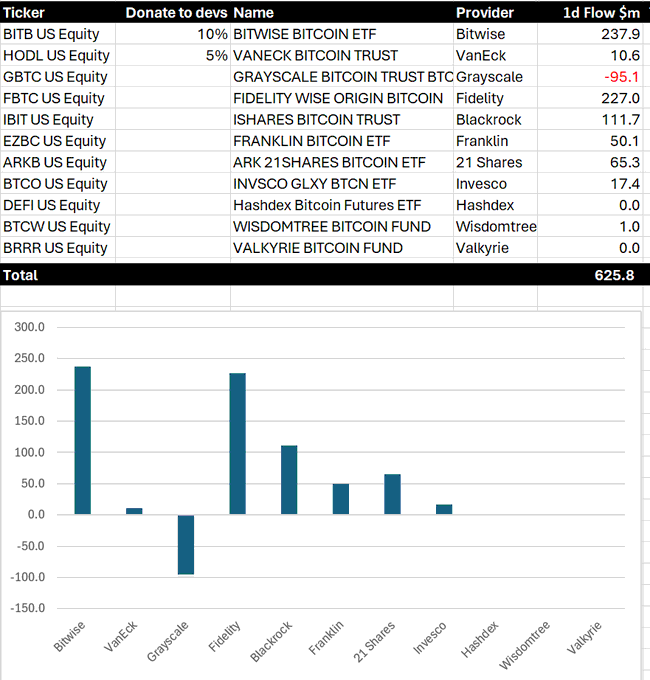

Bitwise and Fidelity Record Highest Inflow Into Bitcoin ETFs, While Grayscale Only Loses $95M in the

The third-largest inflow was recorded by BlackRock's IBIT, however analysts noted that the data may not be full.

Based on Bloomberg statistics, a BitMex Research X post cites Bitwise's bitcoin ETF (BITB), which experienced the largest cash inflow among newly issued products that started trading on Thursday. Fidelity's fund (FBTC) came in second. Eric Balchunas, an ETF analyst at Bloomberg Intelligence, pointed out in an X post that the majority of issuers only disclosed preliminary data concerning inflows until Friday's market opening and that there might be additional delays until Friday evening. Head of research at CoinShares, a digital asset management, James Butterfill, stated via email that the complete picture might not become clear until early next week.

On the first day, Bitwise's BITB brought in $238 million in net assets. $227 million was received by Fidelity's FBTC. Less than some observers had predicted, Grayscale's GBTC, which functioned as a closed-end fund and would not permit redemptions until Thursday, experienced outflows of $95 million. With the asset manager's size and influence, it was generally anticipated that BlackRock's IBIT would be one of, if not the, best-performing newly released ETFs. However, $110 million in inflows were made into the fund. Among bitcoin ETFs, it saw the second-highest first-day trading volume on Thursday. On the other hand, as of Thursday, the fund's website states that IBIT had $112 million in cash and $120 million in bitcoin (BTC). Balchunas pointed out that Friday's statistics might include some of Thursday's influx.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/VI56JNDERBEMRKL5ZTTBPQRDHI.png)

According to statistics published on X by Bloomberg Intelligence analyst James Seyffart, spot bitcoin ETFs wrapped up an incredible first day of trading activity, recording $4.6 billion daily volume combined with Grayscale's GBTC and BlackRock's IBIT leading. ETF analyst at Bloomberg Intelligence Eric Balchunas said in an X post that it was "arguably the biggest Day One splash in ETF history." In contrast, ProShares' bitcoin ETF (BITO), which is based on futures and was introduced close to the peak of the cryptocurrency bull market in October 2021, had $570 million in inflows and $1 billion in trading volume on its debut day.

BITO witnessed outflows of 3,000 BTC worth around $140 million on Thursday as investors presumably shifted some money to more user-friendly spot-based ETFs, although the fund's assets were still up through this week, K33 Research data shared with CoinDesk.:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4KXAIMIY5RDTVDHE2GABTZECSQ.png)

The introduction of spot bitcoin ETFs on Thursday was hailed by many as a major turning point for the digital asset market since it allows regular investors to invest in bitcoin by providing exposure to the biggest and oldest cryptocurrency in a format that is easier to access through traditional financial channels. Industry observers anticipated that over time, these devices will enable billions of fresh funds to be transferred to bitcoin. Analysts at Standard Chartered predicted that inflows into spot ETFs might reach $50 billion to $100 billion this year.