AI can identify anomalies, detect fraud, and help forecast future financial scenarios more accurately. This not only saves time but also enhances strategic planning.

10. Secure and Cloud-Based Infrastructure

Security is a top priority in financial systems. Most modern TMS solutions are cloud-based and use end-to-end encryption, role-based access control, and multi-factor authentication.

Cloud systems allow treasury teams to access financial data securely from anywhere, making remote work and collaboration much easier.

Benefits of Using a Treasury Management System

Businesses that adopt treasury management systems experience significant improvements in efficiency, accuracy, and control. Here are the major benefits:

1. Greater Financial Control

A TMS centralizes all financial activities, giving finance leaders full control over their organization’s cash flow, investments, and risks.

2. Enhanced Accuracy and Reduced Errors

Automation eliminates manual data entry and reduces reconciliation errors. Every transaction is automatically recorded and verified for accuracy.

3. Improved Working Capital Efficiency

By providing real-time visibility into receivables, payables, and cash positions, treasury systems help businesses make better use of their working capital.

4. Streamlined Processes

Tasks that once took hours or days can now be completed in minutes. This includes reconciliation, reporting, and payment processing.

5. Cost and Time Savings

Automation reduces operational costs by minimizing human effort and preventing financial errors that could lead to losses.

6. Real-Time Insights and Analytics

The ability to access real-time financial insights helps businesses make proactive and informed decisions, improving overall performance.

7. Scalability and Growth Support

A treasury management system grows with your business. Whether you expand into new markets or manage more transactions, the system adapts without compromising speed or accuracy.

Why Businesses Need a Treasury Management System Today

The financial environment is becoming increasingly complex. Global operations, digital payments, and volatile markets make manual treasury management outdated and risky.

Businesses need real-time data, automation, and control to stay competitive. A treasury management system provides all three.

Key reasons businesses adopt a TMS today include:

- To manage global cash efficiently

- To improve liquidity forecasting

- To reduce risks and fraud

- To enhance compliance and governance

- To automate time-consuming manual processes

Even small and medium enterprises can benefit from adopting a TMS. Cloud-based solutions make it affordable and easy to scale as the business grows.

Also Read: Why Integrated Treasury Management Systems Are a Game-Changer

Choosing the Right Treasury Management System

When selecting a TMS, businesses should look for flexibility, ease of use, and scalability. Here are a few key points to consider:

- Integration Capabilities – Ensure it connects with your ERP, accounting, and banking systems.

- Customization Options – It should adapt to your workflows and business rules.

- Automation Level – Look for intelligent automation features to reduce manual work.

- User Experience – The interface should be intuitive and easy to navigate.

- Security – Check for encryption, compliance certifications, and access controls.

- Vendor Support – Reliable technical and customer support is essential.

Platforms like Kosh.ai offer integrated treasury and reconciliation automation, providing real-time insights, AI-based forecasting, and seamless connectivity with financial systems.

The Future of Treasury Management Systems

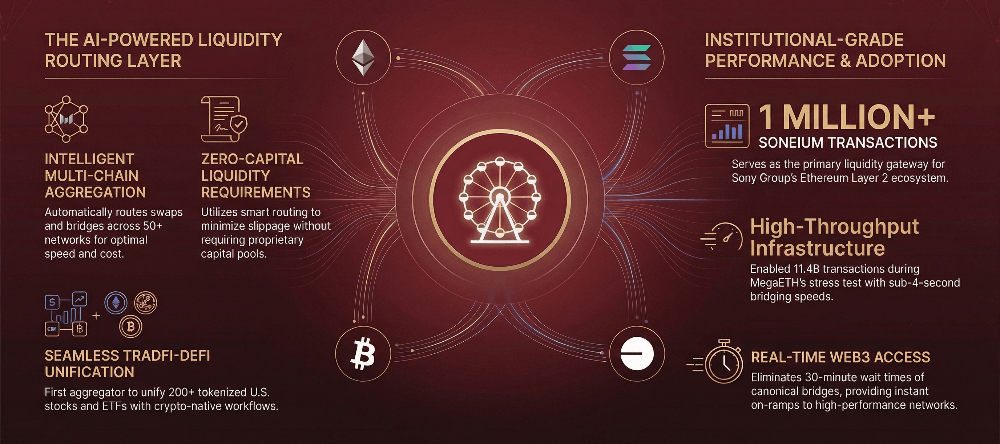

The future of treasury management is intelligent and predictive. Artificial intelligence, blockchain, and advanced analytics are transforming how businesses handle their finances.

AI-powered treasury systems will soon automate not just tasks but also strategic decisions such as investment allocation and liquidity planning. Cloud technology will make these systems more accessible to businesses of all sizes.

By adopting advanced treasury solutions early, companies can stay ahead of financial risks, improve efficiency, and maintain complete visibility into their cash flow.

![[LIVE] BULB Ambassador Program: Empowering the Future of Web3 Creators](https://cdn.bulbapp.io/frontend/images/952f29cd-a8d5-47aa-8e9f-78a1255f8675/1)