Liquidations In Cryptocurrencies, Importance Of Knowing Them.

Cryptocurrencies are a form of digital money that is based on blockchain technology and can be traded on virtual platforms. This type of market is very dynamic and offers many possibilities of making money, but also losing it. Therefore, it is important for investors and traders to be well informed about the risks and ways to reduce them.

One of the most relevant risks is that of cryptocurrency liquidation. What is it and how can it be prevented?

Cryptocurrency liquidation is the process of forcefully closing a trader's positions in the cryptocurrency market. It happens when a trader's margin account cannot support their open positions due to high losses or lack of sufficient margin to meet minimum requirements. Margin is the amount of money that a trader must put up as collateral to open a position with leverage.

Leverage is a tool that allows traders to increase their exposure to the market with a smaller investment. For example, if a trader has 100 dollars and uses 10x leverage, he can open a position of 1000 dollars. However, leverage also involves greater risk, as market fluctuations can affect both profits and losses. If the price of the asset moves against the trader's position, he may lose more money than he initially invested.

When a trader's account drops below the required margin level, the exchange or brokerage platform can initiate the liquidation process. This means that the trader's positions will be closed at the market price to cover losses and outstanding debts. This settlement process is intended to protect both the trader and the exchange from further losses. By closing positions, it helps ensure that the trader does not accumulate more debt and that the exchange can recover any funds owed. Settlement can occur automatically or be triggered upon reaching predetermined margin levels set by the exchange.

It is important to note that cryptocurrency liquidation can lead to significant financial losses for the trader. Therefore, it is essential that traders manage their risk efficiently, monitor their margin levels and employ risk management techniques to avoid or mitigate the possibility of liquidation. Some of the techniques that can help prevent or reduce liquidation risk are:

✔ Using adequate leverage can increase profits, but also potential losses. Therefore, it is important to use a level of leverage that suits the trader's risk profile and available capital.

✔ Establish stop-loss orders, these are instructions that tell the platform to close a position when the price reaches a certain level. This way, the trader can limit his losses and avoid liquidation if the market moves against him.

✔ Add more margin is close to the liquidation level and avoid forced closing of your positions. I personally do not recommend this type of operation because it would imply changing the trading idea that you had conceived before opening the operation, it is putting feelings into your trading strategy (but it is just an opinion).

✔ Another way to avoid liquidation is to manually close some or all open positions before the margin level becomes too low. This can reduce risk and free up margin for other trades.

What is Rekt in crypto? In the context of cryptocurrencies, “Rekt” can be called “liquidation” in professional terms. “Rekt” is a slang term commonly used in the cryptocurrency community to describe a situation where a trader or investor suffers significant losses or “goes broke” financially. It is derived from the word "shipwrecked" and is used to express the idea of someone ruined or destroyed due to their poor trading decisions or unfortunate market movements. When someone says they got “Rekt” in cryptocurrency, it usually means they experienced a substantial loss on their cryptocurrency investments or trades. It is often used with humor or as a way to empathize with others who have faced similar losses in the volatile and unpredictable cryptocurrency market. Taken from https://www.coinglass.com

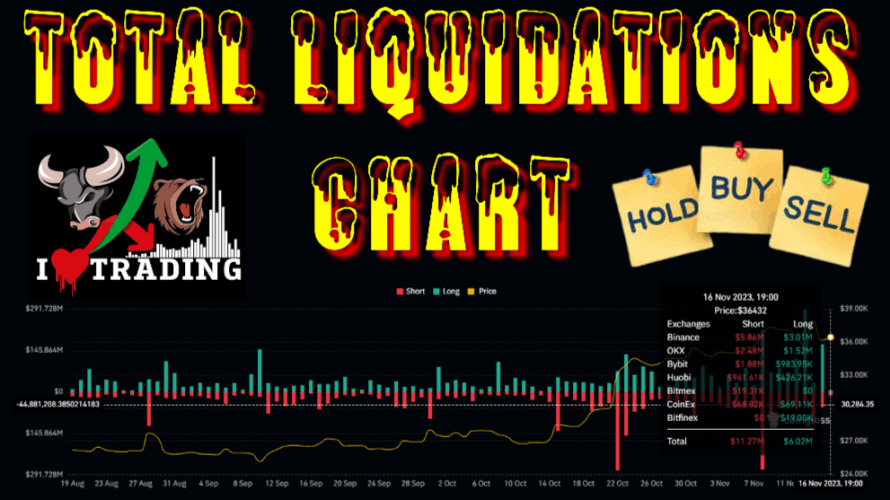

Related to liquidations, there is a lot of real-time information at https://www.coinglass.com/es/LiquidationData that can be very useful. For TradingView you can use the free indicator: Liquidation Levels - By Leviathan, developed by: https://tradingview.com/u/LeviathanCapital.

Liquidation is perhaps one of the worst threats for traders who operate with leverage, it is a risk that we must assume, but that we also have to know and manage. By understanding how it works and how to avoid it, you can significantly improve performance and security when trading in a market as volatile as cryptocurrencies.

TOOLS, PLATFORMS & APPLICATIONS

💲 StormGain - Trading - They can start without investment, capital is acquired for free with the Bitcoin Cloud Miner.

💲 BingX - Trading - Called "The People's Exchange", it places a strong emphasis on social trading and offers its clients extensive features: new user rewards, demo account, high leverage, spot trading, standard and perpetual futures, grid trading, copy feed , etc.

💲 QuantFury (Invite Code: JRRU2593) - Trading - Join using my invite code: JRRU2593 and we will both receive a free share like AAPL or UBER, or crypto like BTC or ETH (up to $250). Trade and invest with no commissions or borrowing fees at real-time spot prices from the NYSE, Nasdaq, CME, Bats, Binance and Coinbase exchanges. With a good marketing management you have the possibility of obtaining passive profits without operating in the market.

💲 CoinEX, KuCoin - Trading - They offer different bonuses.

💲 AddmeFast - Earn daily Crypto. Promote and increase the sources of traffic, visibility, reach and reputation of your social networks.

💲 Bitcoin Spark - ICO - Initial Coin Offerings.

💲Bitrefill - Living with crypto, a philosophy of financial freedom. Travel, play, eat and live with BTC.

💲 Bulb, Publish0x, Ecency - Earn daily Crypto, NTFs or Money for reading or writing articles and interacting with publications.

Author's Note: The opinion expressed here is not investment advice, is provided for informational purposes only, and reflects the opinion of the author only. I do not promote, endorse or recommend any particular investment. Investments may not be right for everyone. Every investment in the market and every trade you make involves risk, so you should always do your own research before making any decision. I do not recommend investing money that you cannot afford to chair, as you could lose the entire amount invested.

💖 Originally Posted: Publish0x