The Business Cycle: A Rollercoaster Ride of Economic Expansion and Contraction.

The Business Cycle: A Rollercoaster Ride of Economic Expansion and Contraction.

The economy, much like the weather, experiences periods of sunshine and storms. This cyclical pattern of economic growth and decline is known as the business cycle. Understanding these cycles is crucial for businesses, investors, and policymakers alike. This comprehensive blog delves into the fascinating world of business cycles, explaining their phases, causes, and implications.

Riding the Waves: The Four Phases of a Business Cycle

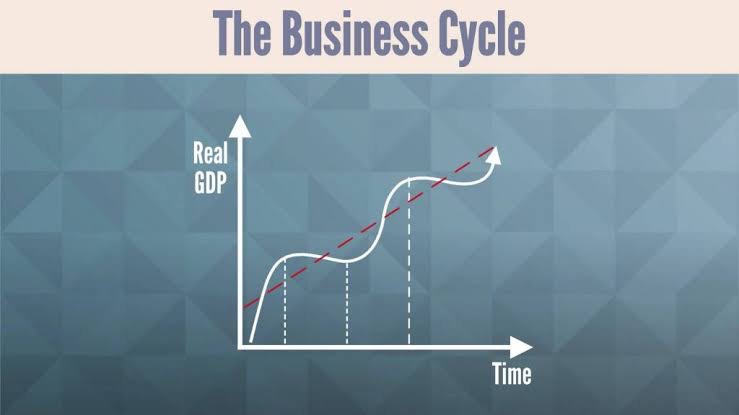

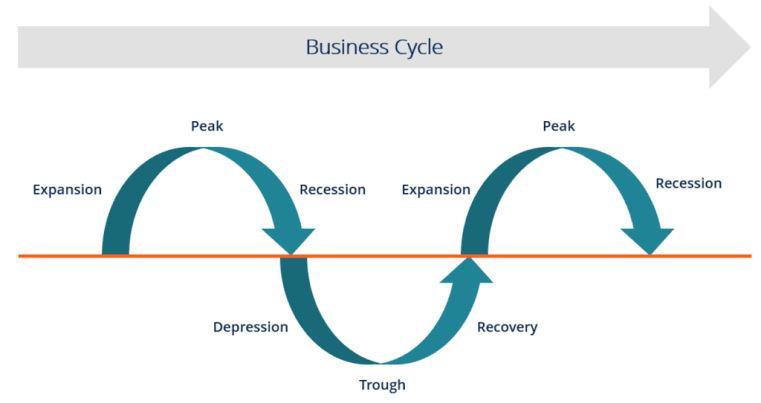

The business cycle is characterized by four distinct phases: expansion, peak, contraction, and trough. Imagine a rollercoaster – the expansion phase is the exciting climb, the peak is the moment of suspense at the top, the contraction is the rapid descent, and the trough is the low point before the next climb begins. Let's explore each phase in more detail:

- Expansion (Boom): This is the sunny period of the business cycle. The economy experiences robust growth characterized by:

- Rising GDP: Gross Domestic Product (GDP) is the total value of goods and services produced in a country. During expansion, GDP increases steadily, indicating a growing economy.

- Low Unemployment: Businesses are thriving and hiring more employees, leading to a decrease in unemployment rates.

- Increased Consumer Confidence:Consumers feel optimistic about the future, leading to higher spending and investment.

- Rising Profits: Businesses experience increased profits due to higher sales and production.

- Rising Stock Prices: As businesses perform well, investor confidence surges, driving stock prices upwards.

- Peak: The expansion doesn't last forever. The economy reaches a peak – a point of maximum growth. Here are some signs of a peak:

- Inflation: As demand for goods and services outpaces supply, prices start to rise, leading to inflation.

- Interest Rate Hikes: To curb inflation, central banks may raise interest rates, making it more expensive to borrow money. This can slow down economic growth.

- Contraction (Recession): After the peak, the economy enters a period of contraction, often referred to as a recession. This is the rollercoaster's descent, characterized by:

- Falling GDP: Economic activity slows down, leading to a decline in GDP.

- Rising Unemployment: As businesses scale back production, layoffs become more frequent, pushing up unemployment rates.

- Decreased Consumer Confidence:Consumers become cautious and cut back on spending, further dampening economic activity.

- Falling Profits: Businesses experience decreasing profits due to lower sales and production.

- Falling Stock Prices: As investor confidence wanes, stock prices experience a decline.

- Trough: The contraction eventually reaches a bottom, known as the trough. This is the low point of the business cycle where economic activity is at its weakest. Here are some signs of a trough:

- Stabilization of Prices: The rate of inflation may slow down or even turn negative (deflation).

- Lower Interest Rates: Central banks may lower interest rates to stimulate economic activity.

The business cycle doesn't have a fixed duration. Expansionary periods can last for several years, while recessions may be shorter but more disruptive. There's no guarantee of how long each phase will last, making the business cycle a dynamic and often unpredictable phenomenon.

The Mystery Unveiled: What Causes Business Cycles?

