Unlocking Passive Income: Exploring Crypto Lending Platforms

In the ever-evolving landscape of finance, crypto lending platforms have emerged as a beacon of opportunity for investors seeking to leverage their digital assets. These platforms offer a unique avenue for individuals to earn interest on their cryptocurrency holdings, providing an alternative to traditional banking systems. By lending out their digital assets to borrowers, users can generate passive income while contributing to the liquidity of the crypto market.

Understanding Crypto Lending Platforms

Crypto lending platforms function similarly to traditional lending institutions, but with a decentralized twist. Instead of relying on banks or financial intermediaries, these platforms connect lenders directly with borrowers through smart contracts and blockchain technology. Users can choose to lend out their cryptocurrencies, such as Bitcoin, Ethereum, or stablecoins, in exchange for interest payments.

How It Works

1. Lender Registration: To get started, users typically need to sign up for an account on a crypto lending platform. They can then deposit their digital assets into the platform's lending pool.

2. Choosing Assets and Terms: Once deposited, lenders can select the assets they wish to lend and specify the terms of the loan, including the duration and interest rate.

3. Matching with Borrowers: Borrowers, who are usually individuals or institutions seeking liquidity, can then request loans on the platform. The platform's algorithm matches borrowers with suitable lenders based on their preferences.

4. Interest Payments: As borrowers repay their loans, lenders receive interest payments directly into their accounts. The interest rates can vary depending on market conditions, loan duration, and the specific platform used.

Benefits of Crypto Lending Platforms

1. Passive Income: One of the primary benefits of crypto lending platforms is the ability to earn passive income on idle digital assets. Instead of letting cryptocurrencies sit in a wallet, users can put them to work and generate interest over time.

2. Diversification: Crypto lending allows investors to diversify their portfolios beyond simply holding cryptocurrencies. By participating in lending, users can potentially earn additional income streams while maintaining exposure to the crypto market.

3. Flexibility: Crypto lending platforms offer flexibility in terms of choosing assets, loan terms, and interest rates. Users have the freedom to tailor their lending strategy to suit their risk tolerance and financial goals.

4. Low Entry Barriers: Unlike traditional lending institutions, crypto lending platforms often have low entry barriers, allowing individuals with varying amounts of capital to participate. This democratization of finance opens up opportunities for a broader range of investors.

Risks and Considerations

While crypto lending can be lucrative, it's essential to understand the associated risks:

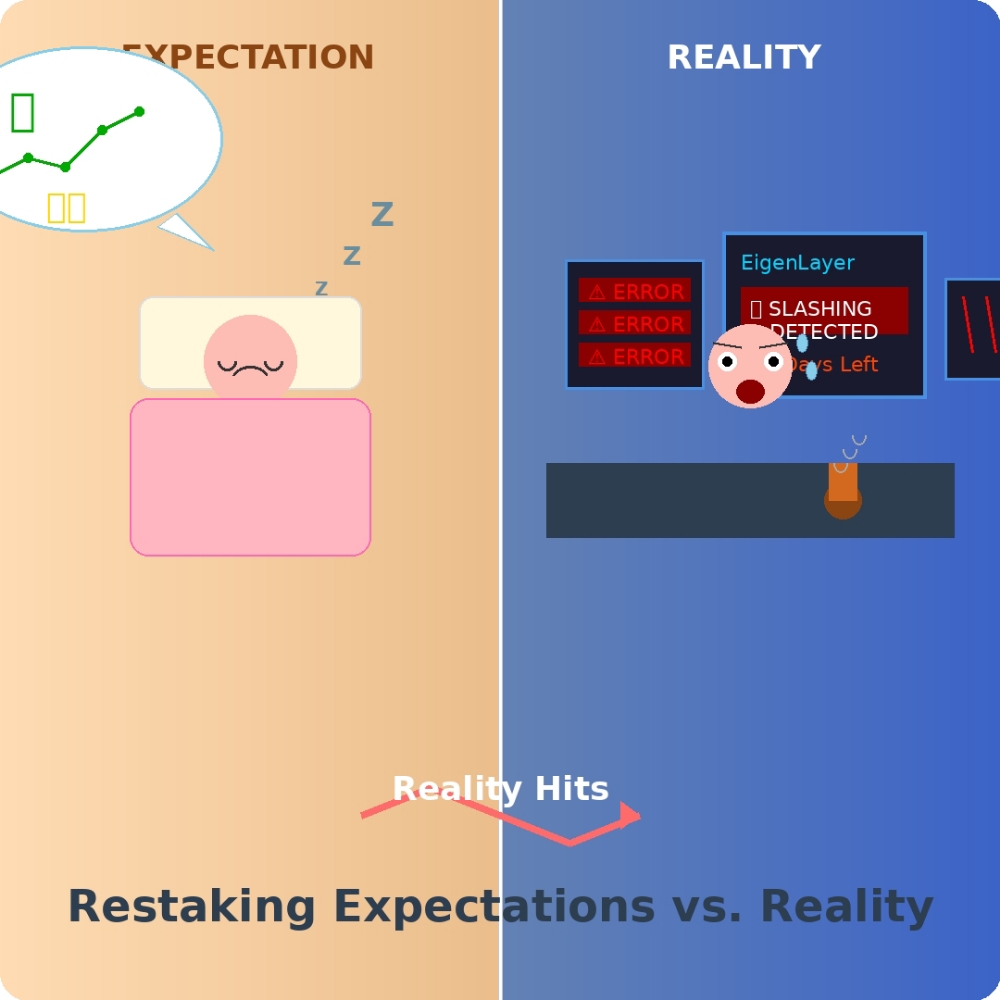

1. Volatility: The cryptocurrency market is known for its price volatility. While lenders may earn interest on their assets, they are still exposed to the risk of price fluctuations, which can impact the overall value of their holdings.

2. Counterparty Risk: There is always the risk of default by borrowers, especially in the case of unsecured loans. Users should conduct thorough due diligence on borrowers and platforms before participating in lending activities.

3. Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies and lending platforms is still evolving. Users should stay informed about regulatory developments in their jurisdiction and assess the potential impact on their investments.

Conclusion

Crypto lending platforms offer an innovative way for individuals to earn interest on their digital assets while contributing to the liquidity of the crypto market. With the potential for passive income, diversification, and flexibility, these platforms have become increasingly popular among investors seeking alternative investment opportunities. However, it's essential to approach crypto lending with caution and conduct thorough research to mitigate risks and maximize potential rewards in this burgeoning sector of the financial industry.

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)