Trading Bots Vs Human Expertise: Striking the Balance in Financial Markets

Hello BULBers,

It's been a long time I posted here and I know most of you have been waiting for my blogs.

Today I want to talk about Striking the balance between the fast emergence of Trading Bots and the touch of Human Expertise in the area of Crypto trading.

Introduction:

In the dynamic landscape of financial markets, the debate over trading bots versus human expertise has garnered significant attention. With advancements in technology, algorithmic trading has become increasingly prevalent, challenging traditional methods of human decision-making. This article delves into the merits and limitations of trading bots compared to human expertise, exploring how each contributes to market efficiency and volatility.

The Rise of Trading Bots:

Trading bots, also known as algorithmic trading systems or automated trading algorithms, are computer programs designed to execute trades based on predefined criteria. These criteria can range from simple instructions, such as price movements or volume thresholds, to complex algorithms analyzing vast amounts of data using machine learning and artificial intelligence techniques.

The appeal of trading bots lies in their ability to operate 24/7, execute trades at lightning speed, and remove human emotion from the decision-making process. By automating trading strategies, bots aim to capitalize on market inefficiencies and exploit opportunities that may be imperceptible to human traders.

Advantages of Trading Bots:

- Speed and Efficiency: Trading bots can execute trades within microseconds, far quicker than any human trader could react. This rapid execution enables bots to capitalize on fleeting market opportunities and maintain competitive advantages in high-frequency trading environments.

- Elimination of Emotional Bias: Human traders are susceptible to emotional biases such as fear, greed, and overconfidence, which can cloud judgment and lead to irrational decision-making. In contrast, trading bots operate based on predefined rules, devoid of emotional influences, thereby reducing the risk of impulsive trades.

- Consistency and Discipline: Bots adhere strictly to their programmed algorithms, ensuring consistency in trade execution and risk management. This discipline helps mitigate the impact of human error and ensures adherence to predetermined trading strategies over time.

- Scalability: Trading bots can analyse vast amounts of data and execute trades across multiple markets simultaneously, a feat beyond the capacity of individual human traders. This scalability enables bots to capitalize on diverse trading opportunities and manage larger portfolios with greater efficiency.

Limitations of Trading Bots:

- Lack of Adaptability: While trading bots excel in executing predefined strategies, they may struggle to adapt to unforeseen market conditions or sudden changes in the trading environment. Human traders possess the ability to interpret nuanced information, adjust strategies on the fly, and capitalize on emerging opportunities that may elude automated systems.

- Over-Reliance on Historical Data: Many trading bots rely heavily on historical data to inform their decision-making processes. While historical patterns can provide valuable insights, they may not always accurately predict future market movements, especially in highly volatile or unprecedented market conditions.

- Vulnerability to Technical Glitches: Trading bots are susceptible to technical glitches, system failures, and cybersecurity threats, which can disrupt trading operations and result in significant financial losses. Human traders, on the other hand, can exercise judgment and intervene to mitigate risks during such disruptions.

- Ethical Considerations: The proliferation of algorithmic trading raises ethical concerns regarding market manipulation, unfair advantages, and systemic risks. While regulations aim to address these concerns, the rapid evolution of technology often outpaces regulatory frameworks, posing challenges for market oversight and investor protection.

The Role of Human Expertise:

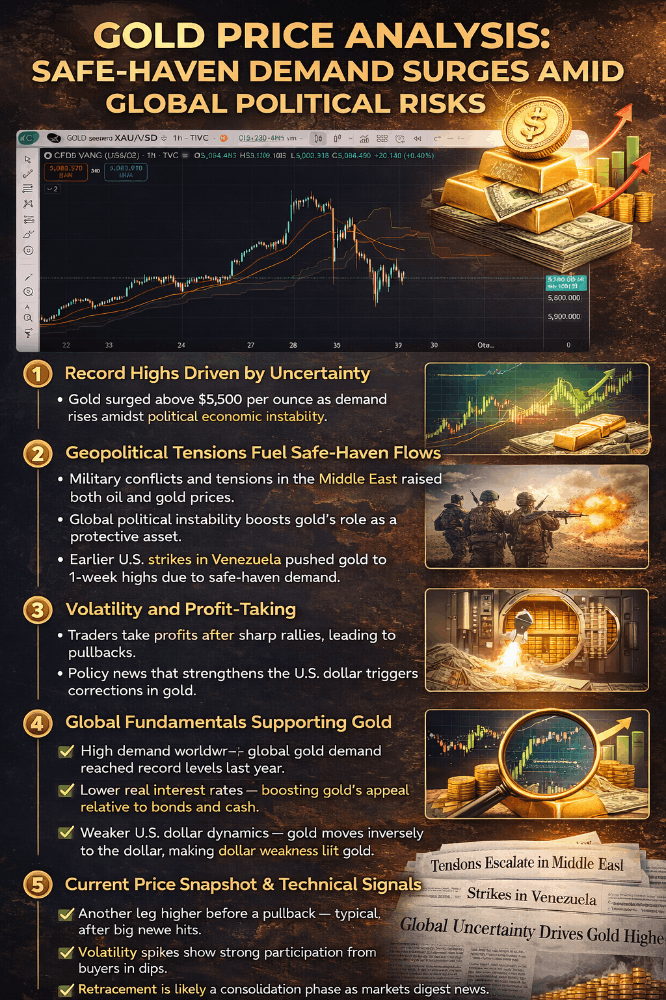

Despite the advancements in algorithmic trading, human expertise remains indispensable in financial markets. Experienced traders bring a nuanced understanding of market dynamics, macroeconomic factors, geopolitical events, and qualitative insights that cannot be replicated by trading bots alone. Human traders possess the ability to interpret news, assess sentiment, and exercise judgment in complex and ambiguous situations, thereby adding value to the decision-making process.

