Unveiling the Financial Impact of Bitcoin on the Global Economy

Since its inception over a decade ago, Bitcoin has captivated the world with its disruptive potential and transformative impact on the financial landscape. As the pioneer of the cryptocurrency movement, Bitcoin's influence extends far beyond its digital realm, shaping the global economy in profound ways. In this article, we'll explore the financial effects of Bitcoin on the world economy, examining its role as a store of value, medium of exchange, and driver of innovation.

Redefining Money and Store of Value

Bitcoin's emergence challenged traditional notions of money and store of value, offering an alternative to fiat currencies and centralized banking systems. As a decentralized digital asset, Bitcoin enables individuals to store and transfer value without reliance on intermediaries or government control. Its limited supply, deflationary nature, and censorship resistance have positioned Bitcoin as a hedge against inflation and economic instability, attracting investors seeking a safe haven for their wealth.

Disrupting Financial Systems

Bitcoin's decentralized and permissionless nature has disrupted traditional financial systems, challenging the dominance of banks, payment processors, and regulatory authorities. By bypassing traditional intermediaries, Bitcoin offers greater financial inclusion, lower transaction costs, and increased accessibility to global markets. This has profound implications for individuals in underserved regions, enabling them to participate in the global economy and access financial services previously unavailable to them.

Fostering Innovation and Entrepreneurship

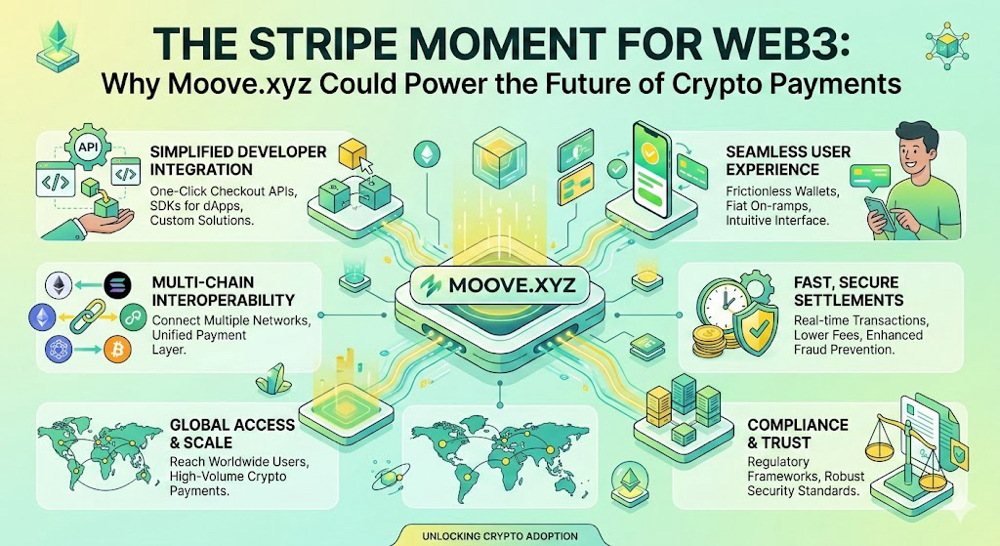

Bitcoin's rise has sparked a wave of innovation and entrepreneurship in the blockchain and cryptocurrency space. Beyond its use as a digital currency, Bitcoin's underlying technology, blockchain, has inspired a myriad of applications across various industries, including finance, supply chain management, healthcare, and more. Startups and enterprises are leveraging blockchain technology to streamline operations, improve transparency, and create new business models, driving economic growth and technological advancement.

Regulatory and Institutional Adoption

As Bitcoin has gained mainstream acceptance, governments, regulators, and institutional investors have grappled with its implications and regulatory challenges. While some countries have embraced Bitcoin and blockchain technology, others have adopted a cautious approach, imposing regulations and restrictions on its use and trading. Institutional investors, including hedge funds, asset managers, and corporations, have begun to allocate capital to Bitcoin as an alternative asset class, further legitimizing its role in the global economy.

Economic Considerations and Challenges

Despite its potential benefits, Bitcoin also presents economic considerations and challenges for policymakers, economists, and market participants. Price volatility, security concerns, regulatory uncertainty, and environmental impact are among the issues that must be addressed to realize Bitcoin's full potential as a transformative force in the global economy. Additionally, the proliferation of cryptocurrencies and decentralized finance (DeFi) platforms introduces new complexities and risks that require careful consideration and oversight.

Conclusion

Bitcoin's financial impact on the world economy is multifaceted and far-reaching, reshaping traditional financial systems, fostering innovation, and challenging conventional wisdom. As Bitcoin continues to evolve and mature, its influence on the global economy will only intensify, catalyzing further innovation, disruption, and transformation. Whether Bitcoin will realize its vision of becoming a global reserve currency remains to be seen, but its legacy as a pioneer of the digital age is already firmly entrenched in the annals of economic history.