The Rise of Central Bank Digital Currencies (CBDCs) and Their Impact on the Economy.

Introduction

In the digital age, the global financial landscape is undergoing a significant transformation, driven by technological advancements and changing consumer preferences. Central Bank Digital Currencies (CBDCs) are at the forefront of this financial revolution, promising to reshape the way we think about money, payments, and economic policies. This article explores the rise of CBDCs and their potential impact on the economy.

The Dawn of CBDCs

Central Bank Digital Currencies are digital versions of a country's fiat currency, issued and regulated by its central bank. Unlike cryptocurrencies like Bitcoin or Ethereum, CBDCs are not decentralized and are backed by the full faith and credit of the issuing government. They aim to combine the benefits of digital currencies, such as instant transactions and enhanced security, with the stability and trust associated with traditional fiat currencies.

Several countries, including China, Sweden, and the Bahamas, have already begun experimenting with CBDCs, and many others are actively exploring their implementation. These developments have raised several questions and sparked debates about how CBDCs will impact economies and financial systems.

The Potential Benefits

- Financial Inclusion: One of the primary goals of CBDCs is to increase financial inclusion. With digital currencies, individuals without access to traditional banking services can have a secure and accessible means to manage their finances. This could help reduce poverty and inequality by bringing more people into the formal financial system.

- Reduced Transaction Costs: CBDCs have the potential to reduce transaction costs for businesses and individuals. Cross-border transactions, in particular, could become faster and cheaper, benefiting international trade and remittances.

- Enhanced Monetary Policy: Central banks can use CBDCs to implement more precise and efficient monetary policies. They can directly influence the money supply and interest rates, facilitating better control over inflation and economic stability.

- Counterfeit Prevention: CBDCs are designed with advanced security features, making them highly resistant to counterfeiting. This can lead to a safer and more secure financial environment.

- Transparency and Compliance: CBDCs offer transparency in financial transactions, making it easier for governments to track and combat illicit activities such as money laundering and tax evasion.

The Potential Concerns

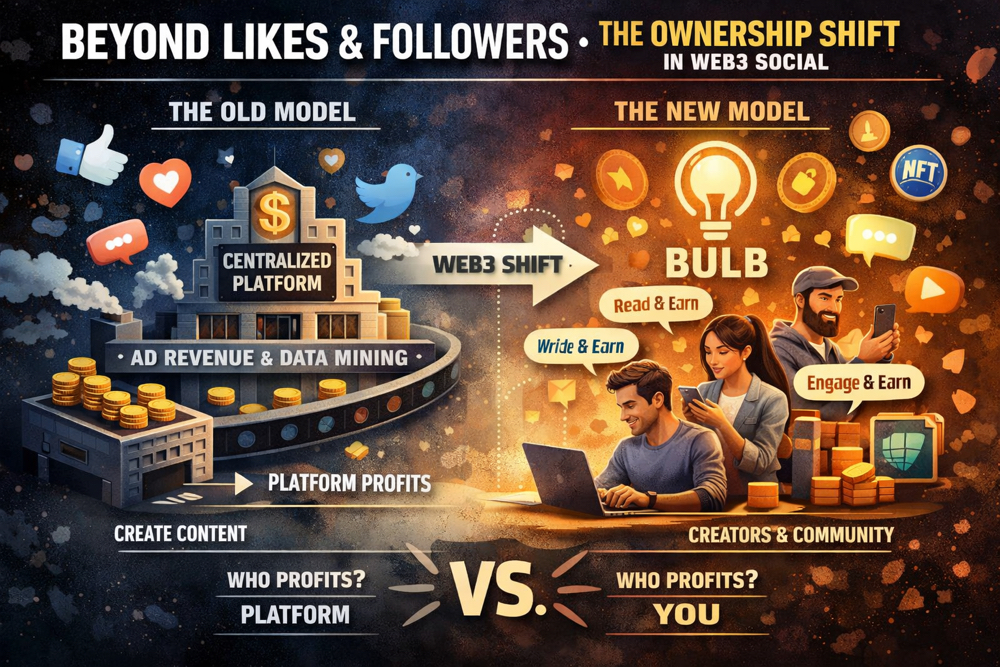

- Privacy Concerns: The use of CBDCs raises privacy concerns, as central banks and governments would have access to detailed transaction data. Striking the right balance between privacy and security will be crucial.

- Disruption of Traditional Banking: CBDCs could disrupt the traditional banking sector by allowing individuals and businesses to hold accounts directly with the central bank. This could potentially lead to a shift away from commercial banks, impacting their profitability and stability.

- Cybersecurity Risks: As digital assets, CBDCs are susceptible to cyberattacks. Robust cybersecurity measures will be essential to protect against theft and fraud.

- Technological Challenges: Developing and maintaining a secure and efficient CBDC infrastructure will require significant technological investment and expertise.

Conclusion

The rise of Central Bank Digital Currencies represents a pivotal moment in the history of money and finance. While they offer numerous benefits, including financial inclusion and enhanced monetary policy, they also raise important concerns related to privacy, cybersecurity, and the disruption of traditional banking.

The successful implementation of CBDCs will require careful consideration of these challenges and a collaborative effort between governments, central banks, financial institutions, and technology providers. As CBDCs continue to evolve, their impact on the economy will become increasingly evident, shaping the financial landscape for generations to come.