Bitcoin Surges to $70K: A Milestone in Cryptocurrency Evolution

In a historic turn of events, Bitcoin, the flagship cryptocurrency, has shattered all previous records, soaring to an unprecedented $70,000 valuation. This remarkable surge marks a pivotal moment in the cryptocurrency's journey, captivating investors worldwide and redefining the landscape of digital assets.

The meteoric rise of Bitcoin to $70,000 represents more than just a numerical milestone; it symbolizes the culmination of years of technological innovation, financial disruption, and mainstream acceptance. From its humble beginnings as a white paper authored by the mysterious Satoshi Nakamoto in 2008 to its current status as a global financial phenomenon, Bitcoin has defied skeptics and surged forward against all odds.

So, what factors have contributed to this remarkable surge in Bitcoin's value?

- Institutional Adoption: Over the past few years, institutional adoption of Bitcoin has gained significant momentum. Major financial institutions, corporations, and even governments are now acknowledging Bitcoin as a legitimate asset class. High-profile endorsements from companies like Tesla, MicroStrategy, and Square have added credibility to Bitcoin, instilling confidence among traditional investors and paving the way for further adoption.

- Scarcity and Halving: Bitcoin's built-in scarcity is a fundamental driver of its value. With a maximum supply capped at 21 million coins, Bitcoin operates on a deflationary model, meaning its supply diminishes over time. The regular halving events, which reduce the rate at which new Bitcoins are created, further accentuate this scarcity. As the supply dwindles, the demand for Bitcoin continues to surge, driving its price upward.

- Inflation Hedge: Amidst global economic uncertainty and unprecedented levels of monetary stimulus, Bitcoin has emerged as a hedge against inflation. With central banks resorting to aggressive quantitative easing measures, traditional fiat currencies are facing the risk of devaluation. In contrast, Bitcoin's decentralized nature and fixed supply make it an attractive store of value in times of economic instability.

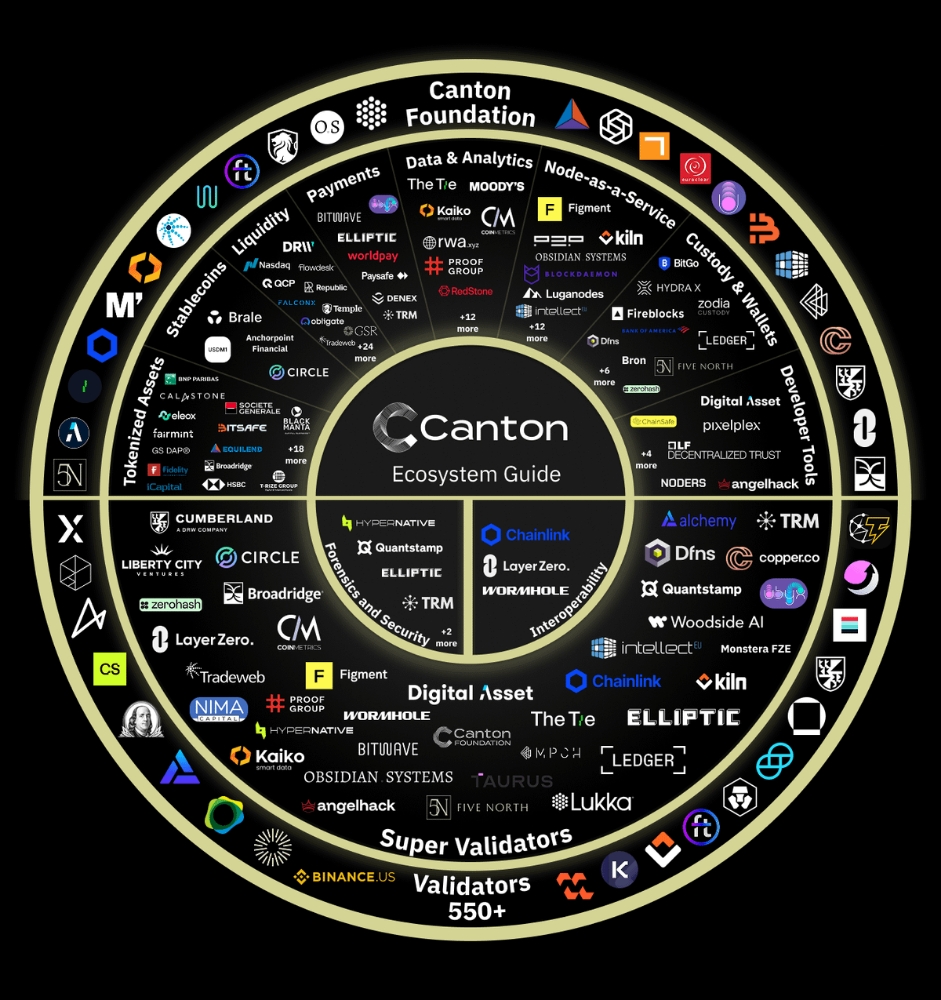

- Market Maturity: As the cryptocurrency market matures, it becomes more resilient to volatility and manipulation. Institutional-grade infrastructure, such as regulated exchanges, custody solutions, and derivatives markets, has enhanced liquidity and stability in the Bitcoin ecosystem. Additionally, the entry of institutional investors with deep pockets has led to a more orderly market, reducing the likelihood of extreme price swings.

- Growing Retail Interest: Beyond institutional investors, retail interest in Bitcoin continues to surge, fueled by widespread media coverage and growing awareness. Retail investors, drawn by the prospect of high returns and the allure of a decentralized financial system, are flocking to Bitcoin in record numbers. User-friendly platforms and mobile apps have made it easier than ever for individuals to buy, hold, and transact with Bitcoin, further fueling its adoption.

While Bitcoin's ascent to $70,000 is undoubtedly remarkable, it also raises questions about its sustainability and potential risks. Volatility remains a defining characteristic of Bitcoin, and sharp price corrections are not uncommon in the cryptocurrency market. Regulatory scrutiny, technological challenges, and competition from alternative cryptocurrencies also pose potential threats to Bitcoin's long-term viability.

Moreover, the environmental impact of Bitcoin mining has come under increased scrutiny, with critics raising concerns about its energy consumption and carbon footprint. Addressing these sustainability challenges will be crucial for Bitcoin to maintain its credibility and secure its position as a sustainable digital asset.

In conclusion, Bitcoin's surge to $70,000 signifies a major milestone in the evolution of cryptocurrencies. It reflects the growing confidence in digital assets as a legitimate investment class and underscores Bitcoin's resilience in the face of adversity. As Bitcoin continues to mature and integrate into the global financial system, its impact on traditional markets and monetary policy is likely to become even more pronounced. However, amid the euphoria, it's essential to approach Bitcoin investment with caution and recognize the inherent risks associated with this nascent asset class.

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)