Economists haven't pinpointed a single cause for business cycles. Several factors, often interacting in complex ways, contribute to these economic fluctuations:

- Aggregate Demand: This refers to the total spending in an economy – consumer spending, business investment, government spending, and net exports. Fluctuations in aggregate demand can trigger changes in the business cycle. For example, a surge in consumer confidence and spending can lead to an expansion, while a decrease in business investment due to uncertainty can trigger a contraction.

- Monetary Policy: Central banks play a crucial role in influencing the business cycle through monetary policy tools. By adjusting interest rates and the money supply, central banks can stimulate economic activity during downturns and curb inflation during expansions.

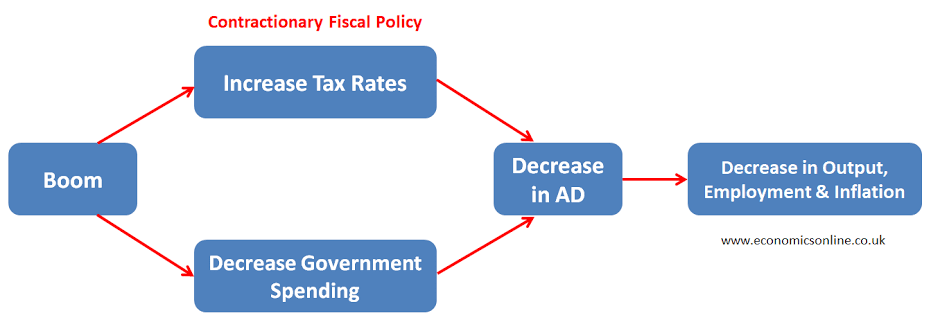

- Government Fiscal Policy: Government spending and taxation policies can also impact the business cycle. Increased government spending can stimulate economic growth during recessions, while tax cuts can increase disposable income and consumer spending.

- Technological Advancements: Technological innovations can significantly influence economic growth. New technologies can drive productivity gains, leading to expansion in the long run. However, in the short term, technological disruptions can lead to job losses and economic instability.

- External Shocks: Unforeseen events like global pandemics, natural disasters, or political upheavals can disrupt economic activity and trigger recessions.

Feeling the Impact: How Business Cycles Affect Us All.

The business cycle doesn't just show up in economic reports – it has real-world consequences for individuals, businesses, and policymakers. Let's explore these impacts:

- Individuals: During expansions, individuals experience job security, rising wages, and a better standard of living. However, recessions bring job losses, decreased income, and financial hardship.

- Businesses: Businesses thrive during expansions, with increased sales, profits, and investment opportunities. Contractions force businesses to scale back production, lay off employees, and struggle to stay afloat.

- Policymakers: Governments use various tools to try and mitigate the negative effects of the business cycle. Monetary and fiscal policies aim to promote economic growth during downturns and control inflation during expansions.

Understanding business cycles empowers individuals to make informed financial decisions. For example, during expansions, it might be wise to invest in the stock market or buy a house. However, during recessions, it's prudent to be more cautious with finances and prioritize saving. Businesses can use their understanding of the business cycle to plan for the future, adjusting their production levels, workforce, and investment strategies accordingly.

The Art of Navigation: How Businesses Can Steer Through the Cycle

While the business cycle presents challenges, businesses can adopt strategies to navigate its different phases:

- Expansion:

- Invest in innovation and research & development to stay ahead of the competition.

- Expand production capacity to meet growing demand.

- Recruit and train skilled employees to support growth.

- Diversify product and service offerings to mitigate risk.

- Peak:

- Monitor economic indicators for signs of a slowdown.

- Control costs and improve efficiency to maintain profitability.

- Be prepared to adjust pricing strategies.

- Contraction:

- Focus on cash flow management to weather the storm.

- Explore cost-cutting measures without compromising quality.

- Retrain and upskill existing staff to adapt to changing needs.

- Consider offering flexible work arrangements to retain talent.

- Trough:

- Develop new product ideas and marketing strategies for the eventual recovery.

- Invest in employee training to prepare for future growth.

- Build strong relationships with suppliers and customers.

By understanding the business cycle and adopting adaptable strategies, businesses can increase their resilience and emerge stronger from each phase.

Taming the Rollercoaster: The Role of Government Policies

Governments also have a role to play in mitigating the negative impacts of the business cycle. Here are some key policy instruments:

- Monetary Policy: Central banks can use interest rates and the money supply to influence economic activity. Lowering interest rates during recessions can stimulate borrowing, investment, and spending. Raising interest rates during expansions can help curb inflation.

- Fiscal Policy: Governments can adjust tax rates and spending levels to influence economic activity. During recessions, increased government spending and tax cuts can boost aggregate demand. During expansions, higher taxes and lower spending can help control inflation.

The goal of these policies is to promote a more stable and predictable business cycle, minimizing the severity of economic downturns.

Conclusion: Understanding the Business Cycle – A Key to a Thriving Economy

The business cycle may seem like a complex and unpredictable phenomenon. However, by understanding its phases, causes, and impacts, we can navigate its fluctuations more effectively. Individuals can make informed financial decisions, businesses can adapt their strategies, and policymakers can implement targeted policies to create a more stable and prosperous economic environment.

Whether you're a business owner, an investor, or simply someone interested in the world of economics, understanding the business cycle empowers you to make informed decisions and weather the economic storms with greater confidence.