Moreover, human traders play a critical role in developing and refining trading algorithms, calibrating parameters, and adapting strategies to evolving market conditions. By combining human insight with algorithmic precision, firms can achieve a synergistic approach to trading that leverages the strengths of both human expertise and automation.

Striking the Balance:

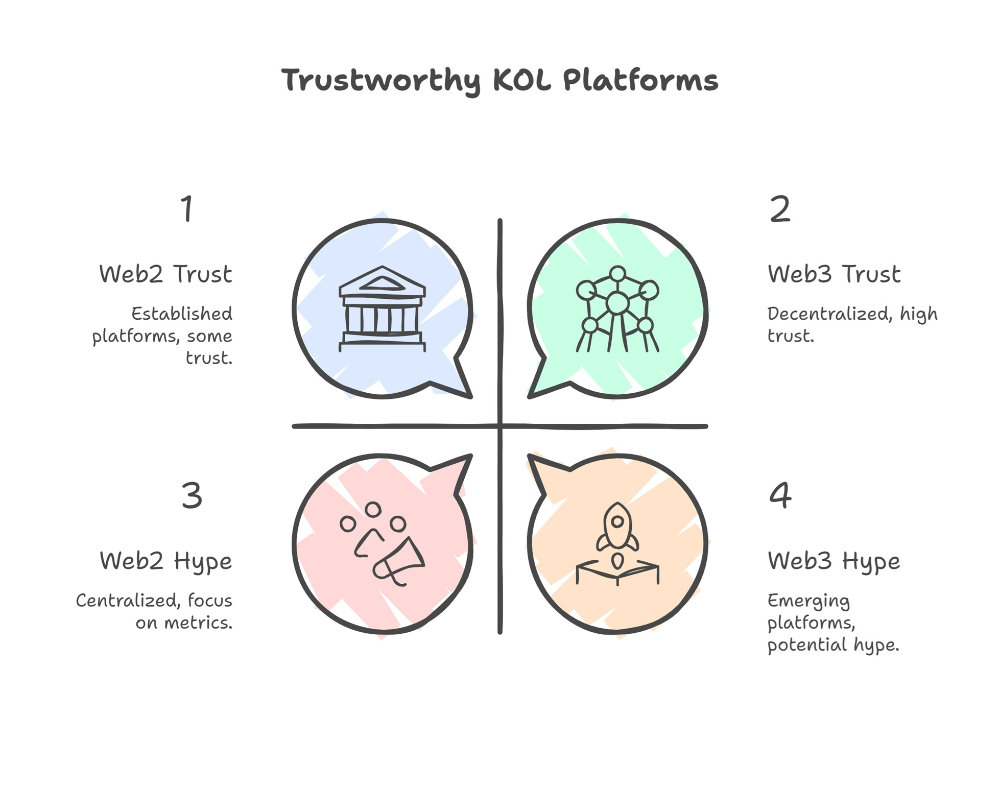

In the debate between trading bots and human expertise, there is no one-size-fits-all solution. Instead, the optimal approach lies in striking a balance between automated trading algorithms and human judgment. Firms must recognize the complementary nature of these two approaches and leverage them in tandem to maximize performance, mitigate risks, and adapt to changing market dynamics.

Key considerations for achieving this balance include:

- Hybrid Models: Integrating human expertise with algorithmic trading systems through hybrid models allows firms to capitalize on the strengths of both approaches. Human traders can provide oversight, discretion, and qualitative insights, while trading bots handle routine tasks, execute trades, and monitor market conditions.

- Risk Management: Establishing robust risk management protocols is essential to safeguarding against potential pitfalls associated with algorithmic trading, such as technical glitches, model errors, and market disruptions. Human oversight plays a crucial role in monitoring risk exposure, stress testing trading algorithms, and implementing corrective measures when necessary.

- Continuous Learning: Both human traders and trading bots must engage in continuous learning and adaptation to remain competitive in dynamic market environments. Human traders can leverage their experience and intuition to identify evolving trends, while trading bots can incorporate new data and adjust algorithms to improve performance over time.

- Ethical Considerations: Firms must adhere to ethical standards and regulatory guidelines to ensure fairness, transparency, and integrity in their trading practices. Transparency in algorithmic decision-making, accountability for algorithmic outcomes, and responsible use of technology are essential principles that guide ethical conduct in financial markets.

Conclusion:

The debate over trading bots versus human expertise underscores the evolving nature of financial markets and the complex interplay between technology and human judgment. While trading bots offer speed, efficiency, and automation, human expertise provides insight, adaptability, and qualitative judgment that are indispensable in navigating uncertainty and complexity.

By embracing a balanced approach that leverages the strengths of both automated systems and human traders, firms can enhance decision-making, manage risks, and capitalize on opportunities in today's dynamic trading landscape. Ultimately, the convergence of trading bots and human expertise represents a powerful synergy that drives innovation, efficiency, and resilience in financial markets.

Do not forget to share and grow your community.

Kindly follow me on Twitter (now X): https://twitter.com/kwekunyarko192 for more content.

Your reaction, share, comment and tips are highly encouraged to help us bring more content like this. Thanks.

Click the links below to read more on my previous blogs:

- Join The Mind Network Zealy Quest Campaign

- Participate in 1,000,000 $FORWARD Token Giveaway on Galxe

- DOP's Road to Mainnet

- Join The Mind Network Testnet

- How to Build up your Trading Skills

- The Pros and Cons of Trading Bots

- Understanding Gender Equality

- Join the Ten ($TEN) Incentivized Testnet NOW!!!

- Navigating the Future of Finance

- Upcoming Analog ($ANLOG) Incentivized Testnet