Banking in the metaverse

Every year we have a new buzzword that keeps us busy and occupied thinking whether we have another trend that might slip past us and we would miss out on catching another “Google” moment in its infancy. Blockchain, crypto, IoT (internet of Things), AI (Artificial Intelligence) — you name it and it was part of the things to look out for in a particular year. In 2022, it’s all about the Metaverse.Right after Facebook changed its name to Meta, people started speaking about what life would be like in the Metaverse, but no-one really knew (not even Facebook) how engaging, how immersive it would be and there is still a pretty long way to go to get to a “Ready, Player One” level of quality.This past Christmas and given all the shortage in chips globally, my family conveniently got me an Oculus Quest 2 instead of a PS5. Even though this meant putting on hold playing FIFA and NB2K for a while, it really opened up a new way of gaming and engagement for me. After having practiced my lightsaber skills, I finished the Star Wars game in one day — I started thinking about all the different experiences that the Metaverse can enhance and that moment got me thinking about what the banking space would look like in this immersive new world in which every big tech and chip company is investing in.

Bye-bye Digital banking and hello Meta-banking?

Virtual Branches

I will not put on a headset to go wait in line at a virtual branch (though I’m pretty sure some banks will waste time, effort, and money on this). However, building a dedicated space where I can meet a staff or a relationship manager (doesn’t have to be human, most likely an AI powered bot) to complete some complex transactions or having a quarterly portfolio review with some cool charts to look at seems like a legitimate idea.

Account Opening

The VR set already has most of the key information and in most cases already has a credit/debit card on file. The sensors on the controllers (they’re controllers now but expect them to become just a high-tech glove later) would be able to scan or get the information needed from the ID card with just a tap. Once your account is opened, you’ll even be able to customise every aspect of your card, paint it and make a NFT (Non Fungible Token) out of it. Every card is unique with no card number, CVV or expiry needed and it gets added to your wallet for your real world transactions.

Security

Picture yourself logging in seamlessly with a combination of IrisID scanning, next level TouchID (since the controller is going to be a high tech glove as, how about PalmID?) — good luck scamming that (only 007 would be able to)! Username & password become truly a thing of the past. IrisID Scanning

IrisID Scanning

A Meta level of experience

You log in and you’re no longer limited by a specific iPhone/Android screen size. UI/UX takes a whole other level with 360 degrees real estate available. This will really unleash designer creativity!

As a user, I can choose my own banking widgets — we can stop guessing which view works best for a user and let the user choose how they want to see and place widgets for their accounts — Minority report style.

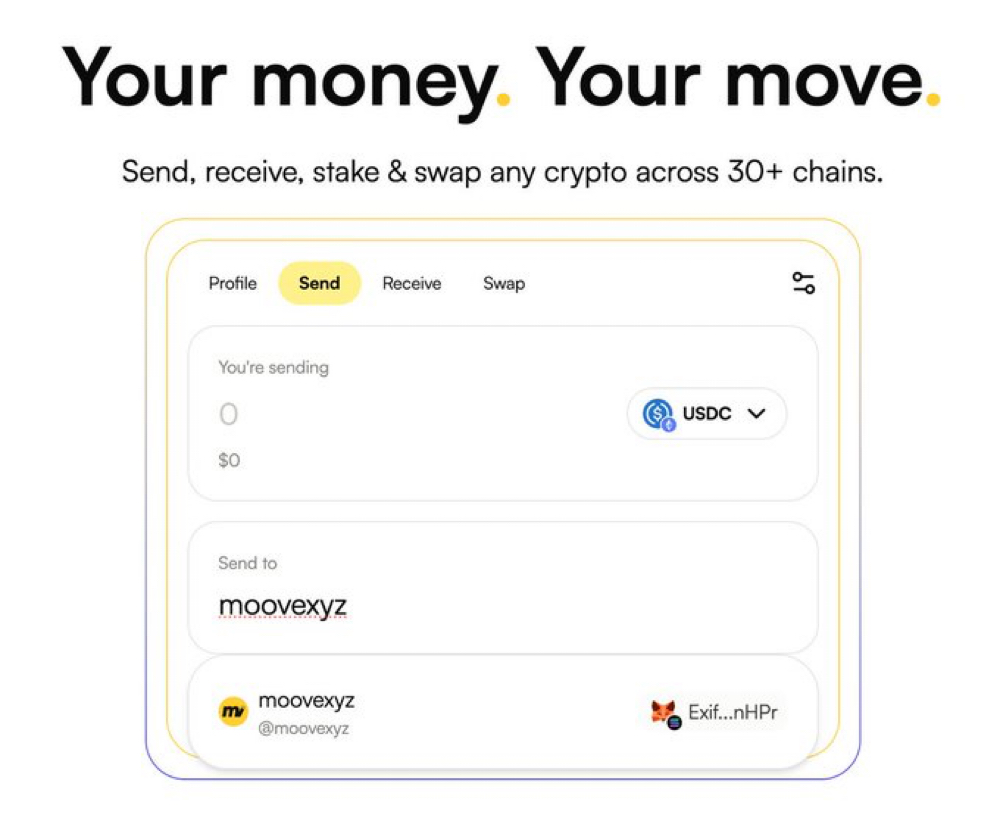

Insta-Payments

If I can be immersed in any geography within seconds, don’t expect me to worry about converting money or worry about high FX rates to pay for experiences — the Metaverse would support all currencies both FIAT and Crypto enabled by a blockchain supported infrastructure would be the backbone. Or better yet, forget about FIAT or the million other cryptocurrencies out there, the Metaverse would have its own Crypto: let’s call it Meta credits! No need for any remittance system (bye bye Swift!) and no one needs to worry about charges or foreign exchange fees — Think of Robox coins!We would be moving from a GIG-economy to a Meta economy where people would be hired to do certain roles in the Metaverse. Just picture going to a virtual art gallery with an option to have a guide that is a bot and a premium pricing for a human — pay and tip accepted in Meta credits!(Meta level) Gamification.

I used to love (and still do) watching Disney movies and one thing that people would have taken great pleasure in was to dive into a pile of money like Scrooge McDuck. With VR, you can do just that! Current gamification schemes don’t live up to its potential and most only require the user to click a button for the screen to have some animation. A lot more can be done to deliver a truly WOW experience: jumping in a pool of cash once your salary is paid is one idea that McDuck would appreciate or being Sonic and collecting tokens as a reward for completing some challenges can be another — there’s so much opportunity is in this space for some transformative user engagement. #ducktales :)

#ducktales :)

These were some high-level thoughts I had while making the best of my VR headset and exploring the so-called Metaverse. There is still a long way to go in terms of adoption, accessibility and not feeling noxious after having the headset on for long.I had fun thinking about all these initial concepts and will be looking forward to building even more immersive and embedded experiences for users in this space.Would love to hear your views of what banking experience you would expect to have in a Metaverse world.